Valuation for today’s CFOs is not merely a matter of compliance; it is a key strategic tool used in a complex and unstable market environment. In 2026, CFOs will have to deal with issues beyond their control, such as financing liquidity, changing investor demands, and sudden market shifts. Knowing the real value of their business allows CFOs to comfortably showcase it to the investors and wisely, strategically decide on the capital use.

For example, Zoom video communications initially offered its shares to the public in April 2019, raising approximately $357 million at a valuation of $9.2 billion. As a result of this IPO, the company recorded revenues of $330.5 million for fiscal year 2019, a 118% increase compared to the previous year. This growth indicates strong traction in the enterprise market. Although the company was heavily reinvesting its profits, it remained profitable, posting a net income of $7.6 million that year. Shares jumped approximately 70–80% on the first day of trading, showing how CFOs and finance leaders use key SaaS metrics (growth, retention, recurring revenue) alongside profitability to build a compelling valuation case and attract capital.

Getting valuation right gives Chief Financial Officers (CFOs) the power not just to manage situations like funding rounds, mergers, and stock option plans, but also to drive the firm’s long-term growth and stability. This post highlights key valuation techniques for CFOs, with step-by-step guidance to make informed financial decisions.

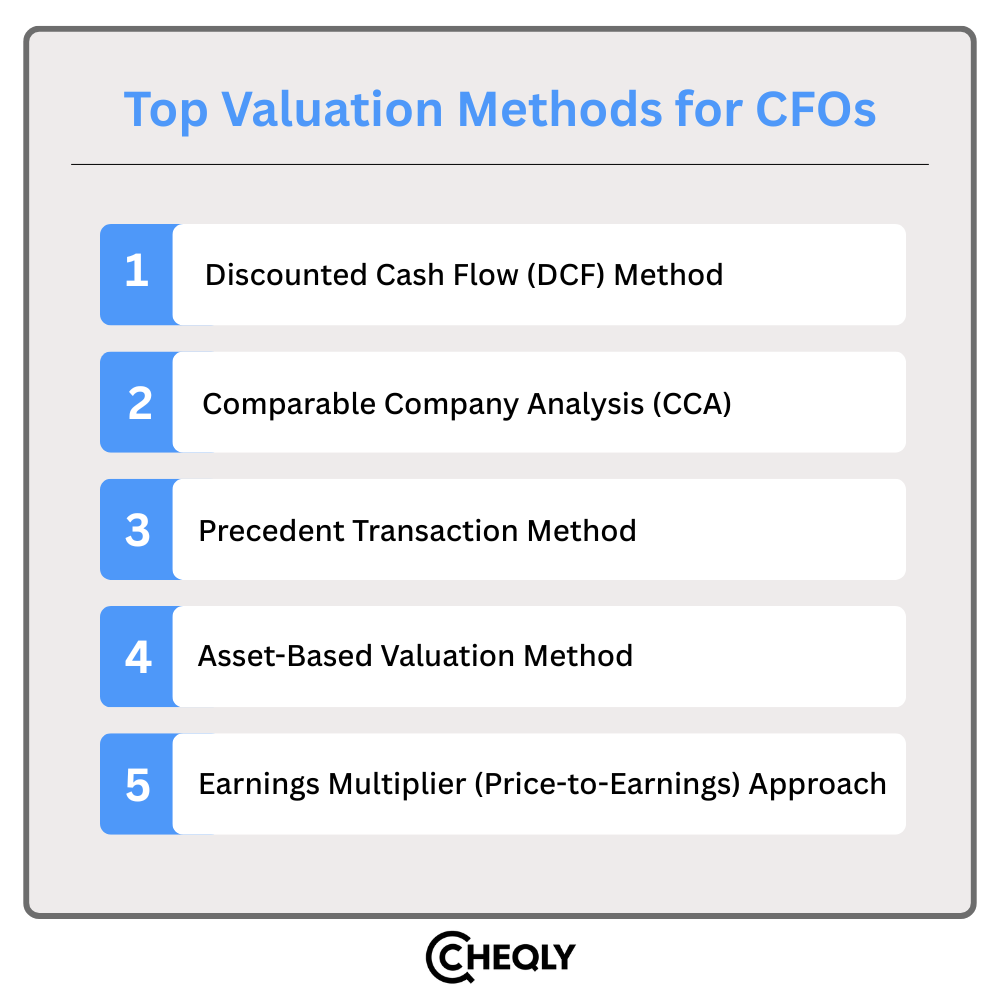

Top Valuation Methods for CFOs

It is necessary to understand that each technique provides a different perspective on the value of a business, even before looking at the details of the methods. A chief financial officer (CFO) may use these methods separately or together to obtain an overall picture of the company’s financial value.

1. Discounted Cash Flow (DCF) Method

The Discounted Cash Flow technique estimates the value of a company by determining the present value of the company’s future free cash flows, which have been projected and then discounted at a rate that represents the risk and the time value of money. It is based on the fact that a business today is the value of all the business’s future cash flows, discounted to their present value.

When to Use

This method is most suitable for businesses that have steady cash flows and can be utilized for internal valuations, investments, and 409A purposes.

Example

