As a business owner, the choices you make right now can determine your company’s future. Financial forecasting is one of the best tools for guiding these choices. Understanding the financial forecasting of your business can help you predict future revenue, manage budgets, and plan for sustainable growth. Whether you’re launching a startup or scaling an established business, forecasting gives you the financial clarity needed to make smarter decisions and avoid surprises.

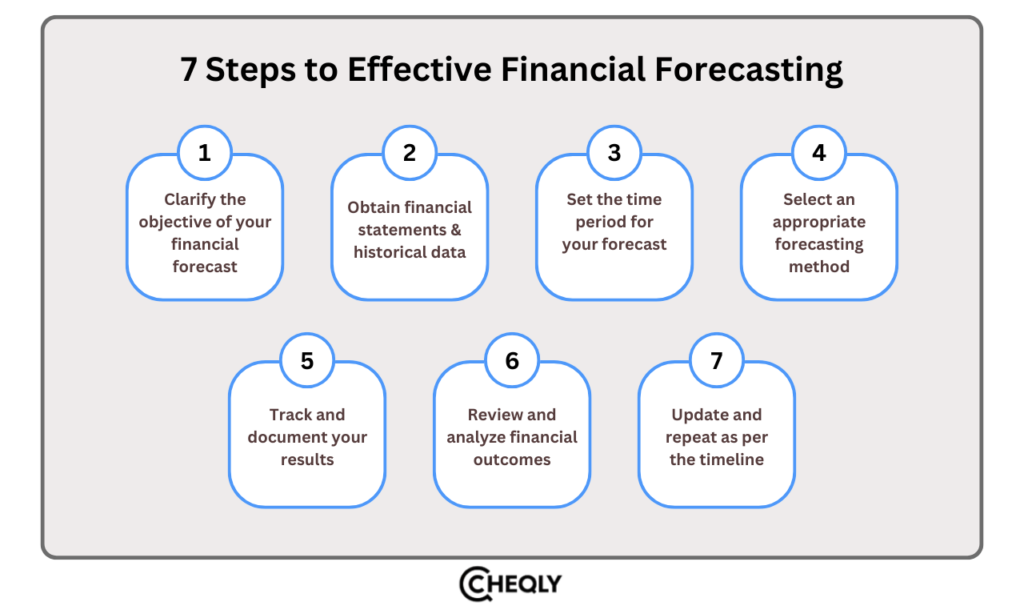

In this article, you’ll learn the seven essential steps to effective financial forecasting, from collecting data and choosing the right method to reviewing results and updating forecasts regularly.

What is financial forecasting?

In simple words, financial forecasting is the process of predicting the future performance of a business by analyzing past data. Companies conduct an analysis of their historical financial performance, current market trends, and other pertinent factors in order to generate accurate predictions regarding the future.

Understanding the Importance of Financial Forecasting

When financial forecasting is inconsistent, our ability to see clearly decreases. Regular forecasting activities have a positive and profound impact on your core business operations by improving planning, resource allocation, and risk management.

- Planning an Annual Budget: Your business’s financial positions, combined with future goals and cash flow projections, become visible in budget documentation for a set fiscal period. Financial forecasting and planning form an indispensable pair, as future business predictions create clarity, which improves budgeting accuracy.

- Setting Realistic Business Goals: Your business expansion or contraction projection requires precise accounting to accurately determine its scope. Suitable forecasting techniques enable organizations to set measurable targets that yield performance standards comparable to their projections.

- Spotting Potential Problem Areas: By analyzing the history of business performance as part of financial forecasting, you can recognize recurring issues. By tracking future trends, organizations can spot upcoming challenges before they happen.

- Minimizing Financial Risks: If you don’t conduct financial forecasting, you may end up overspending. Without forecasted numbers, your decisions would likely be poorly informed in most cases.

- Increased attractiveness of the company to investors: Financial forecasts serve as tools for investors to predict a company’s performance and potential investment returns. Regular forecasting practices demonstrate to investors that businesses are proactive and have robust plans for the future.

Types of Financial Forecasting

Companies create multiple types of financial forecasts for various purposes. These can be classified into four major categories:

Sales Forecasting

A defined fiscal year serves as the time frame for organizations to forecast their total sales of products or services. There are two distinct methods in sales forecasting practice: top-down forecasting and bottom-up forecasting.

The specific benefits of sales forecasting enable both production cycle budgeting and planning while providing many additional applications. Through improved resource management, organizations gain better control over their resource distribution.

Cash Flow Forecasting

Cash flow forecasting involves predicting the movement of money in and out of the business during a specific period. It primarily relies on numbers from revenue and outgoing costs. One of its main uses is identifying short-term funding needs and the process of creating a budget. However, it should be noted that cash flow forecasting is most accurate when done for the short term.

Budget Forecasting

As soon as a budget plan is prepared, the financial department can use budget forecasting to estimate the expected outcome of the budget for the next fiscal period if it is carried out as planned. At the end of the period, variance analysis is conducted to compare the actual outcomes of the business with the predicted budget numbers.

