Batch payment processing is essentially the method through which large numbers of businesses carry out their payments in a timely and effective manner. The payments can be employees’ salaries, suppliers’ invoices, or even international payments. Such digital transactions, which are forecasted to total approximately $38 trillion globally by 2030, are the lifeblood of business finances in the 21st century. Batch processing achieves this by consolidating several payments into one file, which in turn lessens the manual work, lowers the chances of mistakes, and provides businesses with better insight into their cash flow.

Below, we will explore batch payment processing in detail, compare it with real-time payments, and explain why it is a smart choice for managing business payments effectively.

What is Batch Payment Processing?

Batch payment processing, also known as bulk payment processing, is an alternative to processing each transaction in real-time and allows you to pay multiple transactions at once. With this method, all approved payment requests made during a specific time frame, typically a day, are gathered, combined, and processed as a single unit from the same company bank account.

Merchants frequently employ batch payment processing for disbursements such as payroll, supplier bill settlement, and overseas payments.

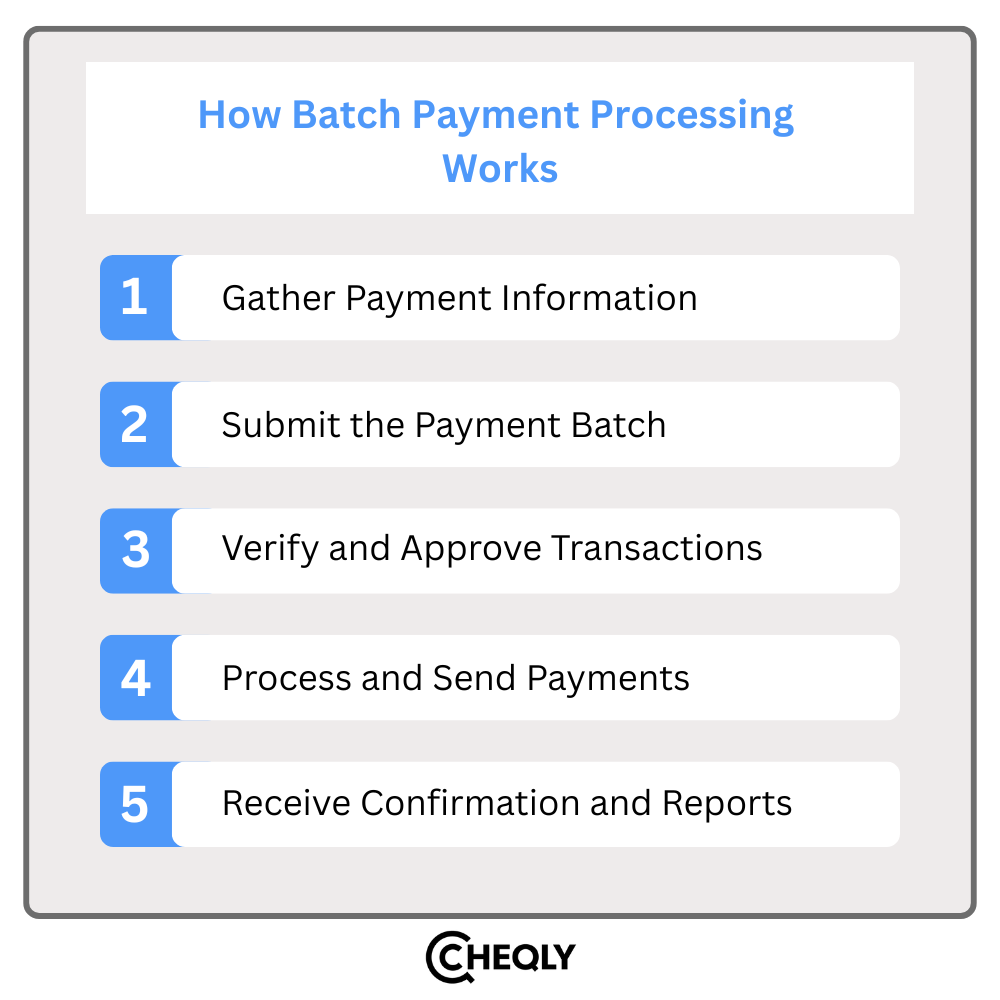

How Batch Payment Processing Works

Batch payment processing makes payouts easier by combining several transactions and processing them together in one cycle. Here are the key steps involved:

- Gather Payment Information: This covers the names, amounts, account information, and the payment method, for example, card, wire, or ACH.

- Submit the Payment Batch: You can upload a file via the dashboard or send it to your payment processor.

