As a founder, making good financial choices means looking past profit and loss statements. The balance sheet gives a snapshot of your company’s financial health, showing your assets, liabilities, and equity, and offering insight into debt, liquidity, and working capital. Data shows that 82% of small businesses fail due to poor cash flow and financial mismanagement rather than market or product issues, so tracking key balance sheet indicators is vital.

This article outlines the essential balance sheet KPIs that founders should monitor to understand their business’s financial condition and use the insights to make informed decisions that ensure long-term viability.

Why are Balance Sheet KPIs Essential?

Small business owners must understand balance sheet metrics, as these are key indicators of their financial stability and liquidity, and they play an important role in guiding strategic decisions, avoiding potential risks, and supporting long-term growth.

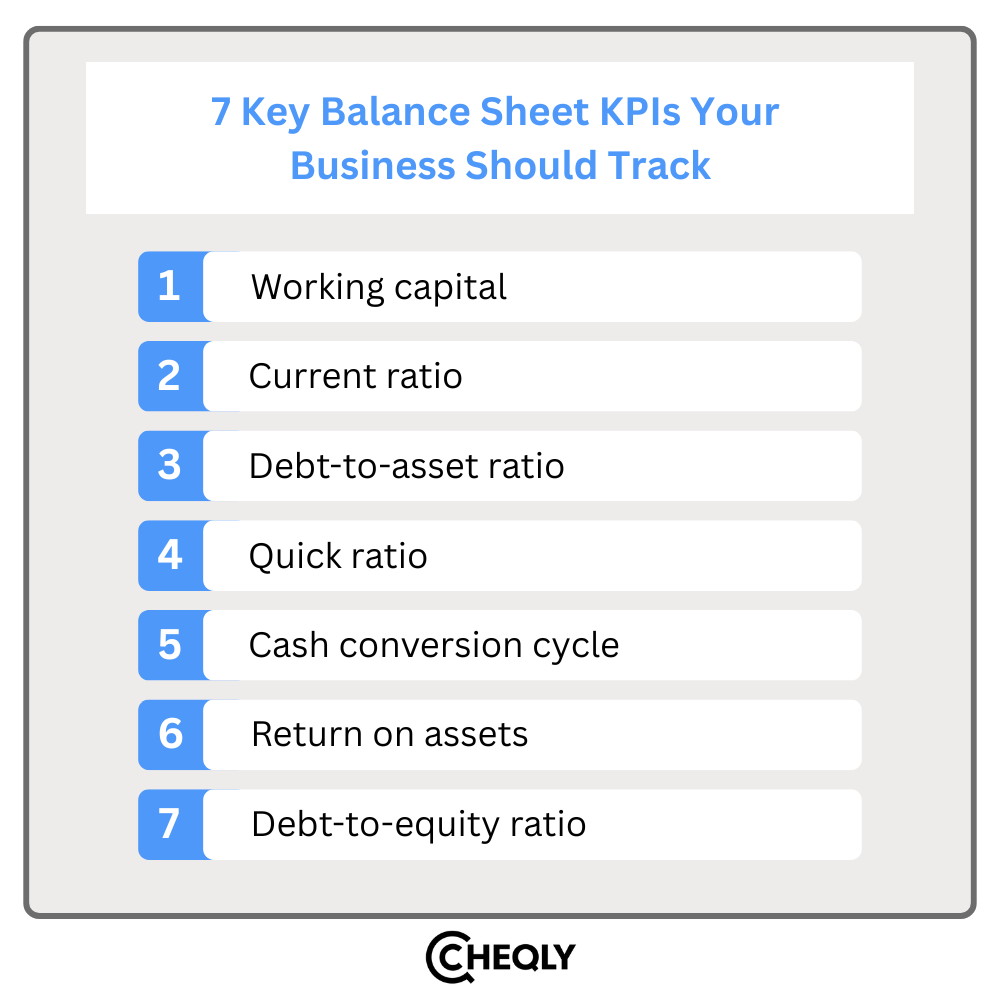

7 Key Balance Sheet KPIs Your Business Should Track

These KPIs give you the ability to identify operational issues quickly, manage cash flow risks, and implement necessary corrective measures even before these problems affect your business.

1. Working Capital

It is the amount of money a company has to handle its daily operations, such as buying inventory and covering monthly loan interest. You may be experiencing a cash crisis if your working capital is negative or low. On the other hand, excessively high working capital can indicate that the company is not using its short-term resources efficiently, for example, by holding too much cash or inventory that could otherwise be invested to generate better returns.

Lenders and investors look for balanced working capital to assess your company’s capacity to continue operating and sustain operations while paying back new debt.

How is working capital calculated?

To determine business working capital, subtract current liabilities from current assets.

Current assets refer to items that a business can convert into cash within one year, for example, stock or money that customers owe. On the other hand, current liabilities represent the company’s commitments, which it has to settle within one year, e.g., taxes or money owed to suppliers.

For example, if your business has current assets worth $100,000 and current liabilities of $80,000, your working capital will be $20,000 ($100,000 – $80,000), which can be used to pay rent, salaries, and other short-term expenses.

2. Current ratio

The current ratio of an organization assesses how well it can use short-term assets (i.e., resources that can be turned into cash within the next 12 months) to pay short-term obligations (i.e., debts and bills due within the next 12 months).

You can use the current ratio to find out if your business has enough liquidity to run on a daily basis.

How is the current ratio calculated?

