Let’s say you are an entrepreneur and you need to make a payment to a supplier or business partner who is operating outside the country. This can be problematic since you have to deal with different currencies, regulations, and banks.

This is the time when intermediary banks intervene. They simplify the transfer process by serving as an intermediary between your bank and the recipient’s bank, hence international transactions can go smoothly.

Below, we’ll explain what intermediary banks do, how they work, when they are required, their fees, and why they are important.

What is an Intermediary Bank?

A bank that facilitates foreign financial transactions by acting on behalf of the bank and sending money is known as an intermediate bank. To ensure that the money is properly transferred to the beneficiary, you must provide the beneficiary’s (or receiving) bank details for your final payment, not the intermediate bank’s.

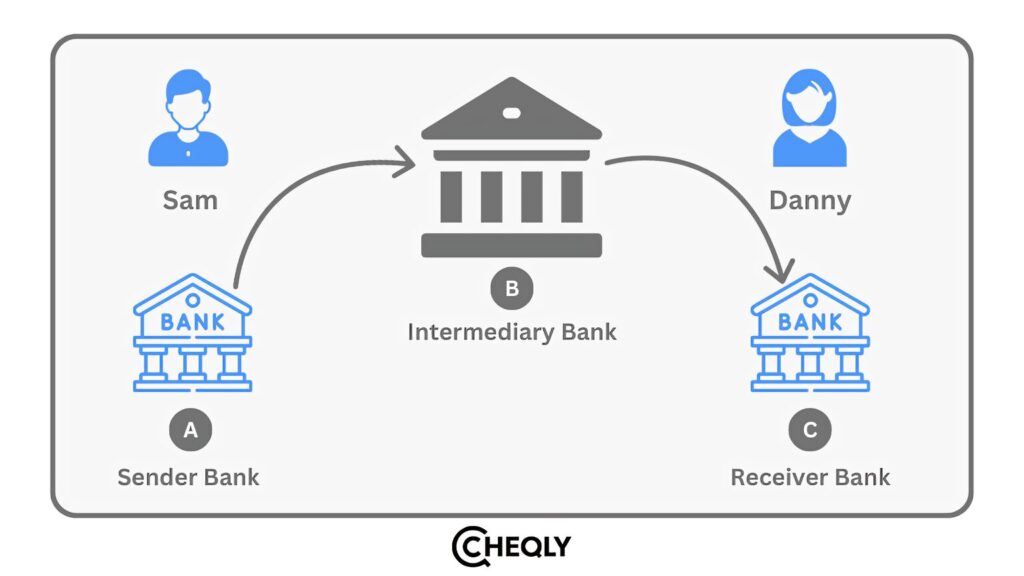

When an international wire transfer takes place, a bank serving as an intermediary sends money from the sending bank, also known as the originating bank, to the beneficiary bank, also known as the receiving bank. The sender’s bank is used by the individual or corporate parties to make payments through their local bank account. Because it is the place where the individual or company will transfer funds to the receiving bank, this is also known as the originator bank.

The receiving bank is the ultimate destination of payments from the sender’s bank and is used by an individual or corporate entity to receive payments in their bank account. Given that the beneficiary receives money from the sender, receiving banks are also known as beneficiary banks.

Lastly, an intermediary bank is employed to develop a more solid link between the two banks because they are frequently located in different nations and do not have a direct relationship. Through this entire process, funds are sent more swiftly from the originator’s bank to the beneficiary bank and are received more securely, resulting in the creation of a reliable and secure network for international transfers.

How do Intermediary Banks Work?

An intermediate bank is probably going to be involved if you are transferring money between banks, particularly if it is to an account in a different nation than your own bank. An intermediary bank acts as a bridge between the sender’s and the receiving bank’s accounts during a financial transfer between accounts at different banks.

This is how the deal could proceed:

- A customer of Bank A wishes to transfer funds to a different individual, a client of Bank B.

- On the other hand, Bank B and Bank A do not share an account or other banking connections.

- Nonetheless, Bank C is the recipient of an account from both Bank A and Bank B.

- It is possible to channel funds through Bank C, the middle bank, in order to complete the transaction successfully.

Example of an Intermediary Bank

Let’s use the example of Sam, a trader from New York who wishes to buy from Danny, a souvenir vendor in France. This example involves an international payment in a cross-border transaction between different countries.

He orders his bank (A) to transfer funds to Danny’s bank (C). His bank must transfer the money through an intermediary (B) to complete the transaction because it does not have an account with Bank C.

When is an Intermediary Bank Required?

An intermediary bank is typically involved when money is exchanged between two banks that do not currently have a connection. Regardless of whether you have a single or shared bank account, you will typically need an intermediary bank when transferring money to a user at a different bank, especially when doing so abroad.

