Operating a small business or merchant business has its own challenges, and keeping a healthy cash flow is probably the biggest one. You plan your expenses, invoice your clients, and rely on on-time ACH payments and other electronic funds transfers (EFTs) to keep money moving.

But what if the money you have been expecting never comes or, even worse, is credited and then suddenly reversed through an ACH dispute or return? In such cases, the money can be withdrawn from your account with very little warning, forcing you to identify the issue and respond within very short timeframes.

According to the recent AFP Payments Fraud and Control Survey, around 34% of the companies faced ACH debit fraud in 2024, which indicates how risky these transactions are. This article clarifies the mechanism of the ACH system, primary types of ACH transactions, the difference between disputes and returns, usual timelines, and helpful measures to prevent disputes and safeguard your cash flow.

Understanding ACH and Its Works

The Automated Clearing House (ACH) is an electronic payment network in the United States that links banks and other financial institutions to allow them to securely make payments and transfers. Practically, it handles tens of billions of transactions every year. Banks process ACH transactions in batches as they communicate through the ACH network, either sending money out or pulling money in.

ACH transactions are basically of two types: ACH credits that transfer money into an account (e.g., direct deposits or refunds) and ACH debits that take money out of the account (e.g., utility bills).

To automate their payment processes, reduce processing costs, ensure fewer payments are missed, and maintain well-organized billing, companies usually depend on ACH for their recurring payments and subscriptions.

What is an ACH Dispute?

Now, let’s see what happens when something goes wrong in your transaction: ACH disputes. An ACH dispute happens when a customer tells their bank, in effect, “I never authorized this transaction.” Once that happens, the bank steps in and places a hold on the payment that was supposed to reach your account, immediately interrupting your cash flow.

Even though disputes are more common with credit card payments, they can happen with ACH transactions as well, and when they do, they can cause serious disruptions and require a quick, well-documented approach to resolving the issue.

- An ACH dispute loss means giving the customer back their money plus possible fees, and if the customer keeps making disputes or chargebacks, this will eventually hurt your relations with payment providers and may result in slower deposits or increased account scrutiny.

- If you win, the funds remain yours, and the issue is settled in your favor. Disputes won through your defense not only save you money but also help in keeping good relations with payment providers.

Different Types of ACH Disputes

Before you can fix an ACH dispute, you first need to understand exactly what kind of issue you’re dealing with. Each type has its own requirements, and often its own set of documents, to get it resolved the right way.

ACH disputes fall into several categories, and each one is covered under specific NACHA rules. Knowing which bucket your dispute fits into helps you respond faster and provide the correct evidence.

- Unauthorized or unapproved transactions: It happens when the payment is made without the customer agreeing to it.

- Incorrect transaction amounts: The amount processed is wrong (a mismatched value).

- Duplicate payments or charges: The same transaction runs twice, creating an extra debit.

- Failure to receive goods or services: When a customer pays but claims they did not receive the goods or services they purchased.

- Mistakes during transaction reversals: The system reverses the transaction but applies it incorrectly.

- Canceled or revoked payment authorizations: A merchant processes a payment after the customer has already canceled or withdrawn consent.

- Inaccurate or wrong account information: The transaction fails or is misdirected because the bank account details entered were incorrect.

How the ACH Dispute Process Works

ACH disputes have multiple parties involved: your bank or payment processor (ODFI), the bank of your customer (RDFI), and NACHA, which establishes the rules and deadlines. The procedure typically goes through these stages:

- Customer submits a dispute: Everything starts when the customer reaches out to their bank and challenges a transaction.

- RDFI notifies the ODFI: Your customer’s bank (RDFI) sends a return through the ACH Network, which notifies your bank or processor (via the ODFI) of the dispute.

- Merchant shares transaction proof: You should provide the proper documents, like authorization records, delivery details, or any other supporting evidence.

- Banks investigate the issue: The dispute is reviewed and analyzed by the customer’s bank, and they also study the documents and evaluate the claim according to NACHA rules.

- Dispute is closed: If the bank sides with the customer, the funds are returned to them, and you may be charged an ACH return fee. If the bank does not uphold the dispute, the funds stay in your account, and the matter is closed.

ACH Dispute Processing Timelines

Timing is a crucial element in the case of an ACH dispute. It becomes very difficult to get your money back, and you may even be put on hold by your payment provider if you do not respond within the given time.

- For customers: Typically, customers have a maximum of 60 days from the date of the transaction to file a dispute with their bank.

- For merchants: Merchants generally have 10 business days to submit their documentation and respond.

How to Identify an ACH Dispute vs Other Issues

Not every reversed payment is an ACH dispute. Some are simple returns, and others fall under credit card rules. Understanding the differences helps you respond correctly and avoid unnecessary confusion.

Difference between ACH disputes and ACH returns

Most payment providers tell you what kind of reversal it is, but it’s still useful to understand the difference yourself. These two situations look similar on the surface, but they happen for different reasons.

- ACH disputes: The customer issues a dispute request to the bank because they think that the transaction was either unauthorized or an error in processing.