A firm is interested in figuring out its total value using the discounted cash flow (DCF) method, which calculates the business value from the present value of the free cash flows generated in the future.

Step 1: Project Future Free Cash Flows (FCF)

We project the annual free cash flows of the company, typically over 5 years.

| Year | FCF |

| Year 1 | $4.0M |

| Year 2 | $5.0M |

| Year 3 | $6.0M |

| Year 4 | $7.0M |

| Year 5 | $8.0M |

Step 2: Determine the Discount Rate (WACC)

We use a discount rate to convert future cash flows into their value today.

Assumption:

Weighted Average Cost of Capital (WACC) = 10%

Step 3: Calculate Present Value (PV) of Each Cash Flow

We find out the present value of each future cash flow by using the following formula:

PV(FCFt)=FCFt /(1+r)t

| Year | FCF | PV Formula | PV(in $M) |

| 1 | 4.0 | 4.0 / (1+0.10)1 | 3.64 |

| 2 | 5.0 | 5.0 / (1+0.10)2 | 4.13 |

| 3 | 6.0 | 6.0 / (1+0.10)3 | 4.51 |

| 4 | 7.0 | 7.0 / (1+0.10)4 | 4.78 |

| 5 | 8.0 | 8.0 / (1+0.10)5 | 4.97 |

Total Present Value of 5-year Cash Flows = $21.03M

Step 4: Calculate Terminal Value (TV)

The terminal value is a measure of the value of all cash flows that are expected to occur after Year 5.

Using the Gordon Growth Method:

TV=FCF5 1+g / r-g

Assumptions:

- Long-term growth rate (g) = 3%

- FCF in Year 5 = $8.0M

TV= 8.0 1.03 /0.10-0.03=8.24 / 0.07=117.71 million

Step 5: Discount Terminal Value to Present Value

To find the value of the terminal value in the present time, we apply a discount to it.

PV(TV)=TV / (1+r)5

PV(TV)=117.71 / 1.1611=73.09M

Step 6: Calculate Enterprise Value (EV)

Calculate the Enterprise Value (EV) by adding the PV of cash flows and the discounted terminal value.

Enterprise Value = PV (5-year FCFs) + PV (Terminal Value)

EV = 21.03 + 73.09 = 94.12 million

It shows the present value of the company’s operations.

Step 7: Adjust for Net Debt to Get Equity Value

Equity Value can be determined by subtracting net debt from Enterprise Value.

Equity Value = Enterprise Value − Net Debt

Assume:

- Total Debt = $10M

- Cash = $2M

- Net Debt = $8M

Equity Value = 94.12 − 8 = 86.12 million

Step 8: Calculate Value per Share

To find the value per share, you need to divide the total Equity Value by the total number of outstanding shares.

Assume total shares outstanding = 10 million shares

FMV per Share = 86.12 / 10 = $8.61 per share

According to the discounted present value method, the fair value of a share is $8.61 today, even if the company may generate substantial cash flows in the future.

