Most people have started using Apple products like phones, watches, etc. The most effective payment option is Apple Pay, which is a reliable and safe option among online payment methods.

With Apple products, including iPhones, iPads, Macs, and Apple Watches, customers may purchase in stores, through applications, and on websites using Apple Pay, a mobile payment and digital wallet platform. With more than 500 million users globally, Apple Pay commands a market share of more than 90% in the US digital wallet industry.

In this article, we will explain everything about Apple Pay, including how it works, its benefits, and any other questions you may have.

What is Apple Pay?

Apple Pay is a payment method Apple introduced. You can use your Apple Phone, iPad, MacBook, and Apple Watch to make payments. By linking your chosen payment method, such as credit or debit cards, to your iPhone, iPad, Mac, or Apple Watch, you can easily make purchases with Apple Pay.

Who uses Apple Pay?

Consumers and companies worldwide are increasingly conducting transactions with Apple Pay. Users find that it is quicker and more convenient than traditional payment methods, and the security features—such as tokenization and biometric authentication—provide even more comfort. Apple Pay’s high acceptance rate is partly attributed to consumers’ faith in Apple’s dedication to data protection. Peer-to-peer financial transfers, in-app purchases, in-store purchases, and online purchasing are among the transactions for which Apple Pay is utilized.

Below are the primary user groups of Apple Pay:

Individual Users

- Clients from Generation Z and Millennials: The group most likely to use Apple Pay is Gen Z (10–25) and millennials (26–41). Of those who use digital wallets, 51% of millennials and 73% of Gen Z users use Apple Pay.

- High-earners: People who make more money than the average are fond of Apple Pay. The median income of iPhone app users in the US is $85,000, whereas that of Android app users is $61,000.

- Tech-savvy consumers: Apple Pay users are also more likely to be early adopters of mobile payments.

- Urban residents: Compared to rural locations, cities with advanced contactless infrastructure tend to have greater rates of Apple Pay usage.

Business User Types

- Retail: Apple Pay is accepted at over 85% of US stores.

- Transportation: Apple Pay is a method customers of public transportation networks worldwide can use to pay for their fares.

- Hospitality: Hotels and restaurants accept Apple Pay as a payment option to expedite the check-in and payment processes.

- Entertainment: Apple Pay is accepted for concessions and ticket purchases in movie theaters and music events.

How do I set up Apple Pay?

Apple Pay setup is a straightforward process. You can use it on your mobile or wearable device for payments by opening the Wallet app and scanning your card to get started. The configurations on Macs and iPads are slightly different.

Follow these step-by-step instructions to set up Apple Pay on your device based on its type.

iPhone

Here’s how to add a card and set up Apple Pay on your iPhone:

- Unlock your iPhone and open the Wallet app

- Tap the + symbol at the top right.

- Select the option to add a debit or credit card.

- Agree to the terms and conditions.

- Scan or manually enter your card details.

Apple Watch

Follow these steps to add a card and set up Apple Pay on your Watch:

- Open the Apple Watch app on your iPhone.

- Go to My Watch, then Wallet & Apple Pay.

- Tap Add Card and go through the instructions to add your new card.

If you’ve already added your cards to other Apple devices, just select the card, tap Add, and enter the CVV. Your bank might need you to complete an extra step to verify before using Apple Pay on your Apple Watch.

iPad & Mac

You also have the option to add Apple Pay to your Mac or iPad.

Please check the compatibility of your iPad with the operating system version. If you are using a Mac, it should be equipped with a Touch ID to be able to use Apple Pay online.

Here’s how to add a card to Apple Pay on your Mac or iPad:

- Open the Apple Menu, then go to System Settings (Mac) or Settings (iPad).

- Tap Wallet & Apple Pay.

- Choose the option to add a debit or credit card.

- Hold your card in front of the camera to scan it or manually enter the card details.

How Does Apple Pay Work?

Tokenization is the main technology enabling online Apple Pay payments. Through tokenization, users’ banking information is shielded from fraud and identity theft. It substitutes “tokens”, or randomly generated numbers, for the customer’s credit card number. There is no chance of financial information being stolen because Apple Pay stores and transmits tokens, not actual account numbers, during transactions.

Here’s how users configure Apple Pay and finalize transactions:

In-Store Payments

The Apple Pay software launches automatically when customers hold their device before a contactless scanner at a store. When communicating with the terminal, the device’s NFC technology chip emits a transaction-specific dynamic security code and the Device Account Number. The user then authenticates the payment using their device passcode, Face ID, or Touch ID.

Online Payments

Users choose Apple Pay as their payment option for in-app or online purchases and then confirm the transaction using Touch ID, Face ID, or the device passcode. The device account number completes the transaction, protecting the cardholder’s information.

Person-person payments

When using Apple Cash, Users can utilize Siri or Messages to give and receive money. A user’s received funds are kept in the Wallet app on their Apple Cash card and can be transferred to a bank account or used for shopping.

