Ever made an online payment without swiping or tapping your card? That’s known as a card-not-present (CNP) transaction — it happens when you pay through a website, app, or even over the phone, without physically using your card. It’s super convenient for shoppers, merchants, and even financial institutions, but it also creates opportunities for different types of fraud. In fact, as of last year, CNP fraud accounted for almost 74% of all card fraud in the US.

For any business that accepts online or remote payments, whether through a digital wallet, phone orders, or stored card-on-file systems, that means one thing: you have to stay alert and protect every transaction.

To help you spot and stop this fraud early, we’ll explain what CNP transactions are, why scammers often target them, and how you can keep your business and customers safe with simple, smart security steps.

What is a Card Not Present (CNP) Transaction?

Most retail payments happen when the card and the payment terminal meet; that’s a card-present transaction. It’s what takes place when you walk up to a checkout counter and pay by swiping, inserting, or tapping your card. The terminal reads your card’s chip or magnetic stripe, and the payment is authorized almost instantly.

A card-not-present (CNP) transaction, on the other hand, happens when you do not use your card physically at the checkout. Instead, you share your payment card credentials, like the card number, expiry date, and CVV, to complete the purchase. This could be while shopping online, paying through an app, or entering your card details manually in a store’s online payment system.

Card Not Present Transaction Examples

With digital technologies growing fast, payments without physically using a card are becoming very common. Its examples are:

- eCommerce: Customers enter their card details online to pay for products or services on your website.

- Online invoices: Your clients pay digital invoices using stored or manually entered card information.

- Digital payment platforms or apps: Users provide card details that are saved in their financial dashboard or digital wallet, and then proceed with online transactions or transfers.

- Phone orders: Customers share card details over the phone for remote payment processing.

- Mail orders: Buyers send their card information on an order form through the mail to complete a purchase.

- Card-on-file: Repeat customers use saved card details for subscriptions or recurring payments without re-entering information.

Card Not Present Fraud: Major Types and How to Protect Yourself

Scammers use more than one trick to pull off card-not-present fraud. Let’s look at the main types you should know and the simple ways to stay protected.

What is Card Not Present Fraud?

Card Not Present (CNP) fraud occurs when someone else uses your credit or debit card details to make a payment, even when they don’t have your card physically. It’s an unauthorized transaction that usually takes place online or by phone.

Scammers get this information in many ways (through phishing emails, data breaches, or identity theft) and then use those stolen details, like the card number, security code, and expiry date, to make fake purchases or payments.

