In 2025, AP teams are utilizing advanced automation, real-time dashboards, and regular performance reviews to manage the main AP KPIs, although full implementation is still in progress. Through these tools, the teams obtain real-time data on AP operations that help them reduce mistakes and thus improve cash flow without the need to depend on guesswork. Being aware of effective ways to gauge your AP department in a financial environment undergoing rapid automation is crucial for making strategic-level decisions.

The article walks you through the most important AP KPIs and gives you simple methods of tracking and applying them to increase your company’s financial well-being.

What are Accounts Payable KPIs & Why are they Important to Track?

The use of accounts payable key performance indicators provides observable information on the effectiveness, accuracy, and efficiency of their AP procedures. They help AP teams measure cash flow, payments, and invoice management with predefined targets.

Suppose, for instance, an accounts payable department sets out to minimize its invoice processing time. Efficiency in AP can be a broad concept; hence, measuring variables such as “average invoice processing time” and “percentage of invoices processed without errors” will help the team measure performance accurately and find the exact reasons for the inefficiency that occurred.

AP KPIs can serve as a basis for setting performance standards for finance teams, which monitor progress, identify inefficiencies, enhance supplier relations, and increase cash flow.

Measure appropriate KPIs, and businesses will reduce expenses, simplify operations, and minimize financial risks.

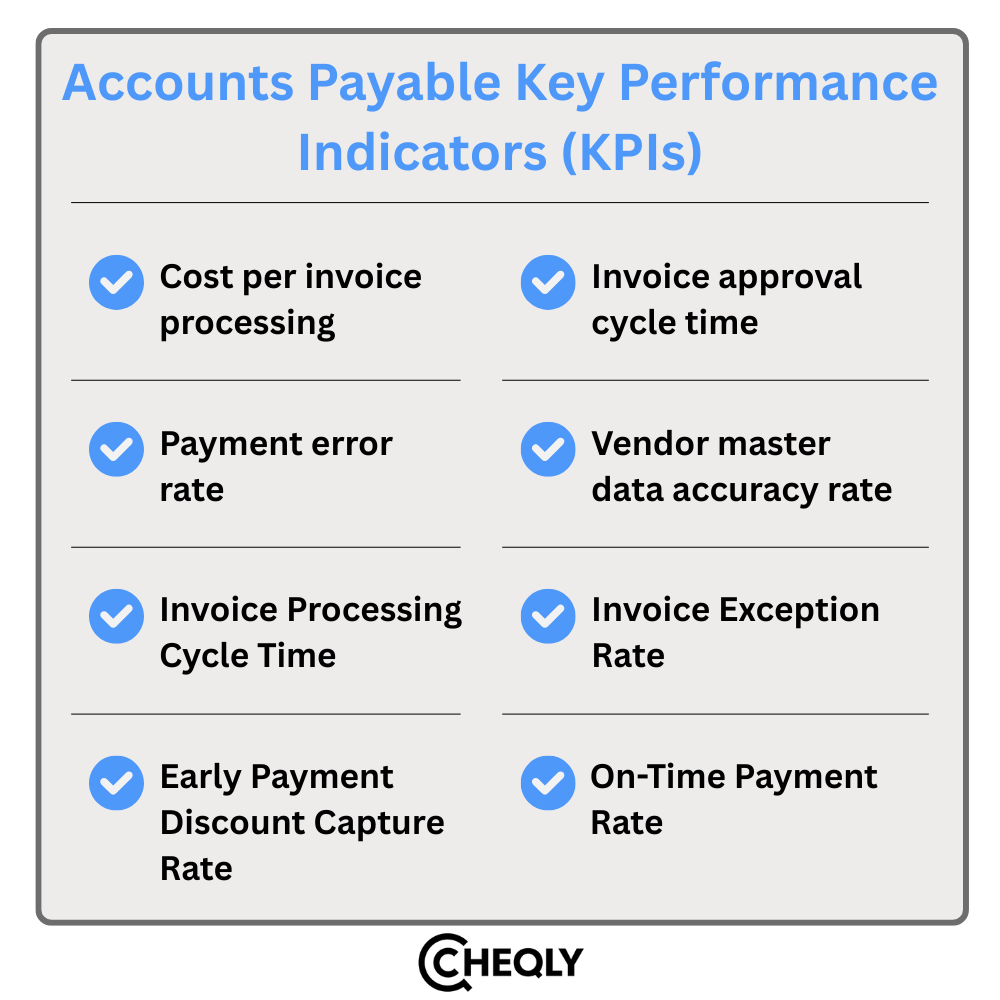

8 Key KPIs the Accounts Payable Team Should Track

Here are eight key AP metrics every finance team should keep an eye on in 2025 to boost performance and make decision-making easier.

Cost Per Invoice Processing

This metric calculates the average cost involved in processing a single invoice, covering all related expenses like software, overhead, and labor.

