Accepting ACH payments is a clever, low-maintenance way to collect your customers’ payments. In the year 2024, businesses made a total of 7.35 billion B2B payments via the ACH Network, which represents an 11.6% increase over the previous year and shows that ACH is becoming a faster, more reliable way of funds transfer, reports NACHA.

Credit card and paper check payments are expensive and slow. ACH payments are a better option, allowing businesses to receive payments electronically.

This guide offers an easy and detailed explanation of the entire process of accepting ACH payments for your business, making it a breeze to start, no matter whether you’re running a small business.

Key Takeaways

- ACH payments refer to a type of bank-to-bank transfer done through the Automated Clearing House network, which has a lower cost compared to credit card payments.

- Receiving ACH payments has proven to be an inexpensive and safe way for companies to get their money, with a considerable rise in use observed over the past few years.

- Businesses, in order to receive ACH payments, must create a bank account, choose the payment processor, open a merchant account, and obtain client authorization.

- Adding ACH payments and options like recurring billing and Same-Day ACH to online platforms helps improve payment speed and convenience.

How do ACH payments work?

An ACH payment is a cost-effective alternative to credit card payments, as it is an electronic bank transfer that is processed in batches through the Automated Clearing House network. ACH is a widely used method for payroll direct deposits and automatic bill payments, and it is relied upon by major brands such as Walmart and Amazon to facilitate secure, low-cost payments at the point of purchase.

It is beneficial to be aware of the distinction between ACH debit and credit when accepting ACH payments:

- ACH debit: A business is able to collect payments by withdrawing funds from a customer’s account through an ACH debit.

- ACH credit: The transfer of funds to another account is frequently used for payroll or refunds.

After understanding these payment options, you will be able to identify the correct approach to meet your transaction demands. The majority of business entities favor receiving payments through ACH debits. Receipt of payment from a customer follows this standard process:

- Customer approval: The consumer initiates and authorizes a payment from their bank account by either completing an online form or providing written consent.

- Payment initiation: The business forwards the customer’s payment request to their own financial institution.

- Bank submission to the ACH network: A digital payment file is submitted by the business’s bank to the ACH network.

- Batch processing and transfer: The ACH network transfers the digital payment files to the customer’s bank.

- Funds settlement and deposit: The customer’s bank releases funds to the business’s bank account, typically within 1-2 business days.

Businesses must initially acquire the knowledge necessary to establish their ACH payment processing system in order to facilitate ACH payments.

How a business can start accepting ACH payments

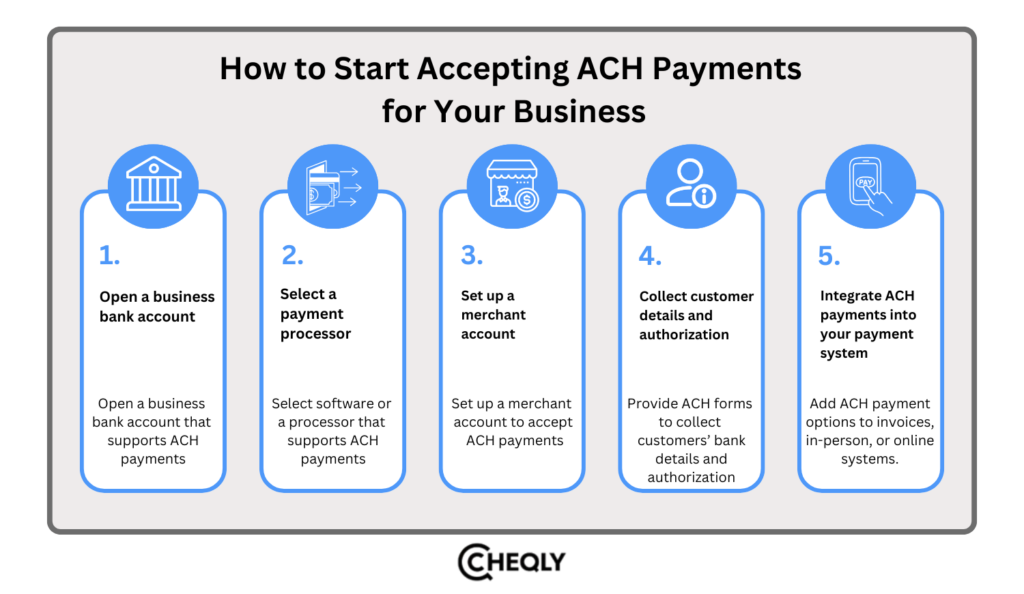

Establishing a processing system to accept ACH payments for your business is a straightforward process. The subsequent procedures are as follows:

- Open a business bank account: Establish a business bank account with a financial institution that facilitates ACH transactions. Bank customers have access to this service, but they should confirm the exact details.

