As a startup founder, one of the most significant obstacles you will face is raising capital, especially if you want to scale your business in a sustainable way. Generally, you would have raised money through equity financing by selling part of your company to venture capitalists. In addition to equity, venture debt has been introduced as an additional instrument, allowing the company to access funds without dilution, extend its runway, and reach the next milestones faster.

This article describes the difference between the two types of funding, the advantages of mixing them, the risks to take into consideration, and how to make smarter decisions on financing.

Understanding Venture Debt and Equity Financing

It is necessary to understand the fundamental differences between each and their benefits before moving on to their combination.

Equity Financing

Equity funding is the procedure where the shares of a company are sold to investors, who could be angel investors, venture capital firms, or institutional funds, in exchange for money. Being equity means there is no obligation for repayment; on the other hand, it reduces the percentage ownership of founders and early-stage investors and generally entails some governance terms, such as the right to appoint a member of the board of directors.

Venture Debt

This is a type of debt financing tailored for startups supported by venture capital. Normally, it comes as term loans or revolving credit with interest and a repayment schedule; however, equity dilution for the startup is kept very low. Generally, lenders request warrants, which are small equity options, as part of the deal, but these are significantly less dilutive than equity rounds.

The two funding sources differ in terms of their financial and control aspects; thus, their combination is a potent means of adjusting the equity structure of the startup.

Why Combine Venture Debt with Equity Financing

Venture debt combined with equity permits start-ups to raise additional capital and, at the same time, help limit dilution of the founders’ ownership and increase long-term value. This approach provides resources that can support strategic growth initiatives, depending on how the funding is used and the company’s ability to manage repayment obligations.

Minimizing Dilution While Accessing Capital

Equity rounds lead to a reduction in ownership that is proportionate to the amount raised, which means that the founders’ control and future financial returns will be affected. Startups can secure additional capital while keeping their ownership stakes larger by combining venture debt and equity in the same fundraising cycle, a strategy that is particularly valuable in a high-growth setting where the rapid achievement of milestones is key to maximizing valuation.

Extending Runway to Achieve Milestones

By adding funds without reducing equity, venture debt increases the cash runway, allowing startups to achieve essential milestones like product launches, revenue targets, and customer acquisition. Having more runway on hand lessens the chances of down rounds—situations where equity is obtained at a lower valuation—since startups have the opportunity to raise the next rounds of equity at more attractive valuations.

By extending the runway, the startup is able to boost its financial flexibility and negotiating power with equity investors, which in turn leads to a better capital structure and more stability over time.

Improving Negotiation Dynamics

Equity financing combined with venture debt is an indicator of financial discipline and planning to investors. It demonstrates that founders are carefully managing dilution and growth risks as well as financial risks. This can increase investor confidence and create more favorable equity terms, as it shows that they are willing to optimize the company’s capital structure rather than rely solely on equity financing.