Budget forecasting leads to greater precision in predicting budget performance and, therefore, increases the reliability of corporate budget planning.

Income Forecasting

Income forecasting estimates future income by looking at past revenue data and the company’s current growth rate to predict net income over a set period.

It helps finance teams to make informed decisions about cost management, price, budget, resource allocation, and investments. They also create trust with suppliers and investors.

7 Steps to Effective Financial Forecasting

Financial forecast outcomes are critically important for various operational elements of your organization, both today and in the future. For instance, forecasting results will influence the decisions of investors, and lenders will use them to evaluate the credit limit to be extended to your company.

So, getting the details right is really important. To help you do this correctly, here’s a simple guide:

Clarify the objective of your financial forecast

What are you trying to achieve with the financial forecast? Are you trying to figure out how many products or services you will sell? Or do you want to identify how the existing budget will impact the company’s future? Understanding the purpose of the financial forecast is crucial in knowing which variables and factors to consider during the process.

Acquire financial statements along with historical data

Past financial data analysis stands as a key component of financial forecasting, as discussed before. That is why it is crucial to collect all pertinent historical data and records, such as

- Revenue

- Losses

- Investments

- Liabilities

- Equity

- Expenditures

- Comprehensive revenue

- Earnings per share

- Fixed costs

It’s very important to collect all the required data as your financial forecast will definitely go wrong because of the missing of some relevant information.

Set the time period for your forecast

Business owners use financial forecasts to gain visibility into their company’s upcoming condition. The duration of the forecast, ranging from weeks to years, depends on your decision regarding the time frame. Most companies, however, create forecasts for a single fiscal year.

Changes occur from time to time in financial forecasts because market trends and business conditions evolve. Financial forecasting provides greater accuracy for the short term compared to the long term.

Select an appropriate forecasting method

There are two methods of financial forecasting:

- Quantitative forecasting uses historical data and information to identify trends and reliable patterns.

- Expert opinions and sentiments regarding the organization and the market as a whole are examined through qualitative forecasting.

Each approach is appropriate for distinct applications and possesses its own advantages and disadvantages. However, Qualitative forecasting is especially useful for startups that lack access to historical data, though it may be less precise than quantitative methods.

Track and document your results

Financial forecasts can never be considered precise, and with time, they are subject to change. That’s why it’s important to track and review your forecast results over time, especially after major changes inside or outside the company. In addition, it would also be beneficial to upgrade your forecasts by incorporating these recent changes. The use of forecasting software that can automate certain tasks can also be of assistance.

Review and analyze financial outcomes

Regularly examining the financial data is the best way to ensure your financial predictions are accurate. Additionally, continuous financial management and analysis help you make better plans for the upcoming financial forecast and keep you informed about the company’s current financial performance.

Update and repeat the process according to the set timeline

If you’re a wise company that understands the value of regular financial forecasting, you should repeat the process when the current financial period ends. Additionally, it’s a good idea to continue collecting, recording, and improving the accuracy of financial data forecasts.

FAQS on Financial Forecasting for Business Owners

Got questions about financial forecasting? Here are answers to help business owners plan for success.

How accurate are financial forecasts?

Even though predictions are derived from data, they are still guesses and can therefore change. The more precise the information you have and the predictions you make, the better the forecast.

How often should I update my financial forecast?

Ideally, revise it every three months, but you’ll have to change it when something significant happens in your business or market situation.

Can financial forecasting help secure funding?

Yes, a well-made, detailed financial plan shows investors and creditors that you understand your company and that its future financial condition will be strong, increasing the likelihood of securing the needed financing.

How do I account for market uncertainty in my forecast?

You can integrate various scenarios into your forecast, such as optimistic or pessimistic, or perform a sensitivity analysis to display the impact of key variables on your results.

What’s the role of assumptions in financial forecasting?

Assumptions are the fundamental factors that help determine your forecast, such as growth rates, expense patterns, or market conditions. They are essential for a thorough understanding of the situation and, therefore, for creating a realistic projection.

How do I know if my forecast is too optimistic or too conservative?

Compare your forecasts with industry benchmarks, historical performance, and market trends to ensure they are realistic and aligned with relevant data. Optimistic forecasts might not be able to identify potential risks, while the conservative ones could hinder growth opportunities.

How can I adjust my forecast if actual results differ?

Consistently compare your forecast with the real results and correct your assumptions, goals, and strategies according to the variances in such a manner that your forecast stays credible and feasible.

Forecast Your Business Growth Accurately

Accurate financial forecasting requires real-time financial data. Cheqly offers entrepreneurs real-time visibility into their cash flow effectiveness, facilitating efficient monitoring of company finances. With access to the latest information, you can make informed decisions, adjust strategies as necessary, and confidently plan for sustained long-term growth. In addition, users can make online transfers at affordable rates and access both physical and virtual debit cards.

Open a Cheqly business account today and forecast your business growth accurately.