Payment fraud is a rapidly developing risk that presents US businesses with severe risks, particularly due to the skyrocketing of digital payment channels in 2025. Since the fraudsters keep evolving to take advantage of the latest technologies and exploits, organizations are experiencing increasing financial and reputational losses. Knowing the most recent payment fraud rates, tendencies, and consequences is crucial to entrepreneurs and small business owners who want to protect their revenues, clients, and their business within a more complicated payment environment.

The article provides useful information on the growing dimensions of US payment fraud in 2025 and leading types of fraud, financial consequences, and the most effective mitigation measures to enable businesses to avoid the emerging challenges.

The Growing Frontiers of Payments Fraud in 2025

Payment fraud is more prevalent and advanced in 2025 than ever, affecting most organizations in the United States. Here’s a closer look at the key numbers:

- A recent AFP survey found that in 2024, 79% of organizations in the US had attempted or experienced payment fraud (stunning), reflecting the scale and persistence of this threat.

- The bigger businesses are even more affected, as 83 percent of organizations with revenues exceeding 1 billion were targets of fraudulent activities.

- The state of consumer financial fraud is worrying. Fraud losses jumped 25% in 2024 to more than $12.5 billion.

- Credit card fraud alone reached 151,000 cases in Q1 2025, impacting 62 million Americans last year.

- With the rise in digital payments, the associated risks are also increasing. Between 2024 and 2029, the total amount of eCommerce fraud is forecasted to go up from $44.3 billion to $107 billion — a 141% increase largely due to the expansion of online shopping and the weaknesses related to card-not-present transactions.

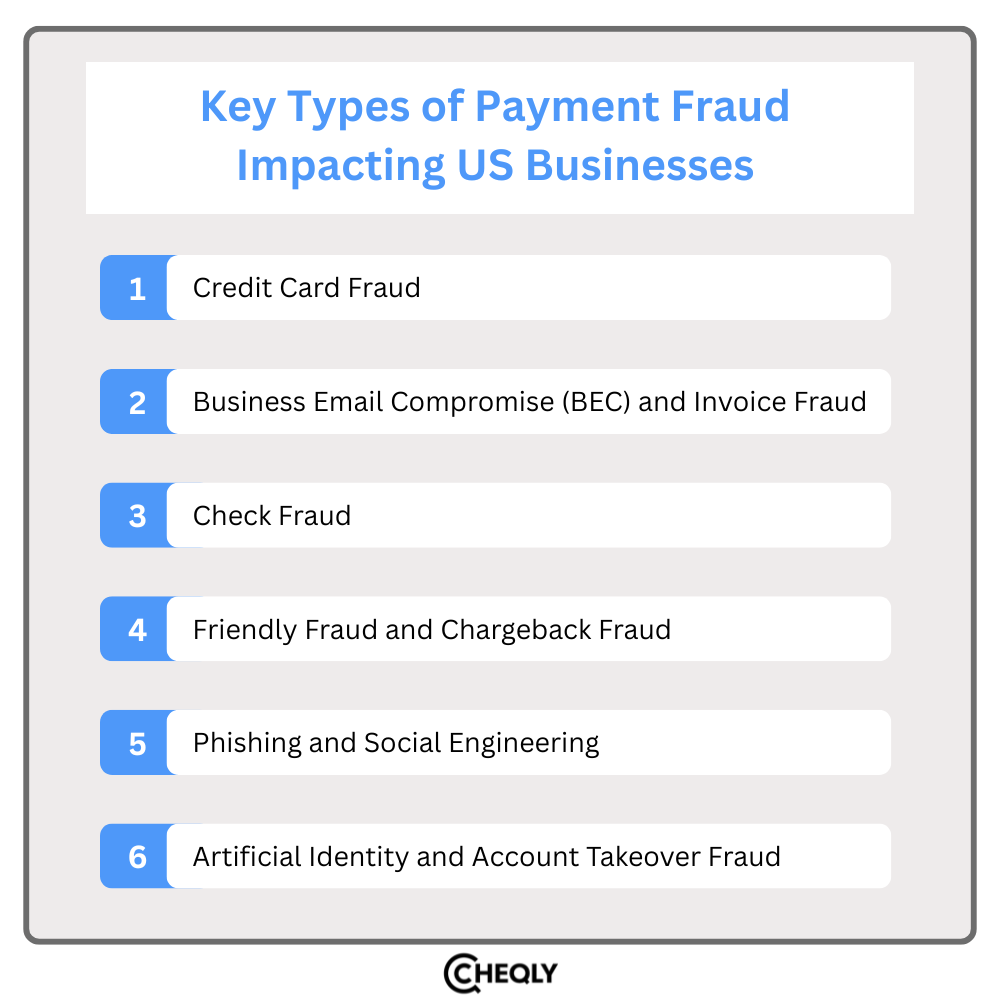

Key Types of Payment Fraud Impacting US Businesses

Fraudsters are always finding new ways to circumvent payment methods. The resulting situation for the US companies in 2025 would be that of increased risks over both their traditional and digital channels. To tighten financial controls, it is helpful to be aware of common fraud types and statistics.

