Digital wallets are changing the ways in which Americans make purchases, payments, and interact with companies. By 2025, convenience, security, and rewards will be the factors driving widespread adoption of digital wallets, impacting consumer expectations and compelling businesses to include wallet-friendly solutions in all of their operations. Companies that do not undergo the necessary transformation are the ones most likely to lose clients to competitors who offer seamless, digital-first payment services.

The merger of mobile technology, secure transactions, and innovative financial instruments has changed the way trade is conducted across the United States. Digital wallets are the main reason for faster transactions, more advanced experiences, and improved customer retention. This trend affects not only small stores but also large enterprises, which are increasingly relying on wallets as a crucial factor in their operational efficiency and sustainable economic growth.

This article explores how digital wallets are transforming business operations in the US and offers key insights for companies adapting to a mobile-first, customer-focused future.

US Market Growth & Consumer Adoption

The digital wallet revolution is backed by data, not mere speculation. The number of digital wallet users soared past 4.3 billion globally by mid-2025, with transaction volumes projected to reach $17 trillion by 2029—up 73% from 2024.

In the United States, growth has been equally dramatic. By mid-2025, 65% of adults were using a digital wallet, compared to 57% in 2024—a clear year-over-year jump. This year-over-year jump highlights how digital payments have moved firmly into the mainstream—no longer just for early adopters or the urban elite.

Adding to this momentum, digital wallets accounted for 39% of e-commerce in the US and 16% of in-store transactions in 2024, according to Worldpay. By 2030, they are predicted to represent 52% of online and 30% of point-of-sale transactions.

Proximity mobile payment transactions in the US reached about $670.5 billion in 2024 and are expected to surpass $1 trillion by 2027, indicating strong growth in transaction value alongside the expanding user base.

The trend also goes beyond national borders. By early 2025, 55% of US consumers preferred digital wallets for cross-border payments—outpacing traditional bank wires and cards for international commerce, travel, and remote work. Global wallet adoption is removing longstanding payment barriers for American businesses operating worldwide.

Consumer Behavior & Preferences

Digital wallets are rapidly changing how people shop and spend:

- 41% of users pick wallets mainly because of the ease of use; 22% choose them to get rewards or loyalty benefits.

- More than half of consumers (51%) do not shop at stores where they can not use their digital wallets, and this percentage increases up to 78% with Generation Z.

- 47% of people in the US use their digital wallets more often than cards or cash. In particular, three in five Gen Z consumers (60%) and 61% of Millennials use digital wallets online on a weekly basis.

- Preference of platforms reveals that 69% of users rely mostly on PayPal, followed by Google Pay (56%), Apple Pay (53%), and Samsung Pay (52%).

- In 2023, 91% of adults aged 18–26 viewed digital wallets as their primary means of payment, illustrating the strong hold of the younger generation on payment methods.

