Having sufficient working capital—the money set aside to meet your short-term needs and maintain the flow of operations—is largely the secret to the smooth running of a business. A lack of it can cause businesses to be profitable yet still run out of money, which may halt their growth or create stressful situations. What’s even better? There are effective ways to build your working capital, enhance cash inflow, and boost your business’s financial health.

In this article, you’ll learn how to calculate working capital, explore adoption trends, and discover practical ways to solve common working capital challenges.

Adoption of Working Capital Solutions Is Accelerating

In today’s fast-paced market, businesses are turning to digital tools and ERP platforms to improve liquidity. In 2024, 81% of growth-stage companies (with $50M–$1B in annual revenue) adopted at least one external working capital solution, up 13% from 2023.

Formula to calculate working capital

Before we go deeper into ways to raise your business’s working capital, it is essential to ensure you are measuring your working capital correctly. A simple formula can help you do that:

Current Assets include accounts receivable, inventory, and cash that will convert into money within a year. Meanwhile, current Liabilities are short-term obligations like accounts payable, wages, taxes, and accrued expenses.

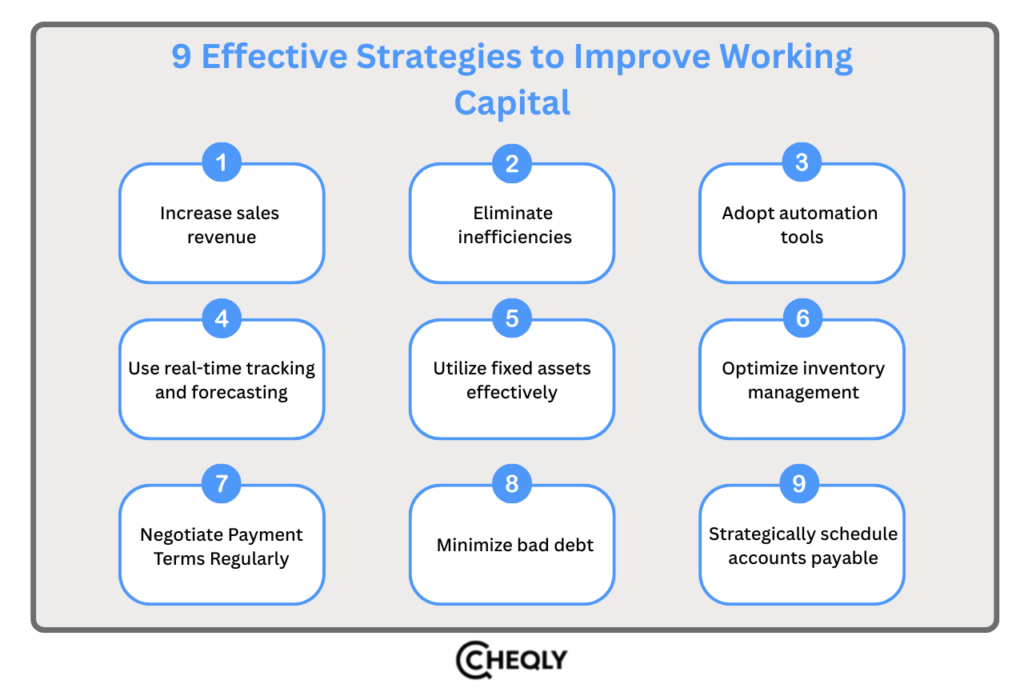

9 Effective Strategies to Improve Working Capital

Let’s look at the effective strategies to improve the working capital:

Increase sales revenue

Selling more is the most obvious way to raise operating capital. Although it’s never easy, it is definitely feasible. Consider exploring new marketing avenues or recruiting additional sales personnel. Additionally, you might enhance your sales force’s incentive program, which can frequently promote better performance.

Raising your prices is another strategy that might annoy your clients. Your cash flow can be improved by setting reasonable, competitive rates if you’re undercharging for your goods or services. If your prices rise too high, your sales could drop sharply.

Eliminate inefficiencies

If you’re not using your money effectively, you’re essentially reducing the amount of cash you have accessible. Assess your company’s operations and outstanding debts on a regular basis to spot wasteful or excessive spending. Consider whether each expense is actually required to maintain daily operations and employee satisfaction.

At the same time, think about restricting the number of staff who can approve spending. There will be fewer unnecessary charges that fall through the cracks when key decision-makers are in charge of authorizing and defending every expenditure.

Adopt automation tools

One of the most effective ways to increase working capital is to shorten your operating cycle, which is the time it takes to turn production assets into cash. In addition to being a very useful tool for speeding up these procedures, automation can free up your accounting staff to work on more crucial projects.

For example, you can increase the precision and promptness of your outgoing bills by using automated processes and verification procedures within your accounts receivable.

The majority of software for automating accounts receivable has analytics features that help you maintain accuracy in your statements and reports. Your consumers will be less inclined to delay payments while they address any unanswered queries or issues with their current account if your statements are more accurate.

At the same time, you can make it easier and simpler for buyers to give you their money by implementing a payment portal (such as Invoiced’s ERP connect) that directly interacts with your clients’ enterprise resource planning (ERP) platforms.

