A company stays financially stable by managing, improving, and checking its cash flow from operations and banking. This helps ensure there’s enough money to pay the bills and keep the business running smoothly.

Businesses face cash flow problems mainly because of payment delays, poor expense management, and inaccurate forecasting. At this point, the fundamental role of a Chief Financial Officer (CFO) in the company becomes crucial. As a financial leader, the CFO provides specialized skills regarding financial planning, cost management, and strategic financial investments that allow businesses to achieve maximum cash reserves through well-optimized payments while utilizing financial technology.

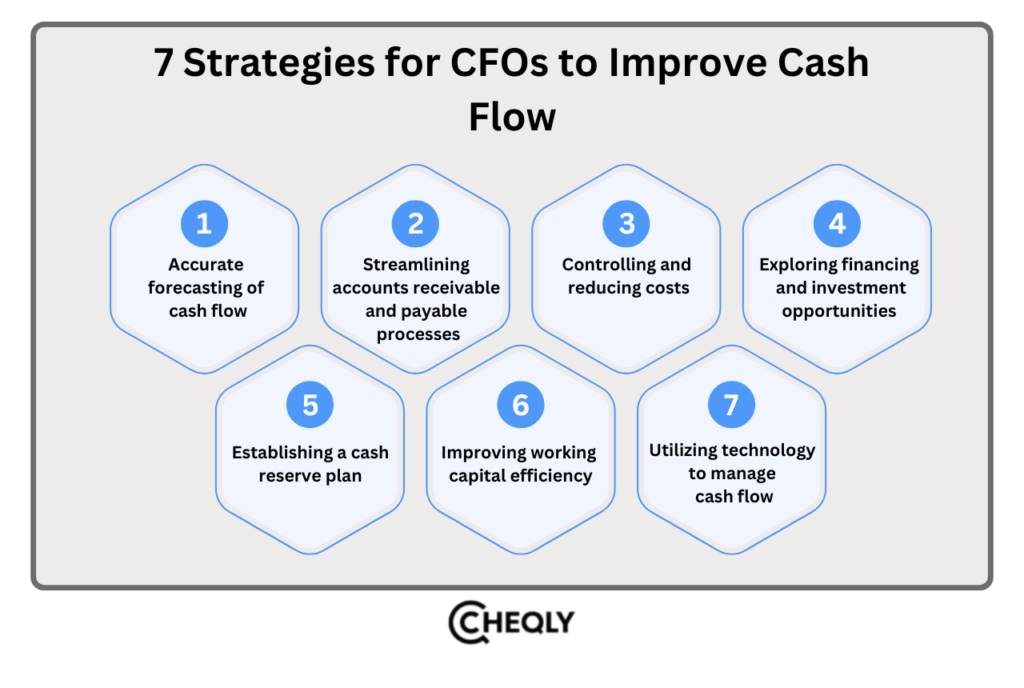

This article explains seven strategies CFOs can use to better manage cash flow, strengthen financial stability, and make better decisions.

7 Strategies for CFOs to Improve Cash Flow

Good financial strategies are essential for CFOs who want to improve cash flow and performance. We will break down seven methods you can use to optimize your cash flow management.

1. Accurate forecasting of cash flow

Forecasting cash flows is one of the main steps in the discipline of financial control. Getting to know your customers’ choices, the market’s fluctuations and the trends of the industry is often the initial stage when it comes to managing your cash. Update your forecast regularly so that you can foresee any unexpected events. Such an approach helps you use your resources wisely, make the right decisions, and come up with a good financial plan.

2. Streamlining accounts receivable and payable processes

Your payment and billing system simplification enables better customer satisfaction and improved cash flow handling through O2C cycle optimization. Order-to-cash procedures impact multiple functional areas within a company, including sales departments, legal teams, financial organizations, and services departments. The key requirement is that your teams maintain a shared understanding of business matters.

