B2B ACH payments in the US are essential to business finance in the present era. They provide banks with a safe, efficient, and cost-effective way of electronically transferring funds between accounts. ACH processing is at the core of payroll, vendor payments, and recurring billing; hence, it is the vehicle through which billions of transactions are carried out annually, with a growing rate of adoption driven by digital transformation and regulatory improvements. This payment instrument will continue to be relevant as technology advances, with developments like Same Day ACH, real-time transaction visibility, and increased fraud prevention measures making it a leading B2B payment innovation.

This article explores the current state of B2B ACH payments in the US, highlighting key statistics, emerging trends, top-performing states, leading industries, and the future outlook of this critical payment method.

Understanding B2B ACH Payments

The ACH payments help in the transfer of funds electronically between bank accounts using the ACH network, which is administered by Nacha, a nonprofit organization that sets rules and standards. There are two primary types:

- ACH credits (push payments), where the money is transferred out of one account and into another.

- ACH debits (pull payments), in which the amount is taken out of an account through authorization.

They find extensive application in paying vendors, payroll, insurance claims, and recurring billing. Same Day ACH is an important source of growth, as the funds can clear in hours, and provides a business with more opportunities to manage the cash flow and make urgent payments.

Key ACH Network Statistics

The following highlights show major ACH Network trends for B2B ACH payments and US ACH development in Q1 2025:

- The volume of ACH payments increased 4.2 percent over the course of a year in Q1 2025, reaching 8.5 billion payments, and their total value was $22.1 trillion, a 6.6 percent improvement compared to the previous year.

- Same Day ACH surged significantly, with 326 million payments totaling $897 billion, 19.1% higher in volume and 24.8% higher in value compared to 2024.

- B2B ACH payments significantly increased by 9% in Q1 2025, reaching 1.9 billion transactions after growing by 11.6% in 2024; the volume of healthcare claim payments also rose by 8.1%.

- Person-to-person (P2P) ACH payments exceeded 100 million in the first quarter of 2025, reaching 109 million payments, which is 20.4% higher than the year before.

- Through the ACH network, 33.6 billion payments worth $86.2 trillion were processed in 2024, and the volume and value of payments increased by 6.7% and 7.6%, respectively (compared to 2023).

- Although electronic payments have grown very fast, about 40 percent of B2B payments in the US are still made using paper checks, which represents a huge potential in terms of additional ACH network adoption.

