A business’s performance can be significantly enhanced by effective cash management. Through cash reconciliation, a company checks its records against bank statements or payment reports to detect errors, maintain transparency, reduce financial risks, and optimize cash flow.

This article explains what it is, why it matters, how it works, common problems, and ways to make it better.

Key Takeaways

- Cash reconciliation checks that the business’s internal cash records match external bank statements, ensuring financial accuracy.

- Identifying and resolving discrepancies helps prevent mistakes, fraud, and financial misstatements.

- Regular reconciliation is beneficial because it ensures compliance with financial regulations and keeps a company’s financial records clear.

- It involves verifying deposits, withdrawals, bank fees, and outstanding checks as significant transactions to ensure accurate record keeping.

- An improved structured process for reconciliation enhances cash-flow management, informed budgeting, and, thus, smarter financial management.

What is Cash Reconciliation?

A crucial financial procedure called cash reconciliation verifies the correctness of a business’s cash records by contrasting its internal cash data with external statements like payment processor reports or bank records. The objectives are to identify inconsistencies and ensure that recorded cash transactions correlate to actual cash inflow and outflow.

Cash reconciliation can be done daily, weekly, or monthly, depending on how much business activity there is. Financial visibility exists while preventing fraud and ensuring accurate financial reports through this process.

Why is Cash Reconciliation Important?

If there are any differences between the cash records in accounting systems and the cash in bank accounts, they can’t be found without regular cash reconciliation. This lowers the accuracy of financial data and causes mistakes in financial statements. That’s why cash reconciliation becomes important. Cash reconciliation enhances the accuracy of financial reporting and the correctness of financial documents. The activity shows its worth by protecting organizational integrity, investigating and preventing fraud, meeting regulatory requirements, and enhancing cash flow optimization.

Reconciliation of cash brings several benefits to finance operations.

- Precise financial records: It can inspire trust and transparency in organizations by providing accurate and dependable financial reports to stakeholders while confirming that the cash transactions on record match the bank statements.

- Fraud prevention: Companies can prevent fraud and protect their assets by correcting any issues right away when recognizing differences between accounting records and bank statements.

- Regulatory compliance: Reconciliation of cash is one of the practices businesses can adopt to guarantee that their internal policies and regulatory obligations are carried out. In fact, many regulatory policies dictate that companies should reconcile their accounts periodically to maintain accuracy, and the contrary can be a punishable offense due to noncompliance with the rules.

- Strong financial oversight: Effective cash reconciliation strengthens the internal control system by ensuring that all transactions are properly documented and validated.

- Effective cash flow management: Businesses can see their cash position clearly, which will help them make smart choices about spending, investments, and budgeting while keeping things running smoothly.

