Operational finance plays a big role in keeping a company financially healthy—it covers the day-to-day work and how resources are managed. But when you pair it with strategic financial leadership, it becomes a powerful way to balance today’s needs with tomorrow’s goals. CFOs who can handle both sides—operational and strategic—are in the best position to make smart decisions that boost efficiency, profits, and long-term success.

The article focuses on the roles of operational and strategic CFOs, what they do to help the company grow, and how to combine both leadership styles to align financial goals with business objectives.

Understanding Operational Finance Leadership

Operational financial leadership focuses on maintaining and upgrading a company’s financial workflow and structure. It manages the financial figures related to business cash flow, which includes sales revenue and government payments, as well as inventory expenses. The operational financial leader evaluates the product risk release level, as well as accounting protocols and the status of executive-investor relationships. Operational financial leadership means looking at how a business makes money and finding ways to make the process more efficient or fix any problems.

For example, take the case of a company that focuses on offering accessories and chargers for mobile phones. The operational CFO would be in charge of checking the cost of each charger produced, the eventual profit that can be realized at the end of the year, and the various available cost-cutting opportunities.

What is Strategic Finance Leadership?

Strategic financial leadership is a leadership style that utilizes an organization’s overall financial planning for future success. Strategic financial executives have dual responsibilities that include operational financial oversight and future-oriented insight development and strategic planning. This duty involves establishing relevant objectives and goals for the next five to ten years, as well as developing roadmaps and identifying key performance indicators (KPIs) that will enable the company to pursue these objectives realistically. Additionally, strategic financial leaders may collaborate more closely with other executives to create supply chain or marketing strategies.

In a similar context to the aforementioned example of a phone accessories company, a strategic CFO would scrutinize the financial figures from their operations and also contemplate the company’s potential for growth as a whole. This may entail that the company aims to achieve its long-term financial objectives through the implementation of supply chain innovations that can reduce per-unit costs, the establishment of partnerships that increase brand awareness, or a price increase for its products.

Operational CFO vs. Strategic CFO: A Leadership Comparison

The financial oversight of a company requires both strategic and operational CFOs who contribute distinct competencies to the organization. These leadership approaches demonstrate major differences due to the following aspects:

Responsibilities

Operational CFOs need to understand how a company operates internally so they can enhance performance by eliminating redundancies. They accomplish this by meticulously examining each function, identifying areas for enhancement, and reducing unnecessary expenses.

The financial health of the company and its potential for future growth are the primary focus of strategic CFOs. They assist management in establishing practical, long-term financial objectives and provide guidance to help the company achieve those goals.

Focus Areas

Operational CFOs concentrate on the daily operations of the business, devising strategies to optimize processes, including:

- Assigning team members to tasks

- Ineffective advertising campaigns are temporarily suspended.

- Optimizing productivity by consolidating tools.

CFOs who prioritize strategic objectives will concentrate on the organization’s comprehensive financial strategy. They frequently collaborate with product designers to develop more profitable product lines, work closely with accountants to ensure accurate financial reporting and explore revenue generation opportunities in emerging markets.

Time Horizon

Operational CFOs typically focus on shorter timeframes, analyzing financial data from the past and present that has been collected over a period of several months to a year.

On the other hand, strategic finance leaders employ a more long-term perspective, assessing information over a period of several years to obtain insights and analysis.

Scope

The operational aspect of a CFO will focus on business units or departments, examining granular details such as daily raw material costs or an individual’s weekly performance.

On the other hand, CFOs who prioritize the strategic aspect of the position will typically adopt a more comprehensive approach, guaranteeing that each department accomplishes its financial goals and fostering company-wide expansion.

Ways Operational and Strategic CFOs Support Businesses

Operational and strategic CFOs are both important to the financial management of a company and need to work together. Operational CFOs are responsible for routine financial operations, while strategic CFOs focus on future growth and competitive positioning. Here are some ways each of them can support your company:

Operational CFOs provide the following benefits to your business:

- Minimize unnecessary expenditures

- Maximize return on investment

- Perform financial analysis and performance management

- Identify and rectify inefficiencies

- Be aware of the company’s financial status and operations

- Offer a thorough assessment of the organization’s current financial status

Your business can benefit from strategic CFOs in the following ways:

