Sending and receiving money is now easier than it has ever been!

Pay systems are flexible and allow both the business and the customers to decide which payment formats suit them best since there are so many options available.

ACH withdrawal is where the party so charged withdraws the money from the paying party’s account with permission to do so. ACH withdrawals are a method of transferring funds that are cost-effective, secure, and efficient. Businesses use them to pay regular bills and collect money from customers.

Let’s read the article and understand ACH withdrawal and its functions.

What is an ACH Withdrawal?

ACH withdrawals are electronic transactions that take money out of one financial account and move it into another. ACH withdrawals include bill payments, direct payments, recurring payments, and transactions from one bank account to another.

The ACH is an interface of numerous banks, including the Federal Reserve Bank in the United States, that carries out simple, fast payments between people or entities, even if they have different banks.

The ACH network is used by individuals and firms to hasten the receipt of payments for various purposes, such as tax refunds and fixed utility bills.

Besides, ACH debit and ACH withdrawal are fundamentally the same. Unlike ACH deposits, which are push-based, ACH withdrawals are pull-based. For example, an employer might use an ACH deposit to transfer an employee’s paycheck directly to a bank account. You have the option to pay your bill automatically directly from your account each month via ACH withdrawal if you prefer.

ACH withdrawals give your business an easy-to-process electronic gateway in which you can accept payment. On the date of your choosing, payments are deducted from a customer’s account with their consent.

How do ACH Withdrawals work?

In the majority of instances, companies employ ACH withdrawals to receive payments directly from clients or consumers for products and services, regardless of whether those customers are businesses or individuals.

ACH transfers are classified as either ACH credit or ACH debit. A credit is a withdrawal that is initiated by the payer, whereas a debit is initiated by the recipient. At present, our attention will be directed toward ACH credits.

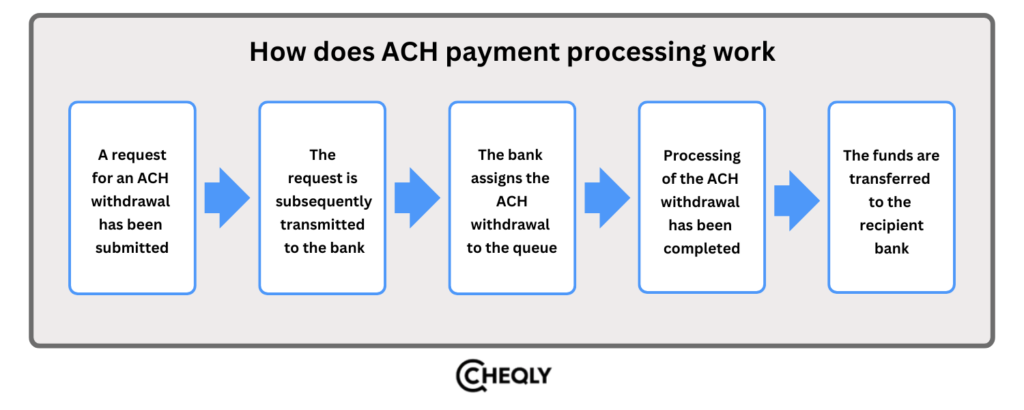

The process is as follows:

- A request for an ACH withdrawal has been submitted. The vendor or their payment processor receives the customer’s financial information. A routing number and bank account number are essential pieces of banking information.

- The request is subsequently transmitted to the bank. The customer’s bank receives a withdrawal request that includes transaction details. They transmit the customer’s account information and verify that a withdrawal has been authorized.

- The bank assigns the ACH withdrawal to the queue. A queue of ACH transactions is cleared out routinely on business days in the ACH network. A withdrawal may not be processed until Monday if it is initiated late on a Friday.

- Processing of the ACH withdrawal has been completed. Before being approved and submitted to the banks, an ACH operator examines queued transactions.

- The funds are transferred to the recipient bank. The merchant’s financial institution receives the funds and deposits them into their account. The transaction is completed.