2. Comparable Company Analysis (CCA)

CCA (or trading comps) is a method of evaluating a company through the analysis of other similar publicly listed companies in the same industry. The underlying idea is that businesses with similar profiles should have similar valuation multiples, thereby making the method market-driven and current.

Common Multiples:

- EV/EBITDA (Enterprise Value/Earnings Before interests, Taxes, Depreciation, Amortization)

- P/E (Price/Earnings)

- EV/Sales (Enterprise Value/Sales)

When to Use

This method works best when there are sufficient numbers of comparable publicly listed companies with stable financials, and a market-driven valuation is required for M&A, investments, or fairness opinions.

Example

A company aims to figure out its value by Comparable Company Analysis, which is basically the application of valuation multiples of similar publicly traded companies.

Step 1: Identify Comparable Public Companies

We choose companies that operate in the same industry, have roughly the same size, business model, and growth characteristics.

Example peer group (hypothetical):

| Company | EV/EBITDA | P/E | EV/Sales |

| Company A | 12× | 25× | 3.0× |

| Company B | 10× | 22× | 2.8× |

| Company C | 11× | 24× | 3.2× |

Average multiples:

- EV/EBITDA = 11×

- P/E = 24×

- EV/Sales = 3.0×

Step 2: Determine the Target Company’s Financial Metrics

Locate the primary financial metrics of the target enterprise that include EBITDA, Net Income, Revenue, Shares Outstanding, and Net Debt.

Our target company (the one whose value we are determining) has:

- EBITDA = $8 million

- Net Income = $5 million

- Revenue = $20 million

- Shares Outstanding = 5 million

- Net Debt = $10 million

Step 3: Apply the Comparable Multiples

Use the comparative multiples to multiply the financial metrics of the target company to get the value.

A. EV/EBITDA Valuation

Enterprise Value = EBITDA × EV/EBITDA

EV = 8M × 11 = 88M

B. P/E Valuation

Equity Value = Net Income × P/E

Equity Value = 5M × 24 = 120M

C. EV/Sales Valuation

EV = Revenue × EV/Sales

EV = 20M × 3.0 = 60M

Step 4: Convert Enterprise Value to Equity Value (for EV-based methods)

To find the equity value of the company, subtract net debt from the enterprise value.

Equity Value = EV − Net Debt

From EV/EBITDA:

Equity = 88M − 10M = 78M

From EV/Sales:

Equity = 60M − 10M = 50M

Step 5: Calculate Value per Share

Calculate the per-share value by dividing the equity value by the total number of shares that are outstanding.

FMV per Share = Equity Value / Shares Outstanding

| Method | Equity Value | Value per Share |

| EV/EBITDA | 78M | $15.60 |

| P/E | 120M | $24.00 |

| EV/Sales | 50M | $10.00 |

Based on CCA, the company’s fair value range is from $10.00 to $24.00 per share, as per the valuation multiple used.

3. Precedent Transaction Method

The approach looks at the most recent sales of similar M&A transactions to determine the most likely value of your company. Essentially, it shows the typical purchase prices of similar companies paid by buyers, and usually includes strategically high premiums.

When to Use

This method works best if there have been recent M&A deals with similar companies, thus offering market-based benchmarks, in particular for decisions related to acquisitions, mergers, or strategic investments.

Example

A mid-market SaaS company is looking to figure out its worth using the Precedent Transaction Method, which mainly relies on the prices paid in the M&A deals for similar companies.

Step 1: Identify Comparable Transactions

We identify new SaaS companies that have been purchased recently, are of similar size & have the same business model.

| Company Acquired | Revenue (LTM) | Transaction Value | EV/Revenue Multiple |

| SaaSCo A | $1M | $60M | 5.0× |

| SaaSCo B | $15M | $75M | 5.0× |

| SaaSCo C | $10M | $40M | 4.0× |

Step 2: Apply the Transaction Multiples to Your Company

Take the key financial figure from your company (e.g., revenue or EBITDA) and multiply it by the transaction multiples to get an approximate enterprise value.

