Comparable Company Analysis (or “comps analysis”) is a popular valuation method, especially suited for later-stage startups with established financial performance. Instead of guessing the value, it looks at similar public companies or private deals to see how others are valued, helping founders get a practical sense of whether their startup might be under- or overvalued.

This guide provides step-by-step instructions for growth-stage startup founders on how to carry out a comparable company analysis (CCA), find suitable peer groups, calculate key multiples, and estimate the startup’s value, while also pointing out best practices, common errors, and helpful resources for reliable market-based valuations.

What is Comparable Company Analysis?

Comparable company analysis, or “comps,” is a relative valuation method that estimates a company’s worth by comparing it to other businesses in the same industry using financial metrics such as revenue, EBITDA, or P/E multiples. Unlike discounted cash flow (DCF) analysis, which provides an intrinsic valuation, comps rely on market-based comparisons. This method is commonly used in corporate finance for IPO pricing, M&A advisory, and restructuring, as well as in support of the exit multiple method for calculating terminal value in DCF models.

When to Perform a Comparable Company Analysis?

CCA works best for startups that have stabilized operations and finances, allowing meaningful comparisons with similar companies. Critical times are as follows:

- Startups use Comparable Company Analysis to assess peers and set market valuation in major funding rounds, typically from Series A or B.

- Right before implementing major corporate strategies, such as mergers, acquisitions, or preparing for an IPO, it is essential to have an accurate valuation based on market comparables.

- Once a startup has reliable financial metrics and an established presence in the market, it can gauge its value through revenue or profit multiples against peers.

- When the company is operating under a mature business model with comparable competitors or peers that have public or known valuations.

- It is often done to check whether the company’s internal business fundamentals and growth projections used to estimate valuation make sense when compared with the market.