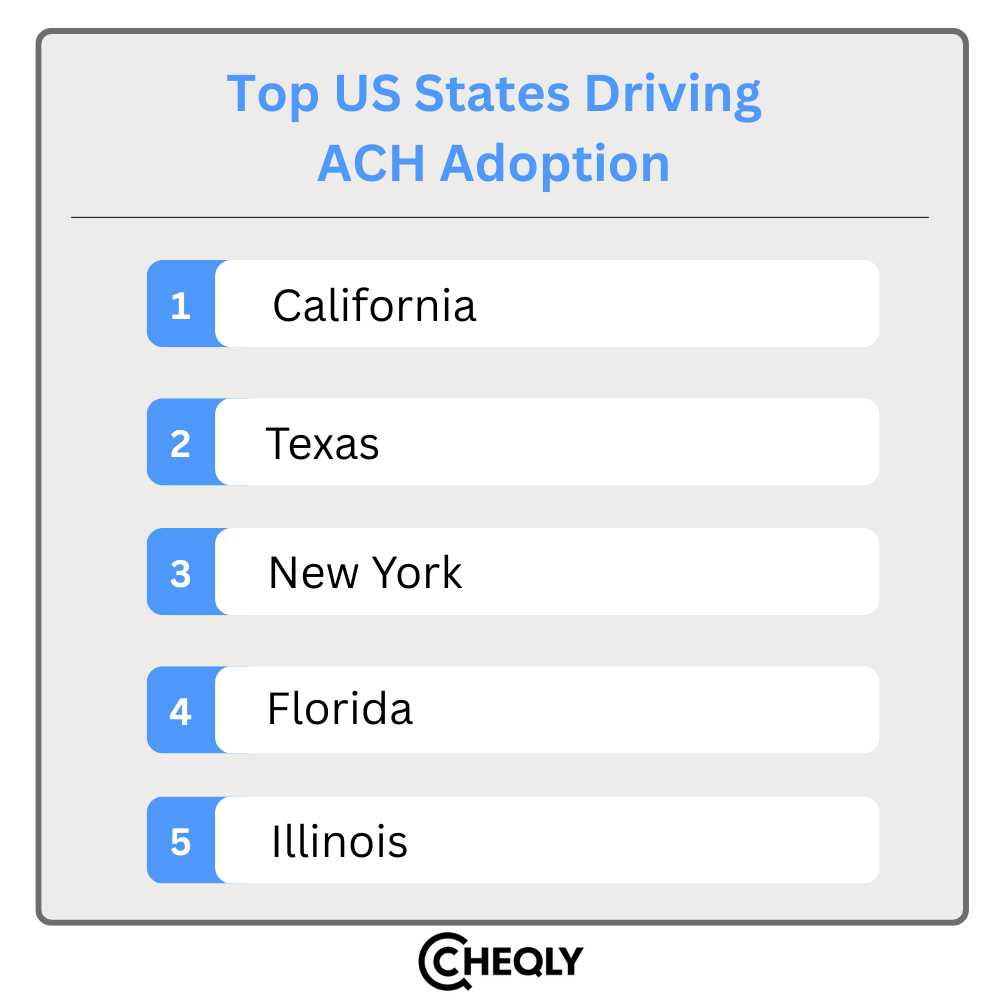

Top US States Driving ACH Adoption

The use of ACH payment in business-to-business transactions is uneven among states in the United States, with the industry being affected by business environments, the level of development of the banking system, and the orientation toward digital financial solutions.

- California is on the frontline with the tech-based economy of Silicon Valley, driving high B2B volumes of ACH transactions as more companies enter the industry and those already in it begin to adopt digital payments to enhance the efficiency of their cash flow.

- Diverse industries such as energy, technology, manufacturing, and logistics contribute to the prosperity of Texas, and all of them have companies that rely on ACH payments because they can receive money faster to pay their vendors and process payroll.

- New York, being a big financial/corporate center, is processing large volumes of ACH transactions, supported by its wide banking networks.

- The growing healthcare sector, tourism industry, and professional services in Florida are actively moving towards the use of ACH payments instead of paper checks to streamline operations and cut costs.

- Illinois, particularly Chicago, is a business and logistical center that supports the mass adoption of ACH, which facilitates cash flow and reduces the administrative burden on businesses.

If you’re starting a new business or planning to move your existing one to any of these states, IncParadise — a trusted partner of Cheqly — is the right place to get support with your business formation and compliance.

Key Business Sectors Utilizing ACH Payments

ACH payments are vital in different sectors as they enable businesses to simplify their finances and enhance their cash flow due to the fast, safe, and cheap nature of the payments.

- Manufacturing: Manufacturers make use of ACH payments to process vendor payments, supply chain payments, and payroll, which minimizes the number of people who have to do manual reconciliation and expedites cash flow processes.

- Technology: Tech and software businesses, especially those with subscription plans, depend on ACH for recurring billing and quick settlement of transaction payments that enhance the predictability of revenue and reduce administrative costs.

- Healthcare: Healthcare providers, hospitals, and suppliers use ACH to receive reimbursements and insurance payments, cutting administrative expenses, accelerating payments, and increasing operational efficiency.

- Retail: Achieving lower transaction costs and quicker settlements, retailers use ACH to make payments to suppliers and between companies and use it to settle franchises.

- Professional Services: Service companies like consulting, legal, and other firms use ACH to bill clients and process recurring contracts in order to minimize billing mistakes and accelerate the collection cycle.

Why ACH is Dominating B2B Payments

There are a variety of reasons behind the fact that ACH is still the main source of B2B payments and, therefore, the most commonly used method by businesses from different industries.

- Cost Efficiency: ACH transfers have a much lower cost compared to wire transfers or paper checks, so companies can cut down on the money spent on payments and increase their profit margin.

- Security: With the ACH network, users benefit from strong encryption and fraud detection measures, which lower the possibility of payment fraud and ensure safe fund transfers.

- Speed: Under the Same Day ACH, businesses can make payments within hours, and this is an essential factor in dealing with tight cash flow and emergency transactions.

- Automation: ACH enables the automation of billing and payroll activities and also supports reconciliation, thereby saving time that would otherwise be spent on manual work, reducing mistakes, and making operations more efficient.

Trends Impacting B2B ACH Payments

There are multiple emerging trends that are influencing the expansion and acceptance of B2B ACH payments in various sectors.

1. Rapid Adoption of Same-Day ACH

In Q1 2025, the use of same-day ACH increased to 326 million payments with a dollar value of $897 billion, which is an increase of 19.1% in volume and 24.8% in value over 2024.

“Same Day ACH continues to grow, reaching 326 million payments worth $897 billion, up 19.1% and 24.8% from the same period in 2024.”

– Nacha

An increase in per-transaction limits in 2025 from $100,000 to $1 million will allow companies to clear large amounts of transactions in hours, eliminating cash flow gaps and clearing vendors and payroll liabilities in a timely manner.

2. Digital Transformation and Automation Integration

The combination of ERP systems and accounts payable automation will promote efficiency. Millions of transactions are now reconciled and detected as fraud with high accuracy using AI-based systems, which reduces errors, lowers compliance risk, and increases the speed of processing invoices and financial scaling.

