Cash flow is the movement of funds into and out of your business. Effective cash flow management is critical for meeting day-to-day financial obligations, ensuring employee compensation, and preventing financial pitfalls.

In this guide, you will learn everything you need to know about cash flow projections, why they matter, and how to create and use them to steer your business toward success.

What Is Cash Flow Projection?

A cash flow projection is a financial forecast that estimates the future cash inflows and cash outflows of capital for a specific period, typically using a cash flow projection template. It assists businesses in predicting liquidity requirements, planning investments, and maintaining financial stability.

Consider cash flow projection as a tool that assists you in predicting the way your business will flow in terms of cash in the future. It entails the rough estimate of cash inflows (receivables) from sales, investments, and financing; the budgeted amount to be used to settle debts; acquisition of assets; and costs incurred. It creates an adequate insight into the future state of affairs concerning the cash situation, thus enabling you to devise reasonable plans that can cover cash shortages, identify extra cash, and help you strive towards rational financial planning.

For instance, if your cash flow projection indicates that you will have higher-than-average expenses and lower-than-average revenues, it may not be the most advantageous time to acquire that new piece of equipment.

Conversely, if your cash flow projection indicates a surplus, it may be an appropriate moment to invest in the business.

Importance of Cash Flow Projections for Your Business

To generate an accurate cash flow projection, it is necessary to utilize a diverse array of financial and non-financial data.

For example, the estimation of future sales will entail an evaluation of past revenue figures and an assessment of the number of opportunities presently in the pipeline and their current stage in the sales cycle. Additionally, you must consider the average time required to close various sales opportunities.

To predict future sales or expense projections, it is necessary to analyze historical data to identify patterns and trends from previous months, quarters, or years. You will also need to consider external dynamics, such as the fluctuating price of products and materials, changing economic or market conditions, and seasonal fluctuations.

Taking into account all of these factors necessitates the acquisition of data that may be stored in spreadsheets, accountancy software, or CRM systems or with various business stakeholders. It is crucial to access this data conveniently for a precise cash flow projection.

Cash Flow Projection and Cash Flow Forecast: What’s the Difference?

The key to a successful business is managing your cash flow. Business owners can more effectively manage their finances and plan for the future by comprehending the distinctions between cash flow forecasts and projections.

| Aspect | Cash Flow Projection | Cash Flow Forecasting |

| Definition | It is the estimation of cash inflows and outflows based on historical trends and assumptions. | It uses past data, the company’s current financial position, market trends, and expected business modifications to project future cash movements over a specified time frame. |

| Purpose | Supports long-term financial planning, budgeting, and investment decisions. | Assists in day-to-day cash management strategies and immediate financial decision-making. |

| Time Horizon | It usually spans several months to a few years. | Typically covers daily, weekly, or monthly timeframes. |

| Update Frequency | The process is reviewed periodically, often quarterly or annually. | Updated regularly to reflect real-time changes in business conditions. |

| Accuracy & Flexibility | This method offers a broader, static view of future cash positions; it is less reactive to short-term changes. | Provides a real-time, flexible view of cash flow that adapts to current performance. |

| Tools & Inputs | Based on historical data, financial modeling, and trend analysis. | Uses live financial data, forecasting financial software, and predictive analytics. |