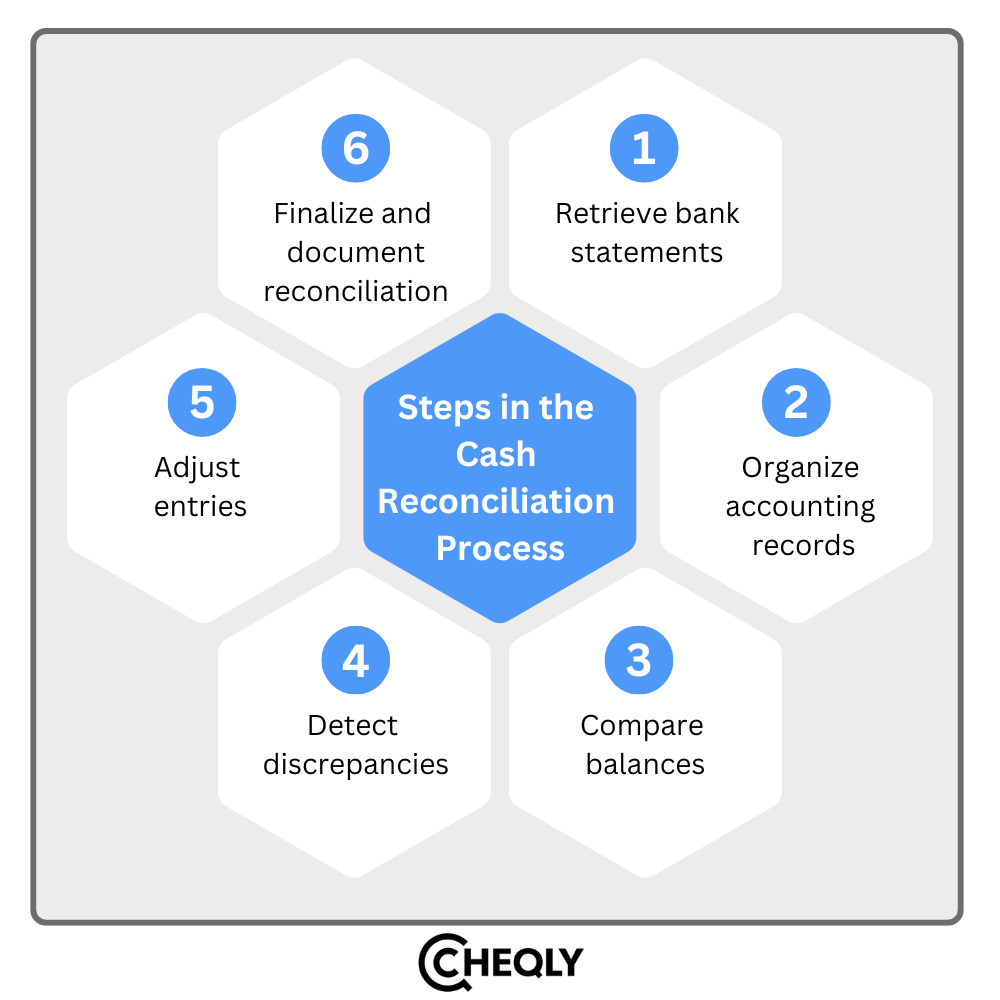

Steps in the Cash Reconciliation Process

Cash reconciliation is a complex operation that is made up of several major steps. Each of these steps is essential in order to guarantee that the accounting cash records match the actual bank balances. Compliance with these well-structured steps will give companies the ability to identify and subsequently deal with any fundamental discrepancies and hence maintain accurate financial records.

A successful and effective reconciliation process requires understanding the cash reconciliation process. The steps in the cash reconciliation process are as follows:

1. Retrieve bank statements

Get the most recent bank statement for the time period that needs to be reconciled. Verify that all accounts and transactions for that time period are included in the statements.

2. Organize accounting records

Verify that the accounting system accurately records all cash transactions, including deposits, withdrawals, and bank fees. Update records for pending or missing transactions.

3. Compare balances

Compare the cash balance displayed at the end of the bookkeeping records with the bank statement balance. Write down the differences when comparing the two balances.

4. Detect discrepancies

Examine every point of dissimilarity in the two balances. Scan for transactions that have not been registered, data input errors, or time differences that might be the reason for those variances.

5. Adjust entries

To correct journal entries for all items that will bring anomalies into order, prepare reconciliation entries. To ensure the accounting records match the bank statement, note any missing transactions, correct mistakes, and consider timing discrepancies.

6. Finalize and document reconciliation

Reconcile it and record the findings and modifications. Proper documentation of the reconciliation process should be obtained for auditing purposes as well as for later usage.

Challenges of Cash Reconciliation

The process of cash reconciliation remains essential because it can prove difficult, especially for organizations that deal with numerous transactions. Typical difficulties include the following:

- Human errors: The human error rate is high when data entry is based on manual procedures for reconciliation processes. These can result in disparities and include inaccurate data entry, omissions, and duplications.

- Timing discrepancies: Timing differences between the company’s internal records and the bank statements can be caused by transactions like issued checks that remain uncashed.

- Large transaction volumes: Manually reconciling all accounts can be time-consuming for large firms that handle hundreds or thousands of daily transactions.

- Missing records: Accounting systems may not promptly record bank fees, interest payments, and other costs, which could cause short-term inconsistencies.

- Limited automation: Relying solely on human procedures slows the reconciliation process and increases the possibility of errors.

Best Practices for Cash Reconciliation

Best practices are guidelines that prevent your cash reconciliation procedure from becoming inaccurate. When starting cash reconciliation with professionals, you must follow certain procedures.

- Segregation of Duties: Segregate cash-handling responsibilities from reconciliation obligations, which will help to increase the strength of your internal controls and minimize the likelihood of fraud.

- Frequent Reconciliation: Perform regular cash account reconciliations, ideally monthly or weekly, for businesses with high transaction volumes. By automating the process, the scheduled tasks run in the background to have the latest information about the finances at all times.

- Proper Documentation: Keep a good set of accurate and specific documents as the reconciliation goes on, covering the observed deviations, the changes made, and the final reconciled amount.

- Utilize Automation: Reconciliations can be done the easier way through automation; thus, they can be more accurate and save more time.

In summary, the purpose of cash reconciliation is to maintain a low rate of error, combat fraudulent activities, and possibly perfect cash management. Businesses may protect financial integrity and compliance by implementing structured reconciliation procedures and substantiating their financial decisions. Automation, documentation, and regular transaction reviews are better ways to guarantee reconciliation efficacy and reliability.

Cash Reconciliation FAQs

Find answers to frequently asked cash reconciliation questions here.

What happens if cash reconciliation is ignored?

Businesses might encounter financial problems such as misstatements in financial statements, lack of cash flow, failure to comply, and the risk of fraud.

What tools can help with cash reconciliation?

To make the process smoother and minimize the risk of inaccuracies, accounting software, automated reconciliation tools, and bank statements are used.

What causes cash reconciliation discrepancies?

Common causes include missing receipts, data entry errors, bank fees, fraud, and timing differences in transactions.

How does cash reconciliation differ from bank reconciliation?

Cash reconciliation involves verifying a company’s internal cash records, while bank reconciliation compares the company’s financial records to the bank’s statements.

Who is responsible for cash reconciliation?

It is usually carried out by accountants, finance teams, and business owners, depending on the company’s size.

Keep Your Budget on Track with Cheqly

Small business owners must handle budget management effectively in order to remain stable and grow. Cheqly is a neobank that provides financial tools relevant for small business owners to manage their budgets in real time by tracking their income and expenses, thereby enabling them to closely monitor their cash flow and make informed financial decisions.

Open a Cheqly account and start managing your budget with ease.