An ACH routing number is a code made up of nine digits, enabling American banks to send money electronically. An ACH number is a requirement for bank transfers in the ACH network. This method of operation helps reduce the probability of errors and expedites the transaction by ensuring that the accounts are properly connected to other US banks.

In this article, we’ll show you how the ACH routing number works, how ACH payments are processed, how to find your routing number, how to use it to track payments, and why having the correct routing number matters.

What is an ACH in Banking?

ACH is an acronym for Automated Clearing House, a network that transfers money and information between banks and financial institutions in the United States electronically.

What is an ACH Routing Number?

Every US banking institution is given a nine-digit number known as an ACH routing number. It serves as a distinct numerical identification, assisting banks nationwide in determining the locations to which and from which to transfer electronic payments.

In the 1970s, the US introduced ACH routing numbers, moving away from the laborious use of paper checks and toward quicker, more convenient electronic payment methods. Thus, you will require your ACH routing number each time you send an ACH payment online.

Understanding ACH Payments and How They Work

ACH is an electronic network for processing transactions in the United States, abbreviated for Automated Clearing House. This is because, through the aggregation of transactions, the processing in batches, thereby reducing costs.

ACH payments are essentially the transfer of funds from one bank account to another over the ACH network in electronic form. Payroll of employees, subscriptions, and other regular payments, as well as funds transfers between personal checking accounts, generally involve ACH transfers. It is also evident that these payments are the most convenient and reliable means of sending or receiving money.

To begin an ACH payment, the following information about the recipient is supposed to be filled in the following fields: account number and ACH transit number. After receiving such information, your bank is legally obligated to process this information and pass it through the ACH system to the recipient’s bank. The funds are then sent to the receiving party’s bank account, usually within one to three days.

An ACH routing number is a nine-digit code that is used by banks to identify themselves for electronic transactions using the ACH electronic transactions. The ACH number is crucial to the process because it provides a level of assurance that the money goes where it needs to go.

The Evolution of ACH Routing Numbers

The ACH routing number system was established in 1970 by the National Automated Clearing House Association (NACHA) to facilitate electronic fund transfers and transactions. With the increasing prevalence of digital transactions, the system was modified to facilitate electronic fund processing.

The nine digits that make up an ACH routing number have distinct functions. The first two numerals indicate the institution’s location within the Federal Reserve Bank district. The second set of numbers identifies the district branch, also known as the processing center of the Federal Reserve Bank. The fifth to eighth numbers identify the bank within its Federal Reserve district, and the last number serves as a checksum to ensure that the previous figures were entered correctly.

The acceptance of electronic payments led to the expansion of the ACH network. By processing these payments effectively, the routing number system made it possible for institutions to send and receive money directly and accurately without physically moving paper.

What are ACH Routing Numbers Commonly Used for?

Even though ACH routing codes are only nine digits long, they are essential to the billions of ACH payments that occur every year between several banking institutions.

Uses of ACH routing numbers include the following:

- Direct deposits: ACH routing numbers, such as staff wage payments, are needed to set up direct deposits. Employers need their workers’ ACH routing numbers to make monthly ACH payments to their accounts, eliminating the need for paper checks.

- Bill payments: Customers must give their bank’s ACH routing number (with their account number) to permit a business or service provider to debit funds from their account for periodic payments such as utility bills, mortgages, loans, or other similar obligations.

- Online purchases: Many online businesses allow consumers to choose ACH transfers as a more convenient and economical payment option. To finalize the transaction, the customer presents their ACH routing and account numbers instead of their credit or debit card details.

- Utility bills: Utility companies use ACH routing numbers to receive monthly payments from consumers.

- Tax Refunds: To send and receive refunds for both federal and state taxes, ACH routing numbers can be used.

- Donations and payments: Companies and charitable organizations use them to collect donations or payments for services provided.

- International transfers: ACH routing numbers are necessary to enable cross-border ACH transactions. Nevertheless, international ACH has certain drawbacks: You must pay in local currency, which isn’t the quickest way to send money abroad. (In addition, not all banks initially provide foreign ACH transactions.) If you send money abroad frequently, you could be better off sending money by wire transfer.

ABA vs ACH Routing Numbers

Although ABA and ACH routing numbers help speed up payment processing, they do different jobs.

ABA numbers, also called routing transit numbers (RTNs), were made to make it easier to sort, bundle, and ship paper checks. They’re still used today to handle physical checks and wire transfers. You can find these numbers at the bottom left of paper checks. On the other hand, ACH routing numbers are used only for electronic transfers and payments. Some banks use the same ABA and ACH numbers for all ACH transactions, while others have separate numbers. This difference helps banks send transactions through the appropriate processing systems, whether for direct deposit, bill payment, or other purposes. Using the wrong number can mess up digital transactions or make them late.

Make sure to get the right ACH routing number from your bank’s website or customer service before making a transaction. This will help avoid any mistakes or issues during the transfer.

How to Find an ACH Routing Number?

For example, you want to sign up for a P2P app to transfer some cash to a friend or make regular monthly payments toward your homeowners’ insurance. The numerous approaches can be used to find the ACH routing number of the respective bank.

