Wire transfers are one of the most effective methods of transferring electronic money to businesses and people across the globe. They are the most trustworthy way of transferring money, especially if their counterpart does not live in the same country. There are many ways to send a wire transfer, including bank-to-bank transfers, wire transfer outlets such as Western Union, and online money transfer services. The delivery method you choose will determine the cost and speed of the wire transfer.

The most common methods of wire transactions are bank wire and wire transfer companies. Most wire transfers incur certain fees, and your requested monetary amount will be debited from your account instantly. In a wire transfer, you require the intended recipient’s name, account number, and banker’s details.

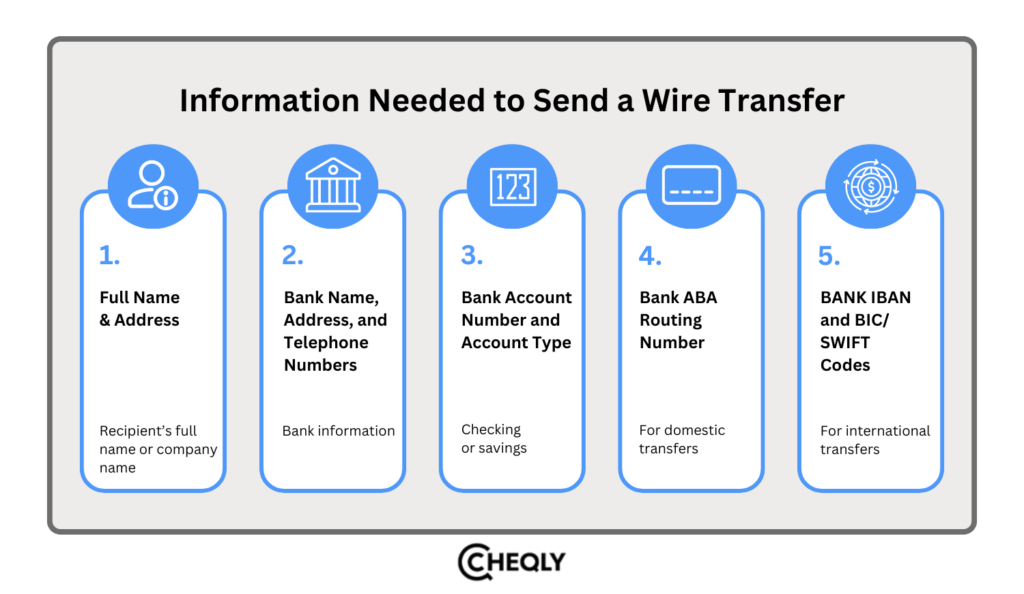

Now, let us break down the article in detail about the types of information required for bank-to-bank, online, and in-store transfers and the different mistakes one must avoid while conducting wire transfers.

What Information is Essential for Bank-to-Bank Wire Transfers?

Banks are among the secure methods to carry out wire transfers. However, they may take longer to complete the transaction and charge higher fees than other money transfer services, such as international wire transfers. You will normally be required to supply the following details in order to send a wire transfer via bank:

- Full name of the recipient

- Full name of the sender

- Phone number of the recipient

- Phone number of the sender

- Name, location, and details about the recipient’s bank

- Details about the recipient’s checking account

You can complete this information in a local branch or online using a form.

For domestic wire transfers within the United States, you will require both your bank account and routing numbers. Technically, the nine-digit number, referred to as the ABA routing transit number (ABA RTN), written on the bottom of checks identifies the financial institution from which the money is sent. This technique, developed by the American Bankers Association (ABA), facilitates easier grouping, packaging, and forwarding of the cash to the sender’s bank for debiting the recipient’s account. In order to identify the paying bank or other financial institution for bank wires, electronic payment systems rely on ABA RTNs. Additionally, the Federal Reserve Bank processes money transfers using ABA RTNs.

These include the IBAN, BIC, or SWIFT code of the international bank account of the recipient in case of international wire transfers. These are Standard Bank Identifier Codes most employees in banks and other financial institutions around the world recognize.

These codes are used for message exchanges between banks and for money transfers, especially international wire transfers and SEPA payments. In addition to providing the dollar amount you are sending, you may be asked by your financial institution to offer a justification for the transfer when sending money abroad. If the sending or receiving bank requests more information, be ready to supply it as well.

