Business owners frequently cross-reference their records with bank transactions to ensure everything runs smoothly. They can verify that the figures on their balance sheet match the bank statement, which is a best practice. The balance sheet is adjusted if any discrepancies or fraudulent charges are found.

The month-end close procedure involves examining the balance sheet, income, bank statements, expenses, intercompany trades, and other data, including a bank reconciliation. It is important to maintain accurate corporate financial statement records to know its economic status and tax management, with all the details of bank withdrawals, debit entries, and credit entries.

What Is a Bank Reconciliation?

A bank reconciliation involves comparing an organization’s cash accounting records with the cash balance reported by the bank. This control ensures that a bank reconciliation is prepared to get the correct picture of money available in the company, including funds in transit. It is then used to identify errors and fraud between the two.

Businesses create bank reconciliation statements as a thorough accounting comparison tool. By verifying their bank account amount with their internal financial statement records, an organization may ensure that all payments have been handled correctly. Bank reconciliation statements are crucial for warning a business of fraud or mistakes. For a bank reconciliation statement to be useful, it has to incorporate all the transactions that affect the business’s financial accounts.

Bank statement reconciliation is important because it helps an individual or a business organization make sure that records and bank statements match, preventing cash loss.

Why Is Reconciliation of Your Bank Statements Important?

Reconciliation is a process of checking records to identify errors or differences. It can also act as a warning for fraud.

Therefore, you can verify your records and find out if there is any error by comparing the balance shown on the bank statement with the company records.

How to do Bank Reconciliation?

Preparing bank reconciliation at least monthly makes month-end the most appropriate time. However, many companies receive bank statements more frequently, for instance, weekly, and if this is the case, you may choose to reconcile the bank statement for each statement received.

Finding problems in a bank reconciliation is easier the more you perform one. Many companies also perform additional bank reconciliations in situations where large sums of money are involved or where unusual financial activity is evident. This can include notices from your bank about questionable activity or sizable deposits and payments. Carrying out an instant reconciliation in these circumstances is a good idea.

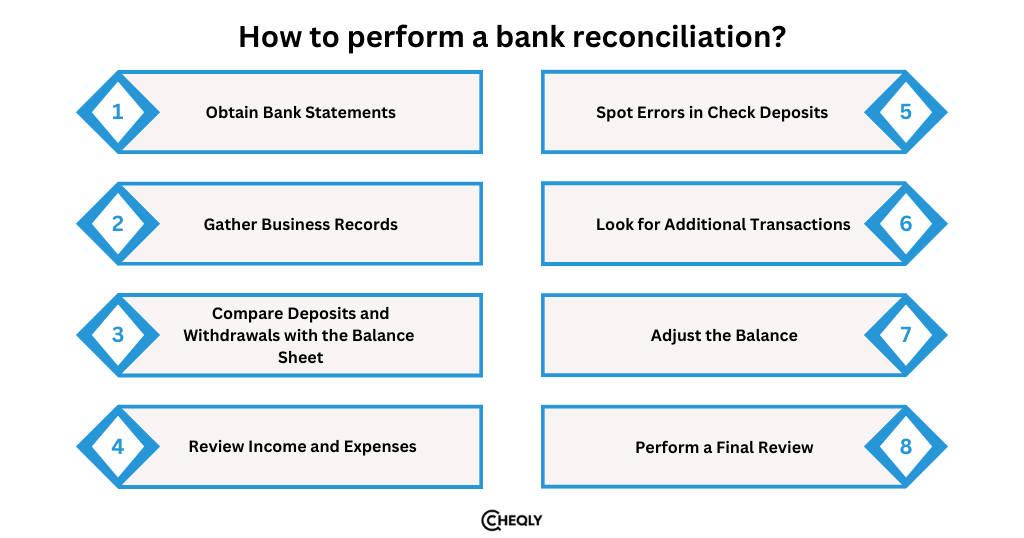

8 Steps for Performing Bank Reconciliation

Companies can assign several people to manage different aspects of bank reconciliation and use various methods to complete the reconciliations. Below are eight steps to follow to learn how to do bank reconciliation:

1. Obtain Bank Statements

The first step is to get a thorough statement from the bank; it contains details on checks that the bank has cleared or denied, transaction fees, and bank fees.

With Cheqly, monthly bank statements are generated on the 1st of each month for the previous month. You can conveniently access and download the most recent financial records. Click here for more information.

2. Gather Business Records

Next, prepare the business records by either typing them into a spreadsheet or using software to keep them current. Check the ending balances on the bank statement and the balance sheet.

3. Compare Deposits and Withdrawals with the Balance Sheet

Verify that the information on the balance sheet, bank deposits, and withdrawals matches. Cross-check to find the source of any discrepancies between the balance sheet and the bank statement. Contact the bank to inform them if they are making an error.

4. Review Income and Expenses

Make sure that the income and expenses on the balance sheet are in accordance with the bank statements so as to uncover any undisclosed expenses or deposits.

5. Spot Errors in Check Deposits

Verifying check deposits is not an easy task for a company. Make sure that the bank’s clearance list matches each registered check. If not, immediately call the bank and notify them of the error. Also, watch out for any uncleared checks.

6. Look for Additional Transactions

The balance sheet must document any random debits and credits in the bank statements. Adjust the balance sheet to reflect all transactions if there are any discrepancies.

7. Adjust the Balance

After you go through all the key items, fix the cash balances to show all expenses and transactions.

8. Perform a Final Review

Check all transactions to confirm that the closing balances on the balance sheet and the bank statements match. Suppose they don’t repeat the steps.

6 Common Mistakes to Avoid in Bank Reconciliation

Errors often happen during bank reconciliation. Here are common mistakes to avoid:

1. Neglecting to Record All Transactions

Missing some transactions in the accounting system causes differences that are often hard to reconcile between the bank statement and the balance sheet.

2. Incorrectly Recording Transactions

If you don’t enter transactions correctly, mistakes will show up in the bank statement and balance sheet, making reconciliation hard.

3. Failing to account for bank fees

These costs can add up and affect your balance sheet. If you skip including certain fees and charges during reconciliation, you might find differences between the bank statement and the balance sheet.

4. Beginning with an Incorrect Opening Balance

Commencing the reconciliation process on a wrong opening balance could lead to errors. Check the opening balance before you start.

5. Failing to identify and resolve discrepancies

Any differences between the bank statement and the balance sheet should be found and fixed immediately. Please do so to avoid more mistakes and complicate account reconciliation.

6. Not Reviewing Reconciliation Reports

These documents offer an overview of the reconciliation process and aid in locating any mistakes or inconsistencies. Reconciliation process errors may arise from irregular evaluation of these reports.

Cheqly: Simplify Business Payments and Financial Tracking

You do not need to worry about how to manage the business finances. Cheqly’s neobanking features will enable you to reduce the effort required for bank statement reconciliation and tracking deposits and withdrawal entries for your business accounting records. Moreover, Cheqly provides solutions like ACH & wire transfer support so you can do your best—to develop your business. Do not let complicated financial procedures come in the way of your progress.