Neobanks, or digital-first, branchless financial institutions, are radically changing the banking landscape for small businesses in the US. In 2025, these businesses will be going to neobanks more and more for their quick onboarding, clear fees, and fintech-integrated services that are specially tailored for small and medium-sized enterprises (SMEs). By providing more accessible and technology-driven banking solutions, neobanks allow small businesses to handle their cash flow, payments, credit, and expenses not only with more convenience but also with higher effectiveness than traditional banks.

This article explores the market growth, unique needs of small businesses, technology trends, and challenges shaping neobank adoption in 2025. Read on to discover how digital banking transformation can power your business growth.

Market Size and Growth Statistics

The US neobank market stands at an inflection point:

- The US neobanking market generated approximately $15.64 billion in revenue in 2022 and is projected to reach $451.45 billion by 2030, growing at a CAGR of 52.2% between 2023 and 2030.

- Globally, the neobank market is expected to hit $261.4 billion in 2025 and expand beyond $1,219.7 billion by 2029, propelled by customer demand for innovation and embedded fintech solutions.

- Business accounts dominate the market with a 67% revenue share, underscoring SMEs’ strong preference for digital solutions.

- North America remains a leading hub, with a 34.6% CAGR through 2026, powered by tech-savvy millennials, startups, and SMEs adopting advanced banking platforms.

The Unique Banking Needs of Small Businesses

Small businesses face numerous challenges in banking:

- Managing cash flow with unpredictable payment timings.

- Avoiding costly fees and managing minimum balance restrictions.

- Getting fast credit to broaden your business activities.

- A set of financial tools that are integrated to take care of invoicing, payroll, and taxes is needed.

- More and more customers expect to conveniently and easily manage their banking via their mobile devices.

Conventional banks frequently do not have the flexibility and the ability to react quickly to small businesses, which find it necessary to seek out neobank alternatives.

How Neobanks Are Solving These Challenges

By providing digital-first, agile services, neobanks in 2025 will fill the information gap between traditional banking constraints and small businesses with their unique financial needs.

- Seamless Digital Onboarding: Small businesses can create an account within minutes without lengthy paperwork or visiting a physical branch.

- Low and Transparent Fees: Neobanks have zero monthly account maintenance fees and charge competitive, upfront transaction fees.

- Integrated Tools: Automated invoicing, payroll automation, and bookkeeping features simplify complex financial management tasks.

- Alternative Credit Access: AI-driven underwriting models ensure quicker, fairer lending decisions—helping even businesses with limited credit histories gain access to capital.

- Real-Time Payments: Faster settlements give SMEs better control over working capital and reduce dependency on short-term loans.

- Mobile-First Banking: Full-service banking apps empower business owners with 24/7 access to accounts, payments, and tools directly from their smartphones.

Through this customized approach, banking is transformed from an operational nightmare into a growth facilitator.

Top Neobank Technologies Driving Growth

Neobanks are disrupting the banking industry with the help of their creativity and flexibility. Speed, ease, and scale are the main advantages behind their exponential growth. The main reasons for the growth of neobanks include the following:

Artificial Intelligence and Predictive Analytics

The foundation of neobanks’ innovation strategy is now artificial intelligence, with estimates suggesting that 70 percent of neobanks will use AI-based predictive analytics by 2025. With AI, SMEs can project their cash flow and expenses more precisely and ensure a proper fit between budget and revenue cycles. Businesses are better positioned to react to financial crises by taking proactive measures to manage risks while also creating opportunities to explore new growth avenues.

“By 2025, 70% of neobanks are expected to leverage AI-driven predictive analytics”

– Coin Law

Machine Learning for Fraud Detection

Machine learning enhances fraud detection precision by 90% compared to conventional methods, which allows small businesses to be protected from scams, hacker attacks, and illegal transactions. Through the capability to detect risky behavior instantly, the technology eliminates financial losses, protects customer satisfaction, and builds trust in e-banking systems.

“Machine learning enhances the accuracy of fraud detection in banking transactions by up to 90%”

– Resolve Pay

Biometric Authentication

Approximately 90% of neobanks are likely to use biometric security methods like fingerprint scanning and facial recognition by 2025. These methods help security but at the same time make the simple way of accessing accounts. Besides, they also make the digital onboarding and sign-in procedures quicker, which makes the service more convenient and reduces the time consumed.

“Approximately 90% of neobanks will implement biometric security measures like fingerprint and facial recognition by 2025”

– Coin Law

Mobile-First User Experience

By 2025, the extent to which customers use neobank apps will have become very high, as their daily app usage has increased 25 percent, and the average session length is 25 minutes. The trend indicates the reliance of SMEs on straightforward, mobile-first banking solutions. Neobank apps are designed to meet users’ needs, offering customized dashboards, 2-minute alerts, expense management functionalities, and in-app payment features that allow them to carry on with their operations smoothly and efficiently in real time.