- Verify and Approve Transactions: Check again for mistakes or duplicates before approving the batch for processing.

- Process and Send Payments: Every payment is handled simultaneously, typically within a single workday.

- Receive Confirmation and Reports: Timestamps, downloadable reports, and receipts are sent to you for your records.

Additionally, the majority of products link seamlessly with your payroll, ERP, or accounting systems, eliminating the need for additional data entry along the process.

Batch credit card processing for customer refunds or ACH payments is made to function seamlessly without the need for messy spreadsheets.

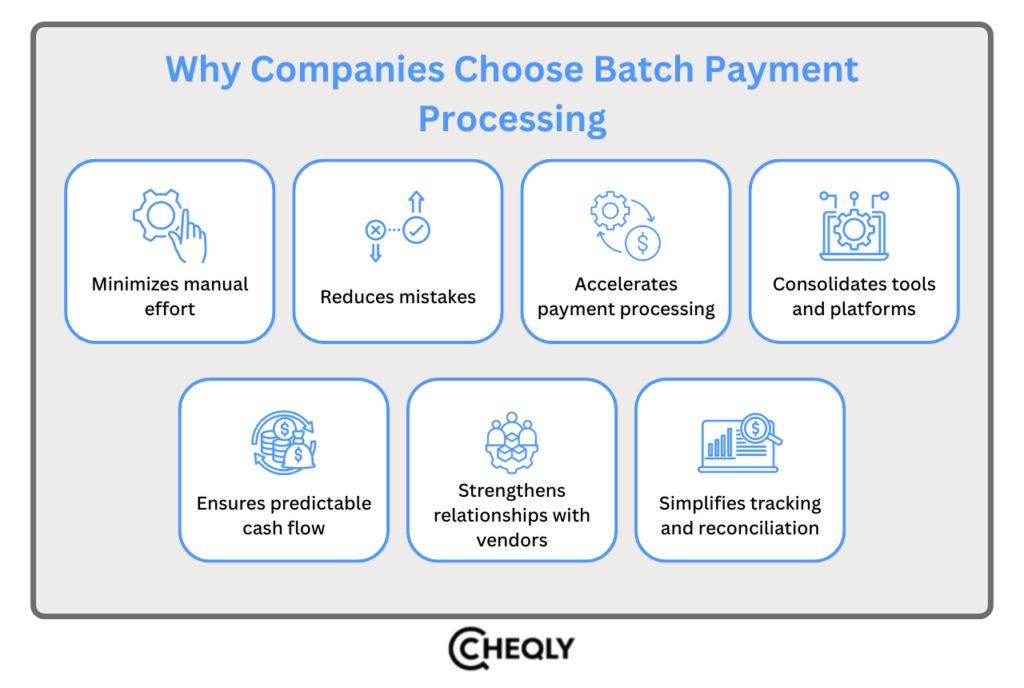

Why Companies Choose Batch Payment Processing

It shouldn’t feel like a full-time job to pay bills. However, handling dozens of such payments each week soon becomes a logistical nightmare for expanding companies. Your to-do list grows with each new employee, contractor, or vendor. One invoice may be paid by card, another by wire transfer, and another by ACH.

Your finance team is immediately overburdened with work when you multiply it by 20. That issue is resolved at scale through batch payment processing.

Here’s why companies choose batch payment processing:

- Minimizes manual effort: You submit all payments in a single, clean batch rather than processing each one separately.

- Reduces mistakes: Errors like multiple payments, typos, and missed invoices are eliminated when there are fewer manual entries.

- Accelerates payment processing: Money reaches partners, suppliers, and staff more quickly, ensuring seamless operations.

- Consolidates tools and platforms: Most systems eliminate data silos by integrating directly with your payroll, ERP, or accounting software.

- Ensures predictable cash flow: You are fully aware of what will be released and when.

- Strengthens relationships with vendors: Regular, timely payments foster trust and may occasionally grant early payment benefits.

- Simplifies tracking and reconciliation: Month-end close is much simpler with batch reporting.

Batch Payment Processing vs. Individual Transactions: What’s the Difference

There are various ways to send money. However, it may be time to zoom out if you’re still handling transactions one at a time.

To help you decide whether to batch and when it still makes sense to go solo, let’s examine how batch payment processing compares to individual transactions.

| Factor | Batch Payment Processing | Individual Transactions |

| Cost | Bundling together results in lower fees per transaction | Increased total fees, particularly as volume grows |

| Time | Submit a file, approve it, and process it in a single run | Each individual payment needs to be entered and approved manually |

| Admin effort | Centralized workflow that requires less toggling between tools | The administrative workload is very heavy, particularly when dealing with more than 10 payments |

| Risk | Less contact points imply less error possibilities | More possibilities of errors (wrong amount, account, etc.) |

When does batching make more sense?

