Accounts payable (AP) is the lifeblood of the financial success of any company, but 39% of invoices still contain errors, and some businesses take an average of 14.6 days to process a single invoice manually. These issues, ranging from invoice adjustments, late payments, manual routines, to compliance problems, often lead to errors, missed due dates, and strained relationships with suppliers. Automation, the use of particular tools, periodic process audits, and good communication with suppliers are all essential strategies for handling such issues. Cloud-based accounting technologies, along with payment systems, would significantly reduce error rates and increase effectiveness.

In this article, you will learn about the most common AP issues, their impact, and practical solutions that can help turn your AP operations into a strategic advantage—streamlining your processes and making smarter use of your cash.

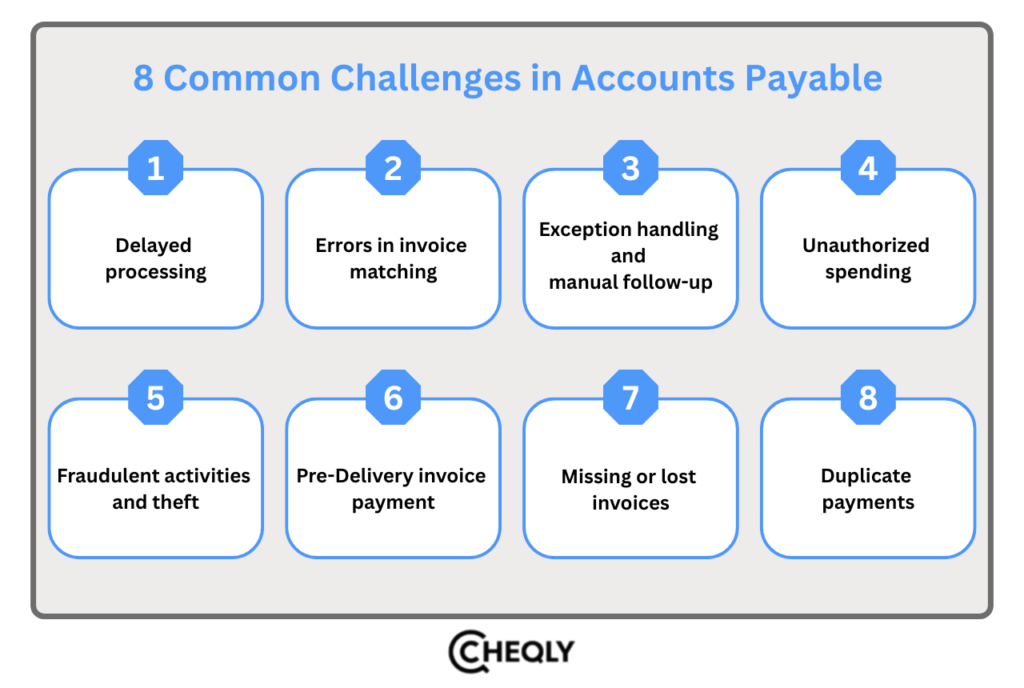

8 Common Challenges in Accounts Payable

Let’s look at the challenges associated with accounts payable:

Delayed processing

Manual, paper-based procedures cause long approval periods as documents are sent back and forth between departments, which eventually leads to slower payments, particularly if businesses are still mailing checks.

Payment delays can lead to a range of problems, from late fees and shipping delays to damage to your company’s credit rating. They can also hurt your ability to negotiate better terms with suppliers and lenders in the future.

Errors in invoice matching

Accounts payable departments typically utilize three-way matching to ensure accurate bill payment. This entails ascertaining that each invoice is attached to the purchase order and that the goods or services were received. Reconciling differences is slow, and this occurs frequently. The most common reasons are inaccuracies or absence of billing information, data entry errors, and the fact that the relevant documentation was created using different systems and formats.

Exception handling and manual follow-up

Dealing with exceptions, such as inaccurate, missing, or inconsistent information in invoices, takes a lot of time for accounts payable departments. The average accounts payable (AP) department spends about a quarter of its time addressing supplier questions related to problems and missing information. At the same time, research firm Aberdeen Group indicates that up to 20% of invoices often contain inaccurate or incomplete information.

Unauthorized spending

Manual procedures and insufficient controls may exacerbate unauthorized purchases. For instance, AP can squander time looking into invoices for purchases made by employees without purchase order approval.

