As online payments are transforming in this digital age, it is essential to protect sensitive payment data. Companies dealing with credit card payments, debit card payments, and other digital transactions need to learn how to guard payment information against fraudsters without falling short of the industry regulations, such as PCI DSS.

That is where payment tokenisation comes into play. This is a powerful data security method that replaces insecure credit card numbers and any other sensitive payment information with encrypted tokens.

In this article, we will explore what payment tokenization is, how it is carried out in a payment system, and the numerous ways in which it can add value to your business when it comes to securing point-of-sale (POS) systems and mobile payment solutions. Let’s get started and learn more!

Key Takeaways

- Tokenization is a process through which sensitive payment information (credit card details) is substituted with a unique, nonsensitive token and is rendered useless should it fall into the wrong hands, like those of hackers.

- By securely storing the real card information during transactions, tokenization enhances payment security and reduces the risk of data theft and fraud.

- By reducing the quantity of sensitive data that businesses retain, tokenization simplifies PCI DSS compliance, thereby reducing the scope and cost of conducting security audits.

- It increases customer confidence because people will be reassured that their payment information is stored properly, which contributes to their loyalty and satisfaction.

- It makes payments smoother by automating transactions, helping businesses handle recurring bills and online checkouts faster and more reliably.

Understanding Payment Tokenization

A token is a random, unique collection of characters used to substitute secret payment data, e.g., credit card numbers, as a security measure referred to as payment tokenization. This process makes transactions secure, as payment data is not used or stored, but the encrypted version of the actual card details is. The token doesn’t contain payment details, so even if accessed, it can’t be used to make a fake order.

Tokens also help eliminate the risk of data breaches and fraud since businesses can use them instead of real card data and guarantee a safe and convenient payment process for their consumers.

How does tokenization work?

In tokenization, the data that is deemed sensitive, such as payment information, is converted into its nonsensitive equivalent, which may be stored and transmitted as safely as possible without the risk of the original data being compromised in terms of security. In payment processing, tokenization works in the following way:

Information Collection

The business receives payment information from customers, including their credit card details, when they initiate a transaction.

Requesting a Token

The business may transmit sensitive data to a secure tokenization service, which is typically provided by a payment processor or a third-party tokenization vendor, contingent upon the configuration of its payment system. When a merchant uses payment hardware or software that is compatible with tokenization, tokenization is performed electronically as a primary element of the payment procedure.

Creating the Token

The tokenization process employs a combination of encryption methods, secure storage, and algorithms to produce a distinctive token that embodies the original payment data. This counterpart is usually a random sequence of characters or digits that has no merit or meaning outside the system of the specific payment mechanism.

Saving the Token

The token is stored in the business’s system, substituting for the sensitive payment data. The secure repository of the tokenization service is where the original payment data is kept in a secure manner to ensure that there is no unauthorized access or data breaches.

Using the Token for Payment

The business may transmit the token to the payment processor or tokenization service to facilitate the transaction. This is then safer because the service securely maps the token to the original payment data, so the transaction can be settled without revealing the sensitive information to the business or other middlemen.

Reusing the Token for Future Transactions

By the same token, one could also use it multiple times, for example, for subscription services or customer profiles that are saved, without having to enter payment information of a sensitive nature every time. This not only facilitates the payments but also ensures that security is not compromised.

Which businesses should use payment tokenization?

Businesses that would benefit from implementing payment tokenization are:

- Online retailers: Tokenization is a method that protects customer payment data and minimizes the likelihood of fraud or intrusions in online transactions.

- Businesses with subscription models: Tokenization is a secure method for organizations that provide recurring invoicing to manage customer payment data for ongoing transactions.

- Physical store retailers: Although the use of tokenization is more common in an online transaction system, it can be beneficial in the case of physical stores that use point-of-sale (POS) or mobile payment systems because it provides an extra level of security.

- Digital platforms and marketplaces: When multiple parties are involved in complex transactions, payment tokenization promotes trust and scalability in the operations of platform businesses by enhancing security and streamlining the administration of sensitive payment data.