3. Federal and Regulatory Initiatives

Federal requirements to cut down on paper checks, together with Nacha’s 2025 rule amendments that require real-time transaction monitoring, are the main factors gradually pushing companies toward the use of ACH, especially those engaged in government contracts. The use of B2B payments via the ACH network is becoming safer thanks to stronger compliance measures that provide a secure environment, instill confidence in e-payments, and make ACH a trustworthy payment instrument in the business-to-business field.

4. Emergence of Open Banking and Pay-by-Bank

B2B payments are being brought into the twenty-first century through open banking APIs and pay-by-bank, which can make real-time bank-to-bank transfers.

Such innovations decrease transaction failures and onboarding friction and increase cash flow visibility, particularly benefiting SMEs and digital-first businesses.

5. Growing Emphasis on Payment Security and Fraud Prevention

In Q3 2025, the ACH Network recorded 8.8 billion payments valued at $23.2 trillion, up 5.2% in volume and 8.2% in value from a year earlier, while advanced fraud prevention has become a top priority for businesses.

“In Q3 2025, ACH activity climbed to 8.8 billion payments and $23.2 trillion in value, marking YoY growth of 5.2% in volume and 8.2% in value.”

– Nacha

Machine learning algorithms, fraud detection, and tighter KYC measures are some of the technologies that reduce the risks of fraud and strengthen the position of ACH as a reliable and secure payment system.

6. Customer and Business Demand for Real-Time Payments

Real-Time Payments (RTP) complement the ACH network by offering an instant settlement option for business needs that cannot wait. In the second quarter of 2025, the number of real-time payment transactions crossed the 107 million mark, giving enterprises the opportunity to manage cash flow in a way that is both cost-efficient through the ACH method and provides immediate availability of funds.

“In the second quarter of 2025, the number of real-time payment transactions crossed the 107 million mark”

– CoinLaw

Strategic Insights for Businesses

To remain competitive, businesses should:

- Adopt the Digital Transformation: Paper checks and manual payments should be replaced with ACH to decrease costs, reduce errors, and enhance vendor satisfaction.

- Invest in Payment Infrastructure: Move to platforms that support ACH payments, support detailed reporting, and can fully comply with NACHA standards to operate more efficiently.

- Train the Finance Team: Educate the finance staff on ACH procedures, advantages, and practices to streamline the management of payments.

- Keep Track of Regulatory Changes: Stay updated with Nacha and federal regulations to remain compliant and take advantage of new opportunities in B2B payments.

Future Outlook: What’s Next for B2B ACH Payments?

B2B ACH payments in the US are set to have a strong and vibrant future. The trend is expected to continue, with the volume of such payments increasing as more businesses opt for digital, low-cost, and secure payment methods. The use of artificial intelligence for automated processes, open banking, and sophisticated fraud detection will make B2B ACH even more efficient. In addition, the presence of government policies supporting digital transformation and the changing nature of business will make B2B ACH the most likely payment method to dominate the market.

By 2034, the US B2B payments transaction market (across all payment modes) is projected to top $1.16 trillion — underscoring how business payments are becoming more reliable and scalable across industries and regions. The ACH channel remains a core part of this evolution.

FAQs: B2B ACH Payments

Here are some frequently asked questions about B2B ACH payments.

How do ACH payments differ from wire transfers or paper checks?

ACH payments refer to electronic transfers that are done in batches and have lower fees as compared to wire transfers, which are faster but costly. In contrast to paper checks, ACH does not require any physical handling; thus, it is less time-consuming and has fewer errors.

How secure are ACH transactions for businesses?

ACH transactions use advanced encryption, multi-factor authentication, and compliance with Nacha rules, significantly reducing fraud risk compared to paper checks and other methods.

How can businesses integrate ACH payments into their financial systems?

ACH can be integrated via ERP and accounting software, automating billing, payroll, and vendor payments to improve accuracy and efficiency in financial operations.

How do ACH payments support digital transformation in B2B finance?

ACH facilitates automation of recurring payments and financial workflows, reducing manual intervention and enhancing real-time cash flow visibility.

How does ACH improve cash flow management for businesses?

ACH, especially Same Day ACH, shortens payment settlement times, helping businesses maintain timely cash flows and optimize working capital.

Power Your B2B Payments with Cheqly

The modern neobank Cheqly allows its users to make and receive domestic ACH payments in the United States without any fee whatsoever. It handles vendor payments and provides real-time tracking of cash flow, all on an easy-to-use dashboard. Cheqly makes online payments easier and helps companies cut expenses, minimize mistakes, and enhance efficiency in their work.

Register with a Cheqly business account today to simplify your B2B ACH payments.