In response to the changing user base, which is mobile-driven, the banking and finance industries have also evolved along with the digital expansion in our daily lives.

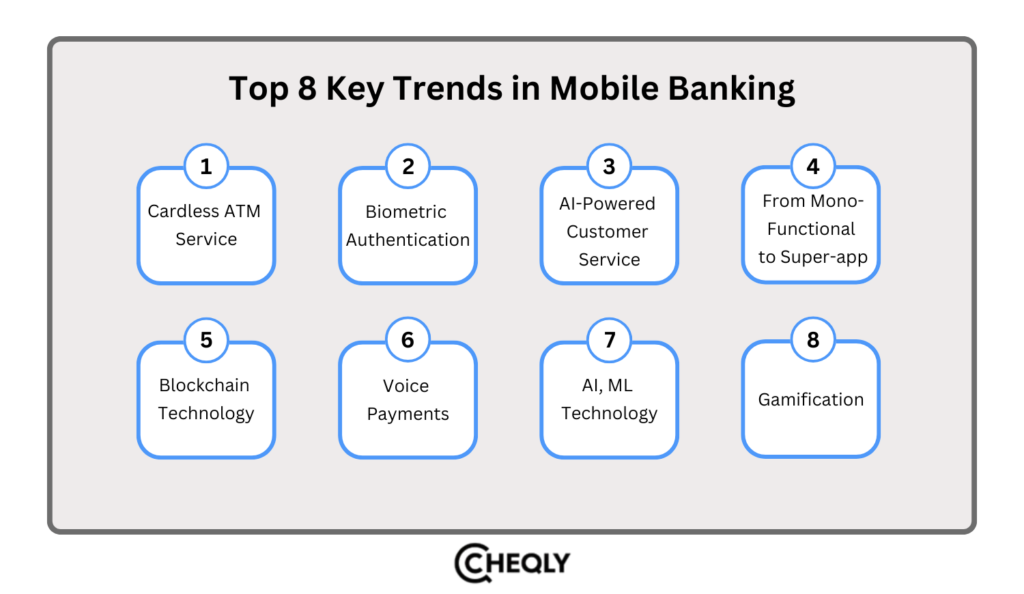

As a result, to maintain competitive advantages and cover a specific audience in the financial market, financial institutions and banks need to implement the development of custom banking applications and provide individual banking solutions. Prior to commencing the development process, there are specific trends and components that your mBanking application must possess. Therefore, in this article, we will cover eight primary trends that are currently and in the future affecting the development of mobile banking applications.

What is Mobile Banking?

Mobile banking is a web of activities people undertake involving banking operations via their mobile phones. These actions may lie on a continuum of simplicity and complexity, ranging from checking the balance in a bank account to moving large sums of money or applying for a loan.

While mobile banking could be said to have been initiated in the 1990s, it has only recently taken center stage because of the Internet revolution. Most people today own smart handheld devices with fast data connections that allow them to use banking applications and services designed for their gadgets.

Additionally, banks are currently motivated to offer banking technologies that are both efficient and user-friendly. In the present day, consumers desire digital experiences that are both modern and convenient. Banks that fail to adapt to this trend will be disadvantaged by their more intelligent and efficient competitors.

Top 8 Key Trends to Watch in Mobile Banking

Let’s find the key trends in mobile banking:

1. Cardless ATM Service

In the last few years, the popularity of cardless ATMs has increased as more banks extend their clients the favor of carrying out cash withdrawals from the ATM without using a card. You can withdraw with it because it eliminates the need to get to a terminal, use the phone number, and directly connect to your bank account either through an application or even by scanning a QR code. Analysis has indicated that the cardless ATM market could grow to $2.11 billion by 2026.

This innovative service also helps minimize the use of physical plastic cards that individuals can misplace or have lost or stolen, thus improving the security and safety of banking transactions. Furthermore, the utilization of Cardless ATM services expedites and simplifies the process of obtaining cash, enabling consumers to proceed with their journey. In conclusion, the cardless ATM service is transforming the banking industry, which combines security and convenience.

2. Biometric Authentication

Biometric authentication is one of the most recent trends that has acquired popularity in the mobile banking landscape, and it is constantly evolving. Fingerprint and facial recognition are now available as additional security measures for customers of custom web application development services. This authentication method guarantees secure access to mobile banking services by necessitating an individual’s physical attributes in order to authorize access. Conducted by Research and Markets, a market study and its analysis predict the usage of biometrics in banking and financial services to rise from $7.2 billion in the year 2023 to $19.5 billion by 2030.

Mobile banking is slowly becoming a safer way of transacting in the financial sector, regarding the recent enhancements of biometric authentication. Mobile banking through a biometric authentication system has quickly gained acceptance by business people and mobile customers because of the convenience and security features of this new technique.

