Being a business owner requires prioritizing financial health and achieving stable cash flow, as these are core responsibilities of the role. Unrecoverable debts from your business operations directly reduce profitability and can devastate your available working capital. Bad debts must be actively prevented, as they affect both cash flow stability and operational costs—both of which are essential for sustainable business growth.

However, your business will encounter substantial monetary losses from bad debts, making it difficult to pay expenses and halting new investment opportunities.

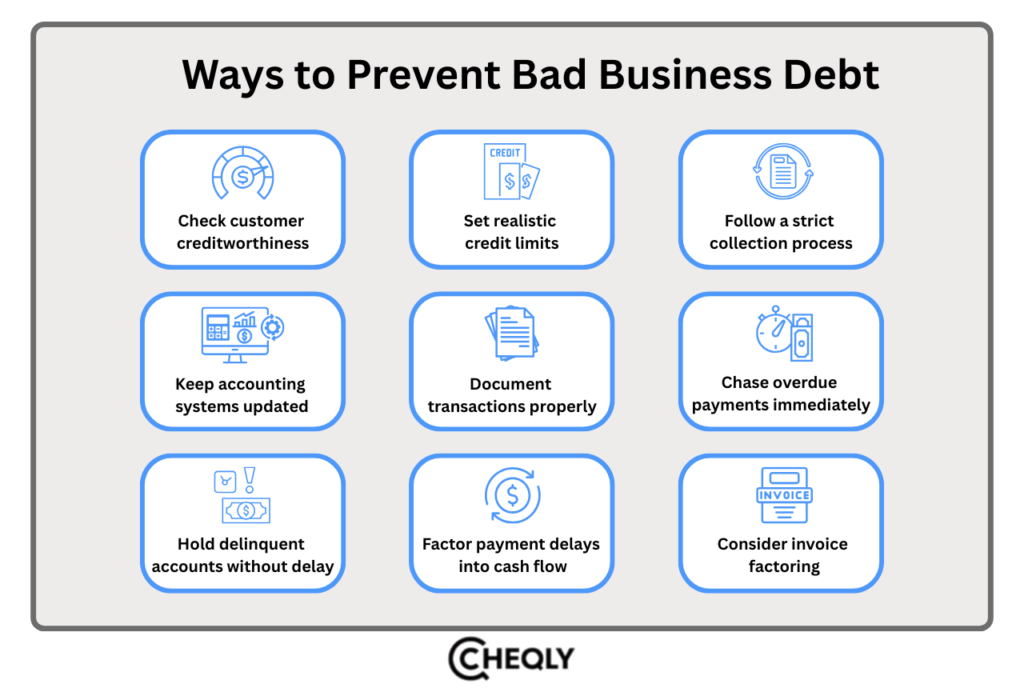

That’s why it’s important for business owners and finance teams to take early steps to protect their money. Simple things like setting realistic credit limits, checking a customer’s credit, and using helpful tools can make a big difference. In this guide, you’ll find 9 easy tips to help you avoid bad debts and keep your cash flow strong.

What is bad debt in a business?

When you send an invoice and let a customer pay later, you’re giving them credit. But if the customer doesn’t pay—either because they can’t or they ignore your payment reminders—and you still can’t collect the money after trying, that unpaid amount is called a bad debt.

How do bad debts affect a business?

Your profitability and working capital drop when bad debt becomes an expense you end up paying instead of receiving the expected income. This can make it difficult to pay your own bills, leave you with less money for daily needs, and prevent you from taking advantage of growth opportunities. Furthermore, insolvency or bankruptcy may occur depending on the total amount of bad debt a company accumulates.

Ways to Prevent Bad Business Debt

Applying the following techniques can help you lower the overall number of bad debts, even though companies might not be able to prevent them completely.

Check customer creditworthiness

Many companies are unaware that their invoicing system resembles a short-term loan, an interest-free loan. Actually, it is the same as extending credit; not everyone is deserving. Running a credit check initially helps prevent bad debt since one of the best indicators of future bill-paying behavior is how past payments have been handled.

In addition to giving you the credit score of the customer, a creditworthiness check will highlight past bankruptcies and late payment problems.

Set realistic credit limits

It goes beyond simply having a clean payment record. Your customers have to be able to pay off their debt as well. They need to have the bandwidth. Traditional lenders, for instance, usually won’t work with a company with a 50 percent or more debt-to-income ratio, indicating their debts either equal or exceed their total income. Conversely, borrowers are seen more positively if their debt-to-income ratio is 36 percent or lower.

You might use a similar approach. Think about how the money your customer will owe you fits their overall picture. Only extend credit to keep their debt-to-income ratio in a reasonable range.

Remember that throughout the course of your relationship, their credit limit and degree of creditworthiness could vary. It’s, therefore, reasonable to adjust the terms depending on the strength of your client.

