The ACH Network plays a vital role in electronic payments, and its importance continues to grow. In the second quarter of 2025 alone, the ACH Network processed an impressive 8.7 billion payments totaling $23.3 trillion—a 5% increase in transaction volume and a 7.9% rise in transaction value year-over-year. These numbers highlight why effective ACH verification has become central for businesses and consumers aiming to safeguard financial transactions and prevent fraud.

This article will discuss ACH payments, how bank account verification protects against fraud, and the best practices. Let’s get started.

What are ACH payments?

Electronic transfers that move funds directly between bank accounts are known as ACH payments. The ACH network, a centralized system run by Nacha that handles transactions in the US, is used to process these payments. Payroll direct deposit, automatic mortgage and bill payments, and business-to-business transactions are just a few of the financial activities that both consumers and businesses use ACH transfers for.

What is ACH verification?

Before starting an ACH transfer, the first step is ACH verification. This helps verify that a bank account is authentic, active, and permitted for transactions.

The finance or accounting department is typically in charge of ACH verification. In smaller businesses, the procedure is usually managed by the bookkeeper or business owner. Financial operations managers or accounts payable (AP) specialists are frequently given this responsibility by larger companies.

The group in charge of ACH confirmation must have access to your company’s banking data and be knowledgeable about financial procedures. To create and validate accounts, they will deal directly with your bank or payment processor.

Although the finance team typically retains responsibility, several businesses additionally involve their IT teams when ACH verification is a component of a wider payment system integration.

How ACH Bank Account Verification Actually Works

Verification of bank accounts reduces the possibility of fraud and guarantees that ACH payments are made to the right account. This is how it typically operates.

1. Gather account details

First, ask the client or account holder for the required bank account details. Account number, routing number, account holder name, and account type are typically included. Current and savings accounts are common account types that affect eligibility for ACH transactions and how the payment is handled.

2. Confirm account ownership

The accuracy of account information and bank account ownership can be confirmed in a number of ways. Numerous criteria, such as the urgency of the verification process, security issues, cost, and client preference, determine the best verification technique.

- Micro-deposits: Micro-deposits are the most popular technique for verifying accounts. The account receives two small deposits, typically each less than $1. The account holder then verifies the exact amounts by phone or through an online portal. Micro-deposits are economical but usually take a few days to complete. Frequently, these are used to verify accounts before authorizing recurring payments such as subscriptions or installment billing.

- Instant account verification (IAV): This real-time technique asks the account holder for their online banking login information in order to use third-party services to validate the account. The legitimacy and ownership of the account are then verified by the service. Although this is the fastest method of verification, some clients may be reluctant to divulge their online banking information.

- Trial deposits: These deposits are made in somewhat larger amounts, although they work similarly to micro-deposits. Asking the client to confirm the exact deposit amounts ensures that the right account is linked before starting ACH payments, thereby verifying bank account ownership.

- Knowledge-based authentication (KBA): In knowledge-based authentication (KBA), the account holder is asked about personal details or financial history that would only be known by the real owner.

- Manual verification: In certain situations, account details can be manually confirmed by getting in touch with the bank or by contrasting them with a canceled check. Compared to IAV or micro-deposit verification, this approach is thought to be less secure.

3. Enable verified account

The bank account is considered legitimate for ACH transactions after the supplied information has been confirmed. This implies that ACH payments can now be sent and received by the account holder.

4. Track accounts for suspicious transactions

In order to identify any suspicious activity or changes in account status, many financial institutions and payment processors also keep a close eye on bank accounts.

Top Practices for ACH Bank Account Verification

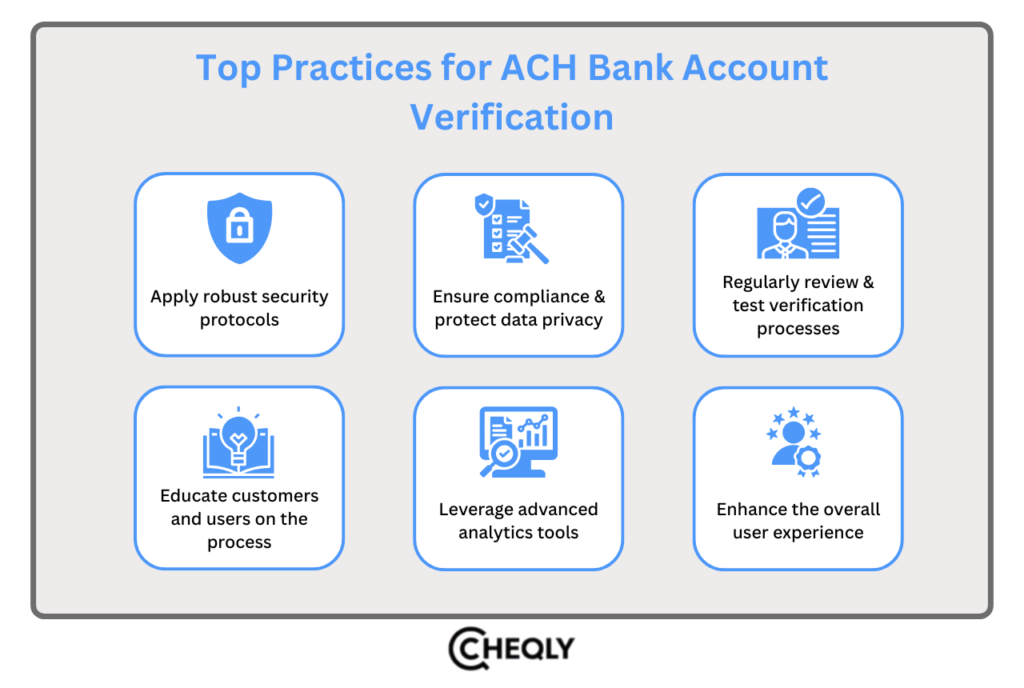

Verification of bank accounts lowers fraud, avoids mistakes, and guarantees that money is moved between accounts correctly. Institutions and companies should use these best practices to streamline the ACH verification procedure for bank accounts.

