Managing customer payments and maintaining a healthy cash flow are critical for every business. Even with rigorous credit policies, companies face inevitable uncollectible receivables. In fact, bad debts affect an average of 9% of all credit-based B2B sales in the US, which underlines the financial risk that comes with extending credit.

As a business owner, accountant or professional in finance, you need to know how to compute bad debt expense to safeguard your profit, enhancing operating expense planning as well as helping to make more intelligent decisions in the future.

In this article, we will explore the two most common methods: the Percentage of Sales Method and the Aging of Accounts Receivable Method.

What Are Bad Debt Expenses?

Businesses recognize that not all customers will pay their outstanding dues. Bad debt expense represents the estimated portion of accounts receivable that the business does not expect to collect. It is recorded as an operating expense on the income statement.

This process ensures that revenues and related expenses are matched in the appropriate accounting period, keeping the financial statements accurate.

The Importance of Bad Debt Expense

Accounting for bad debt is about smart business, not just figuring out who hasn’t made payments.

If you pay attention to your receivables in advance, it can result in better financial planning and maybe even tax benefits. This is what makes it so important. Here’s what makes it so essential:

- Enhance the accuracy of financial statements: Businesses may present a realistic picture of their financial accounts and the worth of their receivables by monitoring outstanding debts and late payments. It’s basically about considering those uncollectible accounts while making a balance sheet and also evaluating the cost of debt.

- Make cash flow projections more reliable: Accounting for probable losses simplifies your company’s planning for future working capital requirements and prevents overstating existing money.

- Ensure alignment with GAAP standards: As long as you use the allowance method to compute it, properly recognizing bad debt contributes to GAAP compliance.

Types Of Bad Debt

There are two types of bad debt, which correspond to various phases at which companies identify losses from nonpayment by clients. While a provision for doubtful debts represents a suspicion that some bills will be unrecoverable, actual bad debts represent those that a corporation knows it won’t be able to collect on. A closer look is as follows:

Actual Bad Debts

Actual bad debts occur when a company determines that a customer will not be making payments. After making a concerted effort to recover the money and discovering that the customer just cannot pay—possibly due to bankruptcy—this decision is made.

When this occurs, the company immediately records this sum as a loss, which impacts its income statement. Additionally, this modifies the balance sheet’s projected receivables balance to reflect what is actually expected to be collected.

For instance, if a business discovers that a client filed for bankruptcy after months of trying to collect $1,000, the $1,000 is removed from accounts receivable and recorded as a loss through a debit to bad debt expense during the accounting period.

Provision For Doubtful Debts

However, the provision for questionable debts is similar to putting money aside for accounts receivable that could eventually result in losses. The credit balance in the allowance for doubtful accounts increases as a result of an adjusting journal entry made to estimate bad debts, before actual bad debts reduce it.

Prior to being certain which particular accounts will not pay, this procedure is conducted. Experiences and the overall state of the economy serve as its foundation.

For instance, a business may set aside 2% of its total credit sales in a bad debt reserve as a safety net for these possible losses if it typically experiences a 2% loss from unpaid credit sales. The allowance for doubtful accounts appears on the balance sheet as a reduction from total accounts receivable. It gives a clearer picture of what the company expects to actually collect by factoring in likely credit losses based on estimated bad debts.

How To Calculate Bad Debt Expense

Bad debt expenses are a way for businesses to plan for the possibility that customer payments may not come. The most frequent methods to estimate bad debt expenses are the Ageing of Receivables method and the Sales Percentage method. Here’s how each is calculated:

1. Percentage Of Sales Method

This method uses historical data to estimate future bad debts by applying a relatively stable percentage to total credit sales, indicating that bad debts generally represent a consistent portion of sales.

A company projecting that 2% of its $200,000 credit sales will go unpaid would recognize $4,000 in bad debt expense.

2. Aging Of Accounts Receivable Method

This method works on the idea that the longer a bill goes unpaid, the harder it is to collect. By sorting receivables by how old they are, businesses can spot which ones are still likely to be paid and which ones might turn into bad debt.

To figure this out:

- Arrange all of the receivables according to the length of time they have been past due (e.g., 0-30 days, 31-60 days).

- Based on prior experience, assign a higher uncollectible rate to older receivables.

- Determine the approximate amount of bad debt for each age group and total them.

For example, company A has receivables totaling $60,000 that are 0–30 days old, $15,000 that are 31–60 days old, and $8,000 that are over 60 days past due. It applies estimated uncollectible rates of 2%, 6%, and 12% to each category, respectively.

The calculation would be:

- $60,000 × 2% = $1,200

- $15,000 × 6% = $900

- $8,000 × 12% = $960

The total provision for doubtful debts is $1,200 + $900 + $960 = $3,060. This results in administrative expenses and accounting records that correctly indicate the expected losses.