It’s conceivable that a commercial financial transaction will take place here. To put it another way, the customer does not have to initiate the use of an intermediary bank.

When is an Intermediary Bank Involved in a Transaction?

Anytime money needs to be transferred between accounts at two different banks, an intermediary bank is frequently involved. The sending bank will typically employ an intermediary bank if it does not have its own account with the receiving bank.

A business’s main bank would almost certainly utilize an intermediary bank at some point to transfer cash on its behalf, even if it believed it could avoid the requirement for intermediary banks (and save money; see more on fees below) by opening several bank accounts.

Difference Between Intermediary and Correspondent Banks

Correspondent and intermediary banking are closely related, but knowing their differences is more essential. Below are some of the significant differences between correspondent and intermediary banks:

| Characteristics | Intermediary Bank | Correspondent Bank |

|---|---|---|

| Role | Acts on behalf of the sender and beneficiary banks | Acts as a middle ground between two respondent banks, possibly in different countries |

| Primary Use | Primarily used for wire transfers between two unconnected banks | Used for a range of international banking services |

| Currency Handling | Transactions typically involve a single currency | Can handle transactions in multiple currencies |

| Service Provided | Mostly used for wire transfers between unconnected banks | Can facilitate a variety of transaction types |

What are Intermediary Bank Fees?

Transparency is compromised by intermediary banks’ absence of regular fees. Yet, depending on the currency and additional set fees assessed, intermediary bank fees differ.

The typical range of intermediary costs for a transaction is $15–$30. Customer frustration stems from the fact that this can be expensive, particularly when multiple intermediate banks are involved, and charges are not disclosed prior to transaction completion.

Who pays the Fees of Intermediary Bank?

The method used to pay intermediary bank fees varies based on the particular transaction. Assume that Person A is giving Person B money. Depending on what the parties involved agree upon, the costs may be handled in one of three ways:

• The code “OUR” is utilized when the sender agrees to cover all costs. An overseas transfer might cost up to $70 on average.

• The code for shared costs is “SHA”. On a normal transaction, Person A will probably pay their bank’s fees ($15 to $30), and Person B will pay the remaining fees from both their bank and the intermediary bank.

• The designation “BEN” denotes that Person B, the beneficiary of the cash, will cover all costs.

How Can You Find the Intermediary Bank Information?

It is not essential for the sender to be aware of the intermediary bank’s information. This is the information that is exchanged between the banks. The only information needed from the beneficiary is the beneficiary’s bank account number and the SWIFT code.

The originator bank may negotiate with an intermediary bank for various reasons, such as the need to meet regulatory provisions, proximity, and practicability. Indeed, as is often the case in such processes, the primary method of ensuring cost reduction and simplification is to utilize the originator bank. The sender may be aware of this information even before the actual start of a funds transfer.

Why are Intermediary Banks Important?

Below are some of the important roles of intermediary banks:

- They handle international transfers from the originating bank to the beneficiary.

- These institutions create an international banking network by organizing a system of money transfers around the globe. Also, they help the bank merge branches and account locations.

- In efforts to combat fraud, money laundering, and other unlawful activities, these institutions are mandated to conduct due diligence.

Intermediary Bank FAQs

Below are the frequently asked questions about intermediary banks and their role in financial transactions.

1. Are receiving banks and intermediary banks the same?

The beneficiary bank is usually the same as the receiving bank. An intermediary bank comes into play when a bank is required between them.

2. Are intermediary banks required for all international transfers?

International transfers don’t always need a middleman bank, just if the sender and recipient don’t have a direct banking link.

3. Can a single transaction include multiple intermediary financial institutions?

Yes, several intermediaries may be involved in a single transaction; it primarily happens when it crosses multiple networks or when different currencies are used.

4. Are intermediary banks subject to regulation?

Yes, just like any other financial institution, intermediary banks are also regulated by the same compliance with anti-money laundering (AML) and know-your-customer (KYC) rules.

5. How do intermediary banks affect the timing of transactions?

Transfers that involve several middleman banks sometimes take longer to process than domestic transfers.

Conduct International Wire Transfers with Cheqly!

An intermediary bank usually comes into play when a bank customer wishes to send money to someone at a separate bank and the two banks are not affiliated. In order to help with financial transactions like wire transfers, both domestically and particularly internationally, intermediary banks collaborate with other banks.

When you choose to perform international wire transfers with Cheqly, you are choosing security, advanced customer service, and a transparent pricing system. Cheqly can give your small business the authority to send money to international clients across borders. Therefore, open your Cheqly account today and take control of your international transactions.