The current ratio on the balance sheet is calculated by dividing a company’s current assets by its current liabilities.

A current ratio in the range of 1.5 to 2 is often cited as a healthy benchmark, and a ratio of less than 1 may indicate potential difficulty meeting short-term obligations. But it’s crucial to remember that the value may vary depending on the industry you operate in.

For businesses that typically run with a heavy debt load, such as financial services or utilities, a current ratio of less than 1 may still be deemed acceptable.

For example, a company with $120,000 in current assets and $60,000 in current liabilities has a current ratio of 2.0 ($120,000 ÷ $60,000), indicating solid short‑term financial health and flexibility.

3. Debt-to-asset ratio

It is one of the most important metrics that helps to understand the proportion of a company’s operations financed through debt. This ratio is favored by lenders and banks, as it indicates the financial strength of the business and the level of risk associated with credit or loan exposure.

A high ratio indicates that your asset generation is primarily funded by debt, which may require you to pay a higher interest rate on new loans. Conversely, a low debt-to-asset ratio may increase your chances of obtaining low-interest loans by demonstrating your credibility as a debt manager.

How to calculate the debt-to-asset ratio?

The metric is calculated as the sum of all liabilities, which includes all debt obligations, divided by the total assets recorded on the balance sheet.

Think of a company that owns $300,000 in assets and owes $90,000 in debt. Its debt-to-asset ratio would be 30%, meaning that 30% of its total funding comes from debt and 70% from the owner’s equity.

4. Quick ratio

The quick ratio is a more cautious measure of your company’s capacity to fulfill its immediate obligations than the current ratio. This is due to the fact that only the “most” liquid assets are used to compute quick ratios. Inventory is therefore not included in current assets since it is believed that, despite being an asset, inventory cannot be quickly turned into cash.

How can a quick ratio be calculated?

Inventory is deducted from current assets, and the resulting figure is divided by current liabilities to calculate the quick ratio.

A quick ratio above 1 signals good liquidity, while a ratio of 1 is generally enough to handle short-term debts.

Let’s say a business has $150,000 in current assets, $15,000 in inventory, and $85,000 in current liabilities. Its quick ratio will be 1.59 ($150,000 – $15,000) / $85,000), which shows that the company is in a good position to meet its short-term commitments.

5. Cash conversion cycle

The cash conversion cycle (CCC) reflects how well a company manages its inventory and accounts receivable. It demonstrates the speed with which you convert inventory into sales and subsequently obtain cash. It is represented in days to measure cash-flow efficiency.

You will likely get paid for outstanding invoices and sell your inventory in a timely manner if your CCC value is low. On the other hand, a high figure suggests that you are struggling to collect payments and could soon run out of money.

How is the cash conversion cycle calculated?

Three elements are used to calculate CCC: days sales outstanding, days payments outstanding, and days inventory outstanding.

Imagine your business has a DIO of 50 days, a DSO of 25 days, and a DPO of 30 days; thus, your cash conversion cycle would be 45 days (50 + 25 − 30). In other words, the time period from when suppliers are paid for inventory until cash is collected from customers is approximately 45 days.

6. Return on assets

Return on Assets (ROA) is a metric that shows how a company is using its assets profitably, essentially indicating how effectively the management converts resources into revenues.

Measures of a “good” ROA differ for each industry because operational costs and business models vary.

How is it calculated?

ROA is figured by dividing net income by total assets.

For instance, a firm with total assets of $800,000 and a net income of $80,000 will have an ROA of 10% ($80,000 ÷ $800,000). Simply put, the company earns a 10% return on its assets.

7. Debt-to-equity ratio

The debt-to-equity ratio shows how much of an organization’s activities are funded by debt as opposed to equity. Investments made by shareholders are referred to as equity, while loans and credit taken on by the business are considered debt. It reveals whether your business is more reliant on loans or shareholder equity and is another crucial indicator of your capital structure.

How is the debt-to-equity ratio calculated?

Debt-to-equity ratio is calculated by dividing total liabilities from the balance sheet by total equity.

For example, a company with $160,000 in liabilities and $100,000 in equity has a debt-to-equity ratio of 1.6, showing that it relies more heavily on borrowed funds.

Balance Sheet KPIs FAQs

Here are some frequently asked questions related to balance sheet KPIs.

How often should founders review balance sheet KPIs?

Founders should check balance sheet KPIs monthly to align with standard financial reporting cycles and spot liquidity or debt issues early.

How can balance sheet KPIs guide fundraising decisions?

Leverage ratios (like D/E) and liquidity measures (like the current ratio) are key factors that investors and lenders evaluate when deciding whether to extend credit.

Can KPI trends predict financial distress before it’s visible?

Yes. Persistent declines in working capital or sustained increases in debt levels often signal emerging financial distress before a cash flow crisis becomes obvious.

Which KPIs have the strongest correlation with long-term business survival?

Working capital, the quick ratio, and the cash conversion cycle are primary predictors of solvency and liquidity health.

How should KPIs be interpreted differently across industries?

Asset-heavy industries (like manufacturing) naturally carry higher debt, while tech or service businesses may rely less on capital assets, so ratio benchmarks vary.

Real-Time Insights for Better Decisions

As a small business owner, you need a clear understanding of your company’s financial health to make confident decisions. To support this, Cheqly, a neobank, offers real-time financial insights that help you track cash flow and expenses, giving you the clarity you need to run your business effectively.

Open a Cheqly business account and get the financial visibility you deserve.