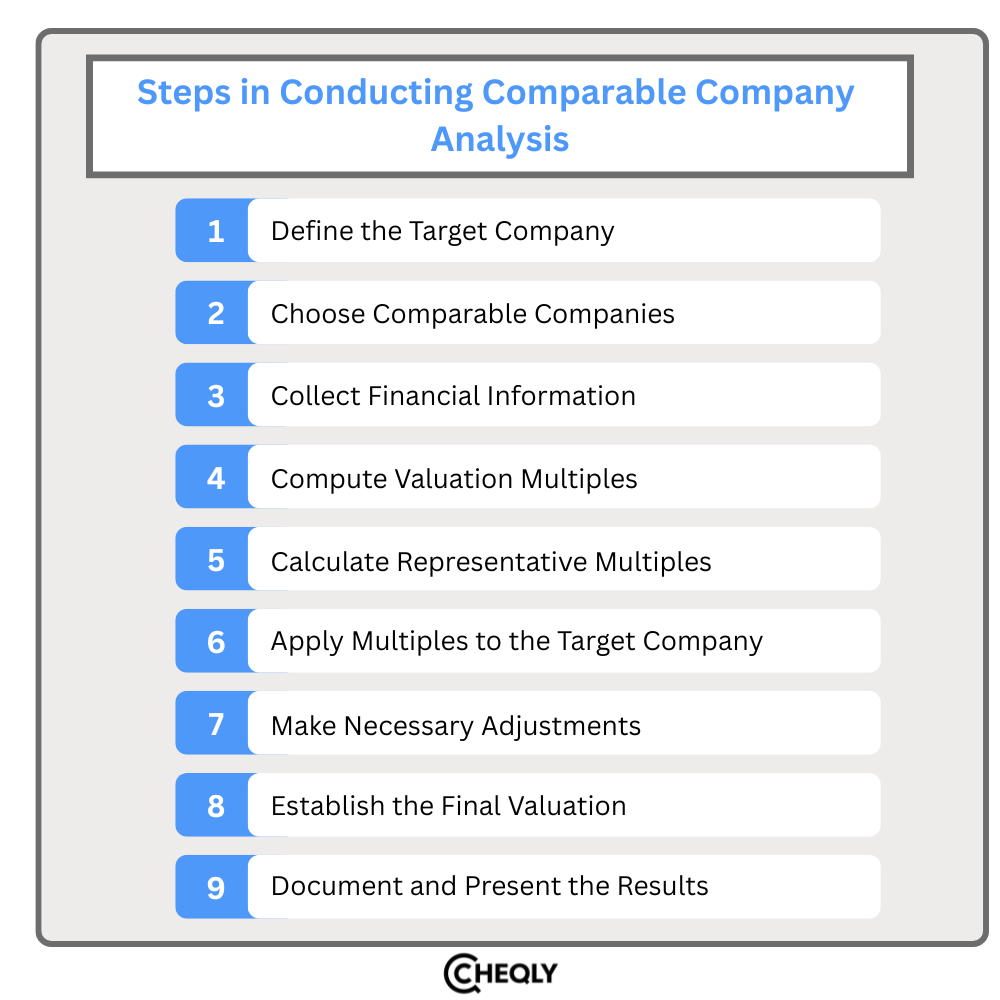

Key Steps in Conducting Comparable Company Analysis with an example

To guarantee a comprehensive and accurate valuation, a comparable company analysis (CCA) entails a number of methodical procedures. The specific steps are as follows, with an example:

Step 1: Define the Target Company

Initially, you need to describe the business you are going to value in the most accurate way. Define its market positioning, industry, business model, financial situation, and growth opportunities. This basic information is indispensable for selecting relevant valuation indicators and suitable comparable companies.

Take, for example, TechTrend Innovations, a midsize company that develops software based on cloud technology. The company belongs to the tech industry and generates $100 million in revenue annually, with $20 million in EBITDA and $10 million in net income. It is a public company with average opportunities for growth and mainly focuses the operations in North America.

Step 2: Choose Comparable Companies

The next step is to identify companies that are similar to your target business. Look for businesses in the same industry with comparable size, growth patterns, and geographic reach. Stock market listings, financial databases, and industry publications are great places to start when finding these comparable companies.

Listed below are three identified comparable software companies with similar size, growth rates, and geographic presence:

- Company A: CloudTech Solutions

- Company B: SoftPeak Systems

- Company C: DataWave Inc.

Step 3: Collect Financial Information

Gather pertinent financial information about the target business and similar businesses in this step. Usually, this information comprises:

- Market Capitalization

- Revenue

- Enterprise Value (EV)

- EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization)

- Earnings per share (EPS) or net income

- Equity Book Value financial databases such as Bloomberg, Reuters, or Capital IQ, as well as annual reports and business financial statements, are the sources of this information.

The financial data for TechTrend and the comparable companies are collected as follows (all figures are in USD millions, and have been standardized for the same fiscal year):

| Company | Market Cap | Enterprise Value (EV) | Revenue | EBITDA | Net Income | Book Value of Equity |

| TechTrend Innovations | To be determined | To be determined | 100 | 20 | 10 | 50 |

| CloudTech Solutions | 500 | 550 | 120 | 25 | 12 | 60 |

| SoftPeak Systems | 600 | 650 | 150 | 30 | 15 | 70 |

| DataWave Inc. | 450 | 480 | 90 | 18 | 9 | 45 |

Step 4: Compute Valuation Multiples

Next, find the comparable companies’ pertinent value multiples. Typical multiples consist of:

- EV/Revenue = Enterprise Value ÷ Revenue

- EV/EBITDA = Enterprise Value ÷ EBITDA

- P/E Ratio = Market cap ÷ Net income

- P/S Ratio = Market Cap ÷ Revenue

- P/B Ratio = Market Cap ÷ Book Value of Equity

| Company | EV/Revenue | EV/EBITDA | P/E Ratio | P/S Ratio | P/B Ratio |

| CloudTech Solutions | 550/120 = 4.58 | 550/25 = 22.00 | 500/12 = 41.67 | 500/120 = 4.17 | 500/60 = 8.33 |

| SoftPeak Systems | 650/150 = 4.33 | 650/30 = 21.67 | 600/15 = 40.00 | 600/150 = 4.00 | 600/70 = 8.57 |

| DataWave Inc. | 480/90 = 5.33 | 480/18 = 26.67 | 450/9 = 50.00 | 450/90 = 5.00 | 450/45 = 10.00 |

Step 5: Calculate Representative Multiples

In this step, calculate the representative multiples from the comparable companies.