- ACH returns: The receiving bank (RDFI) is required to return the payment automatically within 2 banking days if the funds are not sufficient (R01), the account/routing details are invalid (R01/R03), or the payment is a duplicate (R10).

ACH disputes compared to credit card chargebacks

ACH disputes and credit card chargebacks are often confused by most people, whereas each has its own unique set of rules and procedures.

- ACH disputes: These are regulated by NACHA rules, are done through the banks of originator and receiver (ODFI and RDFI), and generally cost less but provide fewer consumer protections.

- Credit card chargebacks: These are regulated by card networks like Visa and Mastercard, and generally, merchants find them a bit more costly to deal with.

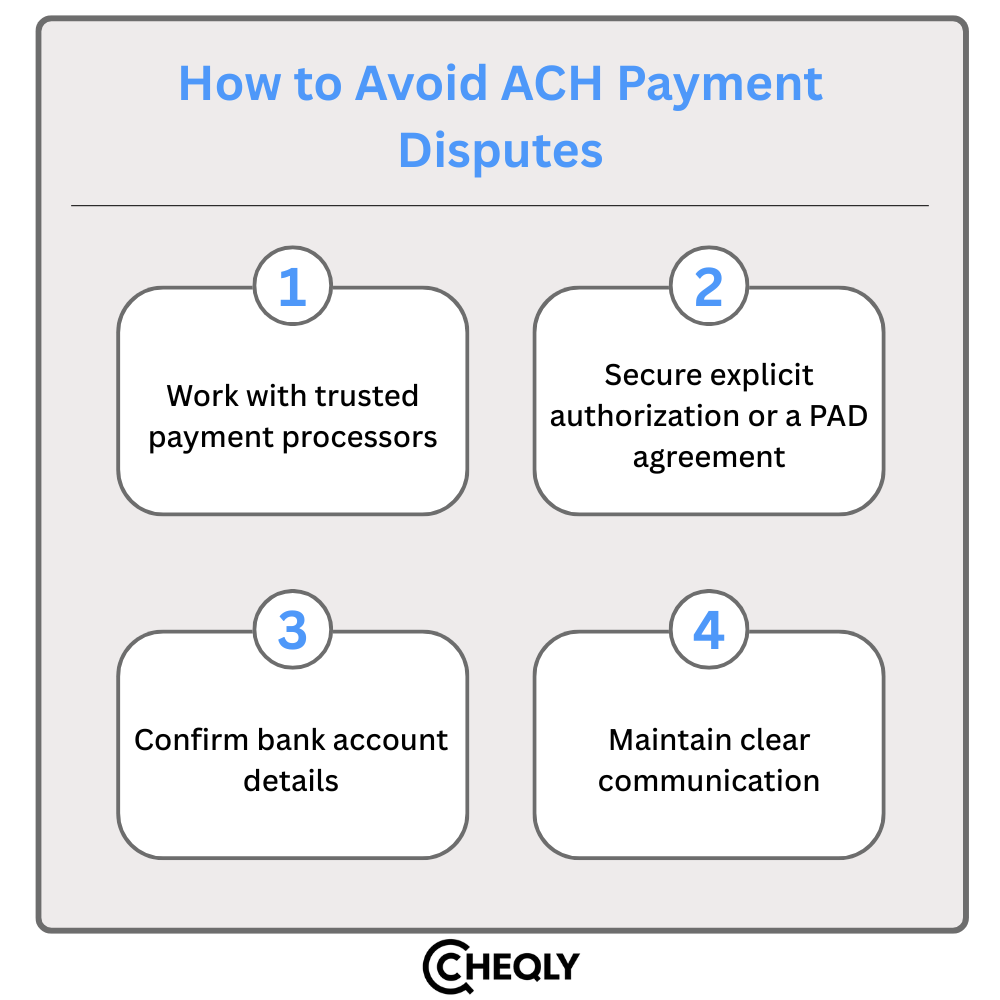

How to Avoid ACH Payment Disputes

Preventing disputes in the first place is a way of saving time, money and stress. Some simple safeguards can go a long way in lowering the probability of payment disagreement.

- Work with trusted payment processors: Opt for a payment processor that is equipped with powerful fraud detection tools, transparent pricing, and integrated dispute support.

- Secure explicit authorization or a PAD agreement: For an ACH transaction, always get a customer’s clear approval in the form of either a signed agreement or a digital consent form.

- Confirm bank account details: Make sure to double-check routing and account numbers for accurate information before processing payments. Even small mistakes can cause big issues.

- Maintain clear communication: Make sure to explain payment schedules very clearly to customers, particularly when it comes to recurring charges, in order to minimize misunderstandings and make billing easier.

