Account

Cheqly currently offers accounts to businesses, and not to individuals for personal use.

After the submission of the application, further documents or information will be requested of you. In these cases, we’ll send an email to the email(s) on file to request this information.

If all documents are duly and timely provided, it will only take a couple of business days for your account to be approved.

Login to your account, simply go to “My Profile” and click on “Security” and change password.

Login to your account, go to “My Profile” and click on “Security” and activate 2FA with the generated token.

When you enable 2FA, it will provide you with 10 codes. Make sure you copy these codes for future use. For eg. if you lose your phone, codes will help you to get access to your business account and reactive 2FA on a new device. Each code works one time only. You will have 10 chances with 10 codes.

Contact Cheqly customer care if you wish to close the account

Money

Reach out to Cheqly support at the earliest. ACH can be canceled before the cut-off time or if ACH is not submitted.

Usually once the transfer is sent to the network transfer will not be canceled. We can request a recall but it all depends on the other banks processing time and money availability on the receiver account.

- Go to our online banking at app.cheqly.com

- Log in

- Click on “Accounts”

- Select your preferred account here

- Click on “Download wire details”

- You will now get a PDF with all the information for the transfer.

You can withdraw cash at any ATM within and outside the United States. The daily limit of cash withdrawals is $100, weekly is $700 and monthly limit is $3,100. If you require higher limits, please contact us and we will help you.

We don’t currently support cash deposits.

Contact Cheqly customer care if you wish to deposit a check.

Some business services, like payroll providers or payment processors, might request a voided check to verify your bank details.

We don’t currently offer physical checkbooks for your Cheqly account, but you can download a bank letter directly from your Cheqly “Account” section that is almost always accepted in lieu of a voided check.

Cheqly does not have IBAN number.

Cheqly supports most of the countries unless it is under Cheqly’s prohibited list of countries.

Cheqly only offers USD accounts right now.

Every Cheqly account is assigned account limits during the onboarding process. If you need to make a payment that is above your designated limit, please write to us at [email protected]

We will ask you some questions about the increased limits request.

For example:

- What sort of (ACH/Wire/Check Deposit) volume should we be expecting?

- Who are you paying? If vendors, do you have any contracts or invoices you could provide us?

Link your external bank account with Cheqly for easy money transfers, by following the below steps:

- Login to your Cheqly account

- Select “Recipient”

- Click on “Add recipient”

For more information on how to receive money to your Cheqly account, visit:

We currently do not have this feature. Cheqly technology team is working on it and when it is ready the feature will be add to the Cheqly web-banking.

We do not currently issue check books.

Contact Cheqly and we will help you file a dispute.

Contact Cheqly and we will help you.

Contact Cheqly and we will help you.

Contact Cheqly and we will help you.

The ACH Network does not settle payments on weekends (or holidays) when the Federal Reserve system is closed. Same with Wire, although you can initiate a wire transfer during the weekend, it won’t be processed until the bank’s next business day.

Login to Amex, add following instructions under payments:

- Company name: Your Company name e.g. YourCompanyName Inc.

- Routing number: 084106768

- Account number: Your account number is 16-digit number.

Please note: The company name in Amex App/WebApp must match the name on the articles of incorporation and Cheqly account e.g. YourCompanyName Inc. Your account number is 16-digit number.

Cards

When your application is approved, you will have access to an activated virtual debit card. Your physical card will be sent to your mailing address. In order to activate your physical card, follow the below steps:

- Login to your Cheqly account after you have received your physical card

- Go to the “Card” section, and click on “Activate Physical Card”

It is an easy 2-step to change the pin of your debit card. You can login to your Cheqly account, go to “Card” section and select “Change Pin” . The system will ask you to provide an OTP sent on a registered email address. This will change the pin of the physical and virtual card.

Simply login to your account, go to “Card” section and click on “View Card Details”. The system will ask you to provide the OTP sent to your registered email address.

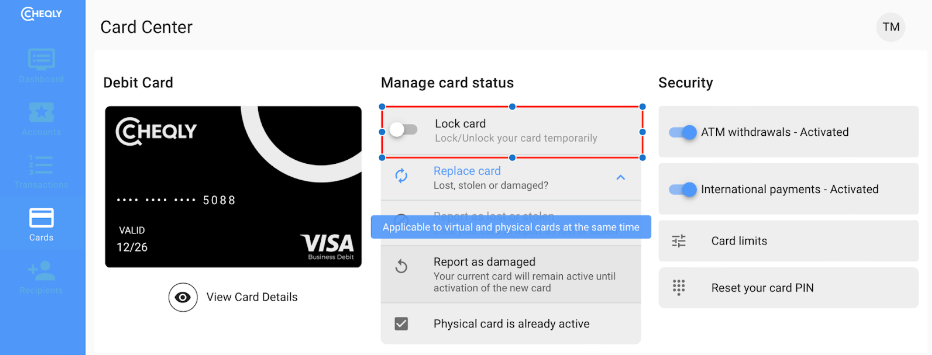

You have an option to lock or unlock your card temporarily. You can simply go to your Cheqly account to use this function. This is applicable to virtual and physical cards at the same time.

