Every business owner wants to succeed and make money, but how you manage your cash is just as important. Profit is a good goal, but it doesn’t tell the whole story. To really understand your business’s financial health, you need to track your cash flow closely.

Cash flow is basically the money that comes in and out of a business during a specific time period. Cash flow-positive businesses have more money coming in than going out.

So, what does cash flow positive really mean, and why does it matter? Keep reading to find out, particularly if you’re a business owner wanting to improve your finances and make smarter choices.

What is Positive Cash Flow?

A company experiences positive cash flow when its cash inflows surpass its disbursements. In simpler terms, the organization generates more money than it spends. Efficient inventory and accounts receivable administration are the most common methods. This is advantageous for any organization, as it shows that the organization is maintaining a satisfactory cash balance and helps build reserves to deal with unexpected situations or use when needed.

Examples of Cash Inflows vs. Cash Outflows

| Cash Inflow | Cash Outflow |

|---|---|

| Selling of Inventory | Buying Inventory |

| Payments of Customers | Returns of Customers |

| Interest earned on investments | Interest paid on business loans or credit cards |

| Dividends on High-Yield Savings Accounts | Fees of Business Accounts |

| Income on Rent | Rent Payments |

| Returns on Tax | Tax on Bills |

| Payment for Services | Payroll Expenses |

Positive vs Negative Cash Flow: What You Need to Know

In contrast to negative cash flow, let us examine the definition of positive cash flow.

A business that experiences negative cash flow incurs more expenses than it generates money. Nevertheless, negative cash flow does not inherently indicate your business is doomed.

Consider the scenario where you acquire new equipment to increase your inventory production. Your company may be at risk for a few weeks or months due to the initial equipment expense. The new machinery enables you to fulfill a greater number of orders and generate a greater amount of revenue. A negative cash flow can result from a business investment in the short term. However, you may be able to profit from this investment in the long run.

Even so, sustaining a negative cash flow is not feasible. If you cannot cover your daily operating expenses, you may need to reevaluate your pricing, obtain a loan, or establish a credit card to cover these expenses. The expenses associated with borrowing can accumulate rapidly, which may expose your small business to risk. However, positive cash flow guarantees that you will have sufficient funds to cover your operating expenses and accounts payable.

Types of Cash Flow

Operating cash flow, financing cash flow, and investment cash flow are the three most prevalent types of cash flow that business owners encounter. Here is how they differ:

Operating cash flow

This cash flow provides a snapshot of its daily operations, including the income from sales and the outflows from salaries, vendor fees, lease payments, taxes, and interest payments. A company is cash flow positive if its sales exceed its operating expenses.

Investing cash flow

Cash flow from investing activities (CFI) refers to money related to long-term investment. The company’s negative investing cash flow refers to the situation when it invests in a startup, meaning it spends more money. A company’s investing cash flow is positive when it sells its startup shares and recovers the money it invested.

Financing cash flow

Financing cash flow, or cash flow from financing activities (CFF), is the net cash associated with financing activities that support numerous companies. To finance operational expenditures, certain organizations sell ownership shares to investors. Certain financing activities generate money, such as selling bonds to raise cash. In contrast, others disburse funds, such as investor stock purchases and dividend payments. For some startups, financing cash flow will be more important than operating cash flow in the company’s overall cash flow management.

Is Positive Cash Flow the Same as Making a Profit?

Profitable enterprises do not necessarily have positive cash flow; the reverse is also true.

A positive cash flow indicates that the liquid assets of a business are increasing. As a result of this growth, the business is able to reinvest in operations, cover expenses, and establish a safety net should future financial challenges arise. While profit represents the business’s overall earning performance after all costs and expenses are deducted from revenue.

For example, a gym may be cash flow positive as a result of the consistent inflow of revenue from monthly memberships. However, the business may run into a loss because of the hefty amount of money they are spending on brand-new fitness equipment and trainers, which are required to make a better customer experience and be on top of the competition in a demanding market. Due to these cost additions, the gym would present a net loss in its income statement instead of a net profit. Nevertheless, business operations and growth initiatives can persist due to the company’s positive cash flow.

Some small businesses are comfortable experiencing a temporary decline in cash flow if it results in long-term revenue growth. Negative cash flow can adversely affect profitability; therefore, establishing the appropriate balance is crucial.

Is My Business Experiencing Positive Cash Flow?

To maintain their operations, small enterprises require access to cash. Nevertheless, many small business owners encounter liquidity-related challenges at some point.

So, how can you tell if your organization is cash flow-positive? Start by reviewing your cash flow statement, which tracks the movement of cash and cash equivalents over a specific period. This statement helps you assess your liquid assets (like cash) and understand your liabilities.

Your business most likely generates a cash flow statement through your accounting software. Your financial statements depend on the quality of your bookkeeping habits at present. Before beginning the process, seek professional guidance from your qualified accountant or bookkeeper.