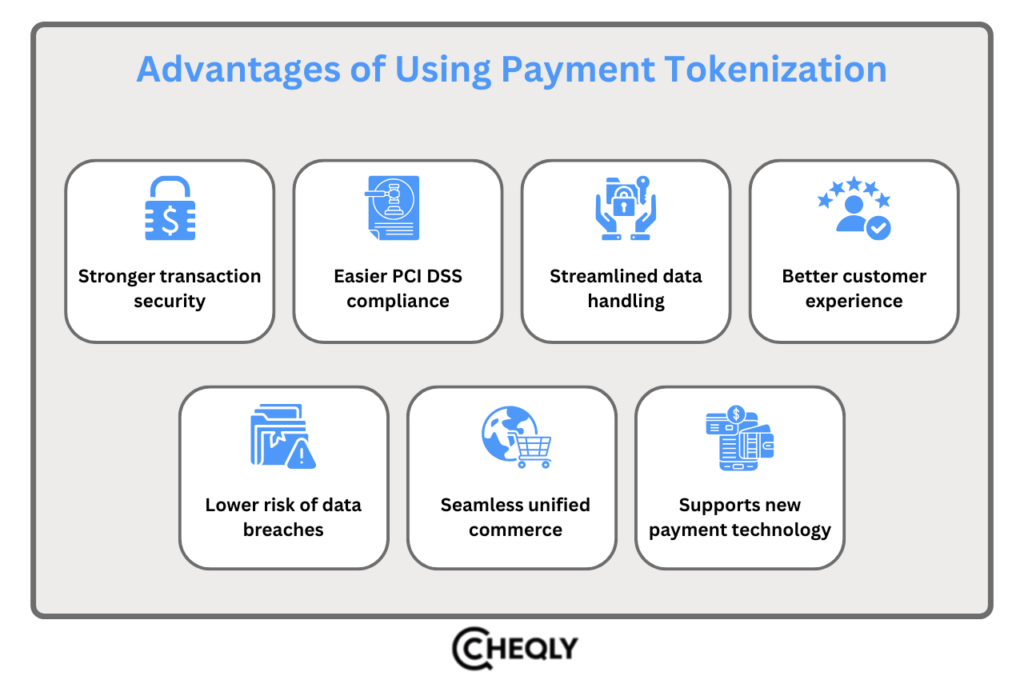

Advantages of using payment tokenization

Numerous industries and business models can apply the system of payment tokenization, which offers numerous benefits. In most cases, where there is a possibility of consumers accepting credit or debit cards as payment methods, tokenization would be beneficial as well. Tokenization offers the following advantages:

- Stronger transaction security: Since nonsensitive tokens replace the sensitive payment information, they eliminate the risk of fraud and data breaches. This ensures that the real payment data does not leak during a transaction, and thus the likelihood of theft or indulgence by unauthorized users or parties is minimal.

- Easier PCI DSS compliance: Tokenization helps a company meet industry-specific standards such as the Payment Card Industry Data Security Standard (PCI DSS) by minimizing the storage and processing of sensitive payment information. Not conforming to the Payment Card Industry Data Security Standard (PCI DSS) may lead to consumer loss and fines from decreased consumer confidence.

- Streamlined data handling: Tokenization helps businesses manage the tokenized payment information of consumers in a better way. The time that is spent on the payment process can be decreased, and the necessity of gathering and storing sensitive data is once again eliminated due to the possibility of using already prepared tokens in subsequent purchases. Simplifying the procedure eliminates data management challenges and reduces associated costs.

- Better customer experience: Fraud reduction not only represents the investment in the safety of your customers’ information but also contributes to a smoother purchase process and an increase in confidence in your organization. An efficient payment system that considers the recycling of the tokens for repeated customers has the capacity to increase customer loyalty and their subsequent purchasing.

- Lower risk of data breaches: Tokenization ensures captured data remains non-sensitive, preventing its use in fraud and minimizing losses if a company suffers a data breach. It will protect your brand image and minimize the negative impact on the business and customers.

- Seamless unified commerce: Tokenization allows organizations to safely process payment data over varied channels, such as online or offline shops, or as part of a customer loyalty scheme. With this smooth overlap, the customer experience remains steady and safe, and the back-end information will be consolidated, regardless of the transaction channel.

- Supports new payment technology: Tokenization can be implemented in new technologies, including digital wallets and contactless payments, as payment methods continue to develop. This allows businesses to implement cutting-edge payment solutions while simultaneously guaranteeing a high level of security.

FAQs on Payment Tokenization

The following are some frequently asked questions about payment tokenization:

Who provides payment tokenization?

Tokenization services are provided by payment processors, gateways, and security vendors who specialize in it.

What data does payment tokenization protect?

Mostly credit and debit card numbers. However, they also consist of other payment information, such as bank accounts.

Can one token represent multiple cards?

Each token generally corresponds to a single card or one piece of confidential information to guarantee privacy and the ability to trace the transaction.

How does tokenization help with recurring billing?

It enables businesses to securely store a token rather than the actual card details, which then makes repeat transactions safe and effortless, thus subscriptions or regular payments become more convenient.

Can small businesses use tokenization?

Yes. It is beneficial for companies of all sizes to secure payment information.

Are tokens linked to specific transactions?

Tokens generally remain associated with a consumer or card, which makes it possible to carry out subsequent transactions without having to keep any actual information.

How does tokenization reduce PCI DSS scope?

Tokenization replaces real card data with tokens and sends only tokenized data to merchant systems, limiting PCI DSS scope, reducing compliance costs, and simplifying requirements.

Cheqly makes your transfers safe and reliable

Cheqly, in collaboration with Socure, doubles the security level with the help of the most innovative KYC and AML systems.

These systems, which are powered by AI, give them the ability to recognize customers, keep track of operations, and detect fraud as well as carry out preventive measures in real time. Your business account is protected at all times. When you choose Cheqly, you can have peace of mind knowing your account won’t be hacked, as it’s secured with advanced technology.

Open a Cheqly business account now and be worry-free!