Follow a strict collection process

Before any credit is issued, your collection policies should be clearly explained to clients and signed off on. A few issues needing work are:

- How is one judged in terms of creditworthiness?

- When and by what means will invoices be sent?

- When and by what means will payment reminders be delivered?

- The procedures and standards for suspending accounts

- If an invoice is not paid on time, the customer will incur a fee

Keep accounting systems updated

Without competent software, following accounting best practices and being current with accounts receivable is impossible. Most of the effort will be automated by modern accounting systems, saving you time. You can also take advantage of tools designed to simplify client bill management. Moreover, outsourcing your accounting or assigning a dedicated accountant would be beneficial.

Document transactions properly

One of the primary causes even good payers overlook their bills is customer disputes. Whether it’s the date of service or delivery, the amount, or the item—anything incorrect on the invoice can prompt a customer to call and question it, casting doubt on the entire bill.

Specifically, make sure all details are precise and that every invoice includes the following:

- Agreed upon terms

- Delivery dates

- Prices

- Quantities

Always ensure you have either a signature or any other type of receipt that proves your delivery. Keep it for the period of at least the full payment of the invoice. There are circumstances—such as legal questions or customer queries—that could require you to hold it for a longer duration. For example, if a client runs an internal audit, they might ask you for that proof.

Chase overdue payments immediately

Over time, the probability of obtaining a balance decreases. Research shows that there is only a 95 percent probability that a payment will be collected if it is not paid by its due date. Thirty days later, collection rates declined to 89 percent. By the ninety-day point, the chance of collecting is less than seventy percent. Clients who run under net 30 payment terms are particularly prone to this since bills are usually due thirty days after they are sent.

Another reason you have to collect unpaid debt as soon as a deadline is missed is that reminding someone of an approaching due date is absolutely vital.

Hold delinquent accounts without delay

Clients should not be able to add to their balances once a due date is missed since the probability of payment drops as the balance ages and the debt-to-income ratio rises. Make sure your CRM and/or order-tracking software is configured to send an alert and stop further debt accumulation upon missed payments.

Factor payment delays into cash flow

At some point or another, all companies will probably deal with slow-paying and non-paying customers. Building a buffer into your budget can help you make sure you have enough money on hand to control spending when this occurs. While it won’t stop bad debt, it will help to guarantee that, should cash flow problems arise, your company won’t suffer in the long term.

Consider invoice factoring

Although they can assist you in avoiding bad company debt, invoice factoring companies are generally sought after because they help organizations boost cash flow by issuing advances on overdue B2B bills. For instance, trucking companies relying on extended payment cycles and needing immediate cash for fuel or repairs often choose transportation factoring.

Most factoring firms will run a credit check on your customer for you, then let you know who is creditworthy and how much credit can be granted. Factoring businesses can also manage your debt collection so invoices are paid without your staff having to pursue them. A better collection system also increases the likelihood of timely payment. If a client pays a little late, your cash flow won’t be much affected, though, since funds are made available to you as soon as you send your invoice to the factoring business.

Many small companies also use factoring to properly handle their cash flow problems.

In short, managing bad debt doesn’t have to be overwhelming. A few small steps—like running credit checks and following up quickly—can make a big difference. Use these nine tips to keep your cash flow steady and your business growing strong.

FAQs on Avoiding Bad Business Debts

The following are common answers to frequently asked questions on avoiding bad business debts.

How can I identify potential bad debts early?

Checking your accounts receivable and evaluating the customer’s payment tendencies regularly can allow you to spot high-risk debts before they turn out to be more severe problems.

How can I encourage early payments from clients?

Providing them with benefits such as discounts for advance payments and other rewards can motivate customers to make quick payments, which can lead to fewer late payments.

How often should I evaluate my business’s debt levels?

Regular reviews are the most favorable to work with, ideally quarterly or bi-annually, and enable you to not lose track of your debt condition and prescribe new methods to keep the risk of bad debt to a minimum.

How can setting up automatic payments reduce the risk of late payments?

Letting consumers choose the automatic payment setup allows payments to be made on time, thus saving administrative effort and also increasing the stability of cash flow.

Should I review the payment history of long-term clients?

Yes, loyal clients might also be under financial stress. Checking their payment track record regularly ensures you are consistently monitoring the situation and taking the necessary steps to avoid the possibility of a bad debt case.

Should I take legal action against customers who default on payments?

If the informal methods to get the money back do not work, it is possible that a lawsuit will have to be filed. Nevertheless, one must be sure that legal proceedings are taken only after all other means of collection have been tried and did not work.

Make Smarter Financial Decisions with Cheqly

Cheqly provides small businesses with resources that can be used to handle their finances, such as business accounts, expense tracking, cash flow insights, and automated financial reports, which are all meant to make better decisions and, thus, your business growth.

Sign up with Cheqly and make smarter financial decisions.