- Select a payment processor: Choose an accounting software or payment processor that enables you to establish ACH payments. Many options are available that offer integration with business systems. Examine their security protocols, services, and fees to determine the most suitable option for your organization.

- Set up a merchant account: Establish a merchant account to request payments from customers and access the ACH network. Be prepared to furnish information such as your business name, address, personal identification number, business documents (e.g., license, operating agreement), federal tax identification number, and estimated transaction volume.

- Gather customer information and obtain authorization: You should provide customers with ACH authorization forms after your account is ready to collect their bank information, including their name, bank name, account sequence, and routing number. Your payment platform allows you to request ACH debits directly. Verifying all provided data simplifies operations and helps reduce ACH hold times.

- Integrate ACH payments into your payment system: Currently, incorporate ACH payment options into your payment system, whether it be through an invoice, in-person, or online. Funds will be transferred directly into your business account within 1–3 days after the consumer initiates payment.

Processing ACH payments online

A business needs to integrate with an online platform that supports ACH payments to accept them for online transactions. The ACH payment system configuration requires the completion of the following elements:

- Select a payment processor for online transactions: Choose a gateway that can be seamlessly integrated into your online platform. Search for a merchant that can process web-based payment authorizations and provides ACH as an option during the transaction process.

- Offer an online authorization option: Ensure that the ACH authorization form is accessible electronically. A number of platforms provide consumers with the option to authorize ACH during the checkout process by selecting a straightforward checkbox.

Processing recurring ACH payments

Businesses that provide subscription-based services, memberships, or any invoicing cycle that necessitates automatic payments are well-suited to utilize recurring ACH payments. Additional factors to contemplate include:

- Choose a processor that supports recurring payments: Select a payment processor that enables customers to authorize ongoing transactions with a single consent by enabling recurring ACH payments.

- Adjust the authorization for recurring payments: Customize your ACH authorization form to include information regarding the frequency of invoicing in order to cover recurring charges. The procurement method allows consumers to learn every aspect of their contractual terms at the beginning of their agreement.

Processing ACH payments instantly (Same-Day ACH)

Same-day or instant ACH serves as a payment option for companies that want to develop faster ACH collection methods. Same-Day ACH provides businesses with a benefit for urgent payments by ensuring same-day transaction clarity.

- Choose a processor that provides Same-Day ACH: You should choose a processing system with Same-Day ACH to make funds accessible during the same business day. However, be aware that these transactions typically incur higher fees.

- Set clear expectations for customers: Notify customers that Same-Day ACH is available for urgent payments and time-sensitive transactions.

Advantages of Accepting ACH Payments

There are several advantages to accepting ACH payments:

- Reduced transaction fees: One of the biggest perks is their lower cost as opposed to credit card payments. Normally, ACH transactions are charged flat fees per transaction or lower percentage-based fees. Thus, they are the best deal for businesses, especially for big or repeated transactions.

- Quicker processing for large payments: These payments usually handle large transactions faster than checks or bank transfers, making them ideal for wages and invoices.

- Lower risk of chargebacks and fraud: ACH transactions are far more secure than credit cards, as the need for bank account authorization ultimately results in a decrease in fraud and chargebacks.

- Ideal for handling recurring payments: ACH lets you set up recurring charges that are processed automatically from customer bank accounts.

In short, ACH payments are an intelligent choice for companies that are eager to send and receive money quickly, securely, and without hefty fees. They are more cost-effective, easier to handle, and, at the same time, reduce the likelihood of fraud. ACH can replace checks and credit cards, providing a quicker and safer method of payment—such a change can bring about better business management, as well as helping to make customer service smoother and faster.

FAQs on ACH Payments

Here are some common questions businesses have when starting to accept ACH payments.

Are there any fees for receiving ACH payments?

ACH payments typically have lower fees than credit cards, though your provider may charge extra depending on your plan.

Can ACH payments be refunded?

Yes, it is possible to refund payments made with ACH (Automated Clearing House), but it is a bit more complicated than carrying out chargebacks on credit cards, and the duration of the refund process might be longer as well.

Is there a limit to the amount I can send via ACH?

ACH payments usually don’t have set limits, but some banks or providers might add daily or per-transaction caps based on your account type or business size.

What happens if there is an error with an ACH payment?

In the event of an error, such as incorrectly indicated bank details or insufficient funds in the account, the transaction can be declined, and it will be necessary to contact your customer or the payment processor to find a resolution.

Accepting ACH Payments with Cheqly

Businesses can use Cheqly to receive ACH payments without paying fees on incoming transactions. This makes it a cost-effective option for managing cash flow. It also offers secure payment processing, which helps businesses handle their financial operations more smoothly and efficiently.

Accept ACH payments the easy way—open a Cheqly business account.