The Generation Z cohort, born between 1997 and 2012, enters adulthood as both digital natives and budding entrepreneurs. Platforms like Shopify stores, TikTok-led brands, freelance collectives, and SaaS micro-startups illustrate how many Gen Zers are monetizing skills and online audiences earlier than previous generations. They do so with a strong digital identity and high expectations shaped by instant applications, creator platforms, and real-time feedback.

This entrepreneurial culture fundamentally changes business banking. Gen Z founders are more mobile-first, flexible, speedy, and value ethics, transparency, and shared principles in selecting financial partners. Accordingly, banks aiming to secure tomorrow’s customers need to transform traditional business accounts into fully digital, insight-driven, and values-oriented startup banking offerings.

The Gen Z Startup Wave

Gen Z business owners take advantage of the digital age, which includes minimal startup expenses, online marketing platforms, social media reach, and remote-work models. Most choose business models that offer flexibility and steady income, giving them the freedom to pursue interests beyond traditional full-time roles. A 2025 survey found that 94% of adult Gen Zers (18–28) intend to become financially independent by age 55 and believe that side hustles and entrepreneurship will help them reach that goal.

From an economic perspective, Gen Z is grappling with inflation, student loans, and job insecurity, which is why many of them opt for self-employment and startups. According to the Bank of America Institute, Gen Z wages are increasing rapidly; however, underemployment and savings gaps persist.

Key traits of Gen Z startups

Lean, digital-first operations that focus on e-commerce platforms, social media marketing, and affordable digital tools for business operations, rather than taking the traditional route of a physical store.

- Agile business models that permit quick experiments, have low costs, and can scale without a large investment.

- Implementation of freelance and gig work, where the majority of founders combine the gig economy with freelance services to generate side income.

- Being independent is one of the main things that matters to Gen Z entrepreneurs. They generally desire to have mastery over their time, earnings, and lifestyle, and so they create businesses that give them back that freedom.

Business banking faces a major challenge from these changes, as Gen Z startup founders look for more than just traditional accounts and want banking tools that align with their digital-first approach, adaptable working styles, and values-driven principles.

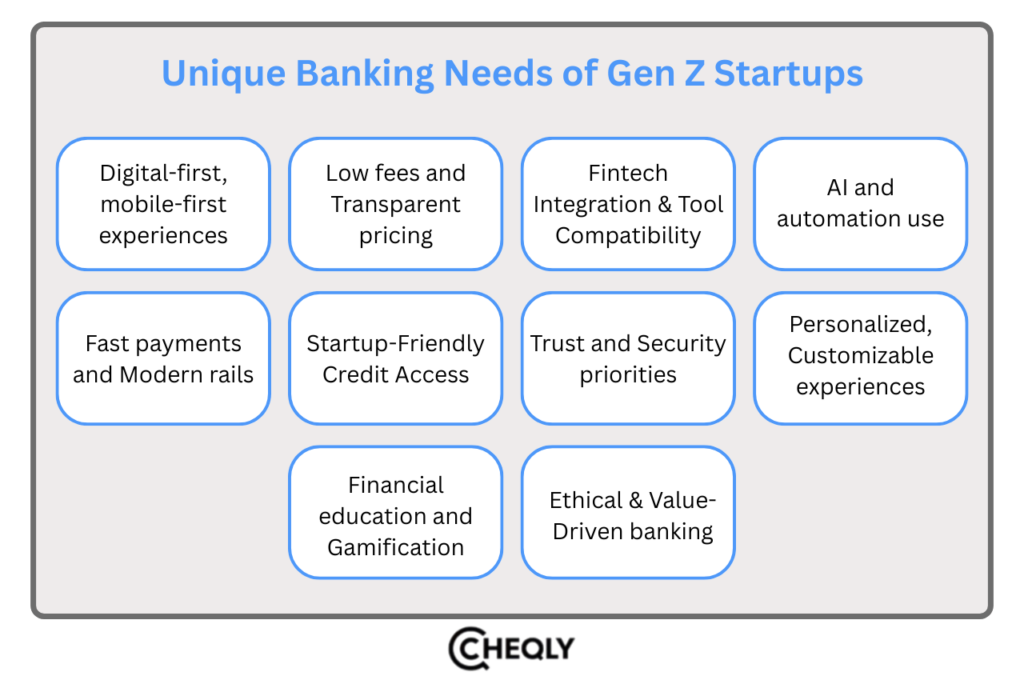

Unique banking needs of Gen Z startups

As Gen Z founders build in a different way, their banking requirements are also not the same. A number of preference patterns are revealed:

1. Digital-first, mobile-first experiences

Gen Z desires to carry out all their activities via applications. The latest US figures indicate that 72% of adults have adopted mobile banking apps. Also, 92% of new business accounts in North America were opened digitally in 2024, which is a clear indication of the trend in SME banking. So, it is a perfect match with the instant onboarding experience that Gen Z was expecting.