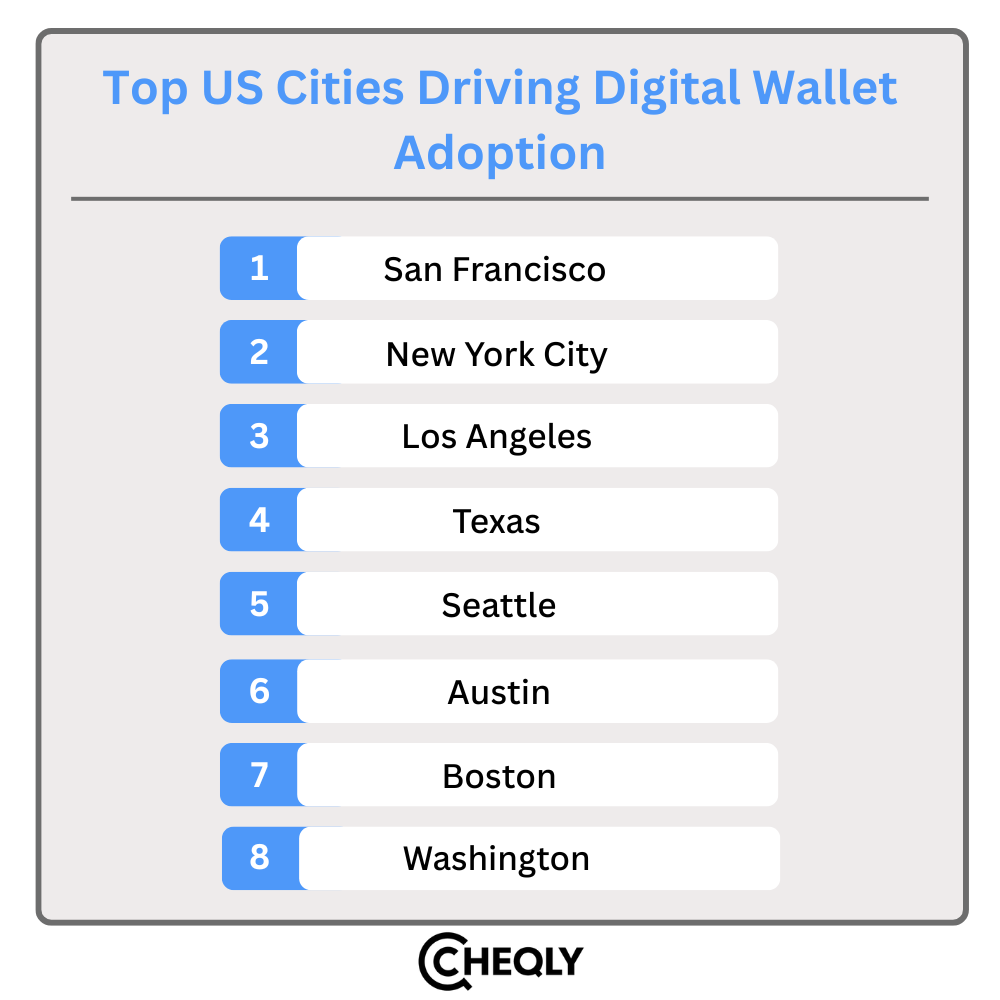

Top US Cities Driving Digital Wallet Adoption

The adoption of digital wallets in America is not evenly distributed, with some cities leading the way due to a combination of tech leadership, public investment, cultural openness, and business willingness:

- San Francisco: With deep tech roots and a culture of early adoption, over 80% of Bay Area merchants accept digital payments. Everything from local shops to major public transit lines like BART is wallet-ready, making cashless living standard for residents and visitors alike.

- New York: Dense population, regular international travel, and a robust infrastructure (including wallet-enabled public transit and taxis) drive widespread wallet use. Merchants of all sizes now prioritize tap-and-pay or QR code solutions for domestic and foreign customers.

- Los Angeles: Its cultural diversity and creative industries have normalized the use of wallets for everything from street food to fine dining and shopping in luxury boutiques.

- Seattle: As the home of tech titans and smart city initiatives, Seattle’s public and private sectors jointly promote wallet acceptance, including digital IDs and citywide wallet-enabled services.

- Austin: A boomtown for tech startups and millennial/transplant populations, Austin’s digital-first businesses—from music venues to coffee shops—quickly embrace wallet and QR payments.

- Boston & Washington: These cities combine high education levels with substantial government spending on digital upgrades, resulting in high mobile wallet usage for routine commerce and transit.

Key US Digital Wallet Trends Driving 2025 and Beyond

Here’s a look at the major forces set to transform commerce and payments in 2025 and beyond.

1. AI-Driven Security & Biometric Authentication

Security cannot be compromised. The digital wallets in 2025 will be built on biometric authentication (facial recognition, fingerprint scanning) and AI-based fraud detection. With the biometric verification market set to achieve a value of $3 trillion by 2025, the trust of consumers has become a major factor in driving mainstream adoption.

“By 2025, Biometrics Will Protect More Than $3 Trillion in Mobile Payments”

– Juniper Research

AI now monitors all wallet payments in real-time, processes data to identify unusual patterns or emerging threats, and prevents fraud almost instantly, sometimes before the customer is even aware.

The combination of frictionless access (just look or tap to pay) and high security levels allows customers to feel increasingly comfortable pushing larger and more frequent payments through their wallets, with quantifiable positive consequences for both user trust and merchant credibility.

2. BNPL Integration & Changing Spending Behavior

Buy Now, Pay Later (BNPL) is now a built-in wallet function. In 2024, one in four wallet users tapped BNPL, and usage spikes dramatically around peak sales events—Cyber Monday 2023 saw BNPL volume jump 42.5% YoY to $940 million-plus.

“BNPL drove $940M in Cyber Monday spending, up 42.5% YoY as shoppers sought flexible payments”

– Adobe

BNPL isn’t just popular with shoppers looking to split up purchases—it’s reshaping checkout design, advertising, and merchant cash flow. Wallets that make BNPL frictionless (one tap to select a payment plan) convert more carts, especially on high-value or multi-item orders, and do so with minimal customer hesitation.

3. Mobile & Contactless Commerce Dominate

In 2024, approximately 68% of digital wallet transactions were carried out on mobile phones, which highlights the prevalence of mobile-first consumer behaviors. The use of tap-to-pay in US retail has increased by 23% year-over-year and currently represents 38% of in-store purchases. Such a sharp increase shows that contactless wallets are turning into the default choice for shoppers, who are looking for convenience and are keeping hygiene in mind.