Batch payments make it more convenient to pay several people on a regular basis, such as vendors, contractors, or employees, thus saving time and reducing the possibility of errors. A single payment is still a good option for one-off reimbursements or partial refunds.

Examples of Batch Payments

A batch file silently performs the heavy lifting behind every seamless payout transaction. These instances demonstrate its potency.

Month-End Freelancer Payments

A creative agency employs more than thirty independent contractors in the fields of development, copywriting, and design. The finance team uses a single ACH batch processing file instead of manually logging in to their bank or payment platform to transmit money one at a time.

Everyone is paid together, letting the team enjoy their Friday.

Affiliate Commission Payouts

Every month, hundreds of affiliate partners receive rewards from a developing SaaS startup. Manual distributions would be a hassle with different commission levels. Instead, they use bulk payments, which entail uploading a single file, checking it, and sending it.

The marketing team can grow the program without hiring more staff, partners are compensated, and the records are spotless.

Customer Refund Processing

Due to a supply chain delay, an online retailer must reimburse a sizable number of orders. They use batch credit card processing to issue all refunds at once rather than manually processing each card.

Payments are on their way, customers are informed, and support tickets remain largely silent.

Whether you’re paying employees or giving them money back, batch payments make it simpler to handle large volumes, guarantee accuracy, and maintain high levels of confidence.

ACH Batch Processing Explained

You are probably already aware of ACH batch processing if you pay contractors, employees, or vendors in the United States, and for good reason.

Banks use the Automated Clearing House network to send money electronically. Batch processing allows you to combine dozens or even hundreds of ACH payments into a single file and send them all at once rather than initiating transfers one at a time. Compared to writing checks or sending money individually, it is quick, dependable, and much less expensive.

Typical Processing Time

Depending on when you submit, ACH batches typically clear in one to two working days. Federal holidays can cause delays, and most banks have cutoff times, which are usually about 5 PM ET. Although it’s not instantaneous, it’s reliable.

Here are some things to be aware of:

- To submit ACH batches, your bank or payment processor must give you permission.

- Inaccurate account information or missing cutoff windows might cause transactions to be delayed.

- Federal compliance laws, such as NACHA regulations, must be adhered to, particularly when processing payroll.

However, when properly configured, ACH batch processing is among the most effective ways to manage regular payouts, particularly for scheduled vendor payments or payout runs.

FAQs on Batch Payment Processing

The following are some frequently asked questions on batch payment processing:

What are the risks associated with batch payments?

The major risks are errors in data entry, incorrect account details, duplicate transactions, and timing problems. If there is even a single error in a batch, it can affect many payments; hence, it is very important to have approval controls and validation checks in place.

How does batch payment processing impact cash flow?

Handling payments in batches helps cash flow, as it consolidates payments, provides a clear view of outgoing funds, and allows more efficient planning of disbursements.

How should businesses handle errors in batch payments?

Stop or recall unprocessed batches without delay. If the payments are processed, then utilize reversals, corrections, or follow-up ACH payments through documented workflows. Make sure that all adjustments are reconciled in the accounting/ERP systems so that batch reports match with ledgers and bank statements.

How do businesses plan for batch payment processing?

Business organizations carry out batch payment execution by walking through successive stages: they prepare for their payment cycles, check account details, set up approval workflows, and confirm that their activities conform to banking and regulatory requirements. Good management is instrumental in reaching the operational objectives of the company, such as saving time, reducing mistakes, and maintaining accurate financial records.

How do modern tools improve batch payment processing?

Modern tools enable batch payment processing in different ways, i.e., they can automatically enter data, confirm account details, detect duplicates and can be integrated with payroll, accounting or ERP systems. These tools help eliminate errors, save time, and make the entire process visible in real time, thereby facilitating bank statement reconciliation with the ultimate goal of quick and convenient payouts.

ACH Payments Made Simple with Cheqly

Cheqly allows small businesses to execute US-based ACH transactions in the most convenient manner, fast, secure, and free of any difficulties. Money transfers can be done at zero cost, you can take advantage of predictable processing times, and you can rely on a secure platform designed for smooth business operations. Through real-time tracking and error-free processing, Cheqly empowers you to manage your cash flow without the need for additional manual work.

Get started with a Cheqly business account today and streamline your ACH payments.