“By 2025, daily neobank app use rises 25%, with average sessions reaching 25 minutes”

– Coin Law

Integration with Third-Party Payment Platforms

In 2025, the integration with payment platforms such as PayPal and Stripe increased by 28% significantly extending the payment options and making transactions more accessible for businesses. Through this, neobanks are supporting companies to facilitate their operations, give their customers more payment options, and concentrate on their development while guaranteeing secure and adaptable payment systems.

“User convenience improved as integration with platforms such as PayPal and Stripe rose by 28%”

– Coin Law

Cloud Infrastructure

Around 65% of neobanks have a cloud-based system, which allows them to take advantage of scalability, uptime, and operational efficiency. This enables them to handle increasing transaction volumes, attract more small business customers, roll out new features at a faster pace, and offer a service that, if well managed, is safe and reliable. Therefore, companies can concentrate on development while benefiting from regular and innovative digital banking services.

“Around 65% of neobanks rely on cloud systems to achieve better scalability, uptime, and operational efficiency”

– Coin Law

Open Banking APIs

Almost half of neobanks in 2025 are expected to depend on Open Banking APIs to connect with external digital ecosystems. These APIs merge banking, accounting, and tax platforms along with e-commerce to create customer-centric, connected financial solutions. As a result, small businesses get a smooth working process that includes automatic payment reconciliation, data exchange between software, and a financial overview.

Top US Small Business Sectors Adopting Neobanks

Small business sectors in the US that include quick-moving, technology-driven, and customer-facing models are the most aggressive adopters of neobank solutions in 2025. The flexibility and the ability to deliver complex and affordable banking have led to neobanks being the banking of choice in various sectors.

- Tech Startups and SaaS Firms: They take advantage of the features of a neobank, including API banking, expense automation, and investor tools that simplify financial activities and allow seamless connectivity with their tech stack.

- Freelancers and Solopreneurs: As part of their automated features, neobanks provide tax savings, expense classification, and prompt payments that enable users with irregular cash flows to manage them effectively and save time, as they do not have to handle most of their financial operations manually.

- E-commerce and Online Retail: Online merchants rely on multi-currency accounts and international payment systems to transact effectively across borders.

- Professional and Creative Services: Service businesses, such as consulting and design firms, can simplify their invoicing and manage their expenses and payroll with easy-to-use tools that streamline their operations and save valuable time.

- Food & Beverage / Restaurants: By integrating with Point of Sale (POS) systems, payroll automation, and contactless payments, eateries and cafes employ neobanks to optimize administrative productivity and simplify staff management.

- Gig Economy Workers: Freelancers in delivery, ride-hailing, and short-term contract work benefit from instant credit, digital wallets, and flexible banking services tailored to fluctuating income streams.