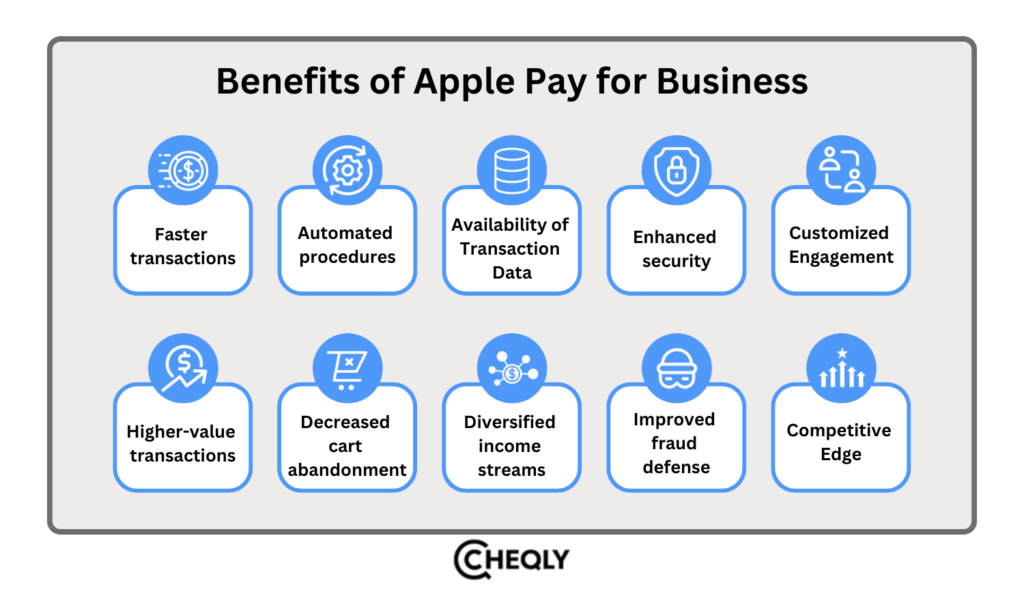

Benefits of Apple Pay Acceptance as a Business

Apple Pay has developed into a sophisticated instrument that has the power to alter corporate operations significantly. The platform can boost client experiences, increase operational effectiveness, and accelerate revenue growth. Below are some benefits:

- Faster transactions: Shorter customer lines, more throughput, and a smaller operating footprint result from Apple Pay’s quicker payment procedure, which also cuts checkout times.

- Automated procedures: Apple Pay’s digital transactions reduce the money needed for operational expenses related to processing payments by eliminating the need for human participation.

- Availability of Transaction Data: Real-time transaction data from Apple Pay offers many business benefits, including insights into customers’ purchasing habits, preferences, and demographics.

- Enhanced security: Apple Pay’s tokenization and biometric authentication protect sensitive financial data, fostering client confidence.

- Customized Engagement: By integrating with reward programs and loyalty schemes, Apple Pay allows for the sending out of tailored promotions and offers.

- Higher-value transactions: Apple Pay’s simplicity and security can inspire customers to spend more, with one case study revealing a 10% increase in average order value when customers use Apple Pay.

- Decreased cart abandonment: The seamless checkout process with Apple Pay can reduce basket abandonment, particularly on mobile devices.

- Diversified income streams: Apple Pay creates new revenue streams by utilizing several strategies, including contactless tickets and in-app sales.

- Improved fraud defense: By thwarting fraudulent activity, Apple Pay’s cutting-edge security measures save companies from possible financial losses.

- Competitive Edge: By incorporating Apple Pay, companies may differentiate themselves from the competition and show they are customer-focused and committed to innovation.

Costs for Businesses using Apple Pay

When you use Apple Pay, there are no associated fees. However, it’s important to remember that using Apple Pay abroad may incur fees assessed by your card issuer, not Apple.

Apple Pay makes using your debit or credit card easier, but you will still be responsible for any fees your card issuer or network levied. When you use Apple Pay to use your card, any fees levied by your card issuer—such as cash advance or foreign transaction fees—will still be applicable.

Where can Apple Pay be used?

Anywhere that accepts contactless payments, such as grocery stores, taxis, and metro stations, can accept Apple Pay, both online and in apps. When making purchases on your iPhone, iPad, or Mac using Safari, use Apple Pay. You can pay with a touch or a glance instead of filling out the lengthy checkout procedures.

Is Apple Pay Secure?

Apple Pay security generates a different transaction code and device-specific number for every purchase. It does not retain your card number on your device or Apple servers, which is considered safer than a real card. Additionally, Apple doesn’t provide businesses access to your card details. Rather, you receive a distinct device account number from Apple Pay, which is encrypted and kept safely on your device. Apple Pay needs your device’s account number and a security code to process payments.

Apple Pay Safety and Privacy

Apple meets all the requirements to ensure customer privacy and keeps personal data safe, both encrypted and stored securely. They do not store any images of payment cards that you scan with your iPhone.

Apple Pay FAQs

Here are some quick answers to common questions about Apple Pay.

How do you complete a payment with Apple Pay?

To use Apple Pay to finish a payment, make sure you have set up your iPhone or your Apple Watch with your selected credit or debit card. If you purchase an item in-store, bring your device near the contactless or NFC reader. To complete the payment, confirm using Face ID or Touch ID or your passcode. Finally, the app will display a checkmark on the screen when the payment has been processed.

Are Apple Pay and Apple Wallet the same?

Apple Pay and Apple Wallet are two different things, yet they are integrated. Apple Wallet is an electronic wallet and a place to safely store payment cards, boarding passes, tickets, and other items you tend to carry in your physical wallet. Apple Pay, on the other hand, is a payment service through which you can transact using the cards saved in the Apple Wallet.

Is Apple Pay more secure than contactless?

Yes, Apple Pay is more secure than traditional contactless payments. To authenticate the payment, only Face ID, Touch ID, or a passcode (biometric authentication) is used to confirm the right person made it. Furthermore, Apple Pay uses tokenization, so the actual account number, name, and details are not transmitted to the merchant. It also doesn’t store transaction data that could be linked to your identity.

Streamline your Apple Pay Payments with Cheqly

Using Cheqly’s virtual debit cards with the Apple Pay wallet for small business owners will enhance security and ease of use, giving you contactless payment freedom. They can make your payment hassle-free and secure because you don’t always have to change card details. Open your Cheqly account today to make your financial transactions effortless!