3. AI-Powered Customer Service

The main way that conversational technology will be adopted in the future is seen in the inclusion of bots into mobile banking apps.

This new technology is being implemented by mobile banking apps for BFSI to improve customer satisfaction through the use of artificial intelligence and machine learning algorithms to forecast the needs of customers. It makes targeted mobile banking customers capable of selecting customized services and products and instantly consulting on their basic needs.

Besides, mobile banking customers display higher effectiveness in their interactions with banks using AI-based voice interfaces as the technology reached a level where it allowed an understanding of the tone and intonation of the human voice. Many of these mobile banking trends allow clients to engage with their bank from their mobile device, and these interactions get quicker answers than previously imaginable.

4. From Mono-Functional to Super-app

The necessity of mobile banking applications for banks is becoming increasingly apparent as mobile banking trends continue to develop. However, consumers are now seeking to expand the capabilities of their banking applications beyond the fundamental features that are available through Internet banking. They desire a comprehensive channel of access to all banking products. The future outlook recommends the development of an ecosystem of financial features and services that are tailored to the user’s requirements.

Therefore, consider incorporating features such as bill payment alerts, account settlement, expense monitoring, budgeting, loan payments, online shopping, or the ability to order online services, such as booking a cab or paying for public transportation. Additionally, the provision of non-banking services by your mobile banking applications enhances your bank’s connection with customers across a variety of channels, thereby increasing the top and bottom lines in the future.

5. Blockchain Technology

Blockchain technology is emerging as a critical instrument for banks to leverage as mobile banking becomes more prevalent. Due to the exclusion of the need for physical third parties, users of mobile banking apps can successfully and safely perform transactions. Statista reported that there are 81 million blockchain wallet users in the world up to 2022.

It was also found that statistical analysis has become more evident in mobile banking services since blockchain technology offers a safe environment for the monetization of data in financial services. The protection of sensitive data can be more readily guaranteed by banks and top finTech companies due to the technology’s reliance on cryptography methods. Furthermore, blockchain provides advantages such as data authenticity and automated transactions.

6. Voice Payments

Voice payment options are now available in online banking applications, with AI playing a critical role in voice banking, as per the most recent banking trends. Many companies, such as Apple, Amazon, and Google, have set the tone when it comes to developing a user-friendly authentication procedure that allows consumers to buy on the Internet by using only their voice through their mobile banking applications. In the same vein, improvement in the areas of security is carried out by employing biometric authentication sensors that are built into mobile phones.

Custom mobile app development services are swiftly gaining traction by allocating resources to AI-driven voice banking technology. This is done with the aim of ensuring that their customers are served better and that users are not strained when transferring their money to the platform. The AI-based voice payment options for mobile banking will continue to be the leading onboard innovations because of the simple accessibility, ease, and uniqueness of providing features that are not available in regular mobile banking.

7. AI, ML Technology

Initially, mobile banking was primarily concerned with the provision of account balances or money transfers to consumers. Nevertheless, mobile banking services now incorporate targeted marketing campaigns that are focused on personalized user experiences and up-sell opportunities.

Online banking applications can enhance the consumer’s overall mobile banking service experience by providing targeted and contextual product recommendations that align with their requirements by utilizing AI and ML technology. A more personalized mobile banking experience for the consumer is the result of these features, which, in turn, enhance the overall customer experience.

8. Gamification

If you are unable to effectively retain users, your mobile banking applications are just as valuable as they are ineffective if they are not easy to use and entertaining, regardless of what they offer. According to the gamification concept, which is the integration of web and mobile application gameplay, it is possible to incorporate engagement and immersion into the application. They realized that by making people enjoy their banking transactions, users would spend more time accessing their accounts.

For example, it permits users to accumulate points by completing duties such as splitting a bill with a friend or spending money abroad. Alternatively, they may receive virtual awards for demonstrating good financial practices, achieving significant milestones, and engaging in specific financial behaviors. This will not only improve the usability of your application but also make you more relevant, increase your conversion, and bring in new customers.

Mobile banking applications can, therefore, be described as constantly dynamic due to future enhancements and the changing nature of mobile users. Innovations such as cardless ATM services, biometric authentication, blockchain, digital wallets, voice payments driven by AI, and machine learning are redesigning the financial services industry; banking has become more secure, convenient, and engaging. Functions like gamification and the possibilities of a super-app look forward to changing client experiences by integrating finance with life.

Thus, the application of innovative technologies such as AI, ML, and blockchain in financial institutions can not only improve organizational and operational performance but also build emotionally attractive and reliable banking products based on users’ trust preferences.

Get Your Business Visa Debit Card with Cheqly Today!

Debit cards for small businesses can be useful as they help keep track of expenses, prepare budgets, and simplify transactions.

Sign up for a Cheqly account, and you will receive both a physical Visa card for in-store purchases and a virtual card for online transactions. Managing daily transactions is very simple.