Individuals and businesses in today’s fast-paced digital economy should understand the distinctions between ACH and EFT. While each is an actual electronic initiation of cash movement, how they operate and what they are used for distinguishes them.

ACH is a specialized form of Electronic Funds Transfer whereby funds are moved in batches with an approximate time span of one to three business days. It is mostly used for regular payments for a certain period: payroll and bills. EFT, on the other hand, is a broader term that covers a variety of electronic initiations of funds transfers, including instant wire transfers and transactions using digital wallets. Thus, all ACH transactions are considered EFTs; however, not all EFTs are considered ACH transactions. EFT is often preferred for urgent transfer that has to be processed almost immediately.

Let’s explore the differences between ACH and EFT in more detail.

What are ACH Transfers?

ACH denotes an automated clearing house; NACHA supervises the operations of ACH as a network. The first ACH association was formed in 1972 in California. In 1974, many regional networks were merged to form Nacha, which has ever since overseen the ACH network in the country.

ACH is a form of electronic fund transfer (EFT) through which people, companies, and even governments can electronically transfer money from one bank account to another. It may also be considered to be a key point for the transfer of funds.

ACH payments operate within the United States, specifically among banks and credit unions. You may be able to transmit money through international ACH transfers; however, other countries will have their own networks and regulatory bodies. Certain nations lack an equivalent network.

The Automated Clearing House is the initial recipient of funds. Subsequently, it evaluates the payments and distributes them in segments throughout the day. Because of this, ACH transfers are not immediate. The duration of ACH transfers can fluctuate: Nacha has recently implemented same-day transfers for eligible transactions, which significantly improve upon conventional ACH transfers, which typically require one to two business days.

How Do ACH Transfers Actually Work?

ACH transfer functionality is based on a data file containing detailed information about a potential payment. It is sent from the payor’s bank through the clearing house to the payee’s bank. The ACH transfer is successful when the money gets transferred from one account to another.

How Does ACH Get Used?

ACH is a versatile tool that can be employed by both consumers and businesses. For instance, direct deposit is frequently implemented by employers through the ACH network. This allows them to deposit paychecks directly into their employees’ bank accounts. An ACH credit, on the other hand, is a payment process whereby an employer, the government, etc., starts the ACH process on its own.

As part of electronic banking, where ACH debit transactions are required, businesses—such as mortgage companies, utility companies, etc.—require the account details of an individual. This implies that the companies in question are capable of directly debiting funds from the individual account as a means of electronic bill payment through the use of ACH. Businesses and individuals may employ ACH debit for one-time payments or autopay (recurring payments).

The Automated Clearing House network can be employed for electronic transfers by even peer-to-peer (P2P) payment mechanisms such as Venmo and PayPal. (Be cautious when such services offer immediate payments, as they may charge a fee and utilize your credit card instead.)

ACH expenses are typically incurred by the employer or merchant facilitating ACH payments.

What is Electronic Fund Transfer (EFT)?

EFTs or electronic fund transfers, on the other hand, cover a vastly larger spectrum of electronic payments. Once again, ACH is a form of EFT, but Electronic Funds Transfer can also include wire payments, debit/credit card payments, local payments, immediate Person-to-Person payments, ATMs, etc. Local or international payment transfers are possible.

The Consumer Financial Protection Bureau describes electronic fund transfers as “any transfer of money conducted through an electronic terminal, phone, computer, or magnetic tape.”

How Do EFT Payments Work Exactly?

EFT payments may or may not utilize the ACH network. Tapping or scanning your debit card to make a payment is an example of a transaction that does not utilize ACH. It is an immediate transfer of funds that does not involve exchanging banking information. The funds are transferred from your account to the stores without any additional verification beyond your PIN.

