A well-structured profit and loss (P&L) statement is a vital accounting tool used by the finance team, VPs, managers, and CFOs to assess the financial performance of a company. This report summarizes revenue streams, business expenses, COGS (cost of goods sold), and net income over a specific period. Whether you’re managing a startup or a well-established enterprise, understanding how to read and analyze a P&L statement is essential.

In this article, we are going to talk about what exactly a P&L statement is, go over its various types (single-step and multi-step), discuss how to make one, and explain the differences between a P&L statement and a balance sheet.

Key Takeaways

- To understand whether a business is making money or losing money, leaders rely on the P&L statement.

- A business can choose how detailed it wants its statement to be by selecting either the single-step or multi-step P&L format.

- To create a P&L statement, businesses start by listing income and then subtract expenses (like COGS, operational costs, and taxes) to calculate net income or EBITDA.

- Regularly reviewing the P&L helps account managers, CFOs, and executives make more informed decisions and align strategy with actual financial performance.

What is a profit and loss statement?

A profit and loss statement is a financial statement that businesses utilize to show their income and expenses during a particular time frame. Organizations typically generate a profit and loss statement (P&L) on a quarterly and annual basis; however, they may generate it on a more frequent basis.

Alternative Terms for a Profit and Loss Statement

Different terms are frequently used interchangeably with “profit and loss statements” by companies. The terminology employed may vary depending on the company, industry, or jurisdiction. Among the alternative terms are

- Income Statement

- Earnings Statement

- Operating Statement

- Revenue Statement

- Statement of profit and loss

How Does a Profit and Loss Statement Work?

A profit and loss statement (P&L) is a financial report that can be used to compare an organization’s performance to that of its competitors in the same industry.

The company can identify areas of improvement and be more prescriptive about cash burn moving forward by observing that each entry on the statement represents either a revenue stream or an expense.

Due to the fact that a P&L statement breaks down revenue and expenses by account, managers, VPs, and even the CFO can promptly ascertain the impact of each account on the bottom line. A P&L statement usually serves as the starting point for these decisions, but you will still need to dig deeper into each account to make the right budget changes or adjustments.

How a Profit and Loss Statement Differs from a Balance Sheet

A balance sheet contains liabilities, long-term assets, and shareholder equity at a specific point in time, while a P&L statement delineates revenue and expenses over a specific period. These two statements are frequently confused with one another. Each is employed to address distinct inquiries and serves as the foundation for distinct reports.

What Should Be Included in a Profit and Loss Statement?

What is the precise content of a profit and loss statement? In general, P&L statements are divided into a few primary categories, although the more specific line items may differ from company to company.

- Sales (or Revenue)

- Cost of Goods Sold (COGS)

- Marketing and advertising

- Selling, general, and administrative (SG&A) expenses

- Taxes

- Interest expenditure

- Net income

Types of profit and loss statements

It is not only the line items within a P&L statement that vary from company to company, but the methodologies used to generate the statement also vary. The two primary techniques are as follows.

Single Step Method

A single-step P&L statement simplifies the reporting process by consolidating a company’s revenue and expenses into just two equations. The statement typically begins with total revenues (and gains) at the top, followed by total expenses (and losses), with net income shown at the bottom. A simplified format of a profit and loss statement is presented below.

- Pros: This is an easy method for businesses to report on their profit and loss statements, as it involves a straightforward equation for each category. Using this method makes it easy for stakeholders to understand the statement.

- Cons: Finding opportunities can be tough for businesses following the single-step method. A firm has difficulty understanding where it makes its money, how it spends it, and where it could eliminate costs.

Multi-step method

The multi-step method for P&L statement creation is a more detailed variant of the single-step method, as you may have inferred. This approach takes a closer look at each type of income and expense, using different calculations to figure out the overall profit and loss.

- Pros: A business should present an expense and revenue breakdown in its analysis to better assess its finances. As a result, budgets, strategies, and the financial health of the company can all be evaluated more wisely by the Office of the CFO.

- Cons: It takes more time to create a multi-step P&L statement from an accounting point of view. Additionally, sifting through all line items may be challenging for investors and other stakeholders, depending on the length. A significant amount of manual labor is generated by the quantity and granularity of data required for these statements unless a financial performance platform is implemented.

