The duties of CFOs are changing continuously through the increasing demand for information-oriented decision making. Today’s modern CFOs are obliged to carry out tasks such as managing risk, planning for growth, and ensuring overall financial health apart from traditional accounting.

Tracking the right Key Performance Indicators (KPIs) is critical in getting your business on the right path. Knowing what to focus on first will enable you to evaluate and thus be responsible for more progress in this new position and your company.

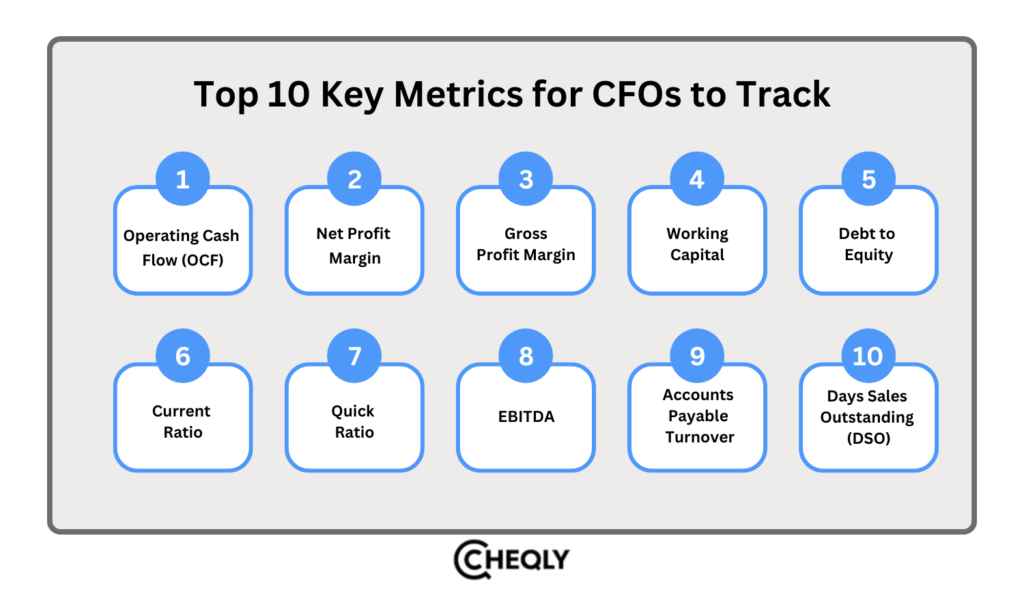

Let’s examine what a CFO KPI is, the purpose of a CFO dashboard, and the top 10 Key Performance Indicators (KPIs) every CFO should monitor. These KPIs provide a detailed view of the financial state of your company and support you in keeping on the right side by controlling the cash flow, prompt payment collection, and early identification of financial risks.

What is CFO KPI?

CFO KPIs are Key Performance Indicators for the Chief Financial Officer and are used to know the financial health of a company. They give necessary information about profits, revenue, and the financial market. Therefore, they aid CFOs in the process of decision-making.

What is a CFO Dashboard?

Finance executives use a CFO dashboard to track and analyze the status of their company’s financial performance. It organizes important financial data and shows key metrics, like cash flow, revenue growth, profitability, and expense management, in a very convenient way for tracking, analyzing, and reporting.

This also provides the company’s top management team with a comprehensive financial overview that helps them identify weak areas and develop better strategies to achieve the company’s financial goals.

Top 10 Key Metrics for CFOs to Track

CFOs need clear and practical KPIs that can help them manage and respond to the issues and opportunities of the year. Although each company’s particular goals and targets determine which metrics are the most important, the upcoming ones are also crucial.

1. Operating Cash Flow (OCF)

It evaluates the cash earned by a company through its normal business activities for a certain period of time. Under this particular metric, firms will be analyzing their net income, non-cash expenses, and the net increment in net working capital.

Formula:

2. Net Profit Margin

Net profit margin is distinct from the gross profit margin in that it involves not only the cost of goods sold but also other business expenses as well. The method is also helpful to the CFO with regard to the assessment of the enterprise’s total profit-making potential.

Formula:

3. Gross Profit Margin

Gross profit margin is the percentage of total revenue that remains with the company once the cost of goods sold (COGS) is deducted. It is expressed in percentage, while gross profit is attributed to dollars. Financial experts and investors, including chief financial officers, will use it to evaluate organizations’ performances. It can also be used by CFOs to make important decisions needed to set the price range of a product or find ways to run an organization more efficiently.

Formula:

4. Working Capital

A measure of the assets available to meet the short-term obligations, including cash, trade, and bills receivable, as well as short-term investments that normally show the speed at which a business can pull off quick cash.

