Fraud in online payments is rising sharply, with BIN (Bank Identification Number) attacks now estimated to account for up to 80% of all credit card fraud, according to FasterCapital. That means most fraudulent card activity now begins with automated scripts testing BINs to find valid card details.

For small businesses and payment platforms, this surge means more than just costly chargebacks—it exposes fundamental vulnerabilities in how online transactions are verified and secured.

To help you overcome this, we’ve put together a simple guide explaining BIN attacks, how they work, and easy ways to spot and stop them before they impact your customers or your business.

What Is a BIN Attack and How Does It Work?

A BIN attack uses automated tools to guess valid credit or debit card details by targeting the card’s Bank Identification Number (BIN)—the first 6–8 digits. Attackers program bots with BINs and run thousands of card numbers, expiry dates, and CVV combinations to find valid matches.

These brute-force checks are fast and cheap to run. Once a bot finds a valid combination, the fraudster can make unauthorized purchases on online platforms, subscription-based services, or any online merchant store that accepts card payments.

BIN attacks pose a greater risk to cardholders, card issuers, banks, and financial institutions, as they lead to chargebacks, harm customer trust, and require increased spending on fraud prevention by payment processors and financial services platforms.

The attack typically unfolds in several steps:

1. Finding BINs: First, fraudsters find the BINs of specific card issuers or banks. They may purchase BIN lists from the dark web, get them from stolen card data, or even collect information from publicly available sources.

2. Generating card numbers: They append random digits to the BIN, compute the Luhn check digit, then automate testing of thousands of generated numbers across online stores, digital wallets, and subscription services.

3. Testing for valid cards: Then, the fraudsters test these numbers on sites with weak security, such as online stores, payment portals, or platforms that allow card registration without an immediate transaction.

4. Misusing valid cards: As soon as a card is confirmed valid, fraudsters use it to shop online, add it to wallets, copy the information, or trade it online.

What Businesses Are Most Vulnerable to BIN Attacks?

The short answer is: almost all. Businesses that handle large volumes of online transactions or rely on recurring payments are often the easiest targets for BIN attacks. Fraudsters focus on these companies because even small gaps in verification can quickly turn into major financial losses.

The businesses most vulnerable include:

- Online retailers: E-commerce stores typically manage dozens of transactions every day, which is why fraudsters find it quite simple to verify card information.

- Digital goods sellers: Businesses selling software, music, e-books, or videos face a higher risk, as they deliver digital products instantly.

- Travel and hospitality businesses: It is very difficult to detect fraudulent transactions in airlines, hotels, and travel agencies because they handle high-value international bookings.

- Gaming and gambling platforms: Instant, high-value transactions and anonymous accounts make these platforms frequent targets for BIN attacks.

- Subscription-based services: One of the risks of streaming services and subscription sites is that scammers can take advantage of recurring transactions to make repeated unauthorized payments.

- Financial institutions: Banks and financial services platforms are targets when attackers exploit gaps in payment processing or security systems.

- Payment processors: Processing payments for multiple merchants makes these companies high-value targets, as a breach can affect many businesses and customers.