ACH transactions are exceedingly inexpensive, frequently cheaper than credit card transaction fees, and the service is advantageous to both businesses and consumers.

- The accounting and finance departments never engage in manual work to enable them to continue acquiring the company’s recurring revenues.

- Automated payments ensure that the customer receives on-time payments, thus avoiding late fees.

Utility companies, mortgage financing companies, any bank that offers loans, and any other company that accepts automatic withdrawals from customers offer the option of ACH payment.

How do ACH Transfers and Direct Deposits Work?

The individual or organization that is responsible for the payments initiates direct deposits. In other words, they expend funds rather than receive them.

For instance, the US government offers e-tax refunds through the direct payment method and delivers social security payments.

ACH direct deposit could be a one-time deposit or a recurring deposit depending on the need. An example of this might be the direct deposit that a business can make to place the employees’ paychecks directly into their checking accounts every month. Alternatively, it may provide corporate merchants with individual payments for convenience.

In either case, the procedure is comparable to that of an ACH withdrawal. The individual receiving payment authorizes the transfer and furnishes their banking information. Automatically, the sender executes the payment in a timely manner.

Steps to Perform an ACH Withdrawal

You can perform an ACH withdrawal with just four simple steps; let’s have a look at them:

- Step 1: Establish an account with an ACH provider for your business.

- Step 2: Obtain written or recorded consent from your customer to authorize a recurring or one-time ACH withdrawal.

- Step 3: Access your ACH payment processor and input the customer’s information. This includes the name of the bank, the routing number, the bank account number, and the legal name of the bank account as it appears on the back of any check.

- Step 4: File the ACH withdrawal request for the agreed-upon sum, whether the given transaction is an ACH single occurrence or a recurring one.

The initial setup is where the most work is required for an ACH withdrawal. The ACH withdrawal process is as straightforward as obtaining confirmation from your client and submitting the transfer request once the verification and account information have been submitted.

Key Advantages of ACH Withdrawals

Consumers can pay through ACH withdrawal, which is secure and charges less than higher-cost options, such as credit card payments. Also, they take much less effort to process than paper checks, thus reducing your load and letting you focus on the growth of your business.

Price

ACH withdrawal fees are cheaper than credit card transaction fees, and they are also cheaper than wire transfer fees as well. In order to calculate ACH withdrawal fees, you need to contact your bank (or an external payment service provider). Additionally, numerous organizations implement automated clearing house (ACH) withdrawals for bill payments, which are generally free of charge.

Safety

ACH payments provide security advantages over both currency and paper checks. Checks may be lost in the mail and, if intercepted, can be a liability due to the fact that they contain your routing and account number. Additionally, the transportation of substantial sums of currency poses a significant risk due to their susceptibility to theft or loss. Consequently, sophisticated security protocols are necessary to prevent theft. ACH withdrawals also offer security advantages over wire transfers, as their one-to-three-day processing time provides a margin during which businesses can halt payment if fraud is suspected or an error is identified.

Ease of Use

The administrative burden of many businesses is reduced, and invoices are paid on time by establishing recurring payments for utilities or other ongoing operating expenses through ACH withdrawals. ACH withdrawals can also be used to collect payments from customers, and this is much better, as it is faster than waiting to receive paper checks and then deposit them.

In conclusion, with the use of ACH withdrawals, electronic payments are managed in a secure, efficient, and instant way by businesses and individuals. The ACH network can be utilized by companies to monitor recurring payments, reduce the administrative burden, and better prioritize customer convenience. ACH transactions are an affordable and user-friendly tool for managing finances in a digital economy, which businesses find worthwhile.

Start your Journey with Cheqly’s ACH Transfers

Use the free ACH payments from Cheqly to easily manage your business’s domestic US transactions. Save on costs, make payments simpler, and focus on growing your business.

Open a Cheqly account today and be a part of smooth, secure transactions that support your success!