This guide covers different ways to pay international vendors, what to think about before paying, and how to keep your transactions safe, fast, and affordable.

Key Takeaways

- For cross-border transactions to be managed well, dealing with payments needs to be quick, affordable, and secure.

- If you combine international payments with your business systems, you can minimize manual blunders and process things faster.

- Providing various methods of payment means businesses can lower risks and remain flexible when working with vendors from around the world.

What are international payments?

The term “cross-border payments” or “international payments” is a general term that encompasses all payments that are transmitted from a financial institution in one country to a financial institution in another country.

The financial institutions must be located in distinct countries. For instance, if you pay an international contractor located in another country but using a US bank account, the transaction is not considered international.

You do not need to be concerned about international payments if your international vendors have US bank accounts. However, you must be well-versed in the ins and outs of making international payments in the event that they possess a local bank account in their own country.

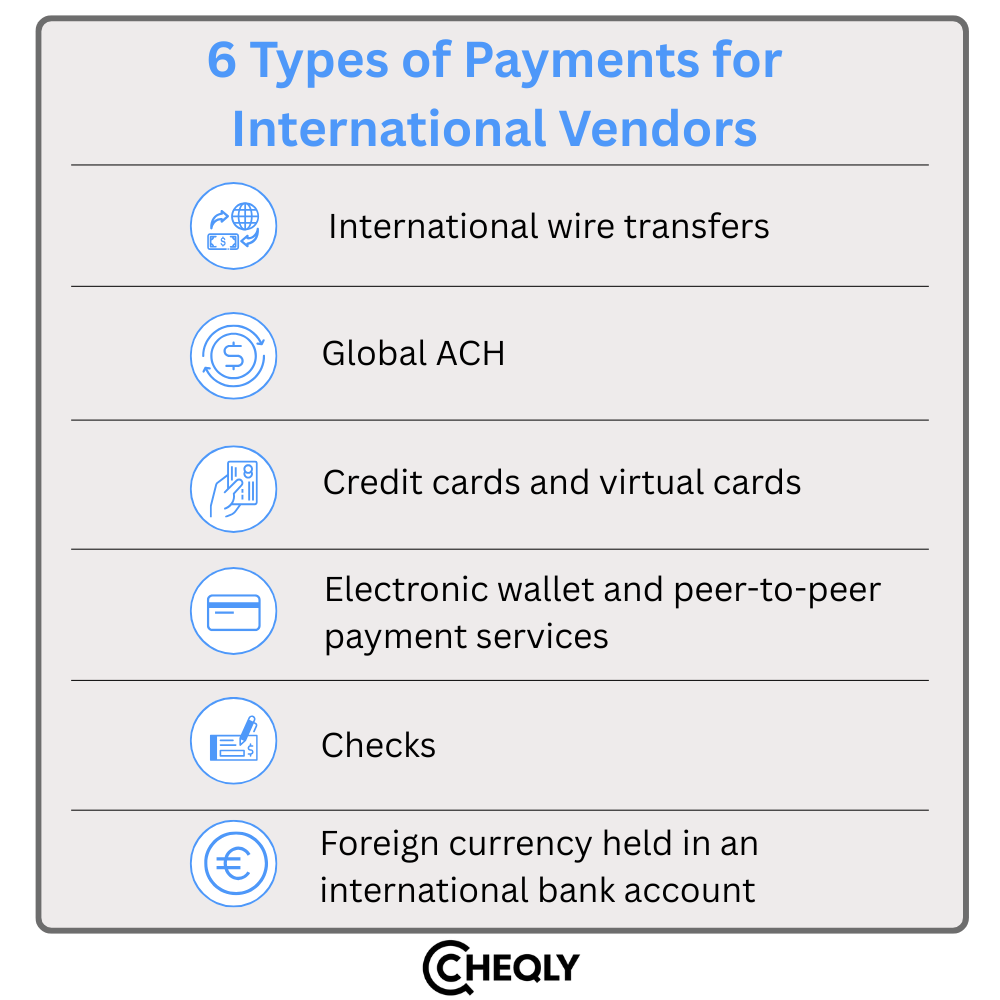

6 Types of Payments for International Vendors

There are six distinct methods to take into account when paying international vendors, each of which has its own set of benefits and drawbacks.

International wire transfers

You can often pay international vendors easily by initiating an international wire transfer. This way, funds move electronically from one bank account to another across national boundaries.

Sending money using international wire transfers is a reliable and safe way, but it can be pricey because banks charge fees. You should provide all the data needed for vendor payments, such as the recipient’s bank account details and the correct currency, to avoid any delays or additional fees. Also, look at the rates and fees you’ll be charged by several institutions to find the best-priced options for overseas wire transfers.

Global ACH

Global ACH or international ACH is an increasingly popular method for compensating international vendors. This system enables businesses to send payments electronically from the United States to vendors in other countries, utilizing a secure, cost-effective, and rapid process.

Global ACH transfers are generally less expensive than traditional wire transfers and can be employed for recurring transactions or one-time payments. Businesses can easily start ACH transactions across the world either through their bank or with a third-party payment platform.

Credit cards and virtual cards

Credit cards enable businesses to make payments efficiently and without any hassle. Virtual cards offer not only security but also control, as they can be configured as temporary numbers that are valid for only one transaction.

