One of the most essential processes in business finance that is usually hard is payment management. At times, a company may experience cash flow interruptions due to errors, delays, or even mismatched records. Such problems may also lead to the weakening of the company’s relationships with suppliers and customers. This is the moment when payment reconciliation steps in. Confirming that each transaction sent or received matches the related invoices and bank entries essentially removes the hassle from businesses’ financial management.

In this article, we are going to explain the concept of payment reconciliation, its importance, and the process involved in practical payment reconciliation.

What is Payment Reconciliation?

Payment reconciliation is the matching and comparison of transaction data to verify that the payments that have been made or received are accurate, and that they correspond to what is recorded in the company’s accounting books or financial statements. The three steps of payment reconciliation help check the accuracy of financial transactions, find and solve issues or fraudulent activities, and maintain the integrity of financial data.

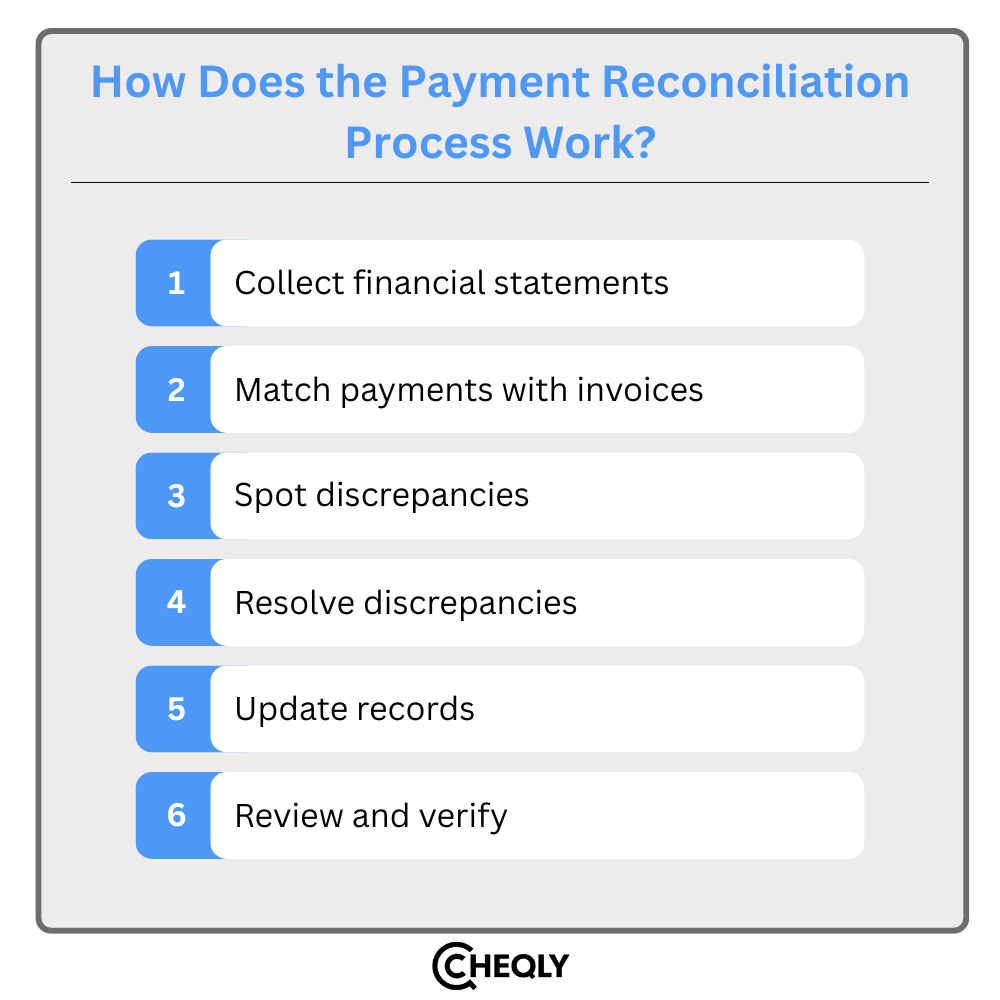

How Does the Payment Reconciliation Process Work?

Financial accuracy and cash flow visibility depend heavily on efficient payment reconciliation. Whether performed manually or through automation, a structured approach ensures that all transactions are captured and exceptions are properly resolved.

- Collect financial statements: Collect all necessary payment data, such as bank statements, ERP records, payment gateways, etc. It is the guarantee of the completeness of transactions if this information is unified.

- Match payments with invoices: Match the payments that have been made to invoices or orders that you know. Automated reconciliation tools can perform this step quickly, thus reducing the number of errors and the amount of manual work.

- Spot discrepancies: Unmatched or partial payments, duplicate transactions, or discrepancies may be indicated. A time delay during the financial close can be avoided if the problem is recognized beforehand.

