Many owners wonder, “What are the ways to raise the value of my business before selling it?” This concern frequently comes up due to disparities in the methods used to acquire a quick valuation estimate.

Business owners may underestimate the company’s value until they have an exit strategy. When it comes to selling a business, it’s more about finding a potential buyer who can buy the company based on its actual worth. If owners can improve and address valuation gaps, then they can enhance their business market value. Achieving a higher selling price means more profit.

In this guide, we’ll walk you through ways to increase your business’s worth and make sure you get a better return when it’s time to sell.

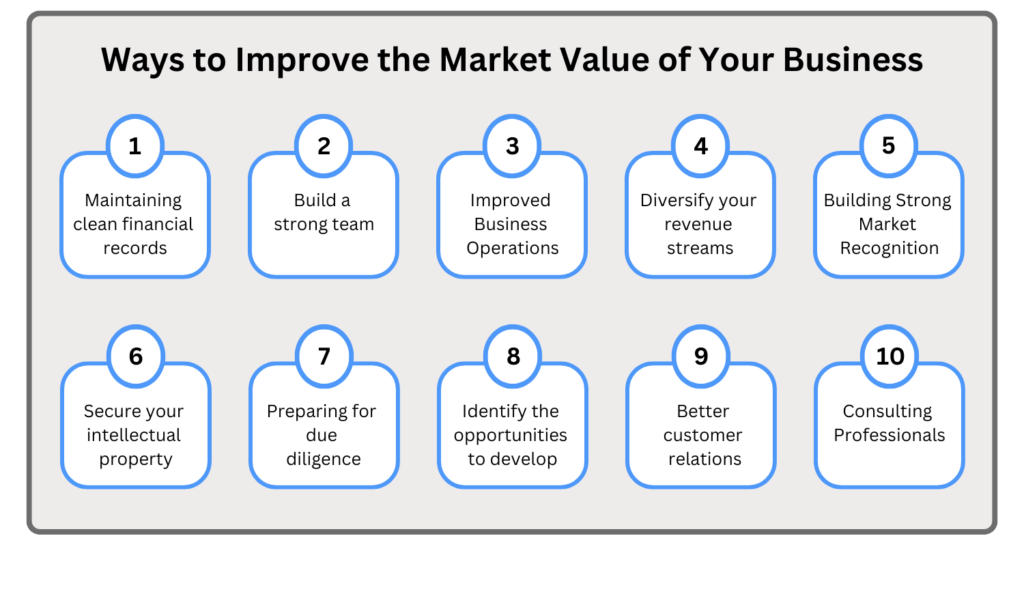

How to Improve the Market Value of Your Business

It is logical for a seller to seek to optimize the value of their business; however, it is also feasible for any organization to enhance its valuation outcomes by employing one or more of these methodologies.

1) Maintaining Clean Financial Records

Financial planning combined with recordkeeping allows businesses and their owners to gain confidence from buyers. When your financial data is organized in a clear manner, you can both identify costs that require optimization and predict future growth potential.

For example, a business owner should contemplate the acquisition of audited financial statements when their organization’s revenue surpasses $10 million. The quality, accuracy, and professionalism of audited financials are guaranteed by adhering to GAAP. Externally reviewed financials are an alternative option for business proprietors, as they offer a superior level of quality in comparison to internal financials.

2) Build a Strong Team

Businesses that have great management teams that are capable of effectively conducting sales, marketing, and product or service delivery are sought after by both buyers and investors.

The involvement of owners in daily operations that are critical to the business’s health is seen by buyers as a significant risk that will have a negative impact on the company’s value during a valuation. Conversely, a potential buyer will perceive a substantial value in a robust management team that independently manages critical matters.

Also, it is imperative that business owners guarantee that their workforce is proficient, efficient, and loyal. Especially when purchasers are interested in sourcing specific skill sets to enhance their existing business, the value of a company can be positively impacted by key employees.

3) Improved Business Operations

To enhance the value of a business, it is essential to have robust systems, processes, and procedures. Owners can make their systems more robust and pass the assessment that prospective investors will undertake by planning for the sale early.