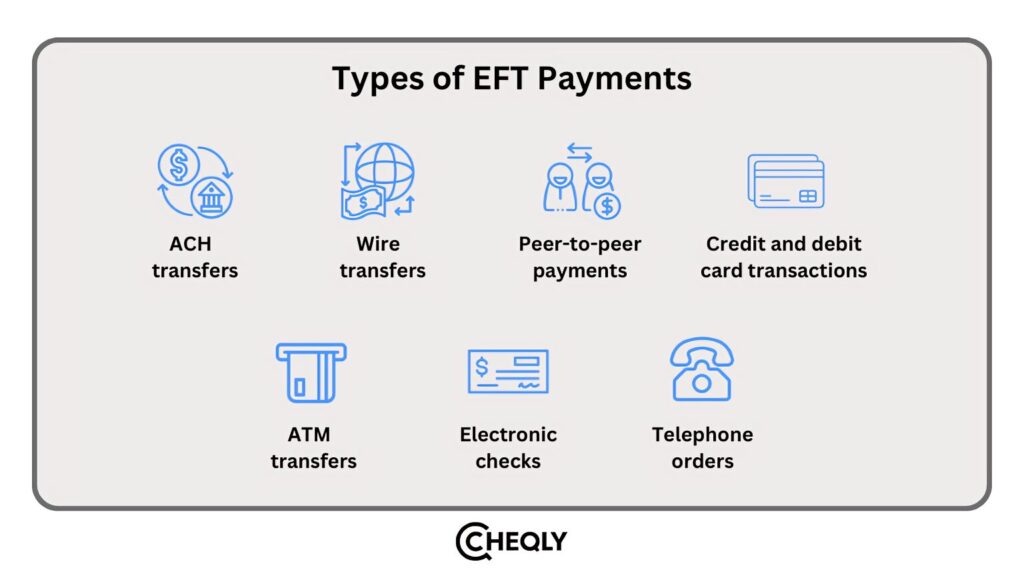

Different Types of EFT Payments

Common transfers, such as ACH and wire transfers, are included in the broad category of EFT payments. The following is a concise list of payment mechanisms that can be classified as EFT:

- ACH transfers

- Wire transfers

- Peer-to-peer payments (frequently conducted via ACH)

- Transactions involving debit cards, whether conducted in person or online

- Credit card transactions (either in person or online)

- Transfers made through ATMs

- E-checks

- Telephone orders

Are There Fees for EFT Payments?

Of course, normally, a merchant would agree to pay a fraction of the value of the given transaction in exchange for the right to use one of the EFT methods. There are instances where consumers are charged a fee for using these methods. For instance, some merchants add extra charges to credit card payments compared to cash or debit card payments, or they may charge an extra fee if you pay by phone. You must be informed of these supplemental charges in a clear manner beforehand so you can decide if you want to continue.

Key Differences Between ACH and EFT

Here, we have mentioned the key differences between ACH and EFT in tabular format:

| ACH | EFT | |

| Available | Traditional ACH is available within the United States. | Different kinds of EFTs can be utilized worldwide. |

| Security | Offers an additional layer of security compared to debit card transactions and paper checks. | Although ACH and wire transfers are less susceptible to fraud. Other types of electronic funds transfers (EFTs), such as debit and credit cards, may be susceptible. |

| Speed | Mostly, the money transfers on the same day, but it is never instantaneous; it may require several days. | It happens instantly. |

ACH vs. EFT vs. Wire transfers

In your banking experience, you will encounter various money transfer methods, such as ACH, EFT, and wire transfers.

So, we can say that a wire transfer is another common form of EFT that can be used to send money to someone’s bank account, in addition to ACH, which is a type of EFT.

Depending on the banks or transfer service agencies (such as Western Union) involved, wires can be domestic and international and frequently incur a charge for both the sender and the receiver. The process of a wire transfer involves an electronic payment by wire, for example, through SWIFT, the Clearing House Interbank Payments System, or the Federal Reserve Wire Network. Sometimes, wire transfers can take two days to complete; international ones might take even longer.

Should You Consider Using Electronic Transfers?

In summary, ACH and EFT payments have many benefits for businesses and consumers, which make the transfer of funds fast, secure, and convenient. Although ACH is a subset of EFT designed particularly for repetitive, occasional payment transactions, EFT covers a complete spectrum of electronic payments across urgent and immediate transfers, like wire transfers and debit card payments. By identifying those differences, business people can select the right payment method for their business.

Complete your Payments through Cheqly!

Ready to streamline your business payments? Open a Cheqly account today to take advantage of secure and efficient domestic ACH and wire transfers for both U.S. and international transactions. Whether making vendor payments, handling payroll, or any other business transaction, Cheqly makes it easy, for fast, reliable, and cost-effective electronic funds transfer. Don’t wait—sign up now and start making payments securely!