It is important to determine the value of a business before selling, purchasing, or investing in an entity. Business valuation is a multifaceted tool that supports various aspects of ownership—from strategic planning to legal compliance—making it an essential practice for business owners aiming to optimize their operations and prospects.

They may sell to an equity investor because of the price; it’s affordable. They may retire and allow their companions to purchase them at a reasonable price. They may act quickly to acquire or buy stock because it appears to be a favorable bargain. However, many people conduct these transactions without a professional valuation, resulting in a loss of value. Professional valuation services are indispensable. Understand the factors that contribute to business valuation and the methods by which you can enhance the value of your company before engaging in any merger and acquisition activity.

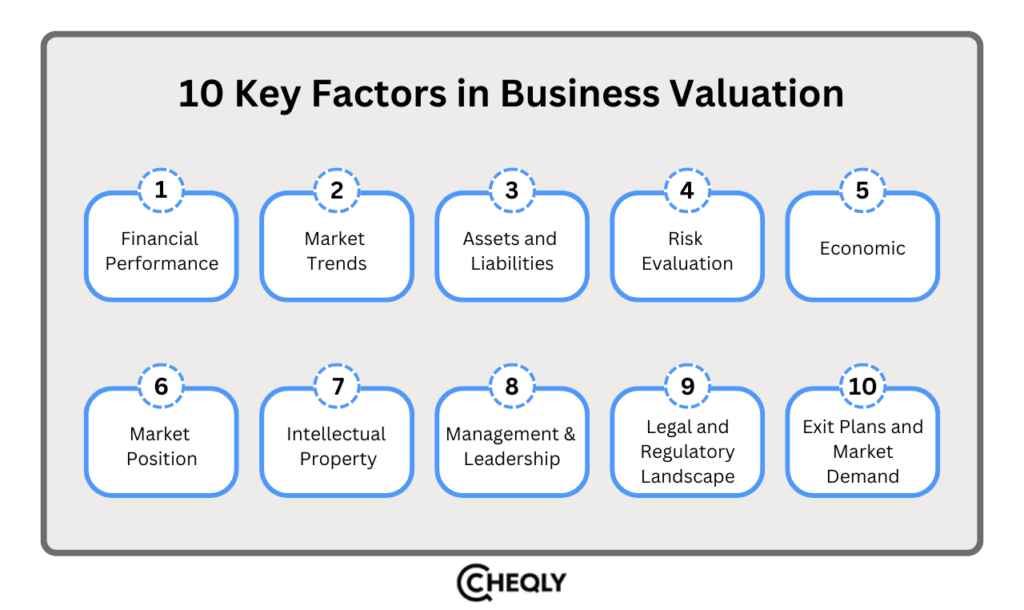

Top 10 Key Factors That Affect Your Company’s Value

Knowing the exact value of your business will help you make the right decisions when selling, buying, or investing. Focusing on these factors that affect its value helps you plan better, make smarter choices, and find more growth opportunities. Let’s take a look at the ten factors that most affect a business’s value:

1. Financial Performance

A company’s value is fundamentally determined by its financial performance. In general, business valuations begin with key metrics such as earnings before interest, taxes, depreciation, and amortization (EBITDA).

Inadequate financial statements can substantially diminish your value. If you are considering selling, it may be advantageous to delay and collaborate with an interim CFO in order to enhance your performance, depending upon the markets. Conversely, if you are purchasing, you may wish to capitalize on a company that has underperformed financially due to inadequate management.

2. Market Trends

It is also important to factor in the market environment outside the organization. Markets affect the multipliers, and if you fail to understand the markets, you may grossly underestimate or overestimate a company. That is why it is important to collaborate with valuation experts/analysts who possess a comprehensive understanding of market conditions and have experience in your industry.

3. Assets & Liabilities

The assets and liabilities listed on your balance sheet may be an even greater concern than the bottom line on your profit and loss statement. These figures must, therefore, be accurate because prospective buyers or investors will scrutinize them during their research. This may entail a change in the carrying value of assets that have undergone a change in the value.

4. Risk Evaluation

Business valuators assess the intrinsic prospects of internal and external threats that could erode the value of the business over time. These include factors such as management turnover, market volatility, and changes in consumer preferences. Constantly, investors face acquisition risks that are not justified by ignoring such risks.

5. Economic

Micro- and macroeconomic factors are also considered in an accurate business valuation. When evaluating a specific business, analysts must take into account its position within the evolving global economy, considering indicators such as interest rates, inflation, and economic growth projections. This guarantees that the valuation considers the business’s historical performance, in addition to the potential impact of economic shifts on cash flows and performance.

6. Market Position

It’s, therefore, safe to presume that the higher the percentage of the market share you possess, the higher the value you may have. However, it is not sufficient to analyze the total market share. For example, a business that has a dominant share of the market in an area that the acquirer hopes to enter increases the value for the buyer. This means that the value may fluctuate depending on whether or not you’re dealing with a strategic buyer.

7. Intellectual Property

Business proprietors of these corporations have not given any value to their ideas, but their buyers do. Even if it is not currently included in the balance sheet, you cannot overlook an organization’s intellectual capital, as it is a valuable asset in any company valuation.

8. Management & Leadership

Although your team is not included on your balance sheet, they are the foundation of your organization. What would be the impact on the value of your company and its operational capacity if you were to lose all your personnel and managers? When evaluating the value of a company, analysts consider human capital.

9. Legal & Regulatory Landscape

A proper business valuation method must consider the legal and regulatory aspects that might influence the business. During the valuation, you should take the applicable laws and regulations currently in force into account. Nevertheless, the most important factor is what the business stands to lose and how changes to these elements will affect its value.

Although proposed legislation that indirectly lowers a business’s regulatory costs might raise a company’s value, potential legislation that introduces competition could decrease its value simply because of its existence.

10. Exit Plans and Market Demand

Demand is strongly connected to value, and the owner’s exit strategy must be taken into account when evaluating business valuation factors. For instance, in a buy-out agreement, the owner receives a check and departs the organization. However, in numerous other types of arrangements, the owner remains in their current position and is required to achieve additional objectives in order to increase the overall value of the transaction.

Understanding the value of a business is crucial to the process of purchasing, selling, or investing in a company. Outsourcing the help of a professional business valuation company will provide you with an accurate and comprehensive valuation of your firm. By effectively considering these aspects, you can increase the value of your business and align your growth plans with market conditions.

Get a Professional Company Valuation Today!

Accuracy and compliance are essential for business success when valuing a company. To support you in this, Eqvista, our trusted partner, offers high-quality company valuations, including 409A valuation as one of their key services. Their NACVA-certified team guarantees your business is protected by delivering accurate, reliable valuation reports. Eqvista uses proven methods to make sure your valuation is both precise and compliant, whether you’re a small startup or a large enterprise.

Get your 409a valuations with Eqvista today and unlock the true potential of your business!