If you have one, an account number and a routing number are associated with your bank account. What makes a difference? Your bank or credit union is identified by its routing number, whereas your checking or savings account is identified by its account number.

Since both numbers are utilized in most banking transactions, including setting up direct deposits and making online bill payments, it is regrettably easy to become confused between them. Continue reading to find out where to locate routing numbers, how they differ from account numbers, and which number to use when.

Key Takeaways

- An account’s bank is represented by its routing number.

- At the bank, an account number serves as a unique identity.

- For several standard transactions, both numbers are needed.

- Accounting and routing numbers show exactly where to deposit money.

- Securing an account number is crucial, as it’s unique to the holder.

- Don’t write things down or give out your bank information to anyone.

Routing vs. Account Number

Both account and routing numbers are required for bank transactions and aid in identifying your bank account. These figures do, however, differ significantly in a few important ways. Here are a few things to remember.

| Routing number | Account Number |

|---|---|

| Identifies the bank or financial institution | Identifies the individual account holder’s account |

| Usually 9 digits | Typically 8-12 digits (varies by bank) |

| Used for Ach transfers, checks and other electronic transactions | Used for all account transactions |

| Can be shared for transactions | Should be kept confidential |

What do they stand for?

While account numbers identify specific bank accounts, routing numbers identify financial institutions.

Private vs. public

Routing numbers are disclosed in the open. Even if you do not have an account with a particular bank, you can still locate the routing number on their website. Account numbers are kept confidential. The account number is only accessible to the account holder.

Who allocates them?

Banks receive routing numbers from the ABA, and these numbers are then assigned to individual customer accounts by the banks.

How long are they?

Routing numbers consist of nine digits at all times. The length of account numbers varies; some have up to 17 digits.

What is a Routing Number?

Your bank or credit union’s routing number is a nine-digit code that acts as their address. The American Bankers Association (ABA) assigned these numbers to avoid confusion between banks with similar names; hence, they are often referred to as ABA routing numbers.

Numerous credit unions and banks only have one routing number. However, large national banks might have multiple routing numbers for some states or even one routing number for each state.

In the past, Automated Clearing House (ACH) numbers were used for electronic transactions between financial institutions, while routing numbers were used with paper checks. These days, though, banks usually only require one routing number for any kind of transaction—paper check or electronic.

What is an Account Number?

Your account number, usually eight to twelve digits long but occasionally longer, makes your account, serves to uniquely identify your account—whether it’s a savings or checking account. Every account is uniquely numbered, akin to a fingerprint. Any banking transaction requires an account number, including transferring funds between accounts at the same or two different banks.

Account numbers are associated with the account, not the user. Thus, your savings and checking account numbers will differ if you have both at the same bank. (Those accounts, however, will probably share the same routing number.)

During a financial transaction, your account and routing numbers tell the bank exactly where money should be deposited or withdrawn.

Understanding the Importance of Routing and Account Numbers

Your account number is like your bank’s fingerprint, meaning it should only be known by you and your bank. This information requires protection. The routing number and the account number are important as they enable a variety of transactions.

These numbers are supposed to let you know where your money is. It shows the system where the money comes from and where it goes. Both numbers help guarantee that the cash goes to the correct place at the right time. Therefore, making a mistake in giving exact numbers can lead to delays and expensive fees.

It’s also paramount to keep this information secret. It could happen that somebody could take money out of your bank account if they have that information. They can do this using ACH transfers and forged checks. So, these digits are quite vital and should only be used to set up new payment scenarios.