Inappropriate use of business credit cards, such as buying products from unapproved vendors, is another example of an improper purchase.

Fraudulent activities and theft

The Association of Certified Fraud Examiners (ACFE) reported that the average cost of fraud in an organization is 5% of the annual turnover, with a median loss of $145,000 per organization.

Although email can also be used for theft, check fraud remains a significant issue. The so-called “business email compromise fraud” involves crooks posing as suppliers or executives and sending emails that appear to be legitimate bills or other payment requests. AP personnel should always remain vigilant against accounts payable fraud.

Paying invoices prior to the delivery of goods or services

Prompt payment for items can result in supplier discounts for your business. However, busy AP staff may unintentionally pay invoices without verifying that the goods arrived in the desired condition.

This could cause problems, especially if the cargo turns out to be of poor quality or doesn’t arrive at all. Early bill payment also lowers the company’s liquidity, which may limit cash flow.

Missing or lost invoices

The chaos of paperwork makes it easy for invoices to disappear. An unpaid invoice can lead to accounting issues in addition to causing conflict with suppliers. Because the expense is absent from the current income statement and the liability appears on the balance sheet later than expected, management is given false information regarding the condition of the company’s finances.

Duplicate payments

Numerous factors, including manual data entry, might result in duplicate payments. A single invoice may be paid twice due to discrepancies in manually entered supplier information, invoice amounts, or code. Businesses that use several banking apps rather than a single integrated system run the risk of unintentionally making duplicate payments.

In small businesses, where one person handles all payments, duplicates might be less common, but that isn’t a scalable approach. Automation and a few best practices are necessary for growth.

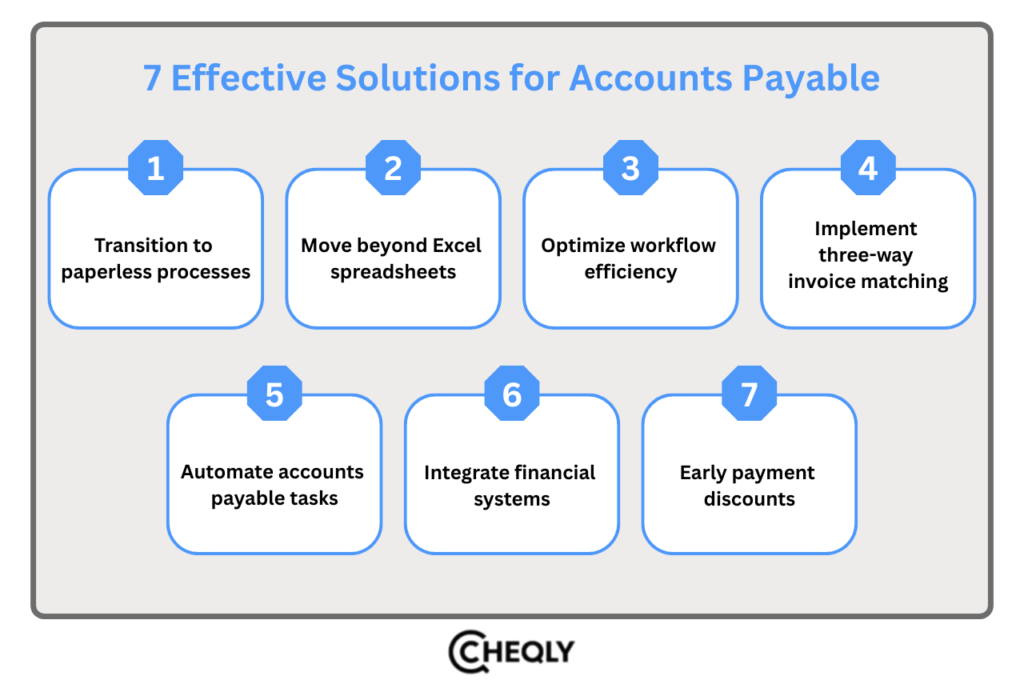

7 Effective Solutions for Accounts Payable

Better AP management means fewer delays and stronger partnerships. Here are 7 smart solutions to enhance your accounts payable function.

Transition to paperless processes

Eliminating manual data entry and mountains of paper bills can significantly reduce processing time and error rates. Accounting software can import electronic invoices, and the remaining paper invoices can be scanned and converted to a digital format using optical character recognition. Accounting software can then track invoices throughout the entire AP process.