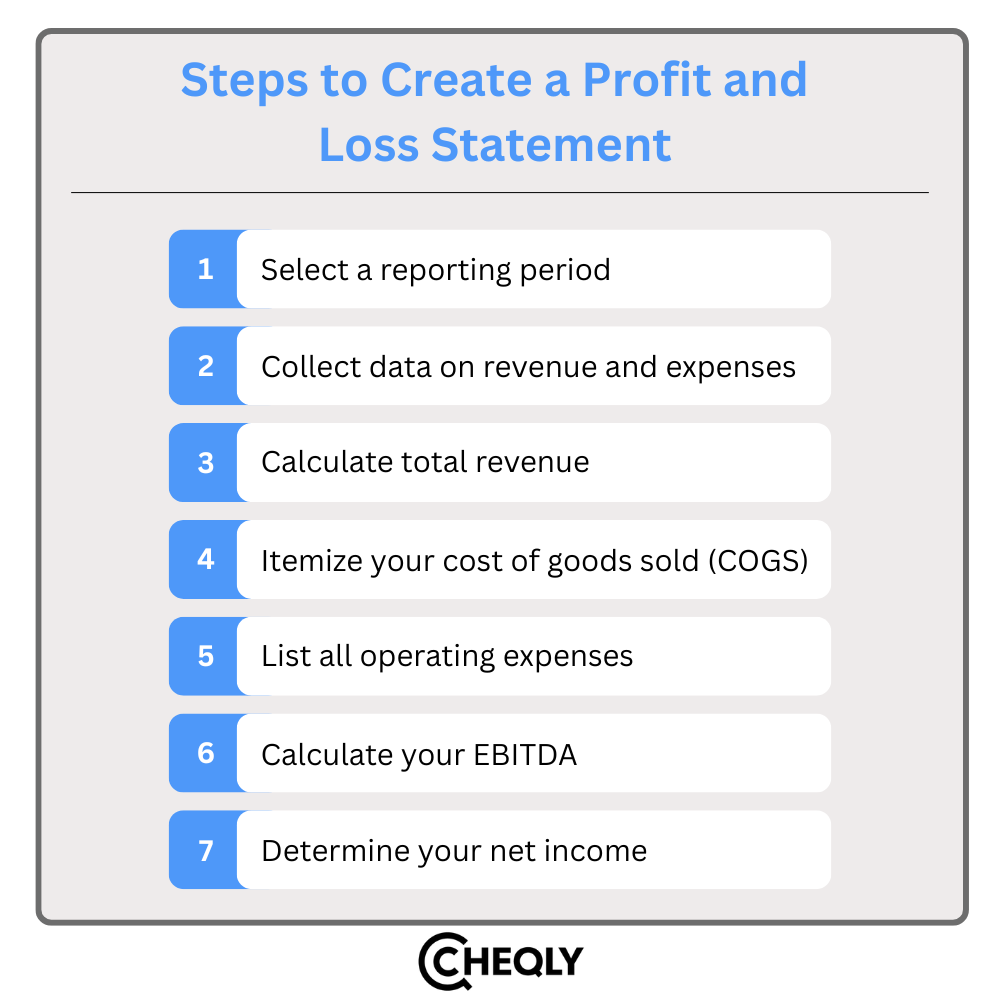

Steps to Create a Profit and Loss Statement

After you have gathered information about the profit and loss statement and its types, let us now see the procedure for creating one.

The subsequent stages constitute a straightforward yet comprehensive profit and loss statement.

- Select a reporting period: Companies are frequently obligated to generate a profit and loss statement at the conclusion of each fiscal year, as mandated by law. Nevertheless, certain organizations elect to disclose their profits and losses on a quarterly or biannual basis.

- Collect data on revenue and expenses: Gather information from your accounting tool regarding the company’s revenue streams and a comprehensive inventory of expenses to facilitate the preparation of each line entry.

- Calculate total revenue: Compute the aggregate of your revenue from each relevant channel.

- Itemize your cost of goods sold (COGS): To optimize the visibility of the cost breakdown, organize your COGS data into individual entries.

- List all operating expenses: Compile a list of your other overhead business expenses in the additional line entries.

- Calculate your EBITDA: The breakdown of Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) will provide an additional method of evaluating overall profitability and should be included in your statement.

- Determine your net income: Given all the information provided above, use the simple equation to find out your company’s net income.

Example of a profit and loss statement

Let’s use Sunny’s Café, a small coffee shop, as an example of how a profit and loss statement can be created using the single-step method. The following is a summary of the financial information for the year ending December 31, 2024:

| Category | Amount (USD) |

| Revenues | |

| Sales Revenue | $100,000 |

| Other Income | $6,000 |

| Total Revenue | $106,000 |

| Expenses | |

| Cost of Goods Sold (COGS) | $40,000 |

| Salaries | $20,000 |

| Rent | $15,000 |

| Utilities | $5,000 |

| Marketing | $4,000 |

| Insurance | $3,000 |

| Interest Expense | $2,000 |

| Income Tax | $7,000 |

| Total Expenses | $96,000 |

| Net Profit | $10,000 |

How the Calculations Work:

Step 1: Calculate Total Revenue

Total Revenue = Sales Revenue + Other Income

= $100,000 + $6,000

= $106,000

Step 2: Calculate Total Expenses

Total Expenses = Sum of all expenses (COGS, salaries, rent, utilities, marketing, insurance, interest, taxes)

= $40,000 + $20,000 + $15,000 + $5,000 + $4,000 + $3,000 + $2,000 + $7,000

= $96,000

Step 3: Calculate Net Profit

Net Profit = Total Revenue − Total Expenses

= $106,000−$96,000

= $10,000

By using the single-step method, the net profit of Sunny’s Café for the year is $10,000. This method simplifies the calculation by first adding up all the revenues and expenses separately and then finding the difference between the two.

In conclusion, making a profit and loss statement can be a stress-free experience after all. Your team can definitely be comfortable with producing correct P&L statements if they agree on a way, get the data, and follow the steps mentioned above.

FAQs About Profit and Loss Statement

Still interested in learning more about profit and loss statements? Below are some of the most frequently asked questions and their answers:

Can small businesses use a P&L statement?

Small businesses tend to be more dependent on P&L statements for their cash flow management, progress monitoring, and decision-making, which are smarter.

How do I choose the right format for my business?

Smaller businesses might lean towards the single-step method for its simplicity, while bigger ones usually require the depth of the multi-step method.

Is a P&L statement enough to understand my finances?

It’s definitely important, but it’s most effective when used together with the balance sheet and cash flow statement to get a complete understanding.

How do investors use a P&L statement?

They look at it to evaluate your business’s profit, efficiency, and ability to grow.

Do I need special software to create a P&L statement?

That’s not really the case. You can create one using Excel, Google Sheets, or accounting software like QuickBooks or Xero.

Revolutionize Your Cash Flow Management with Cheqly

Cheqly helps small business owners manage their cash flow better by giving them quick updates and easy access to their money. It offers low-cost online transfers and physical or virtual debit cards with no hidden fees. Cheqly makes it easier to make smart money decisions that grow the business and improve cash flow.

Get started with a Cheqly business account today and boost your cash flow!