To ensure that their prolonged absence does not adversely affect the efficiency of the systems, owners must disengage from the procedures and establish them. Moreover, owners should allow management to deal with challenging circumstances and obstacles without their involvement.

Business owners have the potential to negotiate a higher asking price for their business by utilizing their robust operating systems.

4) Diversify Your Revenue Streams

It’s well-known that relying on a single source is risky. The same is true for business revenue streams.

Buyers are interested in the prospective diversity of revenue rather than the total monthly dollar amount. The buyer’s confidence in the sustainability and growth potential of the business increases as the number of revenue-generating opportunities increases.

Being a business, you have the option of the acquisition of new consumer groups or the addition of products and services. However, first, businesses that have a deeper understanding of their customers’ purchasing profiles and the products they are willing to purchase will be able to generate new revenue opportunities more efficiently and effectively than those that lack this understanding.

A business with recurrent revenue streams will have a higher valuation due to the higher multiplier it will attract. These businesses are more appealing and less risky because the new owners are guaranteed revenue from the day of the sale.

5) Building Strong Market Recognition

A negative reputation in the marketplace is a substantial value detractor. Buyers or investors maintain awareness of consumers’ opinions regarding a specific organization and its offerings.

Potential buyers will use various methods to know the item’s true condition, including reviewing websites that offer customer feedback, quietly gathering information from business circles, researching events and tradeshows, and seeking input from customers and suppliers.

Owners should establish a favorable reputation in the marketplace as they prepare to introduce the company to the market. To improve the quality, delivery, and pricing of their products and services, they must pay attention to consumer feedback. It could substantially enhance the business.

6) Secure Your Intellectual Property

Intellectual property rights are very important for a successful business sale. If you do not own the patent for the product that is the core of your company, someone else can easily copy it at a cheaper price. Also, the geographical limitations or exclusive rights that may result could affect the attractiveness of your company in the eyes of potential buyers.

Not having a patent or other exclusive rights can cause your company to be less valuable; however, having those protections will give your company a great boost in its worth. It is important to protect the integrity of all records before selling them.

7) Preparing for Due Diligence

Buyers typically compile a checklist of all the items they wish to observe before purchasing a business. Typically, it occurs after executing a letter of intent with a single, exclusive buyer. The candidate is interested in determining whether the information contained in the offer document is accurate.

Determine if your financial statements are ready for due diligence. After the outcome of the buyer’s investigation is positive, the final negotiations are held.

8) Identify the Opportunities to Develop

A well-crafted transition plan assists business owners in achieving their exit objectives and the estimated time required to prepare their company for a sale. Business owners can capitalize on this opportunity to get the best value for the company as per the market value.

9) Better Customer Relations

As a business owner, having strong customer relationships is one of the most effective ways to ensure stable and predictable revenue streams. You will attract new clients through positive referrals from loyal customers, who not only buy from you repeatedly but become advocates for your brand. Deliver exceptional value and personalized service to achieve this. Understand your customers’ needs by collecting regular feedback and tailoring your products or services to address their evolving preferences.

10) Consulting Professionals

Business owners should get services from a higher and accredited valuable firm like Eqvista and obtain an independent professional valuation of their business.

Owners can significantly enhance the value of their companies and, as a result, their sales price by identifying the value generators for their business. Business owners should prioritize the weak value drivers of their company, as identified by those assessments, and strive to enhance them.

In conclusion, your approach to business enhancement goes beyond preparing for a sale because it involves improving every important part of your operations, including financial results and customer connections. Company value depends mainly on financial health results plus growth abilities, while efficiency and brand reputation also play significant roles. By using good business planning and focusing on these important areas, you can increase your profits when it’s time to sell.

Get Accurate and Compliant Company Valuations Today!

Business valuations are complex and should be approached precisely, as even minor inaccuracies can affect the final sale price or investor interest. That’s where our trusted partner, Eqvista, steps in—known for their https://eqvista.com/services/valuation/, with a specialization in 409A valuation. With their NACVA-certified team, they deliver precise business value assessments that meet business regulations and reflect your company’s true value.

Start growing your business today with Eqvista’s trusted 409A valuation service.