Electronic wallet and peer-to-peer payment services

One can also use digital peer-to-peer payment platforms for electronic money transfers overseas. Such platforms allow users to carry out financial transactions electronically without cash, and many offer currency exchange services for cross-border payments.

As a result, it’s now possible to manage financial deals with foreign suppliers in a simple and secure manner. Even so, these services might set the amount of money you can send within a particular time.

Checks

Compensating overseas vendors using electronic payments is the most common and efficient way. However, if some vendors are accustomed to traditional methods or lack access to online payment systems, they may still prefer or require payment by check.

But some banks don’t issue foreign currency checks, and the whole process can be sluggish, expensive, and unsafe. The most advisable course of action is to compare the pros and cons of checks and electronic payments before making a decision.

Foreign currency held in an international bank account

Another alternative is to make a payment in foreign currency from a bank account located overseas. Vendors who prefer to receive payments in their local currency may find this approach more expedient. Transactions can be expedited and simplified for both parties when an overseas bank account is used.

Nevertheless, this may result in currency conversion fees when transferring funds between that account and your local financial institution, and fluctuations in exchange rates may not always be advantageous to you.

Factors to Consider Before Making International Payments

You should consider these factors ahead of time to make sure all international transactions with your vendors go smoothly.

Currency exchange rates

Unanticipated expenditures or savings may result from fluctuations in exchange rates that influence the amount you pay in your local currency. Monitor and prepare for fluctuations in order to make well-informed judgments regarding the timing and method of payment. Your business may incur additional expenses as a consequence of neglecting to evaluate foreign exchange rates.

Ensure that you compare exchange rates and wire fees when evaluating your international payment options.

Legal regulations

Currency exchange, taxes, and import/export duties are among the various regulations that may affect your payment to an international contractor or vendor, as they vary across different countries. By comprehending and complying with these regulations, you can prevent potential legal issues or financial penalties that may result from noncompliance.

Vendor details

It is imperative to comprehend the identity of your international vendor and the location of their headquarters in order to facilitate payment.

Collect information on an international contractor, international employee, or other international supplier, including:

- In locations where the vendor maintains a tax presence

- Which financial institution they are using

- What is their address?

- Who is the primary point of contact?

- Which payment methods are they currently accepting?

The type of payment you should make will be determined by each of these factors.

Taking the time to read the vendor’s terms of payment and return policy can help you decide what is best for you. Think about vendor information in advance to avoid any possible risks to your business.

Transaction fees

To pick the best and cheapest way for your financial transactions, learn about the various payment methods available, such as international wire transfers, letters of credit, and online payment methods. You should also be aware of the possible scams, fees, and currency rates linked to every option so you don’t run into unexpected costs or delays during payments.

Security measures

When operating in many countries, there is greater risk because security rules can change from one nation to another. A proper check of the vendor’s security and a safe payment method will protect you from a data breach or unauthorized charges. Both securing your customers’ trust and your funds can be achieved if security comes first when interacting with international vendors.

Maintaining the trust of your customers and safeguarding your financial assets can be achieved by prioritizing security when conducting business with international vendors.

Processing duration

The payment method you employ can influence whether the money is received prior to the due date, and it is universally appreciated that payments are made punctually. In general, it will require 1 to 5 business days to process and approve an international payment.

While credit cards and online payment portals facilitate the transfer of funds relatively promptly, it still requires time for the payments to be converted, processed, and deposited into the recipient’s bank account.

In the meantime, the processing time may be extended, as international wire transfers and global ACH are routed through intermediary institutions prior to reaching the destination country.

System Integration

Your accounting must be updated each time you make a payment. This entails revising your accounting process, including invoice reconciliation and bookkeeping.

It becomes easier when the payment method fits into your existing systems. Payments that can be processed inside invoicing platforms mean customers won’t have to move data from one tool to another.

Sometimes, even a less cost-effective method becomes the right choice if it fits very well with your existing workflows.

Requirements for making an international payment

The information that must be gathered prior to paying an international vendor is contingent upon the payment method that will be employed. In general, it is advisable to gather the following:

- Name and address of the recipient

- Currency type and amount

- The recipient’s bank name and address

- Recipient’s bank IBAN

- Recipient’s bank BIC/SWIFT code

- Account type into which the funds are being transferred (e.g., savings, checking)

With this information, you are prepared to execute any international payment.

International Vendor Payments FAQs

The following are some frequently asked questions about paying international vendors.

What should I do if my payment gets delayed or lost?

Reach out to your bank without delay and give them the payment information so that they can locate the transfer.

What fees should I expect when sending money overseas?

Fees differ but might cover transfer fees, currency exchange fees, and fees for the receiving bank.

Can I pay vendors in their local currency?

Yes, local currency payments can make the process easier and also reduce the risk of currency exchange.

How do I avoid fraud when paying international vendors?

Make sure to double-check that the vendor is who they claim to be. Also, choose safe payment options and be alert of strange requests.

What are the common mistakes to avoid when paying international vendors?

Incomplete payment details, ignoring the charges, not checking with vendors, and not managing currency risks should be avoided.

What regulations should I be aware of when making international payments?

Be vigilant about possible violations of anti-money laundering regulations, tax declarations, and currency restrictions in the countries involved.

International Payments Made Easy

If you are a small business owner making payments to vendors in other countries, then Cheqly is a great option with international wire transfer services at an affordable price. It offers a reliable, easy-to-use platform that helps you send money overseas quickly and safely.

Get started with a Cheqly business account today and make international transfers effortless.