We take the average of the multiples to apply to TechTrend:

| Multiple | Calculation | Average |

| EV/Revenue | (4.58 + 4.33 + 5.33) ÷ 3 | 4.75 |

| EV/EBITDA | (22.00 + 21.67 + 26.67) ÷ 3 | 23.45 |

| P/E Ratio | (41.67 + 40.00 + 50.00) ÷ 3 | 43.89 |

| P/S Ratio | (4.17 + 4.00 + 5.00) ÷ 3 | 4.39 |

| P/B Ratio | (8.33 + 8.57 + 10.00) ÷ 3 | 8.97 |

Step 6: Apply Multiples to the Target Company

After calculating the representative multiples, these are applied to the target company’s financial metrics.

We apply the average multiples to TechTrend’s financial metrics:

- EV/Revenue: 4.75 × $100M (Revenue) = $475M (Implied Enterprise Value)

- EV/EBITDA: 23.45 × $20M (EBITDA) = $469M (Implied Enterprise Value)

- P/E Ratio: 43.89 × $10M (Net Income) = $438.9M (Implied Market Cap)

- P/S Ratio: 4.39 × $100M (Revenue) = $439M (Implied Market Cap)

- P/B Ratio: 8.97 × $50M (Book Value) = $448.5M (Implied Market Cap)

Step 7: Make Necessary Adjustments

Take into account any qualitative and quantitative variations that could impact valuation between the target company and the comparables. Changes may be required for:

- Growth Rates: If there are notable differences in the target company’s growth prospects.

- Risk Profile: Variations in risk brought on by operational, regulatory, or market factors.

- Size and Scale: Modifications for operational efficiencies or economies of scale associated with size.

Let us assume that due to a recent product delay, TechTrend is expected to grow slightly less than its peers. To compensate for this risk, we put a 10% discount on it:

- EV/Revenue: $475M × 0.9 = $427.5M

- EV/EBITDA: $469M × 0.9 = $422.1M

- P/E Ratio: $438.9M × 0.9 = $395M

- P/S Ratio: $439M × 0.9 = $395.1M

- P/B Ratio: $448.5M × 0.9 = $403.65M

Step 8: Establish the Final Valuation

To finalize the company’s valuation range, calculate implied values using various multiples, accounting for financial metrics and comparable industry benchmarks.

The valuation range based on the adjusted multiples is:

- Enterprise Value (EV): $422.1M – $427.5M

- Market Cap: $395M – $403.65M

After adjusting the valuation multiples, the estimated value range of TechTrend is from $395 million to $427.5 million.

Step 9: Document and Present the Results

Ensure that you have a record of the financial data you have used, the companies that you have chosen which are comparable, the process of your analysis, and the reasons for any adjustments made. Also, disclose the final value range along with your conclusions in a neat and clear way. Such openness provides all stakeholders with an understanding of the valuation method used, and it stimulates their trust in the correctness of the valuation.