The company you are targeting has $14 million in revenue over the last twelve months, is almost debt-free, and has $2 million in cash.

Applying the multiples:

Low case (4.0×):

Enterprise Value = 14M × 4.0 = $56M

High case (5.0×):

Enterprise Value = 14M × 5.0 = $70M

Midpoint (4.67×):

Enterprise Value = 14M × 4.67 ≈ $65.4M

Step 3: Convert Enterprise Value to Equity Value

By incorporating cash and subtracting debt from the enterprise value, one arrives at the company’s equity value.

Given that the company is debt-free and has $2 million in cash on hand,

Equity Value = Enterprise Value + Cash − Debt

| Case | Enterprise Value | + Cash | − Debt | Equity Value |

| Low | $56M | +2M | 0 | $58M |

| Mid | $65.4M | +2M | 0 | $67.4M |

| High | $70M | +2M | 0 | $72M |

Step 4: Derive Per-Share Value

Determining the value for a share requires dividing the total equity by the total shares outstanding.

Let us assume the target company has 10 million total shares outstanding.

| Case | Equity Value | Per-Share Value |

| Low | $56M | $5.80/share |

| Mid | $65.4M | $6.74/share |

| High | $70M | $7.20/share |

Value Range: $58M – $72M

Per-share FMV Range: $5.80 – $7.20

4. Asset-Based Valuation Method

This is a valuation technique that determines the worth of a company as the difference between total assets and total liabilities, its net asset value (NAV). It is most appropriate for asset-intensive enterprises (e.g., real estate, manufacturing).

When to use

This method works particularly well for companies that have a heavy asset base, for instance, those in the fields of real estate or manufacturing. It is also appropriate when a business liquidation or net asset value scenario is being considered.

Example

A mid-sized manufacturing company is interested in finding out its worth by using the Asset-Based Approach.

Step 1: List the Company’s Assets (at Fair Market Value)

Record the fair market value of all company assets, both tangible and intangible.

| Asset Category | Fair Market Value |

| Machinery & Equipment | $12,000,000 |

| Inventory | $4,000,000 |

| Land & Buildings | $18,000,000 |

| Accounts Receivable | $3,000,000 |

| Cash | $1,000,000 |

Total Assets = $38,000,000

Step 2: List the Company’s Liabilities

Document all debts in order to figure out the company’s obligations.

| Liability Category | Amount |

| Long-Term Debt | $10,000,000 |

| Accounts Payable | $2,000,000 |

| Accrued Expenses | $1,000,000 |

Total Liabilities = $13,000,000

Step 3: Calculate Net Asset Value (NAV)

Net Asset Value is figured by taking assets and subtracting liabilities.

NAV = Total Assets − Total Liabilities

NAV = 38,000,000 − 13,000,000 = 25,000,000

So the company is basically worth $25 million, just taking into account its asset base (after deducting liabilities).

5. Earnings Multiplier (Price-to-Earnings) Approach

This method values a company based on its profits. It compares the company’s earnings with similar companies using a multiplier called the P/E ratio. Companies with higher or more stable future earnings get a higher multiplier. Investors use this method to decide how much to pay today for each dollar of the company’s earnings.

When to use

It is the most appropriate method to use for enterprises that have consistent and foreseeable profits, particularly when being compared to similar companies for investment, valuation, or acquisition purposes.

Example

A company that produces consumer goods and is of medium size desires to calculate its worth through the P/E multiple method.

Step 1: Identify Comparable P/E Multiples

We examine comparable publicly traded companies operating in the same industry:

| Comparable Company | P/E Ratio |

| ConsumerCo A | 14× |

| ConsumerCo B | 16× |

| ConsumerCo C | 15× |

Average P/E Multiple = (14 + 16 + 15) / 3 = 15×

Step 2: Determine the Company’s Net Income (Earnings)

Let us assume the target company has earned $6 million in net income over the last 12 months.

