Most US businesses use ACH payments, an electronic payment method that is quite suitable for all types of business transactions. Reports show that the ACH transaction completed 33.6 billion payments in 2024, which generated more than $86.2 trillion. Businesses rely on the ACH payments to pay their employees, receive funds from investors, and get payments from their customers.

ACH payments are more cost-effective than other forms of electronic payments, like wire transfers and credit card transactions. However, ACH payments are not instantaneous; they offer security and take a few days to complete.

While some ACH transactions are one-time payments, many occur regularly. Recurring ACH payments automatically transfer money between accounts on a set schedule. Once set up, these payments happen automatically.

This article explains recurring ACH payments, how they work, and why they’re useful for businesses to manage payments and improve cash flow.

What are Recurring ACH Payments?

Electronic funds transfer through the Automated Clearing House network makes ACH payments one of the most prevalent payment methods in the United States. These payments enable bank-to-bank transfers that substitute for check payments and direct money exchanges. Through the ACH system, employers use it for payroll deposits, and customers execute expenses and other transaction payments.

ACH payment transfers money electronically between bank accounts on a predetermined schedule set by the sender. Tens of thousands of payments, including mortgage payments, utility bills, and subscription charges, work through this method. The bank institution and the account holder enter into an official agreement where automatic withdrawals can occur at prescribed intervals that the parties have mutually agreed upon.

Transfer difficulty is reduced when processors utilize this mode because it eliminates the need for manual bill payments each time they are due. Bills can be settled on time through automatic payments directly from the bank account because the account holder needs no additional action. People and organizations use this procedure extensively to maintain active payment records through automated bill payments, which eliminates the duty to remember individual due dates.

Where can Recurring ACH Payments be used?

Recurring ACH payments are usable across multiple institutions. The majority of recurring ACH payments function in the American territory. Nacha operates the National Automated Clearing House Association (Nacha) to manage the Automated Clearing House network, which is a US-based fund transfer system. The US-based financial institution fund transfer network provides direct deposits and direct payment services.

The ACH network solely serves the United States, while other nations run their own automated payment systems, which operate identically for domestic financial operations. Canada has implemented Electronic Funds Transfer, but the United Kingdom uses Bacs Payment Schemes Limited. The European Union operates under the Single Euro Payments Area (SEPA) to provide euro-transaction capabilities.

The ACH network does not directly facilitate international transactions. Businesses and individuals in the United States generally turn to alternative cross-border payment methods, including wire transfers, international payment services, or other viable solutions. These services frequently collaborate with local banks and financial institutions worldwide to facilitate payment transactions.

How Recurring ACH Payments Work

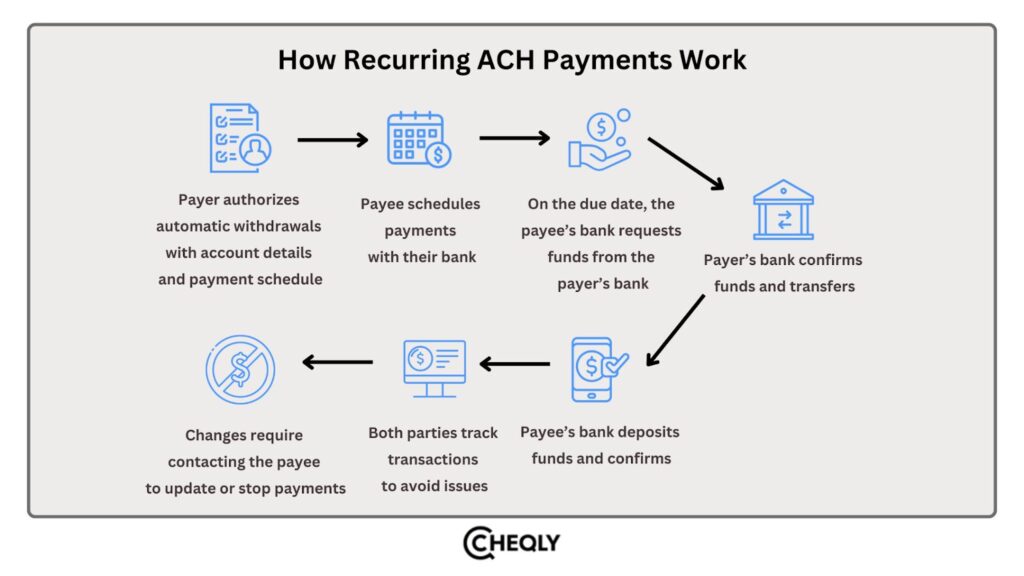

Let’s look at the following steps of how recurring ACH payments work:

- Set up of Authorization: Individuals with accounts must give their permission to the payer for automated withdrawals to obtain access to their funds. Account holders need to fill out a form where they specify the payment details and provide their account number and routing number together with the withdrawal amount information. This document also outlines the payment schedule, specifying intervals such as monthly for utility bills or biweekly for loan repayments.