In the O2C process, departmental alignment can help remove isolated functions’ increased costs, inefficiencies, and margin leaks. Setting up a unified accounts receivable system is one approach you can use to cope with the challenge. It helps teams understand their tasks in the established process, increases accuracy, and reduces billing and collection errors.

Businesses can proactively protect cash flows by using data analytics to forecast future cash flow scenarios, discover past-due accounts, predict financial hazards, and gain insight into consumer payment trends.

The use of automated invoicing alongside payment reminders achieves two goals, which are accurate transaction records and the reduction of both cash flow delays and compliance issues. The finance teams receive sufficient time to perform strategic functions because of this approach.

3. Controlling and reducing costs

As a CFO, you’re a master of cost-cutting because you can see the opportunities that assist in steering the company’s strategy. You may also quickly recognize where the company can save on expenses due to the upcoming ones. To boost profits, consider cutting overhead costs, improving supplier terms, and exploring more budget-friendly ways to handle operations.

4. Exploring financing and investment opportunities

Occasionally, an enterprise may require external funding or make calculated investments for cash flow support or growth. Chief financial officers must investigate various options for funding their companies, such as credit lines and loans, to make sure that the company’s liquidity is enough. In addition, reviewing investment opportunities that result in positive cash flow and that are in line with long-term business growth can help to achieve financial stability.

5. Establishing a cash reserve plan

The business is strengthened by the company’s cash reserves, which allow it to deal with unpredictable expenses or difficult times. In such situations, the CFO should keep track of the company’s financial planning and healthy liquidity by determining if the company has sufficient money to cover contingencies. By combining historical data and future predictions, the CFO creates a proper plan for the company’s financial success, regardless of what may happen. To achieve this, make sure that your business goal is to have a reserve of at least three to six months of operating expenses in cash.

6. Improving working capital efficiency

Working capital optimization is a technique allowing for proper alignment of current assets and liabilities. This can be achieved by the CFO of a company cutting mostly on the inventory holding period, having the best negotiation terms on the payment and applying lean operations. Effective management reduces reliance on external financing and ensures enough cash for essential needs.

7. Utilizing technology to manage cash flow

Technology provides the essential foundations that business organizations require to manage their cash flow operations in modern times. A CFO provides businesses with information about accounting applications and technological solutions that automate financial reporting as well as bill payment and invoicing tasks. Also, these solutions can provide a company’s cash flow in real-time, which helps prevent certain cash flow issues.

Businesses across various sectors, especially those focused on cost management and efficiency, keep an eye on the latest technology. They need to use technology to get accurate and timely data to make better decisions and stay on top of their finances.

Good cash flow management is the basic requirement for the financial stability and long-term success of a company. Using new technology and proactive strategies, CFOs can increase liquidity, handle the problem of insufficient cash flow, and moreover drive better results. These practices help companies become financially robust and cultivate growth, even in a highly competitive market environment.

FAQs on Cash Flow Management

The following are common questions and answers about management of cash flow:

What challenges are CFOs likely to face when managing cash flow?

Payment delays, revenue instability, and high operational expenses frequently make cash flow management tough for CFOs.

How frequently should cash flow be monitored?

A regular review of cash flow is the best way to do it, which can be done every week or month to detect trends, identify problems early, and ensure sufficient liquidity for the company.

What is the difference between cash flow and profit?

Profit arises from revenue after expenses are deducted, while cash flow deals with real money movement, affecting liquidity.

How do CFOs monitor cash flow?

CFOs achieve effective cash flow management through the utilization of financial statements, cash flow projections, and real-time data.

How can CFOs ensure compliance with financial regulations?

Maintaining regular and precise records, conducting audits, and complying with established accounting standards.

Take Charge of Your Cash Flow with Cheqly

As a business owner, managing cash flow is very important, and Cheqly makes it easier for you with real-time financial data. It helps you stay aware of your financial situation, identify potential problems early on, and avoid any major trouble. Plus, with business accounts, affordable online transfers, and both physical and virtual debit cards, you can save on fees and keep your operations running smoothly.

Get a Cheqly account and take full control of your cash flow management.