Credit Card Fraud

In 2024, credit card fraud was the main cause of payment fraud that kept on leading, and it was mainly driven by the increase in online and mobile transactions. Most of the frauds were due to Card-Not-Present (CNP) operations, which accounted for 71% of all US card fraud losses—approximately $10 billion. The growth of ecommerce, digital wallets, and subscriptions has thus created a favorable environment for attackers, while the number of Card-Present (CP) fraud cases has gone down due to EMV chip adoption.

“Card-not-present (CNP) fraud made up 71% of U.S. card losses, totaling about $10 billion”

– Clear Payments

Fraudsters have been increasingly using phishing, data breaches, and dark web sources to obtain card details, thus targeting businesses that do not have strong tools like AI monitoring, velocity checks, and 3D Secure authentication.

Business Email Compromise (BEC) and Invoice Fraud

Business Email Compromise (BEC) is one of the greatest threats to American businesses in terms of payment fraud in 2025. According to the 2025 AFP Payments Fraud and Control Survey, 63 percent of organizations reported BEC as the most prevalent type of fraud compared to other types of corporate payment fraud.

“BEC remains the top fraud threat, cited by 63% of respondents”

– AFP® Payments Fraud and Control Survey

Mostly, cybercriminals use a fake identity of executives or trusted vendors of the C-suite to swindle employees into unauthorized wire or ACH transfers. Although there was a slight decrease in cases of executive impersonation, there was an upsurge to 60% of cases of vendor impersonation fraud, with the most common being spoofed or lookalike email domains. These frauds lead to large financial losses and reputational harm, particularly for small- to medium-sized businesses with limited cyber protection.

Check Fraud

Although the use of digital transactions has been embraced, check fraud remains a significant threat to business. The 2025 AFP survey reported that in 2024, 63% of the organizations had attempted or successfully checked fraud.

“63% of the organizations had attempted or successfully checked fraud”

– AFP® Payments Fraud and Control Survey

Paper checks are vulnerable to fraudsters because they take longer time to process and are not verified in real time; thus, a fraudster can change the payee details or alter the check details before they are detected.

Friendly Fraud and chargeback fraud

Online retailers have become more troubled by friendly fraud and chargeback fraud. Friendly fraud occurs when the valid customers incorrectly reject legitimate transactions, while chargeback fraud occurs when criminals intentionally file a false claim to reverse a fraudulent purchase.

US merchants are hit the most, accounting for an average of 10 percent of global chargebacks, and the volume is expected to reach 146 million cases worth $15.3 billion by 2026. Both forms of fraud put pressure on merchant revenues, customer relations, and increase chargeback costs.

“U.S. merchants face 10% of global chargebacks, projected to hit 146M cases worth $15.3B by 2026, straining revenue and customer trust”

– Chargeflow

Phishing and Social Engineering

Social engineering along with phishing has remained a major cause of online fraud all over the globe. As per the data in 2024, phishing incidents were the cause of nearly 36% of the total data breaches, thus, showing their dominance in the area of cybercrime. Moreover, social engineering methods, such as the victim being manipulated to give permission for transactions or disclose confidential information, which made up 68% of the data breaches, thus, indicating that the error of the human factor is the main reason for the security vulnerabilities in the IT area, were also quite extensive.

“Phishing caused nearly 36% of all data breaches, highlighting its dominance in cybercrime”

– Stationx

Artificial Identity and Account Takeover Fraud

In the US, synthetic identity fraud has remained one of the most advanced methods of payment crimes. It combines real and personally fabricated information, including Social Security numbers and false names, to build believable yet completely false identities. By the year 2030, losses due to synthetic identity fraud in the United States are projected to reach up to $23 billion.

“By the year 2030, losses due to synthetic identity fraud in the United States are projected to reach up to $23 billion”

– Asurity

In addition to this, there is an increasing threat of account takeover (ATO) fraud. Offenders use personal information (frequently obtained in a phishing attack or a data breach) to access accounts with stolen credentials and initiate unauthorized transfer or purchase. The advent of deepfake technologies makes authentication and identity checking even more challenging by allowing impersonation of legitimate users in the process of digital onboarding or transaction approvals.

Payment Fraud by Payment Channel

The nature and intensity of fraud vary by payment channel:

- Wire Transfers: This is the most vulnerable one due to BEC scam, and it is not reversible. In 2024, the number of international wire frauds increased by 40% despite the decline in transaction volumes, indicating the high risk of such attacks.

