When the state of the economy is volatile, the role of a CFO in an organization becomes highly crucial. CFOs are the ones who navigate the company by dealing with issues such as price changes, cash management, and risk mitigation, ensuring the company remains financially stable.

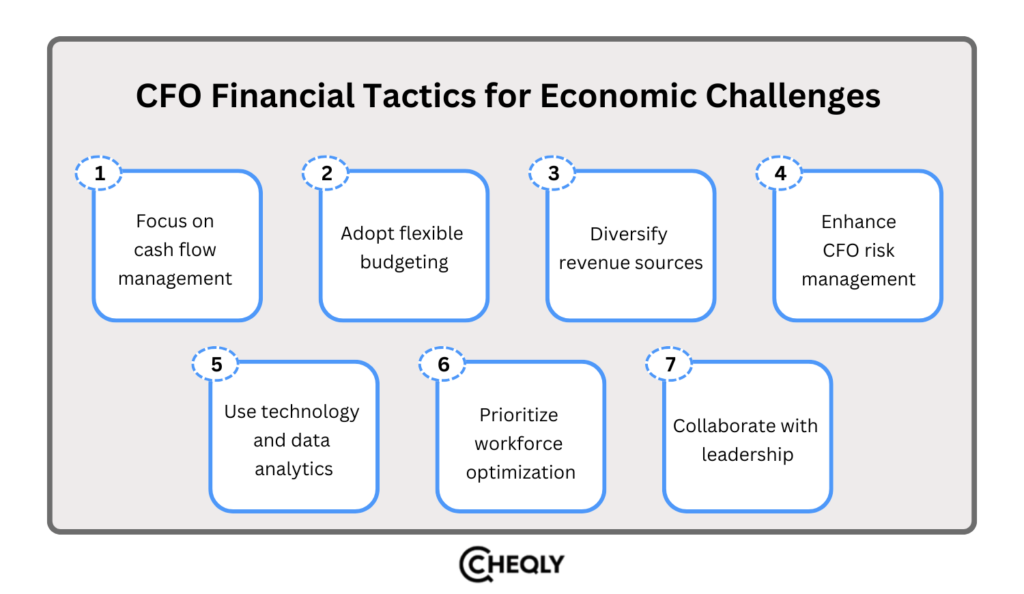

To keep the company stable and help it grow, CFOs should manage cash flow, use flexible budgets, find new ways to make money, use technology, improve the workforce, and work closely with leadership.

This article outlines the most significant financial strategies that CFOs can utilize not just to survive in a difficult economic climate but also to thrive.

Key Financial Strategies for Managing Economic Uncertainty

In tough economic times, companies must focus on maintaining financial stability to handle any uncertainties. CFOs ensure financial plans align with company goals and help keep the business stable in the long term. Let’s explore the financial strategies that can help manage economic uncertainty.

Focusing on cash flow management

During uncertain times, money is the most important thing. The CFO is the person who oversees the company’s money for the difficult times. Good cash flow management always includes keeping savings points and planning for necessities. Businesses need to maintain a reduced working capital but, at the same time, be ready for the future. CFOs develop cash flow models that can be adapted month by month and are frequently updated so that they are able to respond quickly to market fluctuations.

In addition, improving inventory management, moderating fixed expenses, and renegotiating payment terms with suppliers and customers are valuable strategies for preserving a healthy cash flow.

Adopting flexible budgeting

During economic fluctuations, the conventional methods of budget implementation can be exceedingly restrictive. A rolling forecast, which is less rigid, can provide CFOs with a greater opportunity to promptly address new challenges. In contrast to fixed budgets, rolling budgets facilitate the use of and modification of precise and current market data.

Therefore, firm-specific capital budgeting allows the CFO to reallocate resources according to the company’s needs.

A technology firm might opt to use rolling budgets by altering marketing expenses every quarter according to the introduction of new products or shifts in consumer demand. For instance, if demand drops, resources can be reallocated to R&D to prepare for future opportunities.

Diversifying revenue sources

A good financial strategy begins with the CFO of the company, who must focus on including diversification of revenue and the differentiation of products and services. In fact, it is extremely risky for any organization to depend on a single or two sources of income, particularly during periods of economic hardship. Consequently, CFOs can help the organization mitigate risk by diversifying the market, relationships, or operational model.