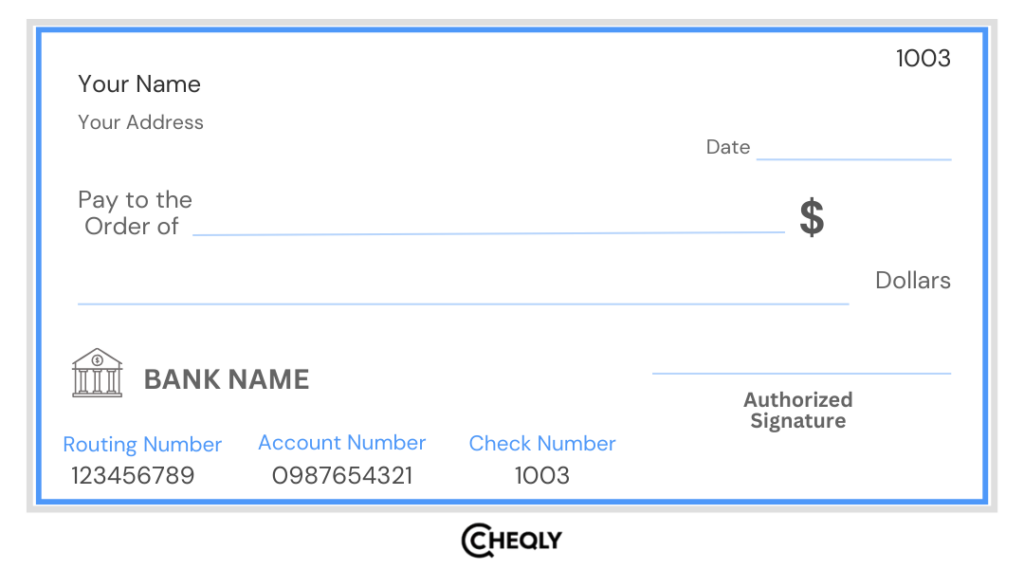

- Go through your checkbook – You will typically find the ACH routing number, a nine-digit number, to the left of the account number at the bottom of each check. The picture below shows where to find it.

- Check your bank statement – View your bank statement to find the ACH routing number. This number is usually located at the top or bottom of the document.

- Visit your bank website – Almost every bank features a section designated for routing numbers, which provides details about your branch or account type.

- Log into your bank’s online banking platform – You will normally find your ACH routing number in the account information or the settings section.

- Use your Mobile Banking App – After logging into the mobile banking app, go to the account details section, and you will find the routing number, which is probably next to your account information.

- Search for Specific Bank Information – If you know your bank’s name, you can search online for “ACH routing number” along with your particular bank’s name. A lot of websites offer this data and thus guide you to get the correct number for your state or zone.

- Contact your bank’s customer service – If you still do not see your routing number, ask the bank’s customer service for help. Request the ACH routing number, as banks often issue separate numbers for various transactions.

1. Receiving Money Domestically

2. Finding Your ACH and Wire Details

How Do You Trace an ACH Payment?

The processing of an ACH payment could take three days. If, for any reason, your ACH payment is delayed, tracking the payment will help you see where it is in the process.

The following is a method for tracing an ACH payment:

- Locate the ACH transaction trace number: To begin this tracking process, finding the ACH transaction trace number is essential. The confirmation receipt or statement issued by your bank at the time of the transaction contains the ACH transaction trace number. This number can be used to monitor the funds as they are transferred through the ACH network.

- Contact the bank: Subsequently, you should reach out to your financial institution’s customer service department. Make sure to give them all the information related to the transaction and the ACH transaction trace number. Your bank can, therefore, track the transaction and give an updated status during the clearing period.

ACH Routing Number FAQs

Keep reading to find answers to your common questions about ACH routing numbers in digital payments!

1. Does the routing number differ for ACH and wire transfers?

Yes, indeed, it has been observed that many times, the routing number for ACH transactions is different from the routing number used for wire transfers. Direct deposits and bill payments are types of electronic transactions handled via the Automated Clearing House network with the assistance of ACH routing numbers. However, wire transfers need an ABA or wire transfer routing number, which the banks use for immediate electronic fund transfers.

2. Is there an ACH routing number for every bank?

Yes, every bank and credit union in the United States has at least one ACH routing number to process electronic transactions within the ACH network. Sometimes, larger banks may have more than one ACH routing number, which may be divided by geographical locations or accounts. To have your transactions go through, there is usually a correct ACH routing number that you should use.

3. Is the ACH number also your account number?

The ACH routing number is, in fact, different from your account number, and it refers to a nine-digit code. The routing number represents the financial institution in the electronic transaction, while the account number refers to a particular user’s bank account within that institution. Both numbers are necessary for an ACH transfer to guarantee that money is transferred to the proper account at the right bank or financial institution.

Seamless ACH Payments with Cheqly!

Nine numbers that a bank uses to transmit money within a rapidly expanding network of institutions electronically are known as a routing code or ACH (automated clearing house) number. Having been in operation for many years, the ACH system facilitates safe and quick transactions, making life easier. While ABA routing codes, commonly observed on checks, and ACH numbers might be used for similar purposes, they are not always the same. ABA routing numbers primarily deal with paper checks, whereas ACH routing numbers allow electronic transfer within the ACH network. Simply verify your checks, visit your bank’s website or app, or use a search engine to get your ACH number. It is that simple.

Small businesses can streamline their finances by easily making domestic ACH payments to suppliers, employees, and others with Cheqly. Enjoy completely free ACH transfers with no hidden fees. It’s a faster, safer, and more affordable way for businesses to handle payments.

Open a Cheqly account today and experience the ease and security of domestic ACH payments.