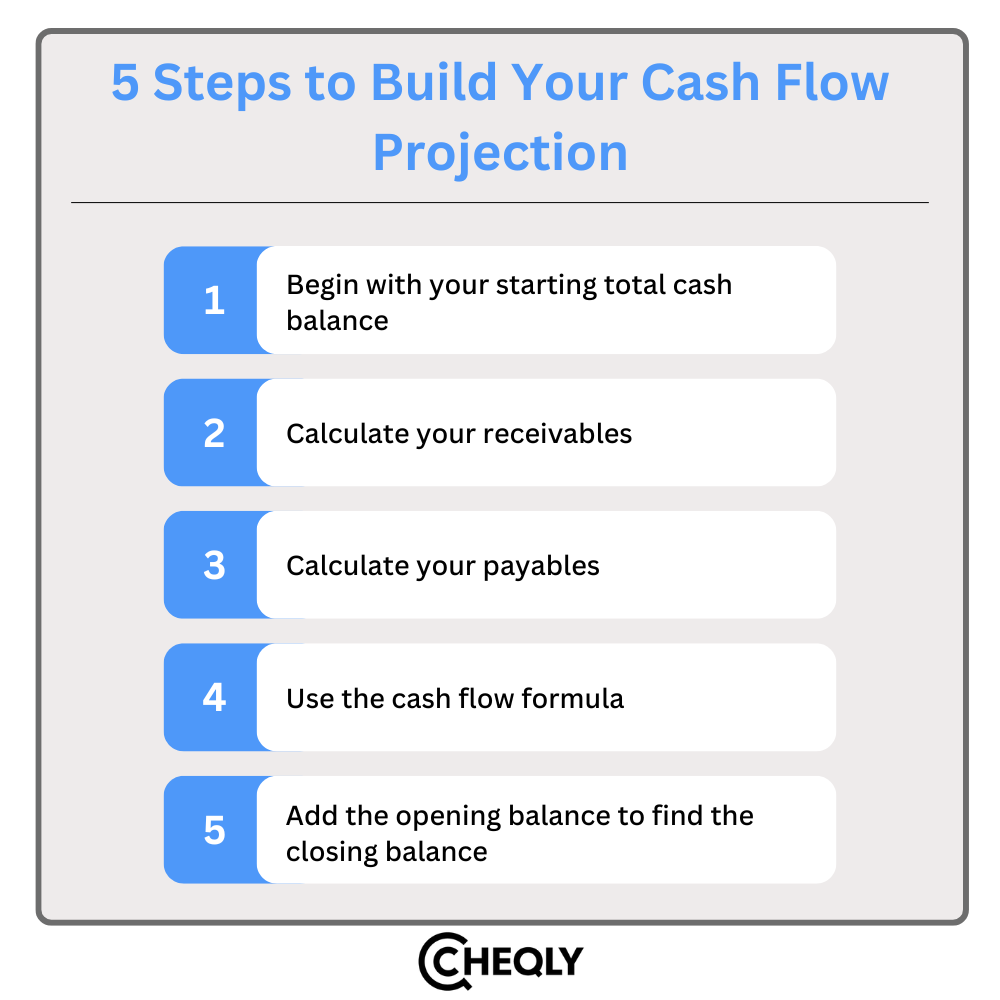

Build Your Cash Flow Projection with These 5 Easy Steps

Creating a project of cash flow is not as scary as it may appear. It is not hard to draw up your expected cash flows, stay ahead of possible shortfalls, and even guide your business strategies with greater confidence.

1. Begin with your starting total cash balance

This procedure is straightforward and effortless. Navigate to your banking app or financial planning portal and retrieve the total cash balance of all bank accounts or other cash accounts.

This number constitutes your initial balance for your developing cash flow projection. Our projected monthly cash flow implies that the opening balance equals the closing balance for the last month.

2. Calculate your receivables

You need to predict the positive cash flow you expect to have next month. Remember to allow for extra revenue flowing in and expected sales forecasts.

The source of this data is as follows:

- Sales revenue for your products and/or services is normally reflected in Accounts Receivable. Ensure that the cash flow projection only includes balances or imminent cash sales due within the specified period.

- Consider making new investments or taking out loans. Suppose you are presently applying for a loan or raising funding that you anticipate receiving next month. In that case, this is considered incoming cash and should be included in this calculation.

- Asset sales. If you anticipate receiving payment for any business assets you sell in the upcoming month, include the corresponding quantity.

- Interest income and other sources of income.

3. Calculate your payables

Subsequently, we will execute the identical procedure for your negative cash flow.

The following are examples of expenses that should be incorporated into your cash flow projection:

- Salaries and compensation of employees

- Fees for rent or lease

- Financial Software subscriptions

- Tax Payment

- Bills for utilities

- Insurance

- Seasonal expenditures

- Acquisition of assets

- Costs associated with marketing and advertising

- Repayment of loans

- Fees for licenses

- Franchise expenses

Please be advised that there are two categories of expenses: fixed and variable. It is straightforward to forecast fixed expenses, as they are likely to remain consistent across all reporting periods. However, the determination of variable costs will necessitate some form of estimation.

4. Use the cash flow formula

You have to subtract the total payables from the total receivables or the negative cash flow from the positive cash flow.

Imagine that your business will receive $18,500 from its customers (receivables) in a month. Still, your proposed payments to suppliers and vendors (payables) are meant to be valued at $22,000. Your cash flow calculation would look something like this:

$18,500 – $22,000 = ($3,500)

This figure indicates that your monthly expenses will exceed your income, resulting in a $3,500 negative cash flow.

If your payables are reduced to $12,000, then your expected cash flow will be

$18,500 – $12,000 = $6,500

According to these figures, your business would have a positive cash flow of $6,500, which means you’re taking in much more than you put out.

5. Add the opening balance to find the closing balance

Add the cash flow amount to the opening balance to determine the closing balance for the cash flow period.

Thus, if our cash flow for the month is $15,000 and we have an opening balance of $5,000, our closing cash balance will be $20,000.

It is crucial to determine the closing balance, as it serves as the opening balance for the subsequent month. Therefore, it is advantageous to generate cash flow projections for multiple forthcoming months in advance (a relatively prevalent method).

FAQs on Cash Flow Projection

Here are some common answers about projecting cash flow.

How often should I update my cash flow projection?

Ideally, you should do it on a monthly or quarterly basis so that it can reflect real business changes and remain scheduled accordingly.

How can cash flow projections help in securing funding?

They show their financial planning capacity and estimate when the money is required.

How far into the future should a cash flow projection cover?

It generally ranges from several months to one year, depending entirely on your business needs.

What happens if my actual cash flow differs from the projection?

Utilize the difference to make adjustments to upcoming projections, which in turn will increase the precision of the predictions.

Can cash flow projections help in pricing decisions?

Yes. Cash flow forecasts let you know if the current pricing is enough to cover expenses while ensuring the achievement of business goals. They empower you to make regular adjustments to prices in the best way to ensure profitability and healthy cash flow.

What are some common mistakes in cash flow projections?

Some common reasons include being overly optimistic about income, underestimating costs, and never revising forecasts.

Handle Your Cash Flow Like a Pro with Cheqly

Your business development and safety depend on keeping your cash flow efficient, which Cheqly intends to assist with. Cheqly provides small business owners with easy-to-use, detailed, real-time insight features to track cash inflow and outflow, plan payments, and instantly see the financial state of their business. Whether you manage your payments, prepare to fulfill your financial obligations, or avoid cash flow issues, Cheqly confidently empowers you to manage your finances with just a few clicks.

Register for a Cheqly business account now and enjoy professional control over your cash flow.