- Resolve discrepancies: Work together with the relevant departments to ensure that the exceptions are resolved by verifying that the customer’s payments were made, correcting the data that was entered wrongly, or making changes to the required records.

- Update records: Once errors are fixed, ensure that payment and invoice statuses are correctly updated in the accounting system or general ledger.

- Review and verify: Financial managers must check the transactions that have been reconciled for correctness and give their approval before the financial close is finalized.

What Are the Different Types of Payment Reconciliation?

Businesses use a variety of reconciliation methods depending on their financial activities and the accounts involved:

1. Bank Reconciliation

This entails comparing a company’s internal cash (for example, a general ledger cash account) with bank records seen on financial institution bank statements.

2. Credit Card Reconciliation

Credit card reconciliation involves ensuring that all credit card transactions recorded within the company are reflected on the bank statements or the credit card issuing company. This process is essential for identifying fraudulent charges and ensuring the accurate documentation of payment services.

3. Accounts Receivable Reconciliation

This procedure compares records of accounts receivable that depict amounts owed by customers with actual payments from customers. It will help detect discrepancies like overpayment or underpayment and ensure that the funds coming in are properly recorded.

4. Account Payable Reconciliation

Accounts payable reconciliation checks the company’s accounts payable records for amounts owed to vendors/suppliers with the invoices received from such vendors. This method is critical for detecting errors, such as duplicate or missed payments, and keeping correct records of outgoing monies.

5. Other Types of Reconciliation

- Payroll Reconciliation: Indicates that the payroll amounts that have been reported internally are the payments made to employees and withholdings.

- General Ledger Reconciliation: Bridges the subsidiary ledgers with the general ledger, confirming that the business is accurate and consistent throughout.

- Digital Wallet Reconciliation: Compares transactions from digital wallets such as Apple Pay and Google Pay with accounting data.

- Recurring Payments Reconciliation: It confirms the transactions that take place regularly, for example, subscriptions or contract payments, and that these transactions have been properly recorded and matched in the accounting system, irrespective of the payment method.

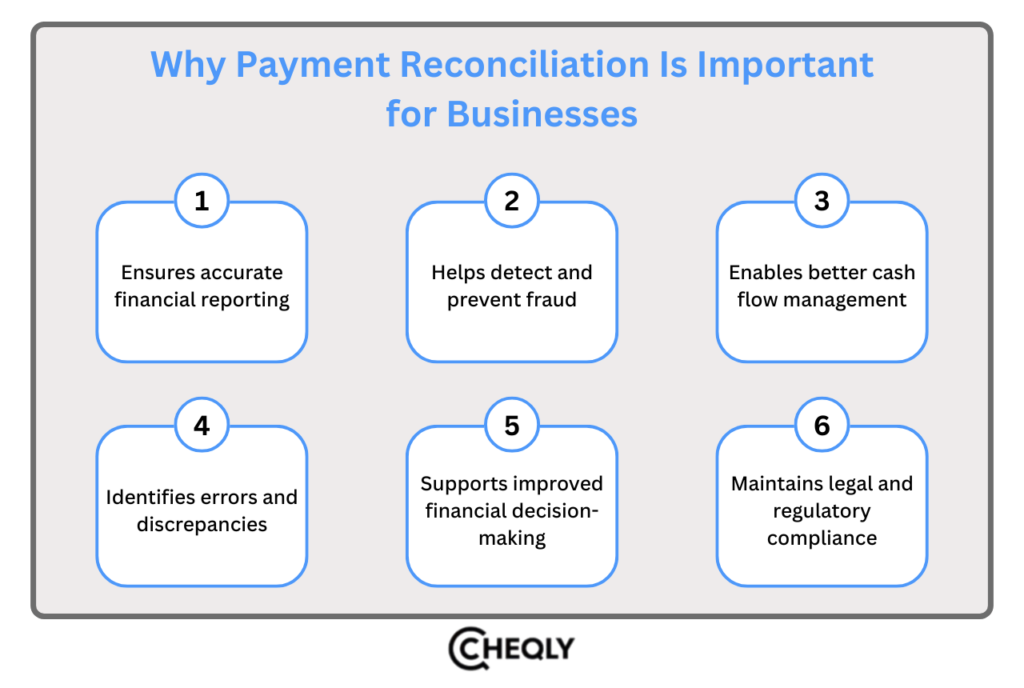

Why Payment Reconciliation Is Important for Businesses

Payment reconciliation is the confirmation that all payments correspond with invoices, bank accounts, and accounting documents. The inefficiency of the reconciliation can lead to slower financial closure, limited visibility of cash flow, and an increased number of errors. This is the reason why great payment reconciliation is the key to success for the finance teams of today.