- Apply robust security protocols: Secure data using SSL/TLS, implement MFA for login to the system, and regularly update security solutions to prevent new types of attacks.

- Ensure compliance and protect data privacy: Develop and implement procedures that comply with local laws for handling, storing, and disposing of sensitive customer data, and adhere to ACH transaction regulations, such as Regulation E and the Electronic Fund Transfer Act (EFTA).

- Regularly review and test verification processes: Periodically evaluate and test the verification process to address defects, keep up with changes in technology and banking regulations, and ascertain security and functionality through inspections and risk evaluations.

- Educate customers and users on the process: Help customers complete verification securely and educate them on keeping their banking information safe and identifying fraud.

- Leverage advanced analytics tools: Implement AI and behavioral analytics to identify abnormal transactions and execute predictive analytics to calculate transaction risk by leveraging historical data and customer profiles.

- Enhance the overall user experience: Design a verification system that is easy to use, reduces the chances of errors and annoyance, and provides various alternatives to accommodate the preferences of different users.

Typical Issues in Bank Account Verification

Verification of bank accounts brings typical risks and challenges; companies are required to create systems that can prevent fraud, comply with regulations, and provide a user-friendly experience. These are a few typical issues that companies face when verifying accounts.

- Risk of fraud: Verification procedures need to guard against dishonest people using fictitious or stolen bank account information to initiate transactions or take money.

- Protection of data: Strict data protection laws, such as California’s Consumer Privacy Act (CCPA), must be followed by verification procedures.

- User experience: Security should be balanced with user-friendliness in the verification processes because an excessively complicated procedure may annoy users.

- System integration: Companies need to have the processes and systems in place that are capable of dealing with different verification methods and that are compatible with the third-party services they work with.

- Compliance with regulations: The laws governing electronic payments and the safeguarding of private financial data differ between nations and areas. Verification procedures must abide by all applicable laws.

- Handling errors: Verification processes must encompass the use of error-handling tools that are aimed at situations where account details have been provided incorrectly or the transaction has failed to avoid delays and operational problems.

- Costs: Setting up account verification procedures can be expensive due to payments for third-party verification services as well as indirect expenses for data protection and compliance.

- Ability to scale: A company’s verification procedures must be able to grow with it while still being accurate and compliant.

How Verifying Bank Accounts Protects Against Fraud

Preventing payment fraud is one of the main goals of bank account verification. Here are some ways that account verification might prevent fraud before it happens.

- Verifying identities: Verification of a bank account is the initial measure that is taken to ensure that the provided account details correspond to the user’s identity and to aid companies in lowering the risk of identity theft and fraudulent transactions.

- Monitoring transactions: It’s simpler to keep an eye on transactions from an account after they have been validated. By flagging anomalies or odd transaction patterns for additional examination, fraudulent activity can be identified and stopped early.

- Ensuring regulatory compliance: By verifying bank accounts, financial organizations can adhere to Know Your Customer (KYC) and Anti-Money Laundering (AML) laws, which help stop fraud.

- Preventing account takeovers: When fraudulent actors take over a legitimate user’s bank account and conduct unauthorized activities, this can be avoided with effective verification. Businesses can stop this kind of fraud by confirming that changes to account information or odd login attempts are legitimate.

ACH Bank Account Verification FAQs

The following are some frequently asked questions on ACH bank account verification.

How long does ACH verification take?

ACH verification duration varies by method. Micro-deposit and trial deposit methods typically take 1–3 business days, while instant account verification (IAV) can be completed in minutes.

Are there fees for ACH verification?

Yes, some methods—like instant account verification and third-party services—may involve fees, while micro-deposit verification is often free or included in banking services.

How many attempts are allowed for verification?

Most platforms allow a limited number of verification attempts, generally 2–3 tries, before requiring additional steps or assistance from customer support.

What happens if verification fails?

If verification doesn’t go through, ACH payments from that account won’t be processed. The user may need to re-enter their details or try a different verification method to continue.

Is ACH verification mandatory for businesses?

ACH verification is not federally mandated for all businesses, but most banks and payment processors require it to reduce fraud and comply with regulatory frameworks (like KYC/AML).

How often should accounts be re-verified?

Re-verification is generally recommended if account details change, access permissions are updated, or as part of periodic compliance checks, especially for recurring payments or businesses handling large volumes.

Cheqly Makes ACH Payments Convenient

As a neobank, Cheqly is an easy and excellent choice for local ACH transactions in the US because it simplifies, speeds up, and makes money flows more reliable. Businesses can effortlessly perform transactions and monitor payments without dealing with the usual complexities of traditional financial systems.

With its accessible platform, timely support, and straightforward processes, Cheqly helps businesses save time, maintain steady cash flow, and perform ACH payments efficiently.

Get a Cheqly Business account today and manage your ACH payments efficiently.