You may have an extensive to-do list and insufficient time to complete it if you establish a new business. However, there is one aspect you should pay attention to when opening a business bank account. Small business owners can derive numerous advantages from a business bank account depending on their bank and specific requirements. Continue reading for advice on how to establish a business bank account.

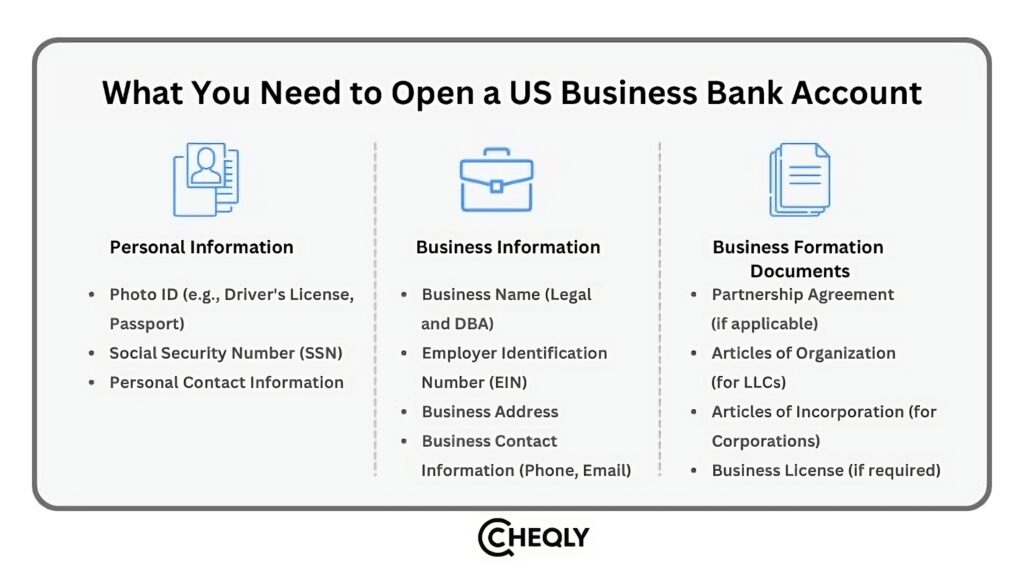

What you’ll need to Open an US Business Bank Account

You will need to collect both personal and business documentation when you open a new business account at the bank. Here is the list of required documents.

1. Personal Information

When you set up a business account, you will need to provide personal details to confirm your identity and follow legal rules. The bank requires this info for all account owners or signers.

- Photo I.D: You may be required to submit supplementary personal identification, such as a passport or an alternative photo ID.

- Social Security Number (SSN): When you establish a new business bank account, you should be prepared to provide your personal Social Security number (and potentially a copy of your Social Security card).

- Contact Information: You may be required to submit your personal contact information.

2. Business Information

Along with your personal information, you’ll also need to have some basic details about your business, whether you open a business checking account online or at a local bank. This may include:

- Business Name: The legal business name of your business, as it appears on any documents filed with the state or Internal Revenue Service (IRS), should be provided to the bank. This should encompass any trade name, fictitious identity, or doing business as (DBA).

- Employer Identification Number (EIN): To establish a bank account for your company, your bank will likely request your EIN if your business is an LLC or corporation. Most banks necessitate this information to verify your business’s legitimacy.

- Business Address: This address should be the same as the one you used for licensing or official business filings (LLC or incorporation).

- Business Contact Information: When you establish a new account with a bank, they may also request additional contact information for your business, including your company’s phone number, website, and email address.

3. Business Formation Documents

Lastly, it is imperative that you have copies of your business formation documents on hand or uploaded when applying for a new business bank account if you are a partnership, corporation, or LLC. More information is provided below.

What Are the Necessary Documents to Open a Business Bank Account?

You might need to provide copies of any of the following, depending on your business type:

- Partnership Agreement: When applying to establish a business bank account, it is necessary to submit a copy of your partnership agreement if your business is lawfully structured as a partnership.

- Articles of Organization: You need to submit your LLC’s operating agreement and articles of organization.

- Articles of Incorporation: The documentation you must submit to the bank when you seek to open a new account is your Articles of Incorporation if your business is structured as a corporation.

- Business License: A bank may also request a copy of your business license(s), depending on the industry in which your business operates.

Do You Have to Deposit Funds to Start a Small Business Bank Account?