- Ensures accurate financial reporting: Accurate payment reconciliation provides financial accuracy, as it can stop the occurrence of accounting errors. This helps avoid inaccuracies in reporting that may have a considerable impact on the decision-making process and compliance.

- Helps detect and prevent fraud: Manual reconciliation can be inaccurate and take up a lot of time. By making the reconciliation process a part of the automation process, the number of errors committed by humans is reduced, and the overall financial closing is faster.

- Enables better cash flow management: Reconciliation is often seen as a way to improve cash flow because it provides up-to-date figures for cash on hand and cash payables. The better visibility of cash is linked to better cash management and more effective financial planning.

- Identifies errors and discrepancies: One of the main benefits of a clean reconciliation trail is that it enables companies to comply with regulations and get ready for inspections. An automatic reconciliation process greatly simplifies the maintenance of accurate records.

- Supports improved financial decision-making: Reducing manual reconciliation tasks allows finance teams to focus on trend research, working capital optimization, and enhancing business performance.

- Maintains legal and regulatory compliance: Accurate payment reconciliation, which is devoid of errors, leads to fewer disagreements with customers as well as suppliers, thereby raising trust in financial reporting for management, investors, and auditors.

Payment Reconciliation Best Practices

Firms should implement some best practices to ensure their financial statements are accurate, prevent the occurrence of fraud, and make the payment reconciliation process more efficient:

- Regularly conduct reconciliation: It should be done on a regular basis, preferably daily or at least monthly, to keep accurate financial records and spot inconsistencies quickly. Regular reconciliation enables the early detection and resolution of difficulties.

- Utilize reconciliation software solutions: It can be automated using specialist software to boost accuracy, save time, improve efficiency, get real-time visibility into cash positions, handle enormous transaction volumes, and ensure scalability. Reconciliation software uses powerful algorithms and rule-based matching to achieve accurate and consistent reconciliation.

- Ensure segregation of duties: In order to minimize errors and fraud, the payment jobs ought to be separated among the employees. One employee should be in charge of transactions while another should be recording, reconciling, and approving. Proper audit and authorization routines guarantee supervision and stop any employee from having excessive power.

- Maintain comprehensive documentation: Maintain detailed documentation throughout the reconciliation process to provide an audit trail, ensure compliance with accounting standards and regulations, allow for cross-checking by other team members, facilitate new employee training, and identify process improvements. Thorough documentation promotes transparency and accountability.

FAQs on Payment Reconciliation

Here are answers to some common questions related to payment reconciliation:

How often should businesses perform payment reconciliation?

Businesses ought to do payment reconciliations on a regular basis. In fact, these should be done daily if the number of transactions is large, or at least monthly if the business is smaller, in order to ensure the accuracy of records and uncover any inconsistencies quickly.

Can payment reconciliation be automated?

Yes. Specialist reconciliation software simplifies procedures, improves precision, time efficiency, and offers up-to-date visibility of both cash positions and transaction volumes.

What are common challenges in payment reconciliation?

Some of the challenges faced include managing enormous transaction volumes, dealing with data that is distributed in various systems, fixing exceptions such as partial payments, and ensuring that documentation is audit-ready.

How long does payment reconciliation take?

The time needed for manual reconciliation is sometimes measured in hours or even days. However, if automation is used, the process can be shortened by 70% or even more, which in turn allows financial closing to be done with less time and more efficiency.

How does reconciliation support compliance?

Reconciliation fulfills the need for records to comply with regulations and be audit-friendly, thus providing both the authorities and stakeholders with a clean, transparent trail.

Can small businesses benefit from payment reconciliation?

Absolutely. Small businesses get better control over their cash flow, lower risk of mistakes, increased confidence in the reports they produce, and easier audit preparation.

How does reconciliation improve decision-making?

Reconciliation provides actual cash visibility on a real-time basis, enabling a more effective strategic planning process. This, in turn, creates the potential for the organization to have better budgeting and make worthy investments.

Can reconciliation errors affect taxes?

Yes, Uncorrected errors may lead to the filing of incorrect tax returns, penalties, or audits. Routine and detailed reconciliation is essential for the observance of tax laws.

How can businesses make reconciliation more efficient?

Employ automated tools, clearly define roles, keep a record, and conduct timely, regular inspections to reduce errors and enhance procedures.

Get started with a secure Cheqly account today

Cheqly makes it easy for entrepreneurs to launch their businesses quickly by setting up a straightforward business account and offering easy-to-understand financial tools. The whole process, from taking control of payments to monitoring cash flow, runs smoothly with Cheqly’s platform, which not only saves users valuable time but also reduces hassles and provides entrepreneurs with a clear view of their finances.

Create a stronger financial foundation—start with a Cheqly business account today.