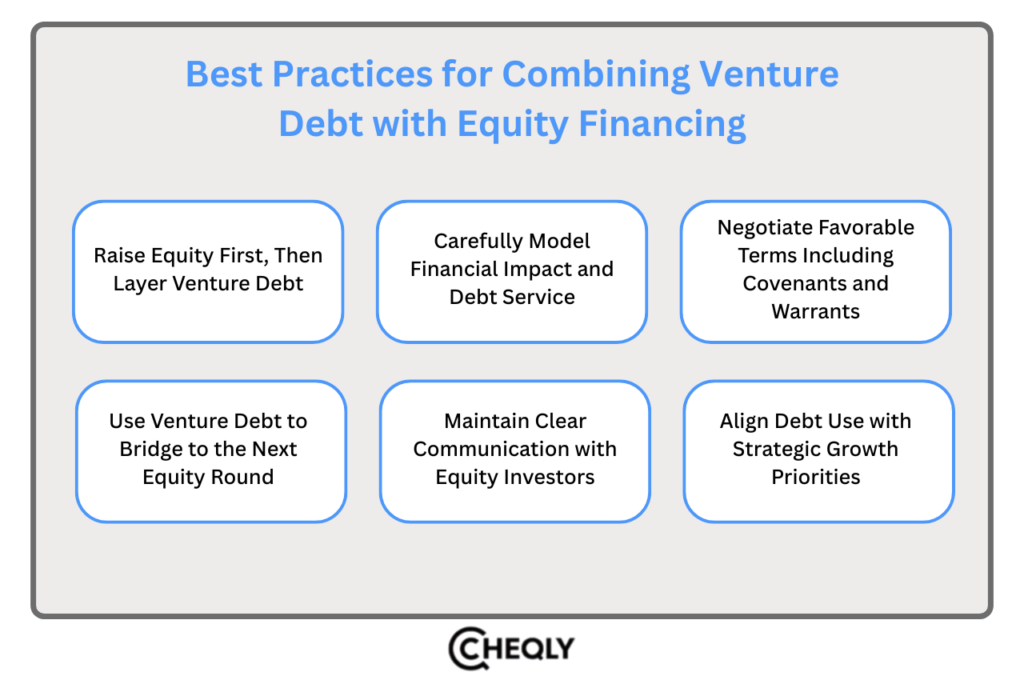

Best Practices for Combining Venture Debt with Equity Financing

Startups should follow structured strategies to maximize benefits and manage risks when using venture debt with equity.

Raise Equity First, Then Layer Venture Debt

Providers of venture debt normally expect that a startup has just concluded an equity round, as this is seen as a confirmation of the business and reduces risk for lenders. The best practice is to secure equity funding for credibility and network access, then use venture debt to amplify available capital. This increases runway and enables achievement of milestones critical for future valuation—without immediate further dilution.

Carefully Model Financial Impact and Debt Service

Founders must thoroughly conduct financial modelling of how taking on venture debt in addition to equity will impact the business, including the costs of debt service and repayment schedules, before they decide to actually raise venture debt. They also need to have a good grasp of cash flow forecasts, interest that will need to be paid, and any covenant requirements that may be necessary to ensure that the debt can be managed with current operations.

Meticulous forecasting and sensitivity analysis, which would often be conducted with a CFO or financial consultant, would protect the start-up against the dangers of excessive debt service as well as operating cash crises.

Negotiate Favorable Terms Including Covenants and Warrants

The founders need to agree on covenants that reflect realistic business circumstances and offer flexibility. Warrants that give lenders some limited equity participation are usually accompanied by lower dilution than equity rounds. Understanding market standards can help secure agreements that balance lender risk with founder interests.

Use Venture Debt to Bridge to the Next Equity Round

Most startups utilize venture debt to delay the next equity round, i.e., they increase the runway just enough to get past crucial milestones that can raise their valuation. Such a tactic is instrumental in steering clear of down rounds, in addition to guaranteeing that shares are raised on the best possible terms.

This method is especially beneficial in the rapid expansion stages; however, it necessitates exact timing and a dependable way to tie either revenue or growth milestones to ensure that the debt can be paid off without diverting resources from the main business activities.

Maintain Clear Communication with Equity Investors

Equity investors must be thoroughly informed about a company’s debt plans. Communication that is open and honest creates trust, ensures that both parties are on the same page, and indicates that the debt is employed in a tactical manner to maintain the value of the equity and to accelerate the business. It is also very important that investors are updated regarding the agreement on how the money will be used and the repayment plans.

Align Debt Use with Strategic Growth Priorities

Venture debt should be used for a company’s high-value activities, such as product development, sales, or market expansion. However, it should never be used to cover losses or operational shortfalls. Using debt in high-impact areas is a great way to improve the company’s return on equity while fulfilling the company’s obligations.

Example: Combining Venture Debt with Equity to Minimize Dilution

Think of a new company, InnovateX, that has just gone through a Series A round of $10 million at a pre-money valuation of $12 million (post-money valuation = $22 million). InnovateX intends to bring in a further $5 million to speed up product development and expand the market.

Option 1: Raise Full $5 Million via Equity

If InnovateX manages to raise the full $5 million through equity financing, the post-money valuation will be:

22 million + 5 million = 27 million

The dilution to existing shareholders is:

5 / 27 ≈ 18.52%

This implies that the ownership of existing shareholders will be diluted by approximately 18.52%, resulting in a correspondingly smaller share of control.