For example, organizations have had numerous opportunities to explore and implement alternative strategic revenue models as a result of digital transformation. CFOs should advocate for the implementation of technology that enables the organization to capitalize on these opportunities without causing long-term harm.

Enhancing CFO risk management

While risk management is one of the key areas that fall under CFO, the other part comprises identifying the risks and opportunities that may be availed along this risk. CFOs must also identify the environmental risks, whether supply-related or geopolitical, so they can ensure their organizations manage any risks within the CFO’s purview. All risks are recognized, evaluated, and controlled by the CFO to maximize the attainment of the organization’s financial goals with the support of an integrated risk management system.

An effective and efficient risk management program would enhance relationship capital with investors and lenders. Open communication keeps everyone informed and allows for action if any financial issues arise.

For example, a production company that buys materials from different places can manage risks by having the CFO set up suppliers from different countries, making sure the business keeps going if there’s a problem in one area.

Utilizing technology and data analytics

Technology stands out as the most important thing for the establishment of solid financial strategies because the current financial environment is constantly changing. CFOs need to adopt accurate analytics, AI, and automation because decision-making is crucial in most organizations. CFOs can acquire knowledge regarding operational efficiency, demand patterns, and cost reduction initiatives that would otherwise remain undetected.

Also, cloud solutions provide improved opportunities for financial systems and platforms and business transparency and scalability, which are essential as market conditions change. The use of data analytics and predictive software makes the company’s management easier during economic volatility. Thus, managing directors and chief financial officers can be well-informed about the financial condition of the company.

Prioritizing workforce optimization

Although cutting costs in hard times is very tempting, the function of the CFO requires a much more interactive way of dealing with employees. Employee morale can be preserved while administrative costs can be effectively reduced through workforce optimization, which includes upskilling, reskilling, and redeployment.

During tough times, CFOs who spend on staff training can lessen the disruption and make the important team members more competent and, as a result, achieve better outcomes.

For example, during a downturn, a software company may decide to train its employees to be knowledgeable about new products, such as AI. This keeps employees ready with knowledge that helps them to be relevant on new projects, such as developing AI solutions for the company, hence increasing both the retention rate and innovation.

Collaborating with leadership

Lastly, CFOs must communicate and work closely with other leaders in the organization. CEOs and CFOs should team up to align financial strategies with the company’s goals, with support from the board, COOs, and department heads. Besides, it provides all the parties involved with an opportunity to be on the same page, which helps the organization during times of change.

Strategic leadership alignment helps experienced CFOs make critical operational decisions quickly and know that financial strategies will be consistent across the organization.

For instance, by working on projects together, such as automating technology procurement and constructing a new warehouse, both CFOs and COOs can significantly improve efficiency. This will make operations sync, and hence, financial resources will be able to fund growth.

In tough economic conditions, the CFO is crucial in ensuring financial stability and driving company growth. The practices listed earlier—cash flow management, flexible budgeting, revenue stream diversification, leveraging available technology, workforce mobilization, and engaging top management in collaborative decision-making—help the CFO effectively navigate uncertainty and prepare the organization for long-term success.

FAQs on Financial Tactics for CFOs

Here are common financial tactics FAQs for CFOs to navigate challenges.

What financial tools and technologies can help CFOs during economic crises?

CFOs rely on financial management software, data analytics tools, and automation platforms to track financial performance, cut costs, and make quick decisions. Using these tools to streamline reporting, budgeting, and forecasting is especially important during tough times.

What are the key performance indicators (KPIs) CFOs should monitor during economic challenges?

CFOs should check KPIs like cash flow, debt ratio, liquidity, profit margin, and expenses to understand the company’s financial health and make needed changes.

What are the common pitfalls CFOs should avoid during economic downturns?

CFOs should avoid cutting costs too much, as it can stop innovation and growth. They need to find a balance between saving money and investing in important areas to stay competitive. Also, if they don’t adjust financial plans to fit market changes, the company could miss out on good opportunities.

Get your Finances Under Control with Cheqly!

Are you tired of your business finances being out of control? Here’s your chance to rectify that by using Cheqly. Small businesses find smart financial tools, efficient cash flow management, and deep analytics to tackle the issues and grow on our platform. Whether you’re managing payments or looking for ways to improve your financial outlook, Cheqly is your go-to solution.

Sign up for Cheqly now and start managing your business finances with ease!