Step 3: Apply the P/E Multiple

Equity value can be figured out by multiplying the company’s net income by its P/E ratio.

Equity Value = Net Income × P/E Multiple

- Low case (14×): 6M × 14 = 84M

- Mid case (15×): 6M × 15 = 90M

- High case (16×): 6M × 16 = 96M

Step 4: Derive Per-Share Value

Determine the worth of each share by dividing the total equity by the number of outstanding shares.

Let’s say the target company has 8 million shares that are outstanding.

| Case | Equity Value | Per-Share Value |

| Low | $84M | $10.50 |

| Mid | $90M | $11.25 |

| High | $96M | $12.00 |

Equity Value Range: $84M – $96M

Per-Share Value Range: $10.50 – $12.00

The company’s fair value is approximately $90 million according to P/E multiples of comparable listed companies.

How Valuation Insights Drive Better Financial Decisions

Valuation mastery gives CFOs the ability to gain insight into strategy far beyond the figures. Knowledge of value drivers can help finance leaders make wiser decisions in budgeting, fundraising, mergers and acquisitions, and business operations:

- Determining what business units or product lines create the greatest value helps in resource allocation and focuses on growth.

- Streamline the capital structure by balancing debt and equity to facilitate growth and sustainability.

- Enhance equity discussions using justifiable, evidence-based valuations for investors or acquirers.

- Integrate company value among boards, employees, and market participants, making buy-in and alignment easy.

The mastery of valuation, therefore, equips the CFOs to relate financial performance to strategic development and to convert raw financial data into business intelligence that can be acted upon by the decision-makers in every part of the organization.

Business Valuation FAQs for CFOs

Below are answers to common questions CFOs face regarding valuation.

How should a CFO reconcile significant differences between valuation methods?

A chief financial officer (CFO) must examine the reasons behind differences in the results of each method by analyzing assumptions, growth projections, and market conditions. A more balanced and informed valuation can be achieved by using a weighted approach or triangulating various methods, which in turn supports strategic decision-making.

What steps should CFOs take to audit-proof their valuation models for regulatory reviews?

CFOs can make their valuation models audit-proof by carefully documenting assumptions, inputs, and the methodologies they use. They should perform sensitivity analyses, compare outcomes across different valuation methods, track changes with version control, and keep all supporting data readily accessible. Regular internal audits and strict adherence to accounting and regulatory standards further ensure the process is transparent and reliable.

When should a CFO choose DCF over Comparable Company Analysis for valuation?

When a company has irregular cash flows, operates in a highly specialized market, or doesn’t have comparable peers, a CFO should use the Discounted Cash Flow (DCF) method rather than Comparable Company Analysis. DCF is more fundamental because it values the company based on its own projected cash flows.

What practical steps can CFOs use to avoid bias in management projections for DCF?

CFOs have the ability to reduce bias in management’s DCF projections by using past performance as a baseline, considering different scenarios (best case, worst case, and most likely), comparing them with industry trends, and obtaining confirmation from an independent source or third party. It is also beneficial to frequently revise forecasts and keep a clear record of all assumptions to ensure the evaluation is fair and reliable.

Build Confidence Through Valuation Mastery

For CFOs, understanding valuation methods is more than a technical requirement. It is a strategic advantage. Each method provides a different perspective on a company’s worth, enabling finance leaders to make informed decisions backed by reliable data. When applied correctly, valuation becomes a tool for consistent growth and helps build investor confidence.

To support this, Eqvista’s Real-Time Company Valuation® platform offers AI-powered, IRS-compliant 409A valuations backed by NACVA-certified analysts. With fast turnaround times, audit-ready reports, and expert insights, Eqvista enables CFOs to manage equity more effectively, set accurate strike prices, and align valuation outcomes with broader business objectives.

Cheqly’s collaboration with Eqvista gives companies access to a smooth, dependable 409A valuation experience. Together, they provide CFOs with the insights needed for accurate, compliant, and strategic decision-making.

Get your IRS-compliant, audit-ready 409A valuation from Eqvista’s expert-backed platform today.