Option 2: Raise $3 Million via Equity + $2 Million via Venture Debt

Let’s say InnovateX gets $3 million through equity raised. Then, the post-money valuation following this equity raise will be:

22 million + 3 million = 25 million

The equity dilution due to this raise is:

3 / 25 ≈ 12%

After that, InnovateX secured $2 million via venture debt. Such venture debt is normally accompanied by equity warrants, generally representing a small percentage of the debt. Let’s say the value of the warrants is 4% of the debt amount:

0.04 × 2 million = 0.08 million

At the post-money valuation, the dilution caused by these warrants is:

0.08 / 25 = 0.32%

It means that the total combined dilution from both the equity and the warrant is roughly:

12% + 0.32% = 12.32%

By combining venture debt and equity, InnovateX gathers the $5 million required for the company, resulting in a dilution of about 12.32%, compared to 18.52% if it had decided to raise the entire amount through equity. Such a move keeps the founders’ and early-stage investors’ ownership stakes and voting rights higher.

Potential Risks and How to Mitigate Them

Startups should be aware of several risks when layering venture debt with equity, but these can be managed with thoughtful planning.

- Debt Repayment Pressure: Venture debt, in contrast to equity, is usually structured with regular payments of principal and interest. The risk of default can be minimized by founders through detailed cash flow forecasting and by taking on debt only when they have a clear path to achieving revenue and profitability milestones, with a repayment period that is sufficient.

- Loan Covenants: Venture debt may include financial or operational limitations that may restrict the borrower’s flexibility. To be on the safe side, founders should establish reasonable covenant levels, for instance, minimum cash balances, or performance goals, and then strictly follow the financial discipline.

- Potential Dilution from Warrants: Lenders usually expect warrants, which means that there will be some equity dilution. You can reduce their effect to a certain extent by settling on a lower warrant coverage that corresponds to the size of the loan and the valuation, thus safeguarding the ownership of founders and early investors.

- Overleveraging: Avoid excessive debt relative to your growth forecasts. Maintaining a healthy cash runway and staying within prudent leverage limits ensures that debt supports growth rather than jeopardizing financial health.

FAQs: Using Venture Debt with Equity

Startups are frequently confused about the issue of combining venture debt with equity. These are definite responses to popular founder anxieties:

Can venture debt replace equity financing?

No. Venture debt does not substitute equity. It is suitable for start-ups that already have venture capital support and where the profit perspective is evident.

When is the best time to raise venture debt?

After closing an equity round, you’ve established credibility and backing, but before needing another dilutive raise. Use debt to bridge to key growth milestones or your next funding round.

How do you prepare to raise venture debt alongside equity?

Develop robust cash flow models, determine realistic milestones, and engage financial advisors for scenario planning. Ensure transparency with investors about debt plans and intended use of funds.

How are venture debt and equity integrated in financial planning?

Both sources should be mapped in capital structure planning, with debt servicing analyzed alongside equity dilution, governance, and long-term growth priorities.

Can startups raise multiple rounds of venture debt?

Yes, if their capital structure and runway allow. Each round should be sized according to growth requirements and cash flow forecasts, keeping debt within prudent limits.

What is the cost comparison between venture debt and equity?

Venture debt is typically less expensive in terms of dilution, but does require repayment and interest. Equity costs more in lost ownership and profit sharing, especially over time.

Maximizing Growth with Debt and Equity

Startups can access the most efficient capital from the growth market if they combine venture debt with equity financing without losing control or their ownership rights. Founders can thereby extend the period for which they can use their funds, achieve necessary milestones, and boost the valuation of their company in future fundraising rounds by maintaining the proper balance.

With Cheqly’s venture debt services, startups can access flexible term loans that, when used strategically, may help lengthen cash runway, finance new product launches, and speed up customer acquisition. Cheqly also offers integrated business accounts and online payment tools, supporting founders in maintaining strong cash balances, managing obligations, and staying investment-ready.

Get started with Cheqly and see if you qualify for venture debt to fund critical initiatives, accelerate growth, and achieve your strategic milestones.