Routing Number vs. Account Number Example

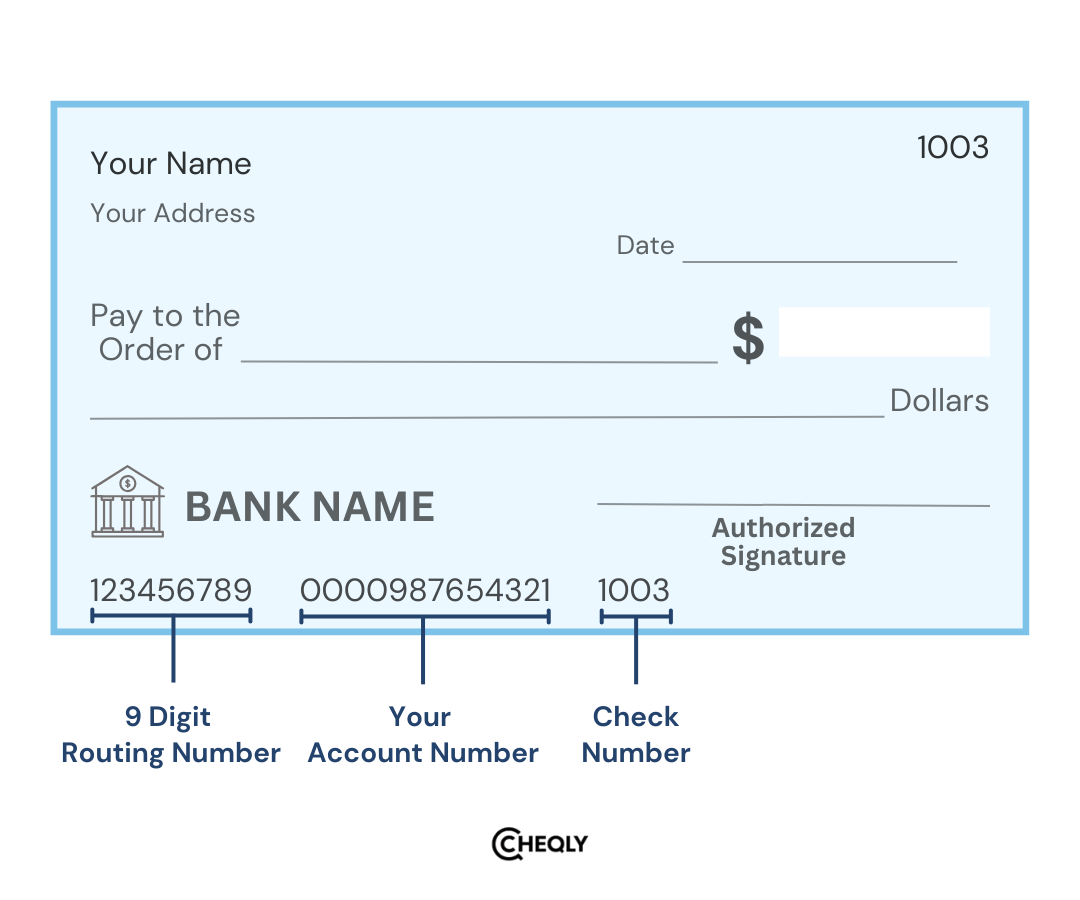

You must always remember your bank routing and account numbers because you might be asked for them often. There is actually no better way for people to find these numbers than to look at their paper checks.

To the bottom left of each check is a series of three numbers. The routing number appears first in the sequence (nine digits), the account number is second, and the last number is the same as the check number above. These numbers are printed with a unique magnetic ink called the MICR (Magnetic Ink Character Recognition) line on the check. This way, the bank machines are able to read the account information without any problems.

It should be understood that sometimes the numbers will be shown in a different order, for example, on an official bank check. If you cannot find the paper check, you can obtain the routing and account numbers through the bank’s password-protected online banking website or simply by searching for the bank’s address on Google. Another option is to contact the bank’s customer care line.

When You Require a Routing Number or Account Number?

For numerous common financial transactions, you’ll require both your account number and, frequently, your routing number. These could consist of:

- Configuring direct deposit of your salary

- Configuring autopay

- Making a withdrawal

- Making a check or cash deposit into your account

- Applying for a rental

- Connecting bank accounts from outside

- Completing a credit application

- Arranging payments from suppliers you work with, such as ACH (automated clearing house) payments

- Wire transfers, both sending and receiving

- Online bill payment

- Sending and receiving money to friends and family

- Asking for a check’s payment to be stopped

How to Find your Bank Routing and Account Numbers online?

Locating your account number and routing information online is simple. Here, we will explain how to find the bank routing number and account number.

- Access Your Online Account: The last four digits of your account number might be visible only when you log in. Usually, you can obtain the entire number by clicking on it. It might also appear automatically with your routing number. If not, you might need to click on an item labeled “Account Details” or “Account Numbers” to obtain your routing number. Additionally, some banks display their routing number on their website somewhere, usually on the home page.

- Get Your Statement Here: Obtaining a copy of your statement online or opening one is another way to discover your bank account and routing number. Your account number may be listed in full, depending on the bank (some only list the last four digits). Your routing number is usually printed on your statement in the upper or lower right-hand corner.

- Use the Mobile App for Your Bank: Simply open your bank’s app and select the account you’re interested in. You should be able to access your account and routing information. Click on an option such as “account information” or “account details” if your account and routing number do not appear immediately.

How to Find your Bank Routing and Account Numbers on a check?

Examining one of your checks is one of the simplest methods to find the routing and account numbers for your checking account. But since there are no labels on these numbers, you’ll have to figure out how to interpret the series of digits printed along the bottom.

- Locate Your Routing Number: The routing number is the first grouping you see when you look at the list of numbers at the bottom of your check. It’s a nine-digit number that usually starts with one of the following: 0, 1, 2, or 3.

- Locate Your Account Number: The account number usually appears immediately after the routing number in the second set of numbers. It could have seven, eight, or more digits.

What do you do if you can’t find your routing and account numbers?

Usually, your bank’s website has your routing number if you cannot locate it elsewhere. Alternatively, you can use the online routing number lookup tool the ABA provides.

You must contact your bank’s customer service line if you cannot locate your account number. Account numbers are private information, so you might be asked a series of questions to confirm your identity. For instance, they might inquire about your driver’s license and/or Social Security numbers.

How do you protect your routing and account numbers?

Your account number is not disclosed to the public, although your bank’s routing number might be. You should be careful about who sees your bank account number, just as you are with your Social Security number.

It’s advisable to keep your checkbook in a secure location and to avoid sharing your account number with anyone or any company unless necessary to prevent potential bank fraud. Before being thrown away, any old checks should be destroyed by shredding. Another smart move is to refrain from posting images of checks you’ve written on social media, even if they were for the down payment on your ideal vehicle.

Boost Your Business Efficiency with Cheqly

Cheqly transforms financial management for small businesses through a comprehensive suite of user-friendly solutions. By enabling businesses to open accounts online, Cheqly eliminates the need for time-consuming visits to physical branches, allowing entrepreneurs to focus on what they do best.

With a Cheqly business account, small businesses can take their financial management to the next level. Cheqly offers powerful tools like automated invoicing, real-time cash flow tracking, insightful financial reports, and more—all designed to support growth. Don’t miss the chance to simplify how you handle money—sign up for a Cheqly account today and boost your business efficiency.