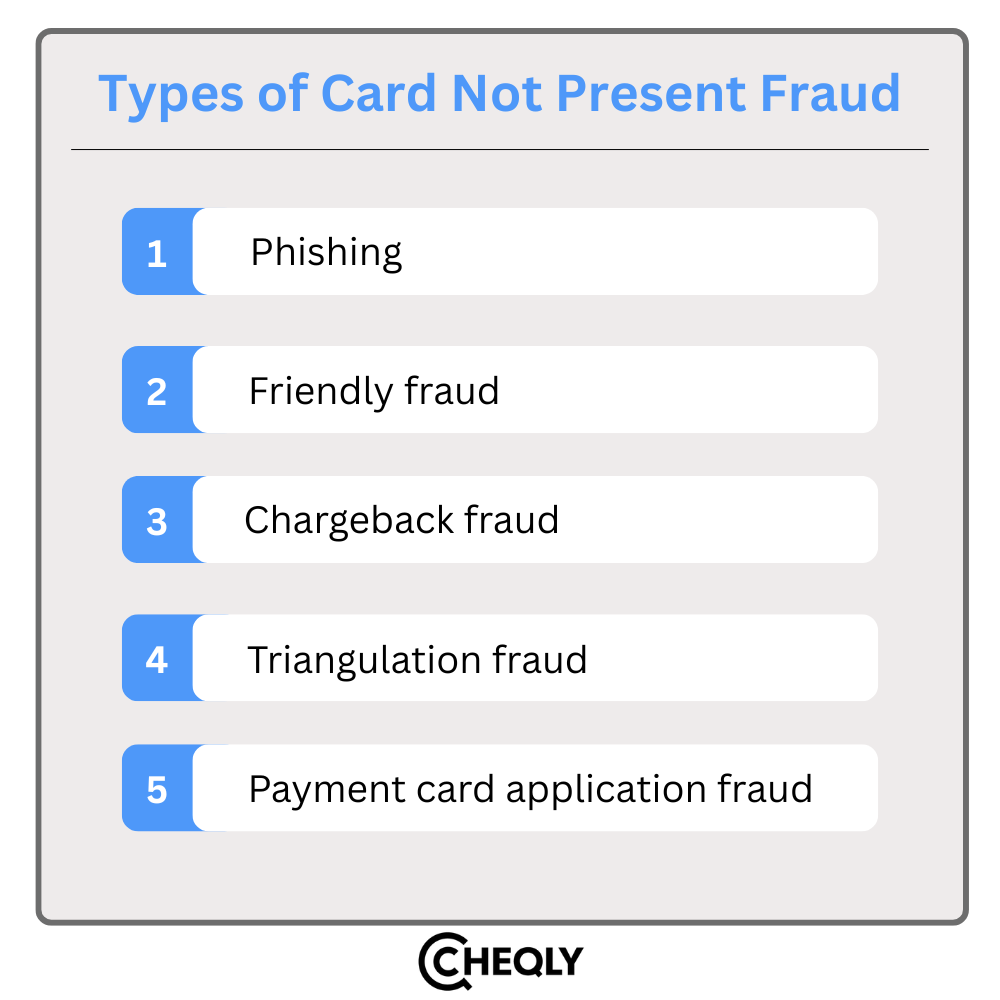

Types of Card Not Present Fraud

Scammers use many tricks to commit CNP-related fraud. Here are the most common types and how to protect against them:

- Phishing: Fraudsters often create/send fake websites, emails, or texts to steal card details and make fraudulent CNP purchases before the victim notices.

- Friendly fraud: A real customer makes a purchase but later falsely claims it wasn’t authorized or the product never arrived, keeping both the item and the refund.

- Chargeback fraud: Criminals use stolen card details to buy items, and when the real cardholder disputes the charge, the merchant loses both the money and the product.

- Triangulation fraud: Fraudsters run fake e-commerce stores, use stolen cards to buy real products from legitimate sellers, and resell them, causing losses for genuine merchants.

- Payment card application fraud: Scammers use fake or synthetic identities to get new cards, make fraudulent CNP purchases, and vanish before detection.

