In the United States, around 50% of newly established small businesses shut down within the first five years. Hence, it is extremely vital to keep a close eye on the financial condition of the business. Business owners should be aware not only of expenditures but also of how well the resources are being utilized for growth and profitability.

In 2026, analyzing the financial performance of a company is imperative, and this is due to the fast changes in the market, the emergence of digital finance tools, and the fierce competition among different industries. Companies that are diligent in tracking their key financial metrics can make well-informed decisions, steer clear of expensive mistakes, and spot opportunities for growth.

This article will guide you through the key metrics, reports, and effective strategies that you can use to track and enhance your company’s financial performance. Consequently, you can make data-driven decisions that will help you lower your expenses and speed up your growth.

What Is Financial Performance Analysis?

It is basically a process of evaluating the financial position of a company through various tools and measures. It provides details about the company’s health in terms of stability, profit-making, cash flow, and operational efficiency. Organizations use this data to keep their position in the market, attract investors, and make well-informed decisions.

The following are important facets of financial performance analysis:

- Profitability analysis: Obtaining the profit generation efficiency of a company relative to revenues, assets, or equity.

- Liquidity analysis: Evaluating whether the company is able to cover its short-term liabilities with the assets on hand.

- Efficiency analysis: Determining how well a business is performing in terms of generating revenue by using its assets

- Leverage analysis: Analyzing leverage involves figuring out how debt is utilized to fund expansion and how that affects risk.

Periodical analysis of a company’s financial performance provides a great avenue for your business to measure its progress, identify the areas where it has problems, and uncover the areas for growth.

How to Track Your Financial Performance

A methodical strategy for recording revenue, expenses, and other financial activities is necessary for documenting financial performance. Accurate bookkeeping, which feeds into accounting systems and produces financial reports, is usually the first step in the process.

The following actions are taken to document financial performance:

- Monitoring Transactions: Maintaining records of sales, purchases, payroll, and various expenses is done using accounting software and other financial performance analysis tools.

- Categorizing Financial Entries: Classifying each transaction into the appropriate accounts, like assets, liabilities, equity, revenue, or expenses.

- Preparing Financial Statement: Statement preparation is the process of collecting data for cash flow, income, and balance sheets.

- Verifying accuracy: Verifying that inputs match bank accounts and accompanying records.

In addition to supporting regulatory compliance and providing a basis for financial analysis, accurate recording enables consistent performance monitoring. Making decisions and assessing performance become difficult in the absence of trustworthy data.

With the help of finance automation software, businesses can connect, organize, and use precise data without having to worry about errors or inconsistencies that could arise from human data entry.

Financial Data Included in Business Financial Statements

A thorough understanding of financial performance is offered by financial statements. The three primary reports consist of:

- Income Statement: Provides information about profitability over a certain time period by displaying revenue, expenses, and net income.

- Balance Sheet: Shows the assets, liabilities, and equity of a business at a specific moment in time.

- Cash Flow Statement: Shows how successfully a business manages its liquidity by tracking cash inflows and expenditures.

Every statement advances our understanding of various facets of performance. For instance, the balance sheet shows financial stability, whereas the income statement shows efficiency and profitability.

The cash flow statement guarantees that the company can continue to operate and expand. When taken as a whole, these records provide a comprehensive view of financial performance. You may access customizable dashboards with pertinent data and create automatic reports using finance automation software to help you make smarter business decisions.

Types of Financial Performance Analysis

There are various methods for performing financial performance analysis, including:

- Horizontal Analysis: Locate the trend of growth and variation through the comparison of financial results of numerous time periods.

- Vertical analysis: Analyzes cost structure and margins by expressing each item as a percentage of a base figure (such as revenue).

- Ratio analysis: Measures liquidity, leverage, and profitability using important ratios such as the current ratio, debt-to-equity ratio, and return on assets.

- Trend analysis: Looks at long-term trends and makes predictions about future performance.

Every kind of analysis offers a different perspective on the issue. To illustrate, trend analysis might help managers to focus on strategic planning, while ratio analysis is most useful for investors in evaluating the level of risk. The use of different methods brings about insights into financial performance that are clearer and more valuable.