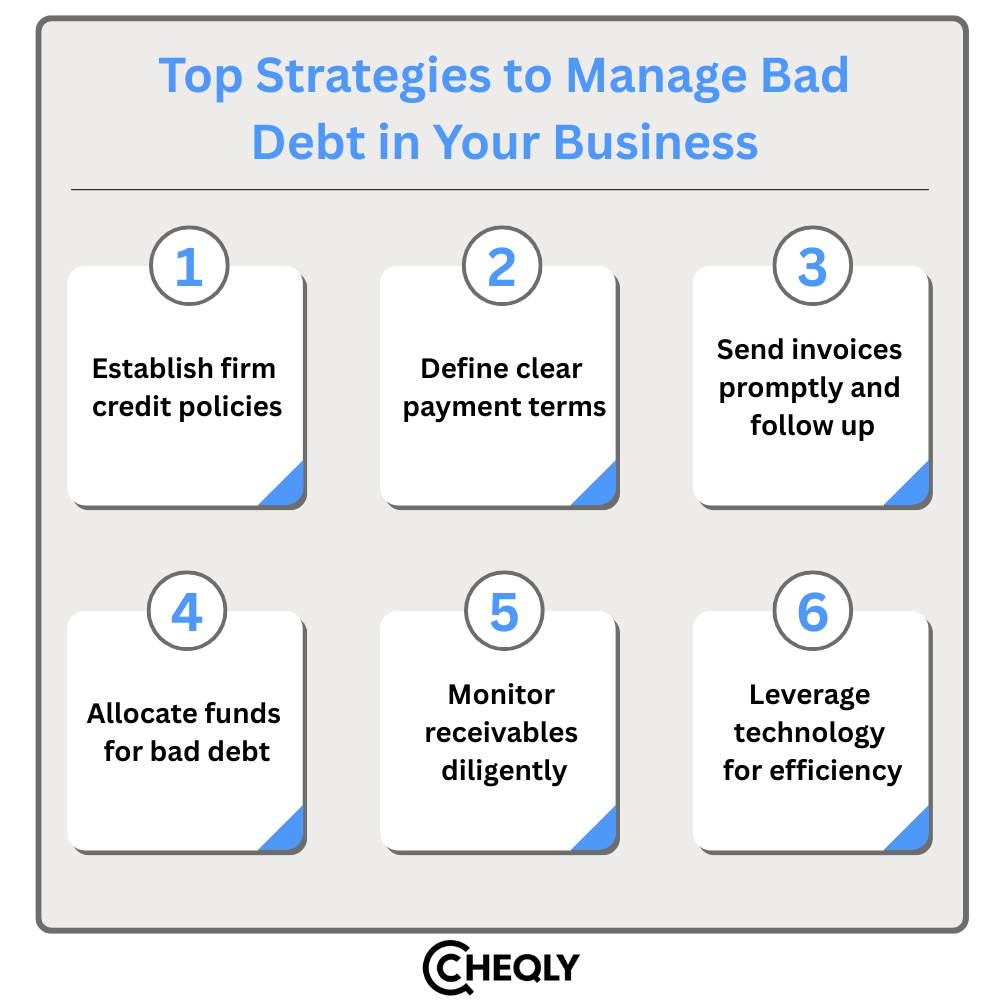

Top Strategies to Manage Bad Debt in Your Business

Bad debt can really impact your business’s financial situation negatively; however, the appropriate strategies can still manage it effectively.

- Establish Firm Credit Policies: Don’t give credit to someone without having done your due diligence. You can carry out a credit check and establish simple and transparent terms that will make it easier to resolve any payment problems later on.

- Define Clear Payment Terms: Let customers know exactly when and how you expect to be paid. Include clear deadlines and any late fees. You can also boost on-time payments by offering discounts for early payments.

- Send Invoices Promptly and Follow Up: It is most advisable that you send the invoice immediately after the sale and also follow up regularly if the customer has not paid on time. Being in touch regularly and sending reminders beforehand will make them more likely to pay the outstanding amount.

- Allocate Funds for Bad Debt: Calculate the likelihood of uncollectible accounts using past performance and the state of the economy. By being proactive, you can protect your finances from the negative effects of bad loans.

- Monitor Receivables Diligently: A good way to avoid bad debts is to keep an eye on your aging report and watch for late payments. This way, you can follow up or tweak the payment terms before things get out of hand.

- Leverage Technology for Efficiency: Make use of cutting-edge accounting software for automated reminders, efficient invoicing, and real-time insights into accounts receivable. By switching your business to automated systems, you can transform your operations—saving time, reducing errors, and gaining valuable information to make informed decisions.

In short, handling bad debt expenses well helps keep financial records accurate and cash flow steady. By catching bad debts early and using methods like the Percentage of Sales or Aging of Accounts Receivable, businesses can get a clearer idea of what they might lose. When combined with strong credit policies, timely invoicing, and the right tools, these methods help lower financial risk and keep the business running smoothly.

FAQs on Bad Debt Expense

The following are some frequently asked questions about bad debt expenses.

Can businesses avoid bad debt expense completely?

It might not have been fully avoided, but better credit policies, proper customer checks, and timely follow-ups could’ve reduced it.

How do you know if your bad debt expense is too high?

You should compare this with industry benchmarks or your historical averages. A high ratio can be a sign of credit or collection problems.

Is bad debt expense deductible for tax purposes?

Yes, bad debts can typically be written off as a tax deduction, particularly for businesses that use accrual accounting.

How can bad debt expense affect cash flow?

It doesn’t impact your cash on hand, but it does point to lower incoming cash and changes how you plan your finances.

What’s the impact of bad debt expense on financial statements?

It reduces net income and leads to lower accounts receivable values on the balance sheet.

How often should bad debt expense be reviewed?

Checking your bad debt expense every month or so (or at least every quarter) is smart. It makes your finances more accurate and shows what customers really owe you.

Manage your business finances more efficiently with Cheqly!

Cheqly makes financial management effortless by offering a neobanking platform that is tailored for businesses of the current era. This platform makes it easier for businesses to manage cash flow, track payables and receivables, and access real-time insights. Transparent pricing and responsive support remove the usual banking frustrations, so businesses can stay financially sharp.

Get started with a Cheqly business account to manage your business finances more smartly.