Errors in cash collection are a real barrier to the growth and stability of a business. It is like a situation where slow payments hold up important projects, and the business has no clear understanding of its finances. According to a PYMNTS report, 93% of businesses wait for their customers’ payments to settle, which is a major reason for delays.

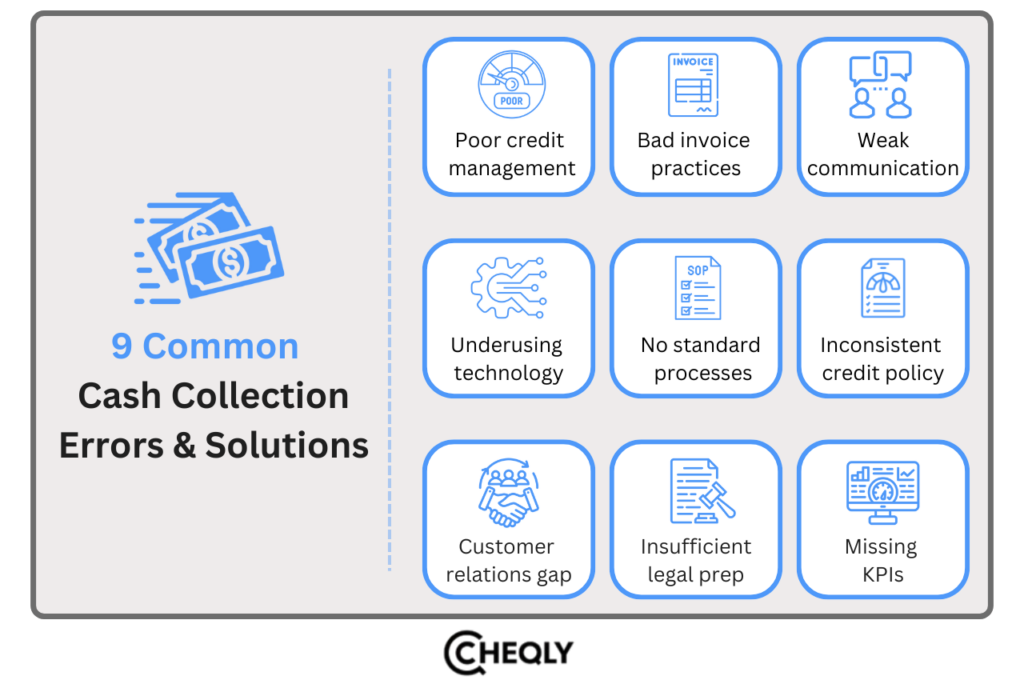

As a business owner, you have to make your business’s cash collection process smooth for liquidity and financial stability. Even with a dedicated financial team, cash collection can be challenging. This article explores the 9 key cash collection mistakes and provides ways to improve your cash flow.

9 Cash Collection Mistakes and How to Avoid Them

Let’s break down the distinct mistakes in cash collection and how to address them.

1. Poor Credit Management Practices

Handling credit properly is the best way to make sure you get paid on time and keep your money flowing. Businesses must assess consumers’ credit standing before authorizing credit access to their clients. A comprehensive assessment of this type helps organizations stay safe against financial risks that put their monetary stability at risk. The proactive approach provides your business with an intelligent starting point to develop great credit management practices and strengthen financial security.

Solution

- Conduct Credit Checks: Not performing credit evaluations on new business clients increases the possibility of payment defaults. Companies need to create a standardized system to evaluate the credit reliability of new clients through credit report screening and external references.

- Update Credit Information Regularly: Changes in a customer’s circumstances may impact their ability to meet payment obligations. You need to assess and revise your customers’ credit information regularly to avoid payment complications.

2. Ineffective Invoice Management

This method proves essential for collecting invoice payments, but inadequate management of this system leads to delayed funds receipt, which reduces your business’s cash flow.

Solution

- Issue Invoice Promptly: The distribution of invoices must happen as soon as possible. Postponements of any kind may lead to payment delays. The invoicing system must function effectively to send invoices as soon as customers receive their products or services.

- Clarify Invoice Terms: Ambiguous payment terms in your invoices, unclear due dates, and charge specifications make clients uncertain about payments, leading to payment delays. Each invoice needs a clear and concise presentation of complete payment information required for quick processing by clients.

- Double-check Invoices: Typical invoice mistakes, including incorrect item amounts or charging the wrong client, will trigger payment delays because of resulting disputes. The adoption of a detailed double-check system helps minimize errors during this process.

3. Weak Communication Strategies

Cash collection requires efficient communication as its foundation throughout the process. The collection process will lose operational effectiveness when misunderstandings arise because of poor communication, which leads to delayed payment receipt.

Solution

- Follow-Up Consistently: The failure to check invoices shows creditors that payment timelines are unimportant to the company. The company needs a strict procedure to track down unresolved invoices and send timely reminders.

- Poorly Managed Disputes: All conflicts require effective management because of their importance. A well-defined dispute resolution process helps customers receive quick solutions while keeping their relations positive.