“Mobile phones accounted for about 68% of digital wallet transactions in 2024”

– Forbes

4. The Super Wallet & Embedded Finance Surge

Digital wallets are upgrading to super wallets—payment platforms that are not limited to payments but also incorporate subscriptions, loyalty, travel passes, identity credentials, and other financial services such as loans and investments. About ten years from now, these wallets will be on deck for everyday consumer decision-making. Large companies offering wallet technologies, such as Apple Wallet and Google Wallet, are nowadays going further by including loyalty, transit, and identity features in their products for an effortless and individualized customer experience.

5. AI & Real-Time Personalization

Instant, customized payment interactions have become the norm for consumers. 71% of them say they would be much more willing to finalize a purchase if it were possible to pay in the way they like, digitally. The use of embedded finance and AI applications in wallets is opening new avenues for targeted offers, fraud prevention, and risk checks. The trend of wallets performing transactions by taking into account users’ habits and the probability of their consent is turning the whole payment process into a more intelligent and user-centric one.

“71% are more likely to buy if their preferred digital payment is available”

– Paypal Study

What Businesses Should Do

To win in this new era, US businesses should:

- Modernize payments: Install and test systems supporting all key digital wallets (Apple Pay, Google Pay, PayPal, and Samsung Pay) and ensure QR/tap pay works seamlessly.

- Maximize visibility: Market wallet acceptance online (checkout pages, apps) and offline (POS signs, window decals), so customers know their preferred payment works before purchase.

- Integrate loyalty/rewards: Connect your in-house loyalty programs directly to digital wallets for easy accrual and redemption.

- Analyze wallet data: Use wallet-based transaction data (securely and with permission) to drive personalized promotions, segment users, and measure campaign results.

- Educate your staff and customers: Offer clear instructions, deal with FAQs, and demonstrate security features to boost trust and adoption.

- Stay alert: Continuously track new wallet technologies—like crypto features, new biometric methods, or “super app” integrations—and be ready to adapt ahead of consumer expectations.

Challenges to Overcome

The transition to wallet-first commerce involves real hurdles:

- Upgrading legacy tech: Old POS terminals or payment gateways may need replacement or software updates to be 100% wallet-compatible.

- Picking the right wallets: Your audience may prefer specific platforms, so study customer data and industry trends to support what matters.

- User onboarding: Some demographics (like older adults) need support and education to use new payment tech. Patience and training are critical.

- Regulation and compliance: Ensure PCI-DSS, data protection, and privacy law compliance, especially as wallets become richer in financial and personal data.

Digital Wallets: Shaping the Future of US Business

Digital wallets have become essential in the American business landscape, particularly in areas of the country known for the intersection of technology, commerce, and young, diverse communities. It is predicted that by 2025, more than $10 trillion in global transactions will be carried out through digital wallets, with the US being the main driver of innovation and integration. As user confidence, security measures, and loyalty incentives continue to increase, companies are receiving a strong signal: it is not only advantageous to have a digital wallet-compatible business but also crucial for sustaining success in the future.

FAQs on Digital Wallets

The following are common FAQs related to digital wallets.

Can digital wallets replace traditional POS?

Not entirely. Although digital wallets are expanding rapidly, the traditional point-of-sale system is still essential for users of cash and cards. At the moment, wallets are supporting POS rather than completely taking over it.

Do digital wallets support cross-border and recurring payments?

Yes. Most wallets offer international payments and recurring billing features, making global commerce and subscriptions simple.

How do wallets impact cash flow and conversion?

Digital wallets carry out cash flow at a much faster rate as they provide the option to make instant payments, eliminate waiting times for the receipt of funds, and make liquidity management smoother. Besides that, they also increase the rate of conversions, since shoppers tend to finalize their transactions when easy and common payment methods are offered.

What are the costs associated with accepting digital wallets?

The main fees are similar to or lower than those of credit cards; wallet-based payment often sees less fraud, further saving costs.

How do digital wallets affect customer data collection?

The transactions carried out through digital wallets provide data about consumer behavior that can be used for analytics and marketing purposes; however, privacy laws and user consent should be followed at all times.

Use Cheqly to Make Smarter Mobile Payments

Managing payments on the go can be a hectic task for small business owners. With Cheqly’s virtual debit card, you can make secure transactions through digital wallets like Apple Pay, Google Pay, or Samsung Pay, as well as online and in-app purchases. Without needing a computer, you can pay vendors, handle recurring bills, or cover everyday business expenses directly from your phone. At the same time, you can easily track all spending, keeping your business finances organized and hassle-free.

Open a Cheqly business account and tap into the power of mobile transactions.