Many people ask whether one can open a business bank account without depositing any money at first. When opening an account, most banks require the new client to deposit a certain amount of money. The compulsory quantity may differ from institution to institution, though it may cost up to $25 or sometimes up to several hundred dollars depending on the type of bank and the type of account being opened. It is extremely important to check with the bank whether these requirements are necessary to open a business account.

This first deposit can concern some specific businessmen, especially beginners in the business field. However, that money belongs to you and can cover any business expenses once you receive it, pay employees, or replenish stock.

How to Choose a Bank Account Based on Your Business Type

Depending on the structure you have chosen or the type of business you operate, the process of opening a business bank account may differ. The following is a list of some of the differences:

Sole proprietorship

This business structure can only be owned by one person who is fully responsible for its running. Thus, business debts and liabilities are your own responsibility, and you are fully exposed to them. One can use a personal account to open the business as a sole trader. Nevertheless, opening a business account for easy monitoring and tax issues is advised.

Getting an EIN and legal business name with the corresponding states is favorable for sole business owners.

Partnership

In a partnership, two or more people own the business but operate it as their own. Whether you decide to incorporate an LP or an LLP, it can be critical for you to open a business bank account that is officially recognized as such. Each partner must provide their personal information to open the account. Your goal is to set up a joint bank account and confirm that both of you have access rights.

Limited Liability Company (LLC)

An LLC is comparable to a sole proprietorship, except that the company assumes liability rather than the individual. This implies that you are generally not liable for more than the investment in your company in the event of an incident, which means that no one can pursue your assets. An LLC must establish a business bank account.

Corporation

Banks mandate dual signatures on all checks for numerous corporations. Personal information for the business owner and the controlling manager must be provided when establishing a business bank account for a corporation.

C Corporation

A C corporation (or C corp) may necessitate two bank accounts for tax purposes, similar to a S corp. Once more, it is imperative to possess the personal information of all proprietors and submit the same documentation as an S corporation despite the absence of a corporate resolution.

- Certified Corporate Charter and Articles of Incorporation (if applicable)

- If the Articles of Incorporation don’t cover it, the documents that list all those who can sign contracts

- A corporate resolution signed by all officers (depending on the bank you choose)

S Corporation

An S corporation (or S corp) is a tax status that a business, whether a corporation or LLC, elects. The documents you will require are contingent upon the structure of your business, whether it is an LLC or corporation.

Non-profit Corporation

Proof of nonprofit status is required to establish a business bank account for a nonprofit. The bank will likely need a copy of your IRS tax-exempt or 501C letter. Certain institutions may request the minutes of your most recent meeting or the election documents. Additionally, it may be necessary to submit your bylaws. It is imperative to identify a bank with nonprofit experience, particularly if they offer specialized resources for nonprofits because nonprofits are distinct from other corporations.

Opening a Business Bank Account: Online vs. In-Person

You can establish a new business bank account online, depending on whether you choose a brick-and-mortar or online bank. Some physical institutions require establishing an account in person, while others provide an online option.

The information and documents we have discussed thus far may be required in either scenario. Those documents must be uploaded if you are applying online. Provide the original documents to the bank representative in person so that they can create a photocopy.

Typically, online applications are completed in a matter of minutes. You will be provided with your new account number and the ability to access your account online. Your debit card will be dispatched to you within approximately one week.

Some banks can print a debit card on the spot for you when you register in person, allowing you to begin using it immediately. Temporary checks may be issued until the checks you ordered with your business details are received in the mail.

Advantages of a Business Bank Account

Having a business banking account has many advantages. For instance, when one’s own and a company’s money are separated, it is easier to control cash flows. A business bank account allows you to accept debit and credit card payments through merchant services. Also, one can conveniently use an account to pay bills that are due in any given account.

Lack of business credit might be a problem when applying for credit, especially for businesses that do not have a business account. You may also need assistance in situations such as obtaining a loan or keeping your business’s tax returns up to date.

Now that you are aware of the kind of information you need to open a business bank account, it’s the perfect time to choose the bank account that suits you. The best thing to do is to check out different options, compare prices and services, and decide on the one that seems to be the best for you.

Start Building Your Financial Future Today

Cheqly is a neobank that makes it easier for entrepreneurs to manage their finances. It offers fast, secure, and simple account setup, plus low-cost online transactions, real-time cash flow tracking, detailed financial reports, and other services to help your business grow.

Open your Cheqly account now and take the first step toward your financial future today.