Electronically paying invoices is also a smart move. Compared to writing checks by hand, it is less costly, simpler to automate, and less prone to errors. The shift to remote work makes it even more crucial to eliminate paper, as this facilitates collaboration among employees and streamlines the process of submitting bills for approval.

Electronic receipt of invoices does not guarantee electronic payment of those invoices. Similarly, paper checks are not required to pay paper invoices. You can pay them online.

Move beyond Excel spreadsheets

Centralized, more effective accounts payable procedures can be achieved by moving away from paper and manual data entry, but only if spreadsheets are also eliminated. Standardizing the processing of invoices from the moment they are received until they are paid improves your AP turnover ratio, a key performance indicator (KPI) that shows a business is paying its suppliers and creditors on schedule. Using a spreadsheet folder to accomplish that is challenging.

In addition to boosting productivity, expert accounting software can lower the possibility of missing invoices or duplicate payments and allow accounts payable teams to produce reports. These insights provide business stakeholders with a clearer understanding of the timing and frequency of supplier payments, which assists them in negotiating better terms.

Optimize workflow efficiency

Effective procedures and workflows that automatically forward invoices to the appropriate parties at every phase of the AP process can be codified using software. Any AP team’s established routine includes recording invoices, comparing them to purchase orders and received products, authorizing invoices, and setting up payments.

Implement three-way invoice matching

Software can manage this crucial AP workflow stage by providing sufficient assurance that businesses can feel more at ease with automated approvals, three-way matching improves accuracy, and actually decreases the effort needed to handle typical invoices.

Once recorded into the same system, the program can quickly determine if purchase orders, receipts, and invoices match. It can then automatically approve bills that match while highlighting any exceptions. Once AP staff schedules approved invoices for payment, they can focus their efforts on addressing any exceptions.

Automate accounts payable tasks

Accounts payable automation, a general phrase that includes the automation of repetitive processes, such as receiving invoices, coding, routing for approval, payment, and reconciliation, is achieved by doing away with paper and using software to optimize operations. Although approvers may still need to click to approve payments, a fully automated procedure can remove the requirement for manual data entry at any point.

Finance teams may oversee the AP process and identify issues with the aid of dashboards and analytical tools that are commonly included in AP automation software. Additionally, you can examine data for anomalies and exceptions, such as fraud, unlawful transactions, and duplicate payments.

Integrate financial systems

Integrating your AP automation system with your firm’s ERP, CRM, and other essential business systems is a recommended practice. By ensuring that all systems operate using the same data, this integration makes it easier to produce accurate reports like cost/benefit evaluations.

Take advantage of early payment discounts

You can save expenses by negotiating early payment reductions with suppliers. However, the impact of early payments on cash flow must be weighed against the value of supplier discounts by the AP and procurement departments. By paying within 10 to 15 days, businesses with sufficient funds can usually reduce the overall bill by 1% to 2%. Early payments, however, can tie up funds that your business could utilize more effectively elsewhere. You can avoid missing deadlines for negotiated discounts by using AP automation.

FAQs About Accounts Payable Challenges and Solutions

The following are some frequently asked questions on AP Challenges and Solutions.

Why is managing accounts payable important?

Managing accounts payable efficiently helps improve cash flow, build better relationships with suppliers, and avoid late payment fees.

How can I reduce manual errors in AP?

Automating invoice processing with accounting software greatly reduces the risk of manual entry errors.

How often should AP be reconciled?

Monthly reconciliation is a standard practice, but for businesses that have a high volume of transactions, weekly or bi-weekly may be more suitable.

What causes delays in invoice approvals?

Unclear responsibilities, multiple approvals, and inconsistent processes are some of the common causes of delays.

How do I improve cash flow through AP management?

Negotiate more favorable payment terms, take advantage of early payment discounts, and strategically prioritize invoices.

Manage Cash Flow Smarter with Cheqly

Cheqly, a neobank that provides services like real-time transaction tracking, low-cost transfers, and both physical and virtual debit cards, can be a good option for small businesses that need to manage their cash flow efficiently. With these tools, you are able to keep track of your expenses and have more time to focus on growing your business.

Ready to master cash flow? Open your Cheqly business account now.