“72% of adults have adopted mobile banking apps”

– Coin Law

2. Low fees and Transparent pricing

Many Gen Z business founders are strongly inclined to self-finance, as 45% of them use their personal savings when starting a business, and as a result, they are very conscious of costs. They look for banking products that do not burden them with high maintenance fees, complicated fee structures, or costly account minimums, a feature to which most fintech and neobank offerings are tailored.

“Around 45% of Gen Z founders rely on personal savings to launch their startups”

– Square

3. Integrated tools and Fintech ecosystem compatibility

Connected workflows are a preferred tool of Modern Gen Z startups. With 92% of US SMBs using online/mobile banking as their primary channel and 84% leveraging integrated digital services, they expect seamless bank integrations with accounting software, payments platforms, and invoicing tools by default.

“84% of SMEs actively using bank-integrated digital services”

– Coin Law

4. AI and automation use

Small businesses can benefit from the increasing use of AI and automation in banks, as studies show that about 65% of commercial banks use AI to streamline processes like onboarding, loan processing, and compliance, which reduces friction and makes services faster and more accessible for small business clients.

“About 65% of commercial banks now use AI to streamline customer onboarding”

– Zidco

5. Fast payments and Modern rails

Instant or near-instant settlement is an absolute necessity for younger founders who run digital-first businesses and have teams of contractors spread globally.

6. Access to startup-friendly credit and capital

Traditional lenders provide loans to only 16% of Gen Z entrepreneurs. Most of them choose neobanks or fintechs that provide them with a flexible line of credit, revenue-based financing, and instant card issuance. Besides that, Gen Z entrepreneurs, who may have limited traditional credit, also find Buy Now, Pay Later (BNPL) solutions and other flexible payment methods increasingly attractive.

“Traditional lenders, like banks, funded only 16% of Gen Z entrepreneurs”

– Whop

7. Trust and Security priorities

Even though Gen Z requires digital convenience, 79% still generally choose conventional banks over big tech companies when it comes to the security of their data; hence, maintaining strong privacy and security becomes an indispensable element of their banking decisions.

“79% still prefer traditional banks over big tech companies for keeping their data secure”

– Coin Law

8. Personalized, Customizable experiences

With AI, Gen Z wants spending, saving, and credit behavior to be the basis of the banking experiences they get, with 68% demanding personalized spending insights directly on their banking app home screen. Customizable interfaces enable them to remix banking dashboards by adding modules such as budgeting, tax planning, or investment tools that mature with their financial needs. Personalized offers and credit products provide the user with a great experience and increase loyalty.

“68% demanding personalized spending insights directly on their banking app home screen”

– Coin Law

9. Financial education and Gamification

Educational tools and gamified features allow Gen Z entrepreneurs to build credit, learn about finances, and develop good money habits. Participating in savings challenges, monitoring credit scores, and receiving rewards for reaching financial milestones help these young entrepreneurs build deeper trust in the platform and continue using it.

10. Ethical & Value-Driven banking

Many Gen Z entrepreneurs, having been raised in a purpose-driven environment, look for companies that are socially responsible, environmentally sustainable, and transparent, with 52% more likely to choose banks promoting social justice or environmental causes. Financial institutions that stay true to these principles in their products and community initiatives earn the trust and loyalty of these customers and gain a competitive advantage.

“52% more likely to choose banks promoting social justice or environmental causes”

– Coin Law

Challenges & Opportunities for Banks & Neobanks

The new wave of digital-first, flexible, and values-driven entrepreneurship is being powered by Gen Z founders. This development presents a major turning point for financial institutions. Both conventional banks and neobanks need to go beyond their usual offerings and align with this generation not only in terms of speed but also in attitude and expectations. For Gen Z entrepreneurs, the following are the key opportunities and challenges that banks must address:

Opportunities

- Working closely with Gen Z entrepreneurs right from the start is a great way to create long-lasting financial connections that naturally evolve as their startups develop.

- Cross-selling business products like credit lines, expense cards, payroll integrations, insurance, and treasury services deepens revenue streams.

- Digital-native branding that mainly highlights mobile business banking, openness, and value-based communication helps in building the loyalty of Generation Z.

- By using data about Gen Z’s online behavior, personalization can allow for targeted offers, AI-powered cash flow notifications, and credit products.

