Business leaders and accountants keep an eye on cash flow performance to help make smart investment choices and hit the company’s short-term financial targets.

Understanding cash flow is key to figuring out how financially strong a company is. There are two ways to prepare cash flow statements: the direct method and the indirect method.

While most businesses don’t pick the direct method as their first choice, it can still offer useful insights that are really helpful for some companies.

This article provides a complete guide on the cash flow direct method, including explanations of advantages and shortcomings, as well as a simple framework for generating statements with practical examples for better comprehension.

What is the Cash Flow Direct Method?

The direct cash flow method is used to show the exact cash coming in and going out from daily business activities when making cash flow statements. It gives a clear and easy-to-understand view of cash movements during a certain time period. It offers a deeper look into the exact cash inflows, which mainly come from payments by clients, as well as the exact cash outflows, which include payments to suppliers and staff.

When should businesses use the cash flow statement direct method?

Let’s explain why a corporation would choose to apply the direct technique over the indirect method, as there are two alternative approaches for computing the operating cash flow for a business.

Not accrual, but rather cash accounting principles, define the direct cash flow approach. Companies looking for cash-based accounting reports for use in decision-making will thus most benefit from this approach.

Most businesses use accrual accounting methods, so the direct approach is not as often used.

Nonetheless, the direct approach to creating the operating cash flow section could provide greater details and understanding of a corporation’s activities. However, producing it can be a bit more time-consuming and labor-intensive. Small businesses with fewer transactions often find it difficult to sort through.

In any case, depending on their particular situation and requirements, management teams have a choice of approach to apply.

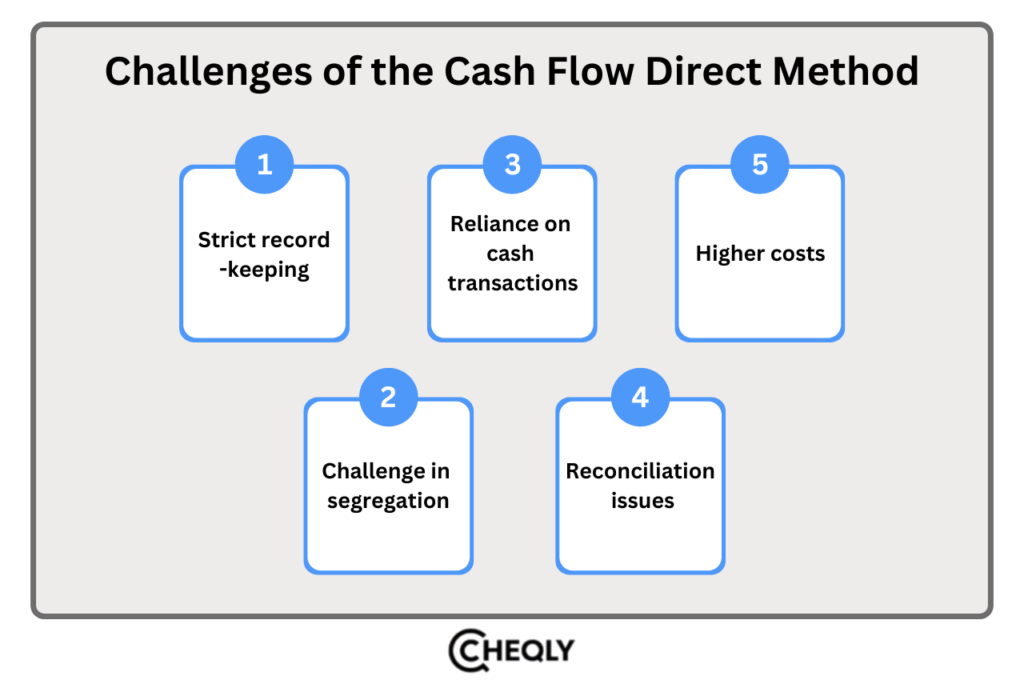

Challenges of the Cash Flow Direct Method

When operating activities cash flow is analyzed using a direct method it provides transparent visibility into its precise movement details. The method also presents some difficulties in implementation.

- Strict record-keeping: Getting experienced accounting specialists who have high proficiency in capturing all cash data related to operating activities in a detailed manner is a must for the direct method. It is a difficult process and requires a lot of time and resources, particularly if the company is heavily involved in numerous operations.

- Challenge in segregation: When transactions involve a combination of different activities, it is tough to separate cash flows into operating, investing, and financing activities. Not handled with care might cause wrong classifications to happen.

- Reliance on cash transactions: The direct approach depends primarily on cash transactions, which can produce distorted pictures of actual economic elements within a business deal. Important non-cash items such as depreciation, amortization, and working capital adjustments can often be overlooked by accountants. Non-cash transactions create difficulties when preparing cash flow statements, as suitable adjustments must be made.