Note: All relevant expenses for a specific period should be included in the total AP processing costs.

Significance: To recognize where you can save money, you need to figure out the real cost of processing invoices. By automating invoice processing, you don’t just allow the business to be more profitable; you also help ensure that the business is more cost-effective.

Payment Error Rate

The payment error rate is a measure that shows the number of payments made in error as a percentage, for example, payments with incorrect amounts, wrong vendor details, or duplicate payments.

Significance: Incorrect payments can lead to monetary losses, poor vendor relations, and compliance issues. Maintaining a steady financial position and trust with suppliers requires keeping payment error rates low.

Invoice Processing Cycle Time

This measures the average time it takes to process an invoice from receipt to final payment and also serves as a reflection of the overall efficiency of your AP workflow.

Note: Time, which directly depends on the quantity of data to be processed and the complexity of the information, can be measured in days or hours.

Significance: Extended durations of the cycle can lead to poor partnerships with vendors, which in turn can affect your finances negatively through loss of discounts or late payments. A quick turnaround of the cycle will ensure the smooth functioning of the business and an increase in cash flow.

Early Payment Discount Capture Rate

The early payment discount capture rate is the ratio of utilized early payment discounts to those available.

Significance: The opportunity to cut costs through the use of prompt payment discounts is huge. Generating better cash flow and decreasing expenses are the two main benefits of taking advantage of discount capture. Measuring this KPI will pinpoint the exact areas that need changes in discount capturing.

Invoice Approval Cycle Time

Invoice approval cycle time generally measures the median time it takes for an invoice to be approved after it has been sent for approval. It is particularly focused on the approval stage of the invoice life cycle.

Significance: Invoice approval hold-ups often occur. This KPI is useful for tracking the flow of the approval process by identifying blockages, discovering delays, and making the workflow more efficient to process invoices faster.

Vendor Master Data Accuracy Rate

It measures how correct your vendor data is, including things like addresses, bank info, and contact details.

Note: The definition of “accurate” will depend on the specific data elements you consider significant.

Significance: Due to incorrect data from the supplier, there is potential for fraud, delays, and errors in payment. Efficient and secure business and finance can only be achieved by accurately updating the data.

Invoice Exception Rate

The invoice exception rate refers to the proportion of invoices that need human intervention or are unusual, such as purchase order matching errors, pricing mistakes, or missing data.

Significance: A high exception rate indicates manual rework and process inefficiencies. Faster processing and cheaper costs result from reducing exceptions through process enhancements, improved data management, and automation.

On-Time Payment Rate

The on-time payment rate is the percentage of vendor payments made on or before the due dates.

Significance: Paying your vendors on time helps keep good relationships, avoid fees, and maybe get early payment discounts. When most payments are made on time, it shows your accounts payable team is working well and organized.

In summary, consistently analyzing these KPIs provides the company with a clearer picture of the performance of the AP department. Through the application of the right tools, automation, and strategy, you can reduce costs, eliminate errors, and, at the same time, earn the trust of suppliers while keeping your cash flow in a good place.

FAQs on Accounts Payable KPIs

The following are some common answers to questions on Accounts Payable KPIs.

Why is AP important for businesses?

AP is responsible for settling invoices on time, supporting vendors, managing cash, and ensuring accurate financial statements.

What are the common challenges in AP?

Typical challenges in accounts payable are manual data entry, delayed approvals, duplicate payments, invoice discrepancies, and lack of visibility.

Are AP KPIs the same across industries?

No, every industry has unique benchmarks and processes designed to match the respective payment periods and vendor dynamics.

Can AP KPIs help with fraud prevention?

Yes, if businesses keep an eye on AP KPIs, they can find anomalies such as multiple transactions for the same payment or an extremely high amount that can be indicative of a fraud situation.

How often should AP KPIs be reviewed?

While once a month is a common practice, it might be necessary to monitor key performance indicators more frequently, especially in cases of high AP flow.

How can I align AP KPIs with company goals?

Develop KPIs that align with broader objectives, such as positively influencing cash flow, lowering expenses, or maintaining the relationship with the supplier.

How do AP KPIs influence financial strategy?

Budgeting, liquidity planning, and vendor negotiations are sources of information critical for healthy financial management.

Which tools are best for monitoring AP KPIs?

ERP systems, AP automation platforms, and dashboard/reporting tools can be used to track KPIs and display the data easily in an understandable way.

Cheqly: The Easy Way to Manage Business Finances

Cheqly offers small business owners a simple way to manage their finances through an easy-to-use business account platform with no monthly fees or minimum balance requirements. You can also manage payment transactions, view your real-time financial insights, access your money via a VISA debit card, and make local and international transfers online—all in one place.

By being simple and easy to navigate and having no extra fees, Cheqly lets you focus more on your business and worry less about the financial side.

Experience easy business finance—sign up for Cheqly now.