Key Tips for Analyzing Your Cash Flow Statement

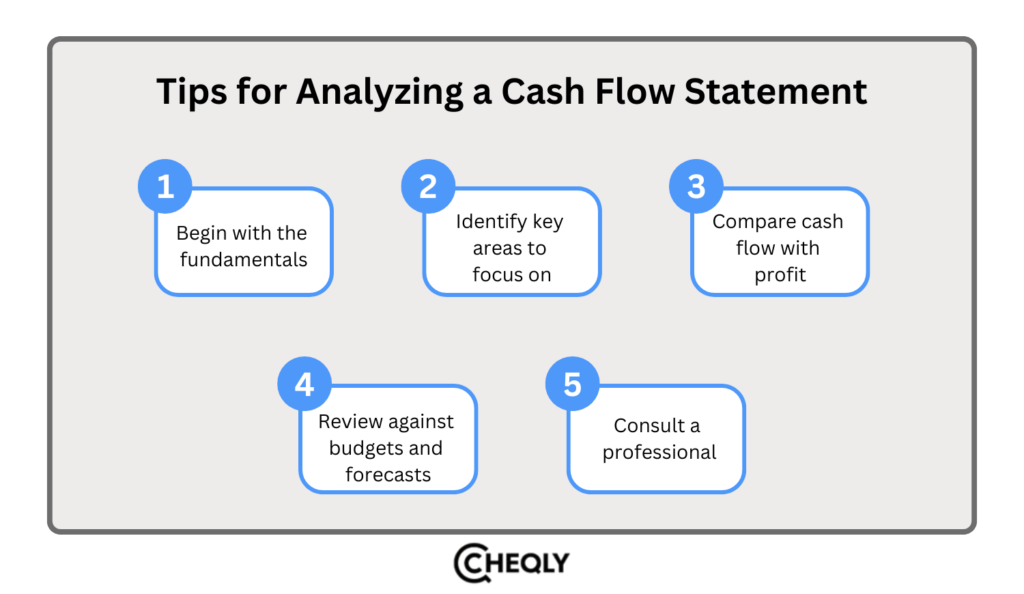

Pay attention to the following tips to succeed when analyzing your cash flow statement for the first time:

- Begin with the fundamentals: Get familiar with the three sections—operating activities, financing activities, and investing activities—that show the different parts of a cash flow statement. After understanding what makes up your organization’s financial movement, the various types of cash flow between your business and outside entities will become clear to you.

- Identify key areas to focus on: Monitor the “net increase or decrease in cash” line, which indicates how much your business’s liquid assets have increased or decreased over a specific period. A positive number indicates that your business generates more money than it spends, whereas a negative number indicates the opposite.

- Compare cash flow with profit: If your business’s profits greatly differ from its cash flow, find the source. A possible reason could be that high profits alongside low cash flow mean your customers are late on payments, so the income is tied up in accounts receivable.

- Review against budgets and forecasts: When your organization creates financial forecasts or budgets, look for differences between planned numbers and actual cash flow results. Through this approach, it is possible to determine if your business is on track, falling behind, or outperforming expectations.

- Consult a professional: If you’ve trouble understanding your cash flow statement, an accountant or financial advisor may give you good advice. These specialists clarify extensive financial data and make more clear the information.

Positive cash flow isn’t just a number—it’s what keeps your business stable and growing. By managing cash coming in and going out, you can cover expenses, reinvest in your business, and build a cushion for unexpected challenges. Whether you’re looking at cash flow statements, matching budgets to forecasts, or understanding the difference between profit and cash, keeping track of your cash flow is key.

Having and keeping positive cash flow helps your business take advantage of growth opportunities, pay bills, and secure its future.

Positive Cash Flow FAQs

Learn the basics of positive cash flow with these common questions.

How can I improve my business’s cash flow?

Sending invoices quickly, chasing down late payments, getting better terms with suppliers, managing inventory well, and cutting unnecessary expenses can all boost your cash flow.

What are the main sources of positive cash flow?

Strong sales, timely customer payments, cost control, proper financial planning, and efficient inventory management are the main positive cash flow sources.

Can a business be profitable yet still struggle with negative cash flow?

Yes, a company may seem profitable on paper, but it may still face a cash flow problem when the customers pay in a very slow manner, costs are too high, or cash is actually blocked in the form of inventory.

What are the biggest cash flow pitfalls to avoid?

Common mistakes include:

- Cash flow is not being monitored regularly.

- Overestimating income and undervaluing costs.

- Not keeping track of accounts receivable and allowing customers to pay late.

- Spending too much on inventory or fixed assets without having enough cash reserves.

How often should I check my cash flow?

It’s a good idea to check your cash flow:

- Weekly or monthly for small businesses or those with limited cash.

- Quarterly for larger businesses with steadier cash flow.

Regular checks help spot trends, predict shortfalls, and make better decisions.

What financial statements help track cash flow?

The cash flow statement is the main document for tracking cash flow, while the profit and loss statement and balance sheet give you more details.

Get Better Control of Your Cash Flow with Cheqly

It’s quite a challenge to manage cash flow as a small business owner, but Cheqly makes it more manageable. With real-time tracking and detailed reports, you can be sure you’re always on top of what matters most in your finances.

Join Cheqly today to boost your business cash flow.