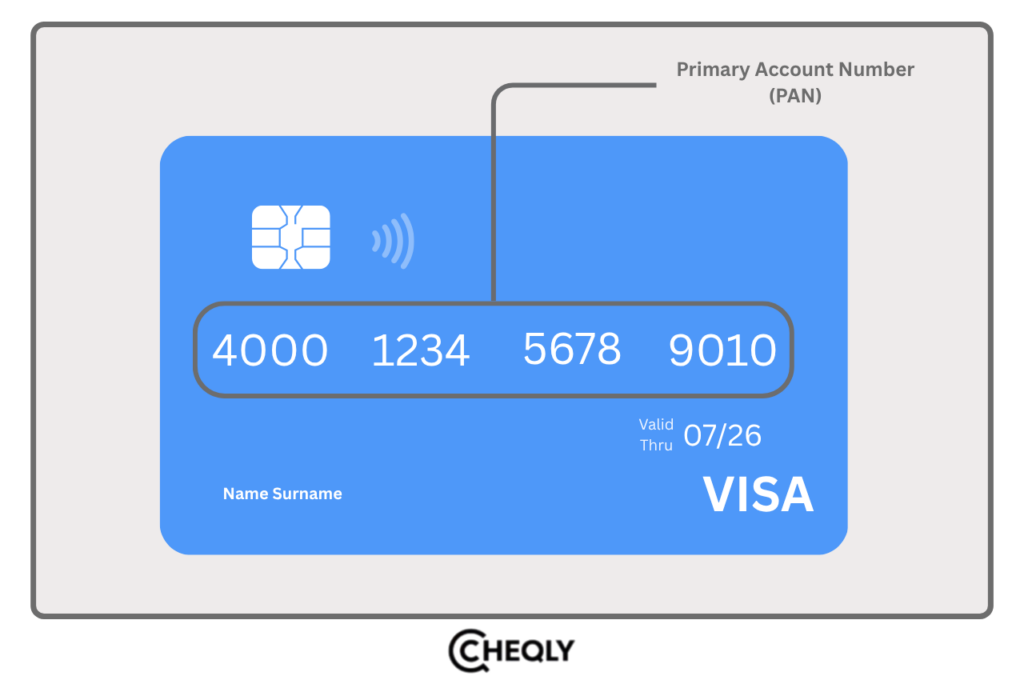

In the modern era of a rapidly changing digital economy, undertaking credit card transactions necessitates that the confidentiality of customer data is guaranteed, and companies must regard this as a key priority. One aspect related to card payments is the Primary Account Number (PAN), which is a set of numbers that appears on the card.

The PAN is basically a set of digits that are used on credit, debit, and also virtual or prepaid cards. It is an essential element for the smooth transfer of data in payment transactions. The PAN, although it does not have any intrinsic features for fraud prevention, still needs to be kept safe because if it gets into the hands of unauthorized persons, they can use it to commit fraud.

In this article, you will learn what Primary Account Numbers (PANs) are, how they function, how they are different from account and routing numbers, and the best ways to keep them safe.

Key Takeaways

- The PAN is a 14- to 19-digit number printed or embossed on a card that uniquely identifies the cardholder’s account.

- It helps payments go through smoothly during transactions between customers, merchants, financial institutions, and payment networks.

- PANs are still the primary target of fraudsters who make unauthorized transactions without their knowledge. If they get hold of the PANs, they can cause huge financial losses to you. Hence, PANs must be kept safe because they carry very sensitive information.

- Businesses can also make sure that their PANs are safe and, at the same time, lessen the chances of cyberattacks if they implement security measures such as encryption and tokenization.

- Compliance with PCI DSS is mandatory for businesses handling PANs to protect sensitive cardholder information.

What is a primary account number (PAN)?

A payment card number, or simply a card number, is another name for a primary account number (PAN), which is basically a distinct set of digits. A unique PAN connected to the cardholder’s bank or eWallet account is automatically generated by the issuer when a customer orders a new card.

Because it is unique to a customer’s payment card, this number differs from bank account numbers like SWIFT and BIC. Additionally, the digit sequence is not completely random but rather adheres to a predetermined framework. The ISO/IEC 7812 standard, which enables the identification of the card and the cardholder, is really met by them. This number should be kept secure because it can be used to commit credit card fraud.

How PANs (Primary Account Numbers) work

Anyone working in the payment processing sector needs to understand the function of the Primary Account Number (PAN). The role of the PAN in a card payment transaction can be illustrated as follows:

Start of transaction

The payment terminal reads the PAN from the card when the cardholder starts a transaction, either through the EMV chip, the magnetic strip, or near-field communication (NFC) (for contactless payments).

Tokenization

Transaction security is strengthened by tokenization, especially in digital or card-not-present (CNP) contexts. In the case that transaction data is compromised, this procedure protects the actual account details by substituting a unique token for the PAN for every transaction.

Information transfer

The business’s bank, referred to as the acquiring bank or acquirer, gets the encrypted transaction data that contains the PAN, transaction amount, and business details.

Forwarding to the payment network

A card network passes this data from the acquiring bank to the cardholder’s bank, which is also called the issuing bank or issuer, through the card network.

Verification and validation

The issuing bank confirms the cardholder’s account by the card number (PAN) and checks if the available balance is enough. It also verifies that no suspicious behavior has been found. If the bank is satisfied with the set of conditions, it authorizes the transaction.