Use real-time tracking and forecasting

Power comes from knowledge. Furthermore, ignorance can be a serious liability. You must have a thorough understanding of your current accounts and any new patterns if you wish to manage your cash flow and working capital effectively.

You should therefore review and report on your working capital on a daily basis. Additionally, this examination ought to delve deeply into certain operations. When are invoices typically sent out? How much time do individual buyers usually take to clear their payments? What is the current status of sales?

You’ll have a better chance of spotting process bottlenecks or other problems before they affect your cash flow if you keep an eye on your financial data.

Utilize fixed assets effectively

Your working capital can be significantly increased by selling your fixed assets, which are tangible items like machinery, buildings, cars, or land. However, because they frequently require more time and work to turn into income, these items are known as “fixed” assets. Therefore, it usually makes sense to sell any extra office space or equipment, even though it might not result in a quick increase in your capital. As an alternative, you might consider renting these extra resources to other parties in order to generate extra income.

Instead of using your working capital to finance these acquisitions, you should use long-term loans because your fixed assets should ideally enable you to create long-term growth. Or, if the technology is upgraded frequently, you can think about leasing the necessary equipment or outsourcing certain procedures.

Optimize inventory management

You cannot spend any of the money you have put in your current inventory elsewhere in your company. Therefore, instead of investing available funds in goods that must be sold, think about switching to a just-in-time logistics approach. You can save money on storage and simplify the procurement of raw materials by better aligning your real output with consumer demand.

Before switching to a more complete inventory management system, you should invest in analytics software because, of course, you’ll need precise sales estimates and projections to effectively adjust manufacturing levels.

Negotiate payment terms proactively and frequently

Your vendors, suppliers, and consumers may offer you the greatest price. Or you may not. You should proactively and routinely renegotiate the financial arrangements governing your operations rather than relying on luck.

Is it possible to get raw materials at a lower cost by moving to a competitor or purchasing in bulk? Yes, you can increase your working capital without experiencing significant disruptions if you put in a little effort and are persistent.

Minimize bad debt

Your working capital and business as a whole will suffer if you are not compensated for your goods or services. However, those outstanding bad debts might be recovered with the use of smart and effective accounts receivable operations. To encourage more customers to pay their bills on time, you may, for example, provide early-payment discounts.

As mentioned, a payment portal can also assist in cutting down on needless wait times. You could look at A/R systems that offer automated chasing. You can schedule these touches ahead of time rather than depending on your human staff’s memory and consistency to send out reminder notes.

Paying more attention to whom you’re giving credit to would also be beneficial. Before extending any terms to new clients, run a credit check or review their most recent credit reports. In a similar vein, monitor your current clientele. Have you noticed that buyers are now taking longer to settle accounts? This can suggest that they are having difficulties with their own working capital and may not be able to make payments anytime soon.

Strategically schedule accounts payable

Managing the timing of your bill payments can have a significant impact on your working capital and cash flow. Do you need to improve your financial situation as soon as possible? You can retain that capital for a longer period of time if you put off paying your bills until the last minute. On the other hand, you should cut checks right away and lower your overall costs if your suppliers provide significant early-payment discounts. Strategies for managing accounts payable can play a significant role in increasing your working capital.

In conclusion, increasing your operating capital is an essential requirement for the continuity of your business and for enabling business expansion. You can improve your company’s financial status by utilizing the above-mentioned tactics, thereby keeping your business resilient.

FAQs on Working Capital

The following are some frequently asked questions about working capital:

What is a healthy working capital ratio?

A ratio of 1.2 to 2.0 reflects a stable balance between assets and liabilities, showing the company can meet obligations without overcommitting resources.

Does strong working capital attract investors?

Yes. Investors value companies with healthy net working capital because it signals strong liquidity and the ability to handle working capital challenges without excess borrowing.

Is it bad to have negative working capital?

It depends. For industries with quick operating cycles (like retail), negative working capital can work. But in most cases, it signals risks in cash flow management.

Can working capital help during downturns?

Yes. Adequate working capital cushions businesses during slow sales cycles, delayed accounts receivable collections, or rising liabilities.

Can automation improve working capital?

Absolutely. Automated workflows in A/R platforms and accounts payable systems shorten payment cycles, enhance data accuracy, and reduce bottlenecks.

How often should I monitor working capital?

High-growth businesses should track financial data weekly or daily. At a minimum, review working capital ratios and sales forecasts monthly.

What are common mistakes businesses make with working capital?

Excess inventory, overlooking credit reports, and ignoring payment discounts are common errors that drain liquidity.

How does working capital differ from cash flow?

Working capital is a snapshot of available short-term liquidity, while cash flow tracks the movement of cash—showing how money circulates through your revenue streams and expenses.

Can renegotiating contracts help working capital?

Yes. Proactively adjusting supplier contracts and accounts payable terms or offering early-payment incentives to customers can free up significant working capital.

Boost Your Cash Flow Efficiency with Cheqly

For the success of small businesses, it is necessary that cash flow is smooth and Cheqly makes the whole process simple. With secure business accounts, real-time financial insights, straightforward local and international transactions, and no monthly fees or minimum balance requirements, business owners can use their money optimally and focus on growing their business.

Get in control of your cash flow today—open your Cheqly business account now.