Challenges

- Micro-businesses with low income can put a heavy strain on the overall profitability of a business because of the costs related to servicing them.

- Credit risk assessment has remained intricate due to unstable cash flows and short histories. As a result, there is a need for new risk models that utilize alternative data.

- Frequent changes of preferences or choices by Gen Z make it necessary to keep updating UX and prices.

- Legacy banks are usually battling with app-based fintechs that have a superior mobile-first customer experience and a more scalable cost structure.

Banks and neobanks that mix digital innovation, good credit and risk management, and startup-friendly services such as instant onboarding and flexible credit have the highest probability of winning Gen Z entrepreneurs.

What This Means for Gen Z Entrepreneurs

Gen Z entrepreneurs require a bank that is in sync with their speed, flexibility, and digital-first way of thinking. These are the implications of the trends for the business owners who are in search of a suitable financial partner.

- Choose Banking That Fits Your Business Stage: On one side, early-stage founders can take advantage of accounts that are either free or have very low fees, and fast mobile adoption. On the other hand, established companies require credit lines, payroll, analytics, and multi-user capabilities.

- Leverage Mobile & Digital Tools: Bank accounts are being transformed into operational dashboards through real-time cash-flow visibility, instant notifications, deposits, and clean transaction histories, which in turn decreases the administrative overhead and errors.

- Prioritize Transparency & Value: Reducing hidden fees and putting an emphasis on clear fee structures allows founders who have limited budgets to avoid unexpected costs and also to maximize the time that is saved.

- Treat Your Bank as a Growth Partner: Look for partners providing credit-building, financial education, advisory services, and founder communities as a source of support for scaling and success that lasts.

- Stay Agile & Open to Change: Frequently evaluate your banking requirements and consider changing banks or opening new accounts to get access to better digital tools and pricing as your business grows.

Future Outlook

As an increasing number of young founders will be turning their side hustles into businesses, thus demanding digitally-first banking solutions, the impact of Gen Z on entrepreneurship and business banking will continue to rise at a fast pace. The next generation of banking will be influenced by the rise of micro-business-oriented products such as instant onboarding and flexible limits, the deeper coupling with commerce and creator platforms, the growing rivalry between the old and new fintech banks, and the embedding of finance in the startup ecosystems. Banks that are willing to adapt to these changes will be the winners in the long run.

FAQs: Gen Z Startups & Banking

Quick answers to the most common questions Gen Z founders have about business banking.

How does Gen Z manage business finances differently?

Gen Z founders are more likely to run multiple income streams, including freelance work, creator revenue, ecommerce, and SaaS, under one business setup, managing finances across several platforms and apps rather than a single channel. They rely heavily on mobile banking, digital wallets, and automated tools to track cash flow, often expecting real-time notifications, easy categorization, and app-based controls instead of in-branch support.

What banking features matter most to Gen Z entrepreneurs?

Key features include low or transparent fees, instant digital onboarding, mobile‑first interfaces, and integrations with tools for invoicing, accounting, and commerce. Many also prioritize virtual and physical business cards, real‑time cash‑flow views, tax‑set‑aside sub‑accounts, and fast payout options from platforms they use to earn.

How can banks attract and retain Gen Z startups?

Banks need to deliver clean, intuitive digital experiences, offer products built specifically for micro‑businesses and side hustles, and provide flexible credit based on modern data sources such as platform revenues. Ongoing retention depends on continuous UX improvement, personalized insights, and clear, fair pricing, since Gen Z is more willing than older cohorts to switch providers if expectations are not met.

What’s next for Gen Z startup banking?

Banking for Gen Z‑led startups is expected to become more embedded, contextual, and automated, with financial tools integrated directly into the software and marketplaces they already use. AI-driven insights, embedded credit, and vertical SaaS platforms that bundle workflow and finance are likely to shape the next generation of startup banking experiences.

Gen Z Startups: Redefine the Future of Business Banking

Gen Z is more than just a consumer group; they represent an energetic entrepreneurial movement. The way they manage their finances is in line with their lifestyle, which is based on platforms, and they take into account that the service should be fast, easy to use, clear, and fair.

Neobanks such as Cheqly are the perfect example of this change, providing business accounts that are digital-first with simple tools, financial management integrated for the most up-to-date founders, and also global transfers. The trend of Gen Z startups in America is a pivotal point for business banking, and the ones who will adjust, such as Cheqly, are the ones to be at the forefront in creating the future of entrepreneurship.

Sign up for a Cheqly business account and take your Gen Z startup banking to the next level—fast, flexible, and fully digital.