If your physical card has been damaged, you can replace the card by simply clicking on “Report as damaged” and we will mail you a new card. Your virtual card will still be active.

The VISA card will be delivered in the United States. In order for us to mail outside the United States, we recommend you to work with one of our partner companies – IncParadise which will help you to deliver cards outside of the United States. You can sign up here.

Documents

For more information please visit our summary here.

EIN – An Employer Identification Number (EIN) is also known as a Federal Tax Identification Number, and is used to identify a business entity. Generally, businesses need an EIN.

We can accept Form CP575, Form 147c, or a completed SS-4. If you are submitting a SS-4, please ensure it is not just the application, but the returned version from the IRS.

I don’t have EIN and want to Apply.

If you need to change or add shareholder or beneficial owner, you will write to us at [email protected]

Adding shareholder (with 25% or more of shares):

- New Organizational structure with percentage of shareholding

- In case of a company – Company Formation Documents (i.e., Business Registration Certificate, Articles of Association, Articles of Incorporation, Articles of Organization, etc.) OR/AND

- In case of an individual – Identification Documents (such as US or Foreign Passport/ US Government Issued Identification Document – State Issued Driver’s License/ Identification Card/ Permanent Resident Card/ US Visa)

Adding a beneficial owner:

- New Organizational structure with percentage of ownership

- Identification Documents (such as US or Foreign Passport/ US Government Issued Identification Document – State Issued Driver’s License/ Identification Card/ Permanent Resident Card/ US Visa)

If you want to remove a shareholder or beneficial owner, please provide documentation (resignation letter, board resolution or similar).

After we receive the information, we will reach out to you for any additional information.

Cheqly monthly bank statements are generated on the 1st day of every month for the previous month — for example, a January bank statement would be available by February 1 at the latest. Accounts created after the 1st of the month will not have a statement available until the following month.

Process to download the statement:

- Login to your Cheqly account

- Click on the “Message icon” on the right side of the corner

- Download your bank statement

Your monthly statement will include:

- Your account number

- A summary of account activity

- Full transaction history for the statement period

Additional Information

- Afghanistan

- Albania

- Belarus

- Bosnia and Herzegovina

- Burma

- Burundi

- Cameroon

- Central African Republic

- Croatia

- Cuba

- Democratic People’s Republic of Korea

- Democratic Republic of the Congo

- Iran

- Iraq

- Kosovo

- Lebanon

- Libya

- Macedonia

- Montenegro

- Mozambique

- Namibia

- Nicaragua

- Nigeria

- Pakistan

- Palestine including Gaza & West Bank

- Russian Federation

- Serbia

- Somalia

- South Sudan

- Syria

- Tanzania

- Turkey

- Ukraine including Luhansk and Donetsk

- Venezuela

- Vietnam

- Yemen

- Zimbabwe

- Adult Entertainment Businesses

- Aircraft Dealers

- All Firearms/Ammunition Sales

- Bearer Shares

- Cannabis Oil/Products

- Currency Exchange Businesses

- Escort Services or Encounter Groups/Clubs

- Fireworks Sales

- Gambling Establishments

- Online Gambling

- Marijuana or Illicit Drugs

- Massage Parlors (not associated with salons/chiropractic care)

- Nested MSBs/Nested Payment Processors

- Online Dating Services

- Offshore Businesses

- Online Tobacco/e-cigarettes/e-liquid Sales

- Pharmaceutical Sales

- Products/Services deemed Illegal by any level of Government

- Pyramid Schemes/Multiple Level Sales/Multi-Level Marketing

- Shell Corporations

- Tattoo Parlors

- Tax Anticipation Programs

- Tribal

- Unfair, Predatory, or Deceptive Practices/Goods

- “Pseudo” Products

- Non-Governmental Organizations (NGOs)

- Politically Exposed Persons (PEPs) including their related entities

- Import/Export Companies

- International Online Gambling

- Services Offering Government Monetary Grants

- Payday Loans

- Credit/Debit Reduction Services

- Internet-Based Work From Home Plans or Business Opportunities

- Continuity or Reoccurring Shipping of Goods

- Coaching – Services offering self-help programs/services or mentoring services

- Funds or Loss Recovery

- Offers to Only Pay for Shipping Costs

- Nutraceuticals – Dietary supplements, male enhancements, weight loss, hair loss, etc.

- Free or Discounted Trial Offers

If you are unsure whether your business nature falls under prohibited activities or not, please write to us [email protected].

Do you have questions about something else? Check out our Customer support or email us at [email protected].