4. Underutilization of Technology

Technology has great potential to boost cash collection efficiency in the digital age. Finance-related operations reach higher efficiency levels when organizations implement technological improvements in transactions.

Solution

- Leverage Automated Systems: Automated billing and payment systems can improve cash collection speed while reducing human mistakes in the process. Using automated systems would allow your organization to improve process efficiency.

- Use Analytics and Data Insights: Payment trends, together with potential difficulties, become clear through analytical analysis. The analysis of business data will enable you to identify patterns leading to the development of strategies that strengthen your cash collection process.

5. Lack of Standardized Processes

The missing standard operating procedures will directly affect your cash collection results through reduced reliability and diminished process effectiveness for financial transaction management.

Solution

- Create Standard Operating Procedures (SOPs): The accounts receivable (A/R) team receives absolute clarity about payment collection procedures through Standard Operating Procedures (SOPs). Without standard operating procedures, the payment acquisition process will gradually decline into disorganized inefficiency, which will cause delays in capturing funds directed to your organization.

- Train Employees: The cash collection process suffers from mishaps when employees remain inadequate in their training. The financial team may also be unaware of the latest updates. Cash collection succeeds better when workers receive proper training to execute cash payment operations.

6. Inconsistent Application of Credit Policies

A business must implement its credit policies according to schedule to establish both fairness and efficiency in its cash collection. The financial activities must remain transparent while using a well-defined standard operation system to deliver reliable financial results.

Solution

- Stick to Credit Guidelines: Giving credit without a clear policy can cause more risk and confusion. Your previously established credit guidelines require strict compliance to protect your credit operations from potential problems that arise from inconsistent methods of credit extension.

- Enforce Payment Deadlines: Providing flexibility in enforcing payment terms may cause customers to take these terms less seriously. Your organization needs to follow its payment expectations precisely while applying suitable consequences every time payments are delayed.

7. Not Prioritizing Customer Relationships

The collection of payments should never compromise your fundamental need to maintain good relationships with customers. Building trust relationships leads to lasting customer loyalty while improving the satisfaction level of your clients.

Solution

- Provide Quality Customer Service: The combination of premium service quality and problem resolution helps customers complete timely payments and receive fast solutions to their issues. A business must verify that its accounts receivable team shares the same commitment to excellent customer service because this creates stronger customer relationships that boost the company’s success.

- Understand Customer Perspectives: If you try to see things from your customer’s perspective, you’ll have a better time negotiating payment terms and resolving disputes. Empathy now will set you up for success later.

8. Insufficient Legal Preparedness

Despite your diligent efforts, legal action may be necessary to secure payment in specific circumstances. Further, recovering the outstanding amount may require legal measures.

Solution

- Document Everything: Maintain comprehensive documentation of all correspondence related to payment requests and disputes. This documentation is essential if legal proceedings become necessary.

- Know the Law: Know the debt collection laws in detail so you can follow the appropriate steps if debt collection becomes necessary. This process involves legal steps such as demand letters and legal actions.

9. Missing Key Performance Indicators (KPIs)

Your assessment of cash collection initiatives requires Key Performance Indicators (KPIs) as critical evaluation tools. Days Sales Outstanding (DSO) performance monitoring allows you to evaluate systematic operations.

Solution

- Track KPIs: Regularly monitoring cash collection is the only way to optimize the efficiency of the process.

- Review Processes Regularly: Your firm should systematically review cash collection procedures to discover ways to improve them—efficient processes combined with better cash flow become possible through this method.

In summary, Cash flow is a detailed process that requires clear and concise instructions within a well-thought-out plan. Your business will be able to optimize accounts receivable management by correcting procedural errors while also decreasing invoice processing time and maintaining the cash flow statement in the desired financial condition. The financial results of every stage within the cash collection process afford you opportunities to strengthen your financial position. Allocate time to evaluate your procedures, invest in training and technological advancements, and cultivate strong relationships with your customers. Therefore, by considering the practices mentioned above, you can improve your cash flow management and tackle the problems better.

Cash Collection FAQs

Here are answers to common cash collection questions.

How can frequent cash collection errors impact my business?

Late arrival of money, weak cash flow, and customer relations that hang by a thread are consequences a company might face if cash collection errors are frequent.

How can I avoid cash collection mistakes in my business?

You need a clear invoicing system to track payment terms, communicate well with customers, and use automated tools to reduce cash collection errors.

How can I prevent errors in invoicing?

Before sending invoices, ensure the right customer and the right amounts are mentioned correctly, and take advantage of accounting software to eliminate human error.

What makes having clear payment terms so important?

Consistency and transparency in payment terms help both parties understand the expectations and also provide a legal framework that can be used if necessary, especially for debt recovery.

Cheqly Makes Managing Cash Flow Simple

Cash flow is key to keeping your business stable. As a business owner, it’s important to keep things running smoothly when it comes to managing cash. Neobanks, like Cheqly, offer services such as ACH and wire transfers with low costs, as well as real-time tracking of your finances, which are great ways to improve your cash flow significantly. If you choose to utilize Cheqly, you will streamline your financial operations and become a more efficient manager of your cash resources.

Sign up for a Cheqly account now and take charge of your cash flow.