Final transaction approval

After the transaction has been authorized by the issuing bank and the card network has passed the transaction to the acquiring bank, the response is usually delivered to the business’s terminal within a few seconds.

How can merchants safeguard their customers’ PANs?

Businesses must understand that PAN security is very important because it is the backbone of payment processing. Security standards like the Payment Card Industry Data Security Standard (PCI DSS) protect PANs while they are being processed, transmitted, and stored. These standards include the following actions:

- Truncation: It is the process that involves hiding a part of the PAN when it is shown. Hence, if a receipt or a payment confirmation screen is used, then only the last four digits may be visible, and the rest of the digits would be replaced with “X”s or asterisks. This way of protecting the PAN is done by limiting the number of characters that are displayed, thus making it harder for the number to be intercepted by unscrupulous persons who may then use it to commit fraud or misuse.

- Masking: Like truncation, masking obscures a portion of the PAN, usually when the cardholder enters the number or it is on the screen. For example, it’s typical to see an asterisk appear next to each digit of your card number when you type it into a website. This makes it impossible for malicious screen capture software or someone watching you from behind to read the entire PAN.

- Encryption: The PAN information that is coded via this process makes it unreadable to users who do not have the decryption key. The system also protects the PAN by encrypting it while it moves from the transaction point (for instance, a payment terminal) to the bank. The encryption gives the fraudsters no chance; even if they find the transaction data along the way, they cannot decrypt or misuse it.

How Primary Account Numbers Differ from Account Numbers

PANs and bank account numbers are unique identifiers that are very important in financial transactions. However, these two have different roles in payment processing.

Primary Account Number

A PAN is a number that is between 14 and 19 digits and is found on prepaid, debit, or credit cards. It is the cardholder’s account and also gives details about the issuing bank and card type. A PAN is confidential information that needs strong security when it is used in online and POS transactions. Rules like PCI DSS tell the companies how to keep the PANs safe while they are being stored, sent, or used.

Account Number

A unique identifier that is used for bank accounts and is not related to the card issuer or the card type. Mainly, it is used for direct banking operations such as deposits, withdrawals, and transfers. It can be seen on bank statements or retrieved via bank portals and is not governed by PCI DSS standards, which apply to PANs.

PANs play a key role in card payments and need strong protection. Account numbers are mainly used for bank-related transactions. Businesses should understand both to keep financial data safe and secure.

Comparison of PAN, Account Number, and Routing Number

It is very important to know the differences between PAN, account number, and routing number in order to avoid fraud and make correct transactions with banks.

| Feature | PAN (Primary Account Number) | Bank Account Number | Routing Number |

| Where Found | Credit, debit, and prepaid cards | Bank statements, digital banking apps | Bank statements, checks |

| Length | 14 to 19 digits | Typically 8 to 12 digits | 9 digits (in the U.S.) |

| Purpose | Identifies a cardholder’s payment account for card transactions | Uniquely identifies a customer’s account at a financial institution | Identifies the bank or financial institution involved in a transaction |

| Used For | Card payments (POS, online, contactless) | Bank transfers, direct debits, ACH, and statements | Routing electronic payments such as wire transfers and direct deposits |

| Issuing Entity | Payment networks (Visa, MasterCard, etc.) | Banks or credit unions | Federal Reserve or banking authorities |

| Security Relevance | Target for payment fraud; subject to PCI DSS security | Sensitive, but not subject to PCI DSS; secured by banks’ policies | Less targeted, but crucial for bank transfer accuracy |

FAQs on Primary Account Numbers (PANs)

The following are some frequently asked questions about primary account numbers (PANs).

What should I do if my PAN is exposed?

In case your PAN is compromised, get in touch with your bank or card issuer and have your card blocked and replaced. Look out for your account to detect any suspicious activities and alert those in charge immediately.

Is it safe to store PANs?

Enterprises that collect and store PANs have a great responsibility to protect the data by using encryption and following PCI DSS requirements in order to be sure that the customers’ information is not compromised.

What is an IIN or BIN in a PAN?

The Issuer Identification Number (IIN), also known as the Bank Identification Number (BIN), is made up of the first 6 to 8 digits of a payment card. It tells you which bank or financial institution issued the card.

How are PANs protected during online transactions?

PANs are generally encrypted and protected with security protocols like SSL/TLS while carrying out online transactions. A lot of systems additionally employ technologies like tokenization and multi-factor authentication to ensure that privacy is maintained.

Why is the PAN important in payment processing?

The PAN helps banks and payment systems complete card payments quickly and accurately by identifying your account. Without the PAN, electronic card payments wouldn’t be possible.

Can two cards have the same PAN?

No, each PAN is different and given to just one person to avoid confusion and make sure payments are handled safely.

Can a PAN reveal personal information about the cardholder?

A PAN on its own is not capable of revealing personal information; however, if it is used along with other data, it can lead to a breach of the privacy of the cardholder.

Safeguard your business with a Cheqly Visa Debit Card

Cheqly, being a neobank, offers your business both physical and virtual Visa Debit Cards, which are flexible and secure ways to manage spending. These cards give you the ability to buy directly from your business account, which means you don’t have to transfer money or use personal cards. With instant access to your money, handling operational expenses, travel, online purchases, or vendor payments becomes easy. The virtual debit card is perfect for instant use and online expenditure; hence, your business will have a quick and safe method to remain operational without any interruptions.

Open a Cheqly account and safeguard your business with a Visa Debit Card.