Formula:

5. Debt to Equity

The debt-to-equity ratio is a measurement of a company’s liabilities to shareholders’ equity. This is a key metric that CFOs must calculate because it can help detect if a company has become overleveraged, which can, as a consequence, result in bankruptcy.

Formula:

6. Current Ratio

This metric assesses your company’s short-term financial position by comparing current assets to current liabilities, determining its ability to meet short-term needs within a year.

Formula:

A current ratio is a measure of near-term solvency that suggests it may be difficult to fulfill debts if the current ratio is below 1.

7. Quick Ratio

Quick Ratio is the other aspect of liquidity ratio calculated from the current assets that is similar to the current ratio. However, it does not take inventories into consideration and includes only the high liquidity assets.

Formula:

8. Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA)

EBITDA margin is an essential measure for a company to be as profitable as possible. CFOs look at it first to see how the company is doing financially, whether they want to borrow money or make accounting decisions. A good EBITDA margin means the company is effectively generating profit from its main activities; therefore, it is the primary tool for investors and managers to assess financial health and make informed operational adjustments if this is not the case.

Formula:

9. Accounts Payable Turnover

Perry Wiggins, the CFO, secretary, and treasurer of APQC, observed that “an optimized accounts payable (AP) process is essential for cash flow management more broadly, as well as for organizations to capitalize on early pay discounts and favorable payment terms.” His article in CFO Dive indicates that top performers could accept an invoice and initiate the payment scheduling procedure within 2.8 days. Individuals in the bottom percentile would require a week or more to complete the same process.

Accounts payable turnover measures how a company pays invoices from its suppliers. It is important to measure turnover in accounts payable because it gives information about a business’s financial health and efficiency which can help to determine if the business is in good standing with its suppliers.

Businesses that oversee invoice efficiency can better devise when and how to make payments. An AP automation solution allows firms to pay in advance so they can adjust their payment mix or synchronize their DPO with the company’s overall strategy. Furthermore, this model helps companies take advantage of early payment discounts or pursue other strategic initiatives.

Formula:

10. Days Sales Outstanding (DSO)

Days Sales Outstanding (DSO) gauges the average number of days it takes for a company to collect payments after a sale is made.

Formula:

Your company is either making transactions predominantly off credit or otherwise struggling to collect payments from debtors, which is indicative of potential cash flow issues. High DSO rates are indicative of this.

CFO KPI FAQs

Learn the CFO KPIs’ importance by going through the list of the most commonly asked questions below.

Which important areas can a CFO monitor using KPIs?

The chief financial officer can monitor major areas such as whether the company has adequate cash flow in the short term to pay off debt and provide payroll to employees, the pace at which it converts the goods into cash, the effectiveness of using investors’ funds to generate profits, and the increase in sales and profits.

How do CFOs use KPIs to manage cash flow?

Operating Cash flows, the current ratio, and DSO are the KPIs that are important for CFOs to track as they help to regulate the cash flow and enable the business to be able to cover expenses, invest in growth, and avoid financial distress.

How often do CFOs need to review KPIs?

CFOs need to keep an eye on KPIs at regular intervals, usually every month or quarter, so that the company ensures its financial goals are being met. Some metrics, for example, cash flow, may necessitate more frequent checks.

What difficulties do CFOs face in tracking KPIs effectively?

CFOs often face issues regarding data accuracy and integration, which in turn makes the tracking of KPIs difficult. The problem is addressed by using automated dashboards, as they collect data more quickly and provide better real-time reporting.

How can modern technology help CFOs keep track of KPIs?

The use of modern financial software and dashboards allows a CFO to automate the process of collecting and analyzing KPIs, offering real-time data and visualizations immediately so that tracking and decision-making become easier and faster.

What key capabilities should a CFO dashboard offer?

A CFO dashboard should be accurate and updated in the first place. The next step is to be able to display the needed information at a glance, swiftly and accurately, show trends and alterations along with data over time, and be easily customizable, allowing the CFO to drill down into the specifics.

Monitor Key Financial KPIs for Strategic Success

Effective financial management is essential for driving business success, and tracking the right KPIs empowers CFOs to make informed decisions. From operating cash flow and net profit margin to accounts payable turnover and DSO, these metrics provide invaluable insights into financial health, operational efficiency, and strategic growth opportunities.

The importance of each KPI alters depending on the industry, company size, and stage of development. A robust financial dashboard that incorporates these KPIs allows CFOs to enhance decision-making, optimize resources, and maintain a competitive edge in today’s dynamic business environment.

Get Your Business Finances Under Control with Cheqly!

Streamline your business operations and gain control over your finances with Cheqly. Our platform provides detailed financial insights that simplify managing cash flow, tracking expenses, and monitoring essential financial KPIs, helping you focus on what truly matters—growing your business.

Take control of your business’s success—create a business account with Cheqly now!