What Details Are Required to Wire Money through Online Transfer Services?

Customers sending foreign currency through international transfers may find that online electronic transfers are a quicker and less expensive option than banks. You will only be able to proceed if you first register & verify the online financial service of your preference. Depending on the service you opt for, you might have to input the recipient’s personal and banking details the same way you would in a bank-to-bank transfer. Electronic wallets like PayPal make it possible to transfer money using only an email address. It is necessary to check that the recipient has a registered account as well.

What Details Are Required to Wire Money Using In-store Transfer Services?

Western Union and MoneyGram are examples of consumers paying money directly to a bank account or any retail outlet for cash pickup. For the purpose of transferring money to a recipient’s account, one will be required to have details about that person’s personal and banking information. Certain stores require you to present your government-issued ID for cash transfer, other than the recipient’s name, country, address, telephone number, and email address. An important point is that the recipient will not be able to receive the money if the name you provide does not match the name indicated on their government-issued ID. In addition to providing a tracking number and presenting identification, the recipient must be aware of the branch or shop where the pickup will take place.

Because you can’t always confirm that the right individual made the collection, cash transfers can be less secure than other methods. To avoid falling prey to these vices and losing your hard-earned money, you should ensure you know the risks and scams of wire transfers.

Is There a Way to Track a Wire Transfer?

Having the ability to track your bank wire transfer can provide you with the assurance that the recipient has acquired the money. You have to register for online banking to track the status of the bank-to-bank transactions. The recipient should frequently check their account since they will be informed when the funds are ready.

A tracking number will be provided by in-store wire transfer services, and the sender will forward it to the recipient. If the sender has created an online account, they can use this number to track the transfer status. The service will alert both parties when the transfer is completed and the recipient when incoming wire funds are available for pickup. Both the sender and the recipient can access their accounts for updates.

Common Errors to Avoid in Wire Transfers

Unlike certain other payment methods, wire transfers cannot be undone. Make sure everything is right before proceeding. Here are some of the main types of errors that senders often make:

- Wrong account information: Verify the accuracy of all the codes and numbers.

- Misspelled recipient names: Verify the spelling one more time.

- Ignoring exchange rates: Recognize how exchange rates impact the total amount of money. For instance, the exchange rates of USD to pound.

- Misjudging delivery times: Wire transfers may take more time than usual while transferring money abroad. Therefore, take processing timeframes into account.

- Overlooking fees: Knowing the wire transfer cost is crucial; it will help you to distinguish and understand the overall cost associated with the payment.

Today, wire transfers continue to be popular as a way of transferring money, regardless of the purpose—personal or business. Getting to know the myriad details that are necessary for different types of wire transfers in banks or online services as well as in retail stores will guarantee complication-free and safe exchanges. Simple mistakes such as wrong account information, misspelling a name, or simply not considering fees or delivery time can waste time and cost one a lot of money. Knowing what to expect and what might happen when conducting a wire transfer can greatly improve the entire experience.

FAQs about Wire Transfer Information

Learn key details about wire transfers with these frequently asked questions.

Why is a SWIFT code necessary for international wire transfers?

A SWIFT code for successful international wire transfers is inevitable, as it is a code that identifies the recipient’s bank globally.

What should I do if there’s an error in my wire transfer?

If you find that there is a mistake after a wire transfer, contact your bank right away. They might not be able to undo the transaction, but they will give you suggestions on what to do next.

Is the recipient’s phone number required for a wire transfer?

The phone number of the recipient is usually not needed for a wire transfer, but some banks may ask for it to increase security.

How long does it take for a wire transfer to complete?

Wire transfers within the country are generally completed in a business day, whereas transfers across international borders can vary from one to five business days due to time differences, bank working hours, etc.

Experience Easy International Transfers with Cheqly!

Cheqly will help remove the unnecessary hassle from your wire transfers so that you can make a smooth, secure, and affordable international transaction! As a small business, you need a platform that’s convenient and easy to use — and Cheqly delivers exactly that.

Sign up with Cheqly today and enjoy smooth international wire transfers that are right for you!