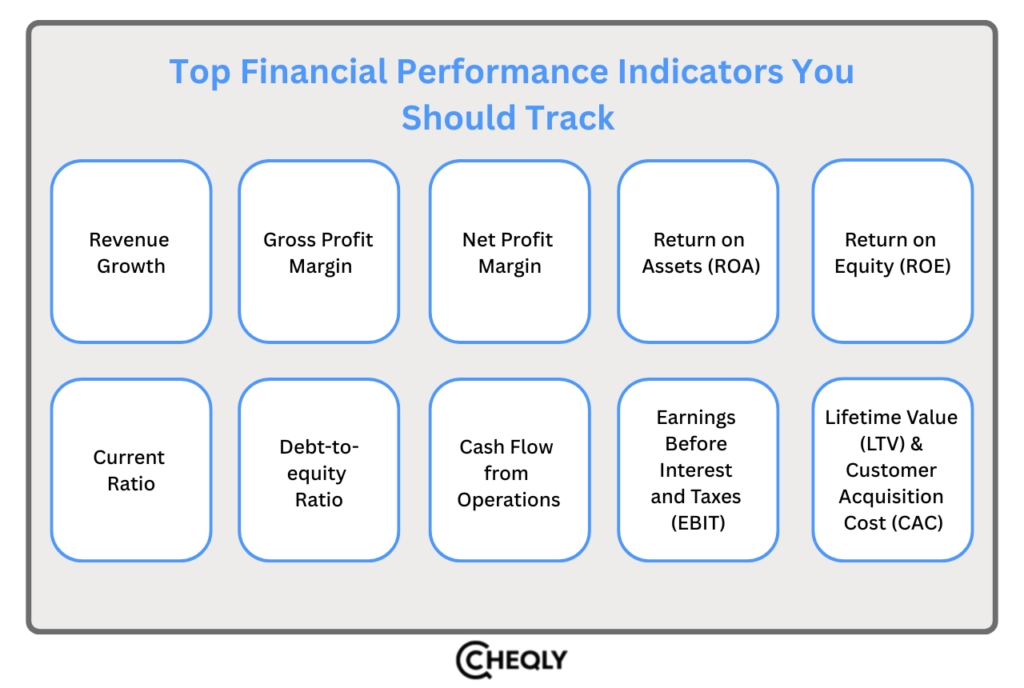

Top Financial Performance Indicators You Should Track

Monitoring the appropriate metrics is necessary for assessing financial performance. Among the most significant instances of financial performance are:

- Revenue Growth: Monitors the rise or fall in sales over time.

- Gross Profit Margin: The gross profit margin indicates how efficient a company is in producing goods or services in relation to the cost of sales.

- Net Profit Margin: After all costs are subtracted, the net profit margin shows total profitability.

- Return on Assets (ROA): Shows the effectiveness of a company in utilizing its assets to generate profit.

- Return on Equity (ROE): Indicates how well investments made by shareholders yield profits.

- Current Ratio: By contrasting current assets and current liabilities, the current ratio evaluates liquidity.

- Debt-to-equity ratio: Shows the proportion of debt and equity financing that is well balanced.

- Cash Flow from Operations: Assesses how much money the business can make from its main operations.

- Earnings Before Interest and Taxes (EBIT): Provides insights into operating profitability.

- Lifetime Value (LTV) and Customer Acquisition Cost (CAC): Link financial results to customer strategy.