- Schedule Payments: Subsequent to obtaining authorization, the payee—whether a corporation or an individual designated to receive the funds—establishes the payment schedule with their banking institution in accordance with the mutually agreed-upon terms. Banking systems allow users to input date information and amount data to establish periodic requests for funds that come out of payer accounts.

- Initiating Transactions: After the established payment date passes, the payment procedure begins from the payee’s bank through the ACH network. The payee’s bank issues a request for a calculated amount to the bank that holds the payer’s funds.

- Transferring Funds: The financial institution verifies the payer’s account to determine whether sufficient funds exist. Once the payer’s account has enough funds, the banking institution withdraws the transaction amount and sends a confirmation message through the ACH network.

- Confirmation and receipt: Subsequently, the funds are deposited into the payee’s account. After successful funds arrive in the payee’s account, their bank releases a confirmation notice. Through account statements or banking alerts, the account holder is notified about the status of their withdrawn funds.

- Continuous monitoring: The parties maintain ongoing monitoring of the financial transactions during their prolonged relationship. The account holder is responsible for making sure that adequate funds are available in their account prior to each scheduled payment. This will prevent any fees or declined transactions of the payment. Each payment arrives on time through the payee, who keeps detailed transaction records to track finances.

- Adjustments or Cancellations: Customers who want to change the payment amount or schedule or disconnect services need to contact the person who receives the payment for needed adjustments to their agreement. The payee subsequently implements the requisite modifications to the payment schedule within their banking system, and the payment schedule proceeds (or terminates) in accordance with the revised terms.

How Much Time do Recurring ACH Payments take?

Recurring ACH payments generally require several business days to process. The duration of each phase of the procedure is as follows:

- Transaction Initiation: Payment is typically initiated one day prior to the actual due date due to the necessary processing time involved. This is called “lead time.”

- Processing Time: Once the transaction has been initiated, the ACH network consolidates the payment with others and processes it on the subsequent business day. This is the moment when the recipient’s financial institution will formally execute the transfer of funds from the account.

- Settlement Duration: The receiving financial institution will generally observe the transaction within its system on the business day subsequent to the processing of the bundle. Nevertheless, the funds may not be accessible to the payee until they have been fully settled.

- Fund availability: Funds sent by ACH become accessible to the payee’s account only after the receiving bank receives the funds during a standard one-day business period. Some banks allow quicker fund access by following their individual guidelines.

The entire ACH payment cycle normally takes between three to five business days to fully process the payment from origination to the funds reaching their destination account. US financial institutions maintain that Automatic Clearing House transactions will not be processed on weekends and public holidays, which extends the total transaction time.

Benefits of Automatic ACH payments

Automatic ACH payments are secure, so let’s take a look at the other benefits of ACH here:

- Ease and Convenience: The ACH payment setup is a one-time process for each recipient, which removes the requirement for recipient calendar alerts to guarantee timely payment receipt.

- Optimized Cash Flow: Payments received through established schedules create better business control over cash flow and increase the reliability of financial operations.

- Budget-friendly: In contrast to credit card payments, paper checks, and wire transfers, ACH payments do not incur the traditionally elevated fees associated with these methods.

- Reduced Mistakes and Delays: Automation with digital processing cancels out human errors and payment delays, which generate major expense costs and cause frustration while ensuring accurate and timely transaction execution.

In conclusion, recurring ACH payments give users a reliable way to handle regular, affordable money transfers. They help improve financial stability and efficiency by removing manual work, reducing mistakes, and ensuring payments are on time. These methods make it easier for businesses to handle payments, payroll, and bills. With digital solutions changing quickly, using these methods has become a smart way to improve cash flow.

Recurring ACH Payments FAQs

Below are some common questions and answers about recurring ACH payments.

Do I need any special software to set up recurring ACH payments?

You only need a bank account and access to an online payment system or a payment processor that processes ACH transactions.

Are recurring ACH payments secure?

Yes, ACH payments are safe. They keep your money and data secure with encryption and other safety features during transfers.

Do recurring ACH payments come with any fees?

Most banks allow ACH payments for free or at a low cost. However, some banks or payment services may charge a small fee for certain types of transactions in specific cases.

What problems can businesses face with recurring ACH payments?

Companies may encounter problems such as delays between processes, incorrect payments, or customer bank issues, namely insufficient funds or closed accounts.

Can I cancel a recurring ACH payment?

Yes, you can cancel your payments anytime by contacting your bank or the person you are paying.

Easily Manage Domestic ACH Payments with Cheqly

Small enterprises can use Cheqly to make ACH payments free of cost in the US, as it helps control cash flow, pay staff, and handle other vendor payments, thus ensuring smooth and safe service.

Create your Cheqly account now and enjoy easy payments!