- Reconciliation issues: Under the direct cash flow approach, accounting information may not accurately align with the company’s income statement or balance sheet. Determining differences between the cash flow statement and other financial records proves challenging through direct methods. This directly causes errors in financial analysis.

- Higher costs: Organizations must dedicate resources to educating staff, upgrading accounting software, and building detailed records when adopting the direct approach accounting method. Small enterprises facing financial restrictions, along with organizations with limited capacity, may struggle to succeed in implementing the direct approach.

Examples of the Cash Flow Direct Method

Here are some examples of the cash flow direct method:

- Supplier cash payments: Payments made to providers for inventory and raw materials are recorded as cash outflow in operations.

- Customer cash receipts: The cash flow from business operations includes payments from clients directly.

- Interest and dividend cash receipts: The cash received from interest and dividend income is reported directly as cash coming into the business from its regular operations.

- Employee wage payments: Cash payments for employee wages and salaries are directly shown as cash outflows from operations.

- Operating expense payments: Cash that is paid for operating expenses such as rent, utilities, and advertising are directly reflected as cash outflows from operating activities.

How to Develop a Direct Method Cash Flow Statement?

The following is a basic cash flow statement layout for the direct method:

You must manually review all of your transactions for the period to ascertain whether they were cash inflows or outflows in order to calculate your net cash flow for operating activities when creating a direct method cash flow statement.

Let’s examine this in greater detail to see how it actually appears.

Determine cash inflows from operating activities

You must first list all of the cash inflows that came from your operations within that time frame.

As opposed to accruing revenues, this will usually consist of the actual money you get from clients for the sale of goods or services. This also covers any sum that clients settle on their accounts receivable.

To get your overall cash inflows from operating activities, add up all of these transactions.

Track cash outflows from operating activities

You will proceed to the cash outflows after you have totaled all of your cash inflows for the time period.

Keep track of any business-related transactions that reduce the cash balance. Any payments you made to suppliers during that time, the amounts of accounts payable you settled, and any additional operating costs that caused a cash outflow will all be included in this.

Include any monetary payments for taxes or interest in this computation as well.

Once again, do not include any costs that were only incurred within that time. Only real monetary transactions should be your main concern.

Compute net cash flow from operating activities

Your net cash flow from operating operations can be calculated by deducting your total cash outflows for the period from your total cash inflows.

To get the overall net cash flow, add the net cash flow from both financing and investing activities to the operating cash flow.

Benefits of the Direct Method for Cash Flow

Below are some more advantages of them:

- Improved transparency: A company operates with operational clarity when its management presents direct monetary data about how operating activities generate earnings while using funds. Stakeholders find it easy to comprehend through the methodology that examines cash flow patterns between both incoming and outgoing cash.

- In-depth insights: Operational cash analysis under the direct method produces more thorough results than the indirect method can generate. Financial evaluation, along with management decisions, benefits significantly from precise information about cash flow.

- Enhanced comparability: Organizations can easily conduct sector-wide cash flow analyses through the direct approach because it standardizes the reporting of operations cash flows. The direct approach enables organizations to perform benchmarking research while improving monitoring across different entities.

- Clear cash flow visibility: When companies report actual cash transactions directly under operating activities, it’s easier to see how money is coming in and going out. The direct method helps businesses get a clear view of how well they’re making and using cash.

Organizations must maintain exact records through the cash flow direct method while achieving exceptional visibility into their operating cash flow activities. The method creates transparent financial conditions to inform stakeholders about the company’s health, allowing for both superior decisions and evaluation benchmarks. The benefits of having clear and easy-to-compare information usually outweigh the early challenges, especially for businesses with complex systems or limited resources. Accountants need to know this method to make accurate financial reports that help the business.

FAQs on the Cash Flow Direct Method

Check out these common questions and answers about the Cash Flow Direct Method:

How is the Direct Method different from the Indirect Method?

The direct method presents real cash transactions, whereas the indirect method begins with the net income and then modifies it for non-cash items.

Do I need special software for the Direct Method?

Not always, though if you are using accounting software, it can definitely simplify your cash flow tracking and reporting.

How often should I review cash flow using the Direct Method?

Schedule one, preferably once a month, to monitor your financial well-being and make timely decisions.

Do all businesses have to use the Direct Method?

No, companies have the option to use the direct method or the indirect method. However, the direct method is mostly opted for since it is clearer.

Achieve cash flow control with Cheqly!

Gaining a deeper understanding of cash flow management makes it easier for you to handle and provides real insights into your business. Cheqly can track the money coming in and going out, help you predict your future cash flow, and guide you toward the best decisions for your business.

Open your Cheqly account today and manage your cash flow better.