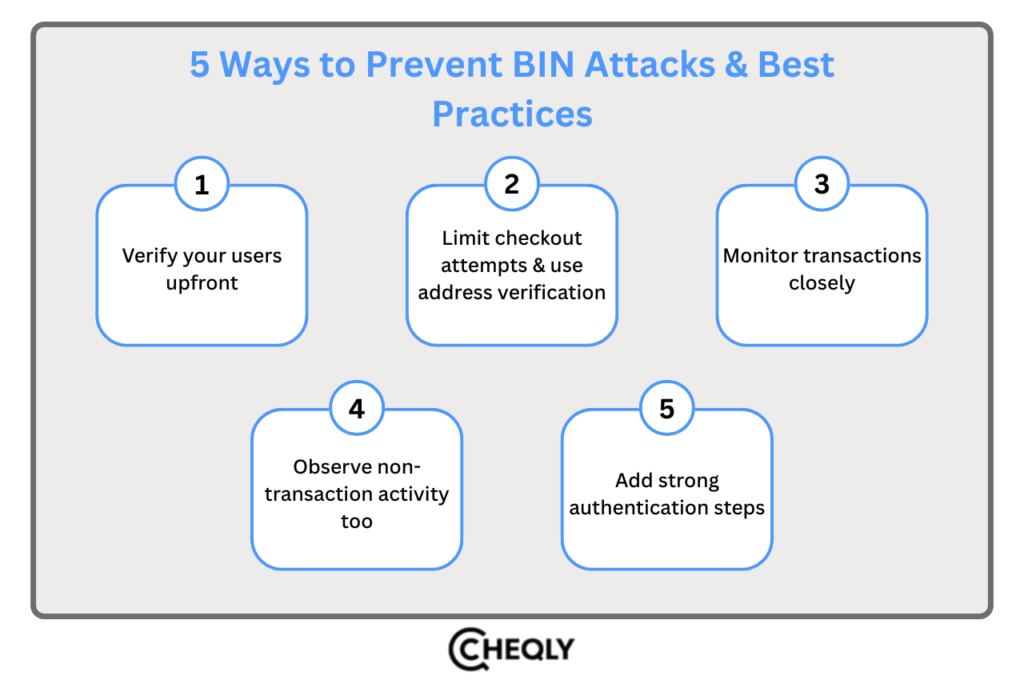

5 Ways to Prevent BIN Attacks & Best Practices

Fraudsters may always find ways to guess credit or debit card numbers using the Bank Identification Number (BIN), but businesses can stop these attacks before they cause damage. Whether you run an online merchant store, a subscription-based service, or a financial services platform, here are five practical ways to prevent BIN attack fraud and secure your transactions.

- Verify your users upfront: Start by confirming that customers are who they claim to be. Conduct KYC checks, customer due diligence, and enhanced verification to reduce the risk of fake accounts.

- Limit checkout attempts & use address verification: BIN attacks often involve many low-value online purchases in a short window. Limit checkout attempts per user and utilize the Address Verification Service (AVS) to verify the billing address and ZIP code.

- Monitor transactions closely: Watch out for unusual transaction patterns, especially multiple small payments or repeated CVV and expiry date errors, to catch card testing early and prevent larger fraudulent purchases.

- Observe non-transaction activity too: Go beyond transaction data. Monitor logins, device changes, IP addresses, and account updates, as they can reveal suspicious behavior before money moves.

- Add strong authentication steps: Add an extra layer of protection during payment processing. Use CAPTCHA to block bots and include multi-factor authentication (biometric verification or facial recognition) so that only genuine cardholders can complete transactions.

FAQs on BIN Attacks

The following are some frequently asked questions on BIN attacks:

How can e-commerce businesses detect BIN attacks?

E-commerce businesses can detect BIN attacks by tracking transaction logs. This helps them identify trends in failed authorization attempts, which often signal a BIN attack in progress.

What role do banks and payment processors play in preventing BIN attacks?

Banks and payment processors reduce BIN attack risks by watching for unusual transactions and using strong security measures, all while following regulatory rules.

Can BIN attacks be reported, and to whom?

BIN attack fraud should definitely be reported as soon as possible. Companies, with the help of law enforcement or fraud organizations, can initiate investigations by reporting the suspected BIN attacks. Besides that, it is very important to inform the banks, card issuers, and payment processors that are affected, since these organizations have the resources, including security personnel, who can help control the situation and conduct surveillance.

What is card testing in the context of BIN attacks?

Card testing involves fraudsters validating stolen credit or debit card information by making small purchases to determine if the card is active and has available funds.

How can businesses monitor suspicious activity related to BIN attacks?

Businesses can monitor suspicious activity by analyzing transaction velocity patterns, failed authorization attempts, and other anomalies to identify potential BIN attacks.

Are virtual cards safer against BIN attacks than physical cards?

Yes, virtual cards are indeed safer than physical cards as they create a buffer between you and your customer’s real credit card account information, helping limit the impact of data breaches.

Scale Your Business Faster by Going Cashless with Cheqly

Going cashless isn’t just convenient; it’s a smarter way to grow. With Cheqly, small business owners can simplify payments, save time, and focus on scaling instead of managing cash flow challenges.

Use physical or virtual debit cards for everyday expenses, or pay easily through digital wallets like Google Pay, Apple Pay, and Samsung Pay. Need to move money fast? Cheqly supports secure wire and ACH transfers to keep your business running smoothly.

Open a Cheqly account today and experience how going cashless can make your business faster, smarter, and more efficient.