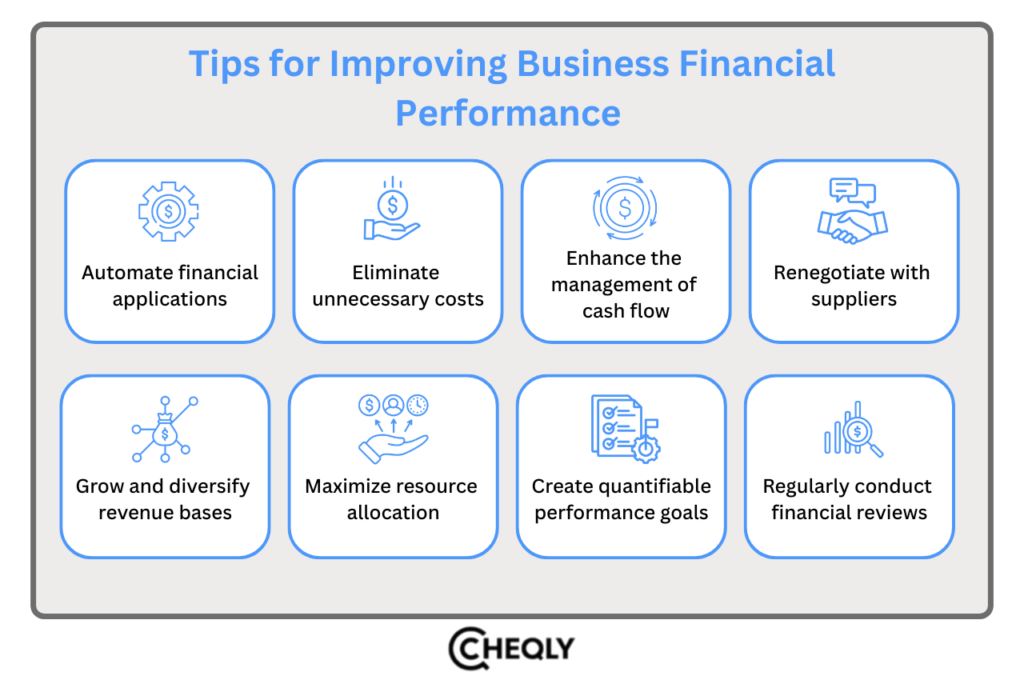

Tips for Improving Business Financial Performance

Financial performance improvement is a conscious approach that should be achieved over time. The following steps can work toward enhancing profitability, liquidity, and efficiency:

- Automate financial applications: Smart accounting and finance automation tools allow one to track, report, and forecast in real-time with precision.

- Eliminate unnecessary costs: Audit regular costs and discontinue non-performing investments or subscriptions.

- Enhance the management of cash flow: Speed up the collecting of receivables, strategically plan the extension of payables, and maintain a high operating cash flow.

- Renegotiate with suppliers: Look for better payment terms, discounts, or collaboration opportunities.

- Grow and diversify revenue bases: Identify new products, recurring models, and geographic expansion.

- Maximize resource allocation: Prioritize resources towards high-ROI initiatives like automation of marketing or technology infrastructure.

- Create quantifiable performance goals: Set clear profitability, efficiency, and liquidity ratios.

- Regularly conduct financial reviews: Review financial statements on a monthly or quarterly basis to spot and fix problems as soon as possible.

FAQs on Financial Performance Analysis

The following are some frequently asked questions related to financial performance analysis:

How often should a business perform a financial performance analysis and review its KPIs?

Ideally, businesses are supposed to undertake financial performance analysis on a monthly or quarterly basis. Periodic reviews ensure that managers are able to respond to trends in time.

Can these metrics help in strategic decision‑making (growth, investment, funding)?

Yes. Financial performance indicators are used to make decisions pertaining to growth, pricing strategy, cost structure, and investor relations, and they provide a quantified picture of financial health.

How can businesses use metrics to prevent financial distress?

Following the liquidity ratios, cash flow, and debt levels linked to a business will reveal warning signs and allow preventive actions to be taken before cash crunches can impact operations.

How do I measure profitability effectively?

Monitor gross profit margin, net profit margin, and return on equity to measure the profitability of the production, operation, and investment levels.

Take Control of Your Financial Performance with Cheqly

Financial performance analysis is an essential skill that cannot be compromised in business development in 2026. Measuring the right metrics, understanding your financial statements, and using actionable insight can keep your company afloat and profitable.

The process can be simplified with Cheqly, a fully digital neobank. Cheqly gives real-time insights, automated tracking, and an easy dashboard to monitor key financial performance indicators, including cash flow, account balances, and expense tracking. It also sends alerts and provides dashboards, helping you power up your business with smart, data-driven financial decisions.

Create a Cheqly business account today and manage the control of your financial performance with ease.