- ACH Payments: Used as a common target of account takeover and social engineering. Even though individual transfers are usually smaller when compared to wire amounts, ACH transactions are so common that they remain a target of treasury fraudsters.

- Digital Wallets and Prepaid Cards: Fraud attacks are on the rise, with the loyalty points programs recording the highest attack rate of 6.19% in early 2025, which is fueled by account takeovers and rewards abuse.

- E-commerce Transactions: Most of the money lost to fraud is due to card-not-present (CNP) fraud, which accounts for nearly 80% of e-commerce credit card fraud, while overall e-commerce fraud is expected to exceed $50 billion worldwide in 2024.

Impact on Businesses

Organizations of all sizes are affected by payment fraud cases, but those that have over $1 billion in revenue have the most frequent and vast attempts of fraud-associated cases, which proves that there are no businesses that will be immune in 2025.

Besides direct monetary losses, companies also spend a substantial amount of operational expenses on the prevention, investigation, dispute management, and recovery of fraud, which eventually affect the bottom lines and productivity.

The recovery rate of funds is also low, with just 22% of organizations being able to recover 75% or more of the lost finances in 2024, highlighting the growing challenge of recovering losses from fraudulent transactions.

Best Practices for Fraud Prevention

In the contemporary payment environment, effective fraud management plans are important in achieving revenue protection, customer confidence, and business continuity.

- Machine learning (ML) and artificial intelligence (AI) have the ability to cut credit card fraud by analyzing transactional data, device fingerprints, and suspicious behavior to identify unusual activity.

- Multi-factor authentication (MFA) enhances the security of logins and transactions, making them more difficult for criminals to commit account takeover fraud.

- Full processing of transactions, such as behavioral analytics and real-time risk scores, allows organizations to identify fraud before losses occur.

- Training of employees and internal controls can raise awareness of social engineering scams, prevent fraud, and maintain a strict payment approval procedure.

- Vendor and invoice verification processes eliminate invoice fraud and business email compromise by verifying supplier details and payment instructions.

- Sharing of threat information and collaboration with regulators and peers in the industry enables quicker detection of fraud patterns and faster responses to emerging fraud types.

Looking Ahead: Preparing for Fraud in a Digital Future

With the digitalization of payments, companies should switch to sophisticated solutions to fight fraud in the future.

- Biometric authentication and decentralized identity management help in preventing synthetic identity fraud and thwarting advanced account takeover schemes.

- Automation promotes quicker fraud detection, consequences, and prevention, reducing strain on the operational aspects of organizations.

- The tightening of the data governance institutions and increased regulatory compliance are essential to fulfilling emerging standards and safeguarding sensitive data.

- Open and safe payment experiences create a sense of trust in customers and loyalty in online shopping settings.

Through active adoption of new technologies and flexible best practices, companies will experience safer, scalable development in the fast-evolving digital payment sourcing environment.

FAQs on Payment Fraud

Payment fraud remains a critical concern for US businesses—here are answers to some common questions.

How does credit card fraud occur?

Criminals steal cardholder information through phishing, skimming, or hacking, then use it for unauthorized transactions.

What is card-not-present (CNP) fraud?

Fraudsters use stolen card details for online purchases without physically presenting the card, exploiting e-commerce platforms’ vulnerabilities.

What is check fraud and how can it be avoided?

Fraudsters alter, forge, or duplicate checks; businesses should use positive pay systems and monitor transactions regularly.

Which payment channels are most vulnerable to fraud?

Wire transfers, ACH payments, digital wallets, prepaid cards, and checks all have unique vulnerabilities, with wire and CNP transactions facing high-value attacks.

How can wire transfer fraud be prevented?

Strict payment approval, vendor verification, and employee training help prevent unauthorized or manipulated wire transfers.

How often should businesses review their payment security measures?

Regular audits and continuous monitoring are recommended to stay ahead of emerging threats.

How can AI and machine learning help detect fraud?

These technologies analyze millions of data points to identify abnormal behaviors and flag suspicious transactions in real time.

Why is multi-factor authentication important for payment security?

MFA adds an extra layer of protection against credential theft and account takeover incidents.

Cheqly Safeguards Every Transaction You Make

Cheqly is protecting small businesses against payment fraud by collaborating with Socure to offer secure identity verification along with AML/KYC compliance. Cheqly employs Socure’s AI tools for instant client identity verification and for checking them against watchlists to prevent fraud and money laundering. Thanks to encryption and real-time alerts, enterprises can monitor transactions securely, reduce fraud exposure, and easily manage compliance requirements.

Sign up for a Cheqly account today and enjoy secure, worry-free payments.