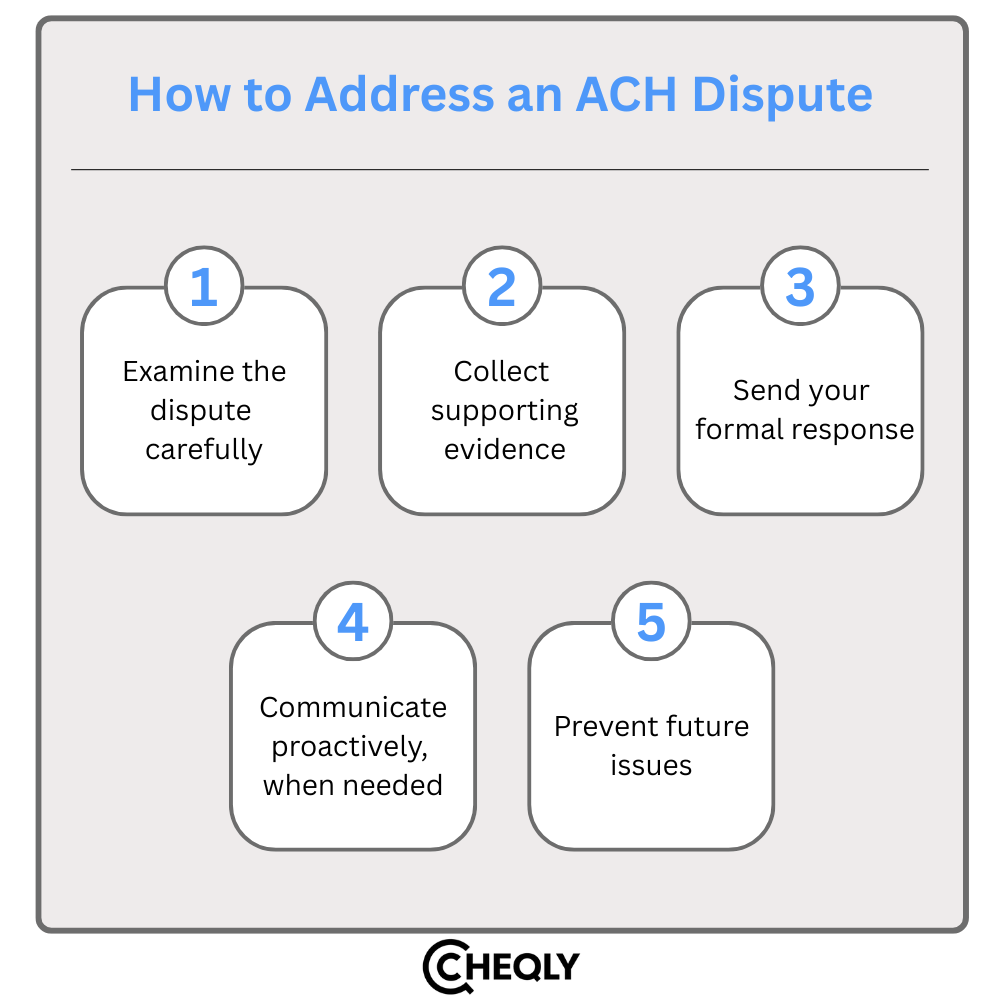

How to Address an ACH Dispute

An ACH dispute can be quite stressful, but the way you respond (and the speed at which you do it) may even determine the result. A planned method helps you keep track of everything and secure your income.

- Examine the dispute carefully: Check if the problem is just a misunderstanding, an internal mistake, or if the situation is potentially fraudulent. You should also carefully review the details of the dispute with your bank or payment processor.

- Collect supporting evidence: Collect and arrange unambiguous pieces of evidence like authorizations, invoices, proofs of delivery, agreements, and customer communications that are in line with the transaction and respond to the claim.

- Send your formal response: Submit your documentation to the ODFI within the required window, usually about 10 business days. Make your response organized and complete to avoid delays. Faster, cleaner submissions give you better resolutions.

- Communicate proactively, when needed: Reach out to the customer (depending on the situation) to clarify what happened. Sometimes a conversation resolves the confusion before things escalate further.

- Prevent future issues: Look over each dispute to find recurring problems and make better authorizations, billing communication, and transaction checks so that there will be fewer disputes in the future.

ACH Disputes FAQs

The following are some frequently asked questions about ACH disputes:

Are there any financial penalties for merchants losing an ACH dispute?

If merchants don’t stick to NACHA rules, they could end up being fined or even kicked off the ACH network. Besides, merchants might get charged return fees by their payment provider.

What is the role of NACHA in ACH disputes?

NACHA creates the payment rules for ACH, such as timelines for disputes, standards for authorization and compliance enforcement, which banks and merchants follow in resolving disputes.

How should a business monitor ACH transaction health?

Businesses should track returns, dispute patterns, and transaction anomalies regularly, using strong monitoring tools.

How can a merchant prevent ACH disputes with unhappy customers?

Having a clear authorization, transparent communication, verified account details, and a hassle-free support process can effectively lower the likelihood of disputes.

ACH Management with Cheqly

Cheqly is a helpful platform for SMEs and startups by providing an easy-to-use online business account that allows them to manage their domestic ACH payments and overall finances effectively. You can easily send, receive and track your payments, get detailed account and routing information, and make transfers directly. Besides, the platform offers customer support for payment errors or disputes, thus giving you better visibility and security.

Open up a Cheqly business account to manage ACH transactions more clearly.