- Partnering with executives to facilitate future planning

- Assessing the organization’s financial stability

- Collaborating with the CEO and HR to address financial personnel requirements

- Determining strategies for resource allocation

- Enabling sustainable expansion through mergers and acquisitions

- Increasing the confidence of investors and stakeholders

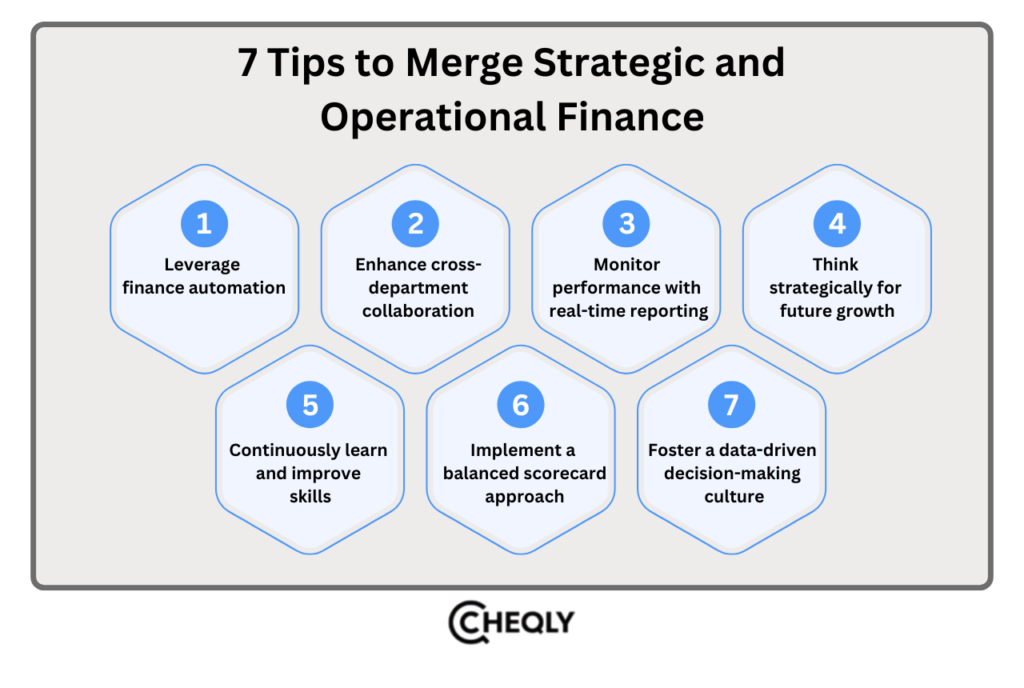

7 Tips to Merge Strategic and Operational Finance

Combining strategic and operational finance is key to connecting long-term goals with day-to-day financial work. Here are seven useful tips to help you bring these two areas together effectively:

Leverage Finance Automation

Your implementation of advanced automation systems creates more time for improved strategic decision-making and allows you to carry out extensive operational analyses.

Enhance Cross-Department Collaboration

Effective department partnership serves as your key approach to merging strategic and operational finance activities seamlessly.

Observe how staff members understand each other’s priorities by encouraging open communication, as this will result in financial strategies that align with organizational goals.

Monitor Performance with Real-Time Reporting

The use of real-time reporting systems brings organizations an advantageous competitive position. As a contemporary CFO, you will be able to address deviations from anticipated outcomes and maintain a harmonious balance between strategic and operational concerns by monitoring performance indicators in real time.

Think Strategically for Future Growth

A series of examinations of past achievements needs adjustment because we must develop a future-oriented outlook. Achieve financial stability along with long-term business success through market change prediction, followed by growth opportunity identification and risk prevention.

Continuously Learn and Improve Skills

A person should continually upgrade their skills and stay current on industry developments as the financial sector continues to undergo transformation.

To become a full-fledged CFO who comprehends both strategic and operational finance, one should embrace professional development opportunities.

Implement a Balanced Scorecard Approach

An organized scorecard system that combines strategic and operational finance KPIs enables organizations to achieve maximum performance benefits.

This impactful solution connects financial targets to the overall business objectives, which in turn ensures that immediate short-term operational improvements help achieve long-term strategic development.

Foster a Data-Driven Decision-Making Culture

Your organization should learn how to make decisions based on data by promoting the value of data as an operational tool. Teams should use data as their primary decision-making tool to demonstrate their impact on the company’s financial position.

In conclusion, the ability to master operational finance enables CFOs to transition from basic number processing to full business partnership status. CFOs who synchronize their financial operations with their strategic plans will achieve improved financial health with greater operational efficiencies that drive sustainable business expansion. A modern CFO needs to execute both operational tasks and strategic management because these skills position them to succeed in today’s fast-moving market.

FAQs: Operational Finance for CFOs

Given below are a few frequently asked questions that are relevant to operational finance and will help CFOs enhance their financial leadership and decision-making skills.

How can CFOs use data analytics in operational finance?

CFOs can use data analytics to identify patterns, make accurate forecasts, and execute data-driven solutions, thus making the business thrive.

What metrics are essential in operational finance?

Operating margin, budget variance, cash flow, working capital ratio, and return on assets (ROA) are the metrics one should definitely monitor.

What tools help manage operational finance effectively?

Tools like ERP systems, financial dashboards, accounting software, and automation platforms can be used for reporting and compliance.

How can CFOs align operational finance with business goals?

Through the establishment of measurable KPIs, the allocation of resources according to strategic objectives, and the regular checking of performance.

What are the biggest challenges CFOs face in operational finance?

The challenges you may encounter include managing unpredictable cash flow, controlling expenses, aligning your financial and operational goals, and adapting to changes in the market.

Optimize Business Operations Using Cheqly

Cheqly helps businesses handle their money without the hassle. With free domestic ACH transfers, affordable international wire transfers, and both virtual and physical debit cards, managing your finances is simple. You get real-time updates to stay in control, avoid mistakes, and make smarter decisions. And with customer support, you can count on Cheqly to keep your business steady in a fast-moving world.

Optimize your business operations by signing up for a Cheqly business account today.