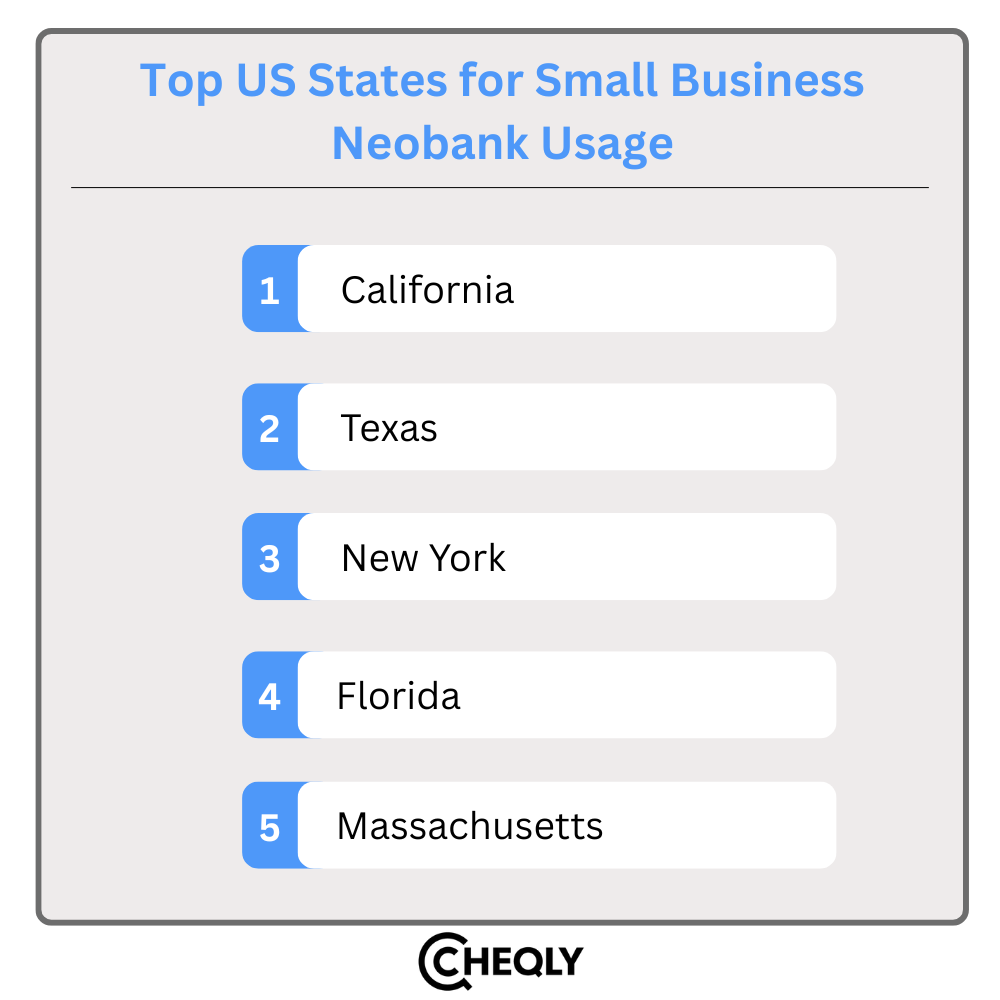

Top US States for Small Business Neobank Usage

Neobank adoption is thriving across the US, but certain states are leading due to startup ecosystems, high entrepreneurial density, and fintech adoption trends.

- California: California, with Silicon Valley at its center, is the top leader in the adoption of neobanks. The reason is that the startups and small businesses are seeking digital-first financial services to get the fast growth and to save time.

- Texas: It has developed a reputation for its blossoming small business market, and as a result, the state’s businesspeople have adopted digital banks to gain better control of their cash flow, make payroll more convenient, and save money through practical use of technology.

- New York: New York is a diversified business center, and small and medium-sized enterprises in the city are significantly dependent on mobile-first and adaptable banking services, thus making neobanks a fascinating option for managing the quick pace of their financial operations.

- Florida: Florida’s tech-savvy entrepreneurs have turned to neobanks to have a smooth and digital-centric banking experience, as the small business sector in the US is growing at a rapid pace.

- Massachusetts: Within the robust fintech ecosystem in Boston, small businesses find it advantageous to make use of cutting-edge neobank solutions that are designed to simplify their daily operations, offer financial automation, and provide innovative banking services.

Challenges & Considerations

Although neobanks are associated with transformative benefits, in the US, small businesses should not ignore the dangers and drawbacks of using digital-first banking solutions.

- Regulatory & Compliance Frameworks: Neobanks have to work with changing regulatory demands. Small enterprises must ensure that their financial partners meet the US requirements to secure funds and guarantee legal protection.

- Cybersecurity Risks: As digital banking has become more popular, the number of cyber threats has also climbed. Owners of enterprises should check if their neobank is equipped with strong fraud detection, encryption, and biometric authentication to ensure security.

- No Physical Branches: Some business owners still value the reassurance of in-person service. Neobanks must address this by offering responsive digital support and advanced self-service tools.

- Market Consolidation: Due to the acquisition of smaller neobanks by large industry players, the competition can decrease, lowering innovation and differentiation of services. Small businesses should carefully consider the long-term viability of providers.

The Road Ahead

The future of neobanks is oriented towards more intelligent, integrated, and secure digital ecosystems, which will fuel the growth of small businesses.

- AI-Based Financial Solutions: Better analytics and credit risk models, predicting trends, minimizing risk, and obtaining specialized financial services.

- Embedded Finance Expansion: Lending and payments will be a direct part of a business platform.

- Hybrid Models: It is anticipated that neobanks will work more closely with fintech start-ups and conventional banks, a combination of innovation and regulatory support.

- Embracing Blockchain: Although it is still not widely used, the implementation of distributed ledger technology (DLT) is being experimented with to improve transparency, facilitate international payments, and possibly make some specific applications safer.

Neobank FAQs

Below are common questions related to neobanks:

Are neobanks regulated like traditional banks?

Yes, most neobanks partner with licensed banks or operate under regulatory frameworks, ensuring compliance and deposit protection.

How do I open a neobank account?

Accounts can often be set up entirely online in minutes, requiring only business documents and identity verification.

Are business debit cards provided by neobanks?

Yes, most neobanks issue physical and virtual debit cards for business transactions.

How quickly are transactions processed in neobanks?

Transactions are typically processed in real-time or within minutes, far faster than many traditional banks.

Can neobanks integrate with other business tools?

Yes. Numerous business neobanks allow complete integration with accounting software, payment platforms, and e-commerce systems to simplify processes and better manage the company’s finances.

Cheqly: A Neobank Designed for Small Business

Neobanks deliver faster access to payments and other financial services that small businesses can use, particularly those usually overlooked by traditional banks. It is predicted that specialized neobanks concentrating on certain niches will expand, whereas big banks will steer clear of startups, thereby restricting their presence in this market. Thus, there is a need for additional user-friendly and creative platforms to adequately assist these underserved businesses.

Neobanking services are paramount for your business. Cheqly provides business accounts along with Visa debit cards for startups and SMEs, with no minimum balance or monthly charges. With Cheqly’s online platform, supported by excellent customer care, you can effortlessly handle your finances from anywhere. Get a Cheqly business account now!