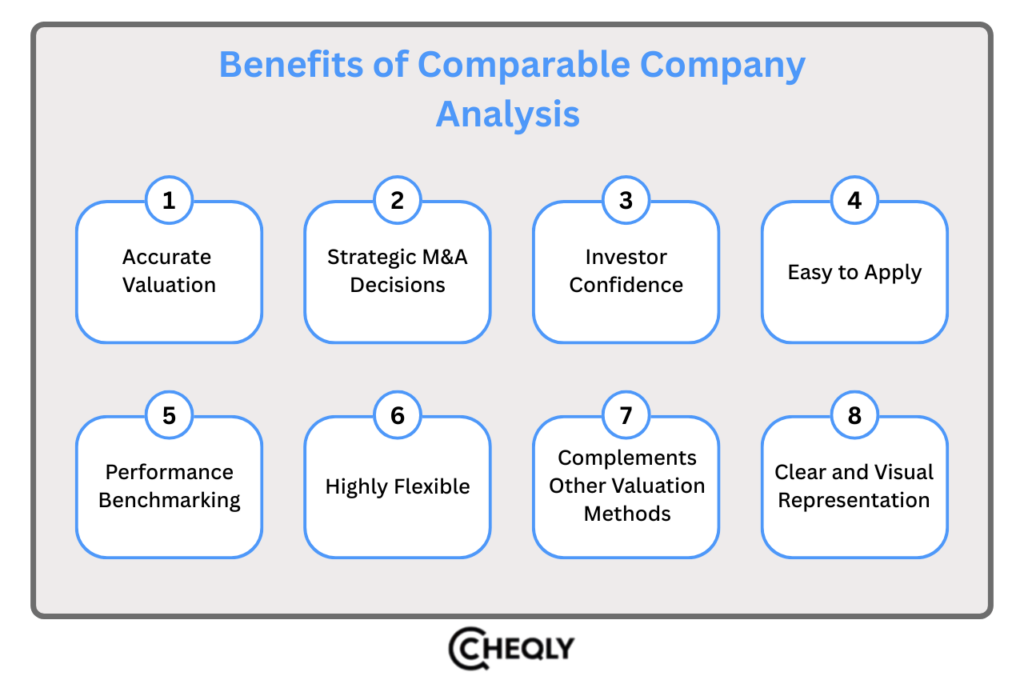

Benefits of Comparable Company Analysis

Comparable Company Analysis has a number of benefits that allow it to be one of the most widely used valuation methods.

- Accurate Valuation: By using data from comparable companies, CCA provides a market-based valuation that can be verified. This valuation supports better decision-making and builds investor trust

- Strategic M&A Decisions: It is a major factor in M&A (mergers and acquisitions) as it helps to figure out the fair market value, find new investment prospects, and provide a basis for buying or selling.

- Investor Confidence: Comparable Company Analysis (CCA) uses real market data to determine a company’s value, making it clear and easy to understand. This transparency builds investor trust, improves communication, and strengthens investor relationships.

- Easy to Apply: Rapid approach utilizing data that is accessible to the public.

- Performance Benchmarking: It helps companies compare themselves with competitors, identify strengths and weaknesses, and gain insights to improve performance, strategy, and competitive positioning.

- Highly Flexible: Adaptable to many business sizes and sectors, provided that a sufficient number of comparable companies exist.

- Complements Other Valuation Methods: Used in conjunction with precedent transactions, DCF, or LBO analyses.

- Clear and Visual Representation: Fast comparisons are made possible through tabular representation.

FAQs on Comparable Company Analysis

Comparable Company Analysis raises several common questions:

How do I select the most comparable companies?

Select companies in the same industry with comparable size, location, and growth patterns to ensure your valuation comparisons are meaningful and accurate.

What if I cannot find enough truly comparable public companies?

Expand your peer group to include private companies, past transactions, or use additional methods like DCF; always explain any limitations. Combining multiple valuation approaches can provide a more balanced view.

When to use median vs average multiples?

Use the median to reduce outlier impact; use the average only if data is tightly clustered without extremes. Median offers a more robust representation in most practical cases.

How do market conditions affect comparable company valuations?

Market trends directly influence multiples—values rise in strong markets and fall in weak ones, so always consider the current environment. Being aware of market cycles helps in adjusting expectations appropriately.

How to adjust multiples for growth and risk?

Apply a premium for higher growth or lower risk, and a discount for lower growth or higher risk, then justify your adjustments. Clear rationale for adjustments improves transparency and credibility.

Can I use CCA for early-stage startups without financial history?

CCA is usually unsuitable for early startups lacking financial history; use qualitative or alternative methods for valuation. Methods focusing on milestones and potential are better suited for such companies.

How does CCA differ from Precedent Transactions Analysis?

Precedent Transactions use historical M&A deal values, while CCA uses current market trading multiples.

Can Comparable Company Analysis be used for private companies?

Yes, but it is more difficult. Data for private companies is limited, making it a real challenge to find suitable comparable peers. Analysts usually rely on industry averages, private company databases, or recent transactions and may need to make adjustments for differences in size, growth, and risk.

Is CCA used alone or with other valuation methods?

It is usually applied alongside DCF or precedent transactions for a more balanced valuation.

What are common mistakes to avoid in CCA?

Using unrelated peers, ignoring adjustments, relying on outdated financials, or overemphasizing a single multiple.

Build Credibility with Accurate and Transparent Valuations

Comparable Company Analysis is an essential valuation instrument for startups in the growth phase, as it allows market-based benchmarking by comparing the financial multiples of companies with similar characteristics. It can be a very valuable tool if a startup founder decides to use it for team planning and communication with investors. Moreover, it can be combined with other methods to provide a more balanced and reliable view of the startup’s valuation.

Selecting a professional advisor who aligns with your requirements is the smartest move. Cheqly has a partner, Eqvista, to provide accurate, compliant, and transparent valuations, including 409A valuations necessary for startups raising funds. Engaging professionals in your valuation process helps reduce risk and improve negotiation outcomes. Contact us to learn more!