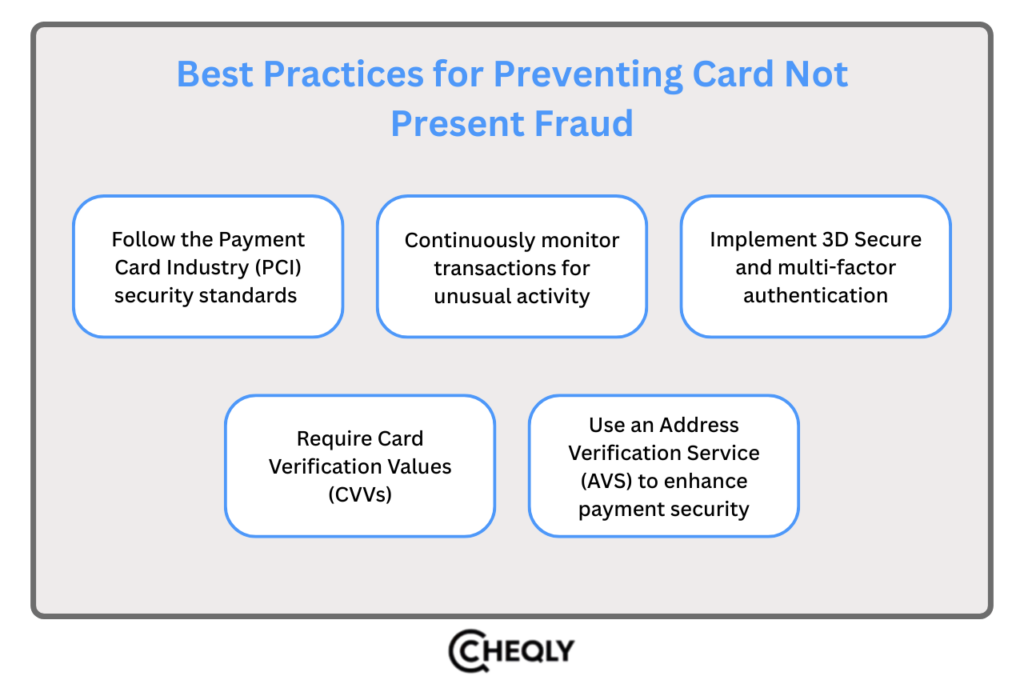

Best Practices for Preventing Card Not Present Fraud

You can’t stop scammers from trying, but you can make it harder for them to succeed. Let’s look at the best ways to prevent CNP fraud before it happens.

Follow the Payment Card Industry (PCI) security standards

Follow the Data Security Standards (DSS) set up by the Payment Card Industry’s Security Standards Council, developed by members, including major card networks like Visa and MasterCard. These standards include using firewalls, encrypting cardholder data, securing systems, and limiting access to sensitive payment information.

Continuously monitor transactions for unusual activity

Track your customers’ behavior, devices, and transaction patterns to identify if anything is suspicious. Even small “test” transactions can be a red flag for CNP fraud, so consistent monitoring helps catch issues early.

Implement 3D Secure and multi-factor authentication

Add extra verification steps like OTPs, IDs, or fingerprints before approving a payment. These methods make it harder for fraudsters to complete unauthorized CNP transactions.

Require Card Verification Values (CVVs)

Always ask for CVVs during checkout. Since scammers don’t always have these codes, this small step adds a strong extra layer of protection against fraudulent payments.

Use an Address Verification Service (AVS) to enhance payment security

Enable the AVS system to check if a customer’s billing address matches the one linked to their card. This helps block suspicious payments and strengthens your overall payment security.

Card-Not-Present (CNP) Fraud FAQs

Got questions about CNP fraud? Here are some quick answers to help you understand how it happens and what businesses can do to stay protected.

How can businesses detect and prevent CNP fraud?

Businesses can use fraud detection tools to monitor payments as they happen and quickly spot any spending patterns that look unusual.

What authentication methods help reduce CNP fraud risk?

Strong authentication methods, such as 3D Secure, two-factor authentication (2FA), and CVV verification, help confirm the buyer’s identity and reduce fraud risk.

How do chargebacks relate to Card-Not-Present fraud?

Chargebacks often happen when a cardholder disputes a fraudulent or unrecognized CNP transaction, causing the merchant to lose both revenue and goods.

How does 3D Secure (3DS) technology prevent online card fraud?

3D Secure adds an extra verification step during checkout, such as a one-time password, to ensure only the legitimate cardholder approves the transaction.

Are small e-commerce businesses more at risk for CNP fraud?

Yes, small businesses are often easier targets because they may lack advanced fraud prevention systems and dedicated security teams.

What are the financial and reputational impacts of CNP fraud on businesses?

CNP fraud can result in direct financial losses, chargeback fees, and damage to customer trust—hurting both profits and brand reputation.

To sum up, with the continuing rise of digital payments, card-not-present (CNP) fraud remains one of the major challenges for online businesses. To defend effectively, multi-layered authentication, intelligent fraud detection systems, and secure, PCI-compliant payment gateways that protect customer data are indispensable.

Strengthen Payment Security with Cheqly

Use Cheqly’s safe payment methods to safeguard your money. You can record transactions instantly, use virtual and physical debit cards to make the purchases you want, and trust Socure’s cutting-edge identity verification technology to reduce fraud and ensure account security.

Sign up for a Cheqly business account and protect your transactions with confidence.